Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Wednesday, crude oil declined sharply after the U.S. Energy Information Administration report. A stronger greenback pushed the commodity lower as well. Thanks to these circumstances, light crude lost 3.28%, erasing almost all Tuesday’s rally. What’s next?

Yesterday, the EIA showed in its weekly report that U.S. crude oil inventories declined by 4.3 million barrels in the week ended July 10, beating analysts' expectations for a 1.2 million drop. Despite this decline, yesterday’s data disappointed market participants as the American Petroleum Institute reported a decline of 7.3 million barrels. Additionally, supplies at Cushing, Oklahoma rose by 438,000 barrels last week. On top of that, gasoline inventories increased by 0.1 million barrels, while distillate stockpiles rose by 3.8 million barrels. These disappointing numbers in combination with a stronger U.S. dollar (the USD Index climbed to the levels seen at the beginning of the month) weighed on investors’ sentiment and pushed the commodity sharply lower. Will we finally see a decline below the barrier of $50 in the coming days? (charts courtesy of http://stockcharts.com).

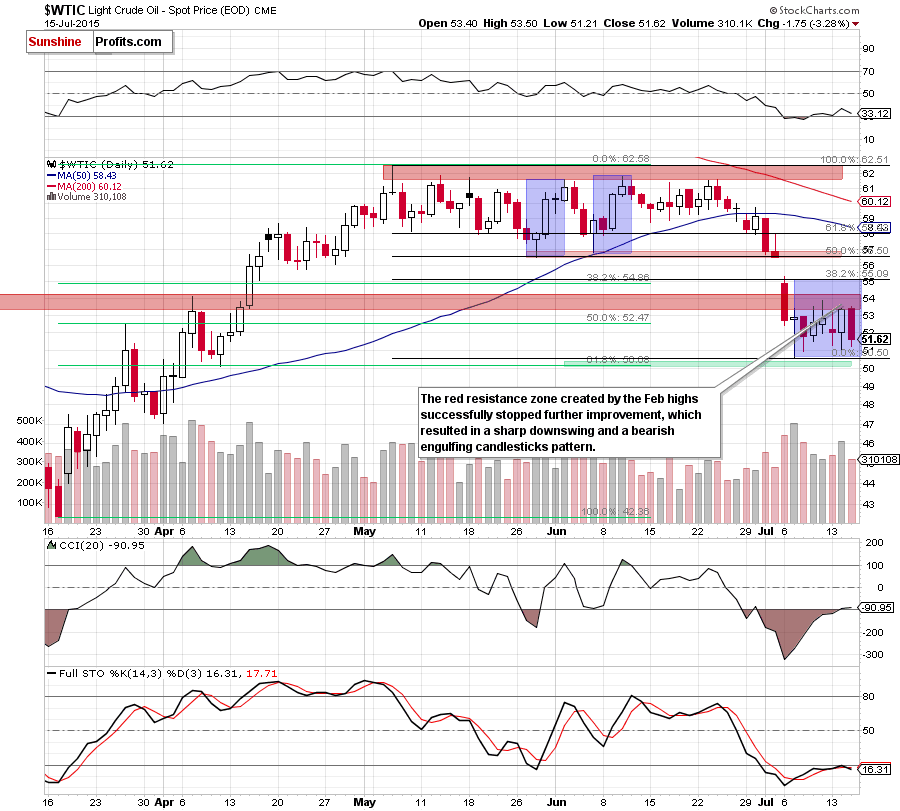

Looking at the daily chart, we see that the key resistance area withstood the buying pressure, which translated to a sharp decline. With this downswing, light crude erased almost all Tuesday’s rally and created a bearish engulfing pattern (this negative formation will serve as an additional reinforcement of the red zone), suggesting lower values of the commodity in the coming days.

Taking this fact into account, we believe that our previous commentary is up-to-date:

(…) light crude remains under its key resistance area (there was also another daily close below it). (…) the recent rebound is much smaller than the previous upward moves, which we saw at the end of May and later in June (all marked with blue on the daily chart). Additionally, it didn’t even reach the 38.2% Fibonacci retracement (based on the May-Jul decline), which means that (…) the short-term downward trend remains in place (…) although the following decline doesn’t have to cut crude oil’s price in half once again, it does seem that the current decline has only begun.

(…) Nevertheless, in our opinion, another acceleration of declines will be more likely if light crude closes the day under the psychologically important barrier of $50 and the 61.8% Fibonacci retracement.

Summing up, short positions (which are already profitable) in crude oil are justified from the risk/reward perspective as the commodity declined sharply, creating the bearish engulfing pattern, which will serve as an additional reinforcement of the red zone. But more importantly, the downtrend remains in place, suggesting lower values of the commodity in the coming days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts