Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Wednesday, crude oil lost 2.77% after EIA weekly report showed unexpected increase in domestic oil supplies. As a result, light crude declined sharply and broke below the psychologically important barrier of $50. How low could the commodity go in the coming days?

In our previous alert, we wrote the following:

(…) we would like to draw your attention to yesterday’s API report, which showed that crude oil inventories increased by 2.3 million barrels in the previous week. If today’s EIA report confirms a built in domestic stockpiles, it would be a negative signal, which will give oil bears an additional argument to push the price lower.

As it turned out, yesterday’s EIA weekly report showed that U.S. crude oil inventories rose by 2.5 million barrels in the week ended July 17, missing analysts’ expectations for a 2.3 million drop and confirming the American Petroleum Institute data. On top of that, supplies at Cushing, Oklahoma increased by 813,000 barrels last week, compared to forecasts for an increase of 300,000. Thanks to these bearish numbers, light crude declined sharply and closed the day below the key barrier of $50. What does it mean for the commodity? (charts courtesy of http://stockcharts.com).

Quoting our yesterday’s alert:

(…) the green support zone encouraged oil bulls to act, which resulted in a rebound in the following hours. Did this upswing change anything in the short-term picture? Not really, because it was very small compared to a one-day rally that we saw on Jul 14 and it was also small relative to the size of the move lower in the USD Index. This suggests that yestrday’s upswing was just a pause within a downtrend – not a beginning of a post-bottom rally.

(…) in our opinion, another acceleration of declines will be more likely if crude oil closes the day under the psychologically important barrier of $50 and the 61.8% Fibonacci retracement.

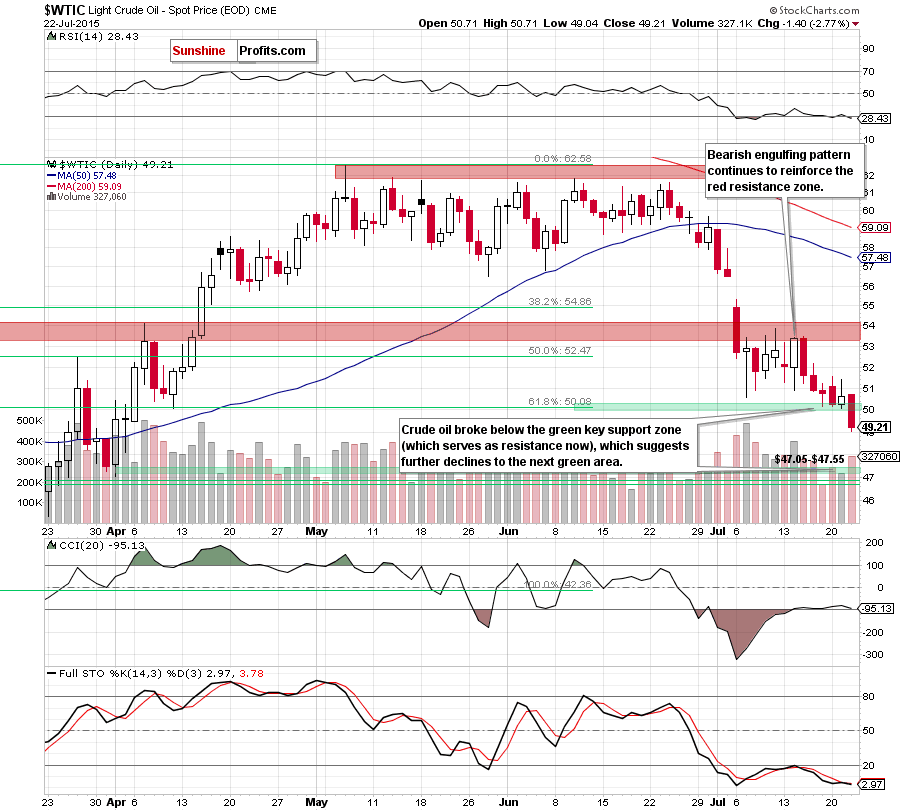

As you see on the daily chart, the most important event of yesterday’s session was a breakdown not only below the 61.8% Fibonacci retracement, but also under the key level of $50. On top of that, the commodity closed the day below these levels (an additional bearish sign), which means that lower values of light crude are just around the corner.

How low could the commodity go in the coming days? We believe that the best answer to this question will be the quote from our last commentary:

(…) If crude oil declines under the above-mentioned support zone, the next downside target for oil bears would be around $47.05-$47.55, where the Apr 10 low (in terms of an intraday and opening prices) is. If it is broken, crude oil will likely test the lower border of the support zone created by the 76.4% and 78.6% Fibonacci retracement levels (around $46.72-$47.17).

Summing up, crude oil moved sharply lower, breaking below the key level of $50 (and making our positions more profitable), which confirms that the downtrend remains in place, suggesting lower values of the commodity in the coming days (especially when we factor in sell signals generated by the weekly indicators).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts