Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Monday, crude oil lost 1.53% as a stronger greenback pushed the commodity lower. What impact did this move have on the short-term picture?

On Friday, Baker Hughes report showed that U.S. oil rigs increased once again (only by 5 to 645, but still), which fueled worries over another build in crude oil inventories and weighed on investors’ sentiment.Additionally, Greece and its international creditors reached a deal on a principal agreement for a bailout through the European Stability Mechanism (ESM), which boosted demand for the greenback, making crude oil less attractive for investors holding other currencies. As a result, light crude closed another day under the key resistance zone. Does it mean that we see lower values of the commodity in the coming week? (charts courtesy of http://stockcharts.com).

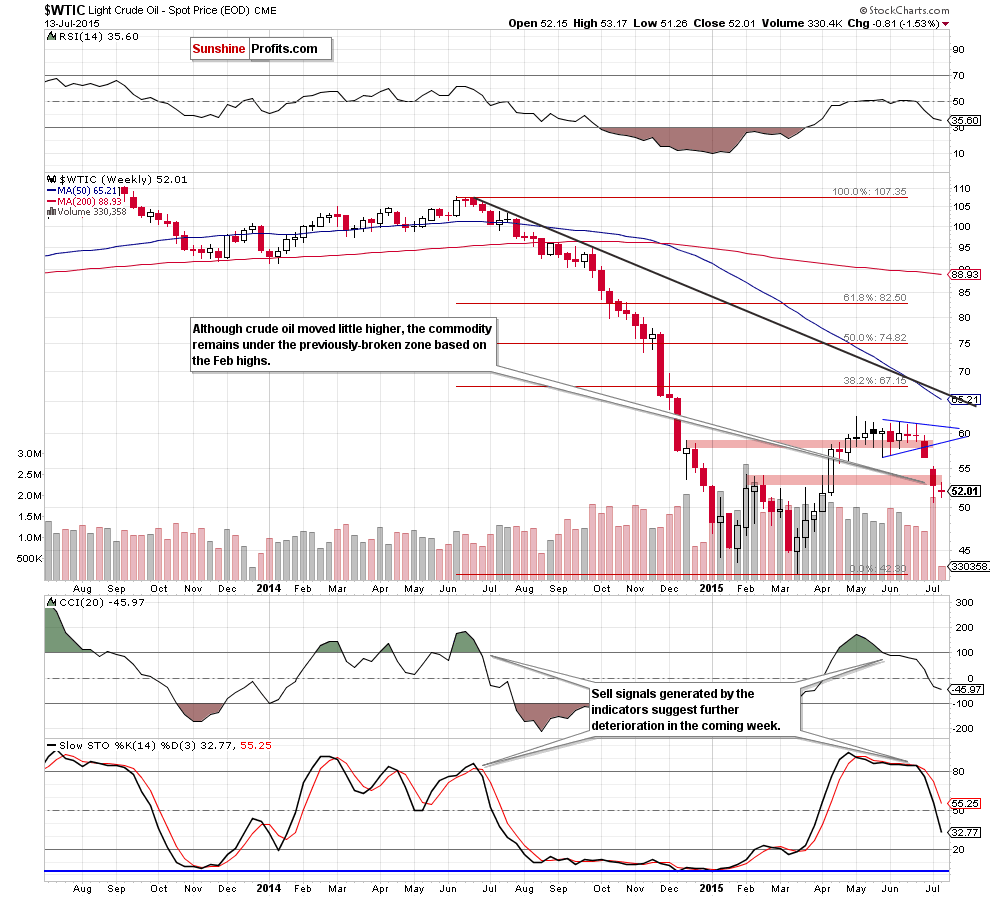

Looking at the above chart, we see that although crude oil rebounded slightly, the commodity closed the previous week under the red resistance zone based on the Feb highs. Taking this fact into account and combining it with sell signals generated by the indicators (we wrote more about them and similarities to what we saw in 2014 in our yesterday’s Oil Trading Alert), we believe that although the following decline doesn’t have to cut crude oil’s price in half once again, it does seem that the current decline has only begun.

Having said that, let’s take a closer look at the very short-trm picture. What an we infer form it about future moves?

Quoting our previous alert:

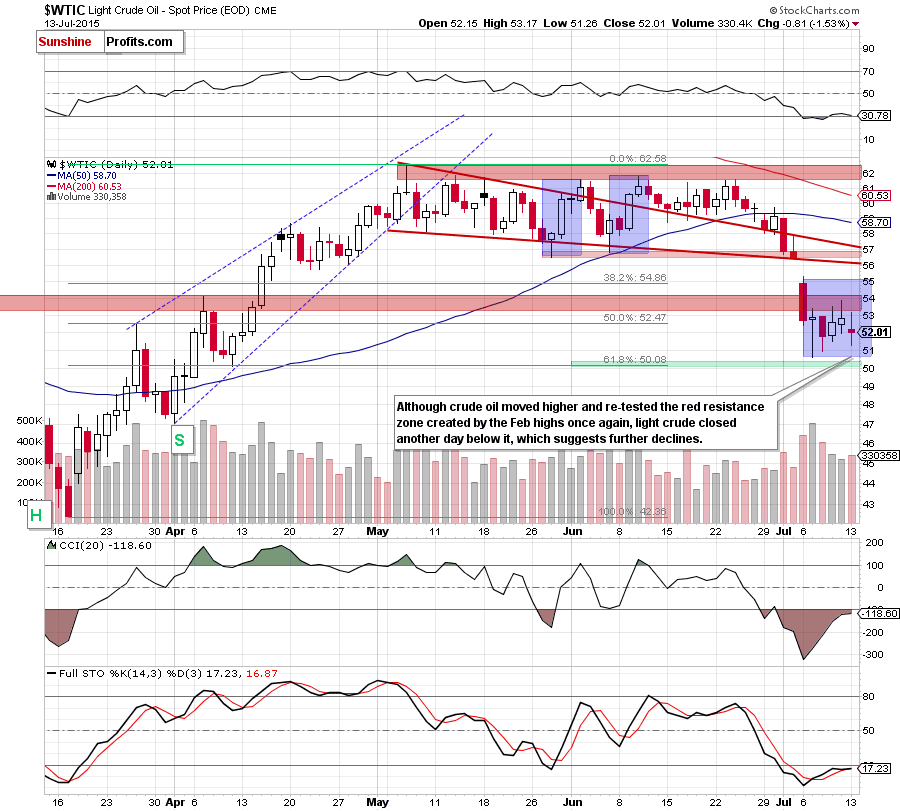

(…) crude oil didn’t move above the previously-broken resistance zone. Moreover, the black gold moved higher on relatively low and declining volume. It seems that last week’s moves higher were just a counter-trend bounce (...) upswing is much smaller than the previous upward moves, which we saw at the end of May and later in June (all marked with blue on the daily chart). This means that the short-term downward trend remains in place, suggesting lower values of the commodity

From this perspective, we see that oil bulls didn’t manage to hold gained levels and light crude bounced down the key resistance zone yesterday. As a result, the commodity closed another day below it, which suggests that further deterioration is just a matter of time. Nevertheless, in our opinion, another acceleration of declines will be more likely if light crude closes the day under the psychologically important barrier of $50 and the 61.8% Fibonacci retracement.

Please keep in mind that although the Stochastic Oscillator generated a buy signal (while the CCI is very close to doing the same) , we believe that as long as there is no invalidation of the breakdown below the Feb highs a sizable upward move is not likely to be seen.

Taking all the above into account, we can summarize the situation today just like we did on Friday:

Summing up, in our opinion, short positions in crude oil are justified from the risk/reward perspective as crude oil verified the breakdown under the zone created by the Feb highs. Additionally, not only the long-term, but also short-term downward trend remains in place, suggesting lower values of the commodity in the coming days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts