Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Monday, crude oil lost 6.76% as Greek and Iranian negotiations in combination with a bearish Baker Hughes report published on Friday weighed on investors’ sentiment. This one of the biggest selloffs in 2015 took the commodity to a fresh 3-month low of $52.41 and resulted in a breakdown under important support levels. How low could light crude go in the coming week?

On Friday, Baker Hughes report showed that U.S. oil rigs increased by 12 to 640, which fueled worries over another build in crude oil inventories and weighed on investors’ sentiment. On top of that, Sunday’s referendum showed that Greeks rejected conditions for a bailout package, which added to worries over county’s future in the euro zone. Although the new next finance minister (Euclid Tsakalotos) will represent Greece in an emergency meeting of euro zone finance ministers in Brussels today, the uncertainty over economic stability in Europe continues to weight. On top of that, U.S. Secretary of State, John Kerry, confirmed that a final nuclear agreement with Iran may not be reached by today’s deadline as difficult issues remain in discussions. In these circumstances, light crude declined sharply breaking below important support levels. How low could light crude go in the coming week? (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

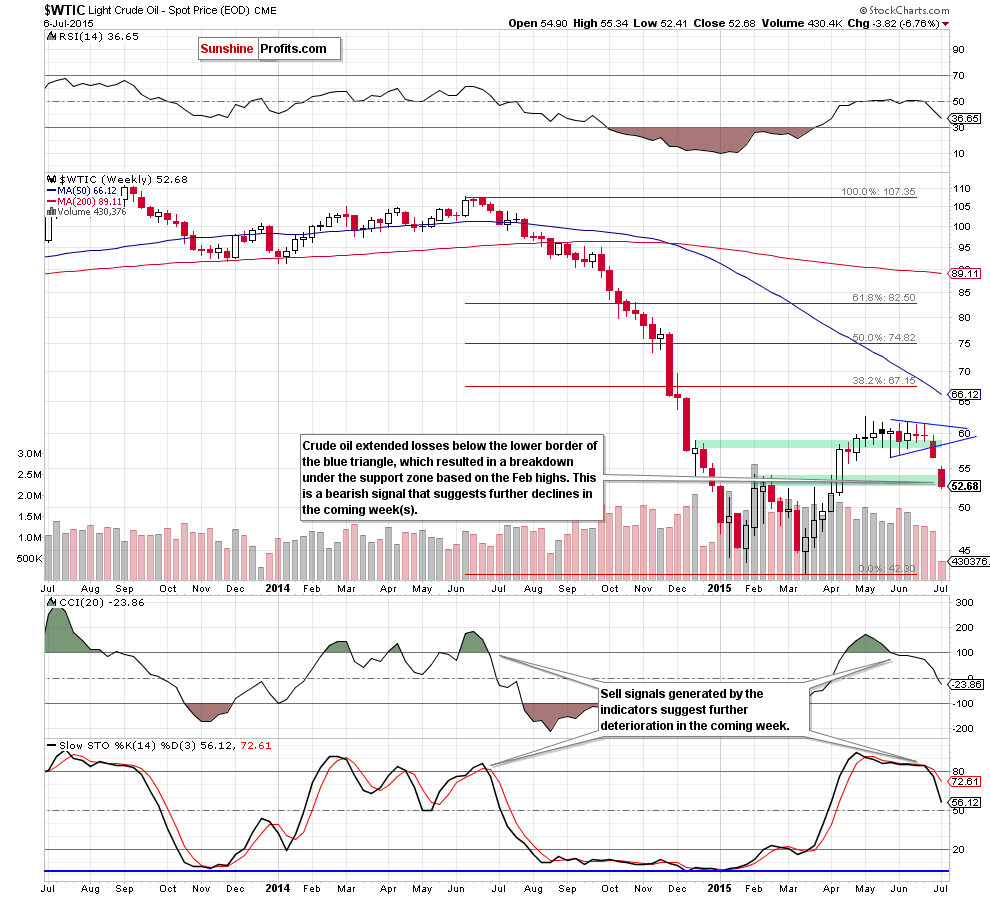

(…) crude oil extended losses below the previously-broken lower border of the medium-term triangle, which suggests that our downside target from Tuesday (around $52.34-$54.24, where the green support zone created by the Feb highs is) will be in play in the coming week.

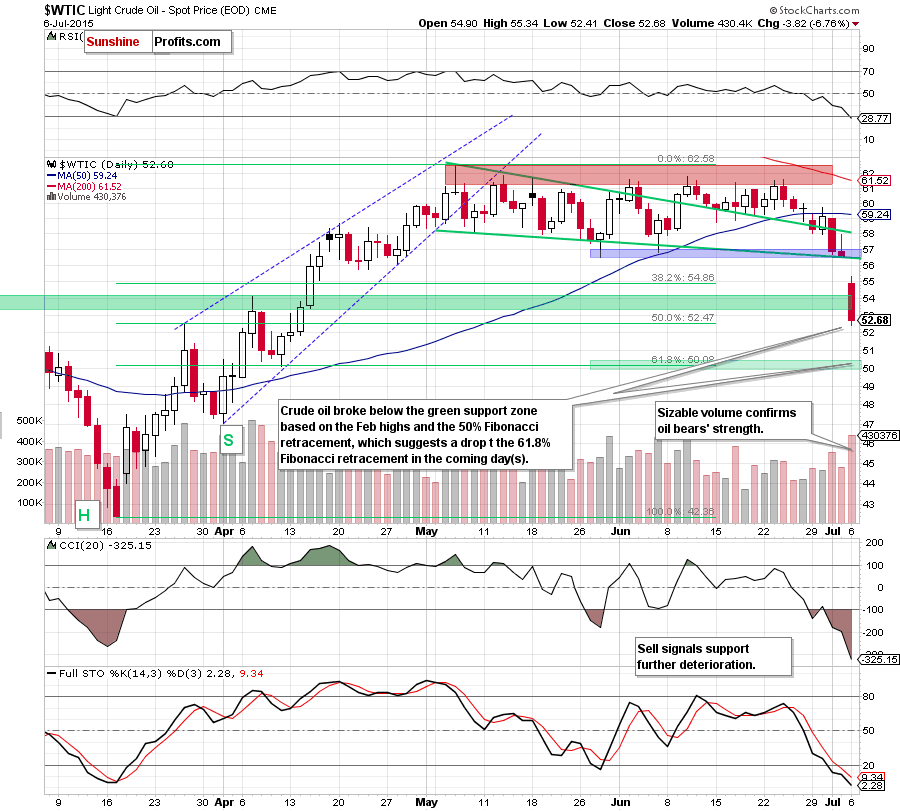

Looking at the above charts, we see that oil bears not only took the commodity below the green support line and the blue zone based on the previous lows (marked on the daily chart), but also managed to push light crude below the green support zone created by the Feb highs. Taking this bearish signal into account, and combining it with sell signals generated by the daily and weekly indicators, we believe that lower values of the commodity are more likely than not. At this point it is also worth noting that yesterday’s downswing materialized on sizable volume, which confirms that oil bears are strong enough to trigger further declines.

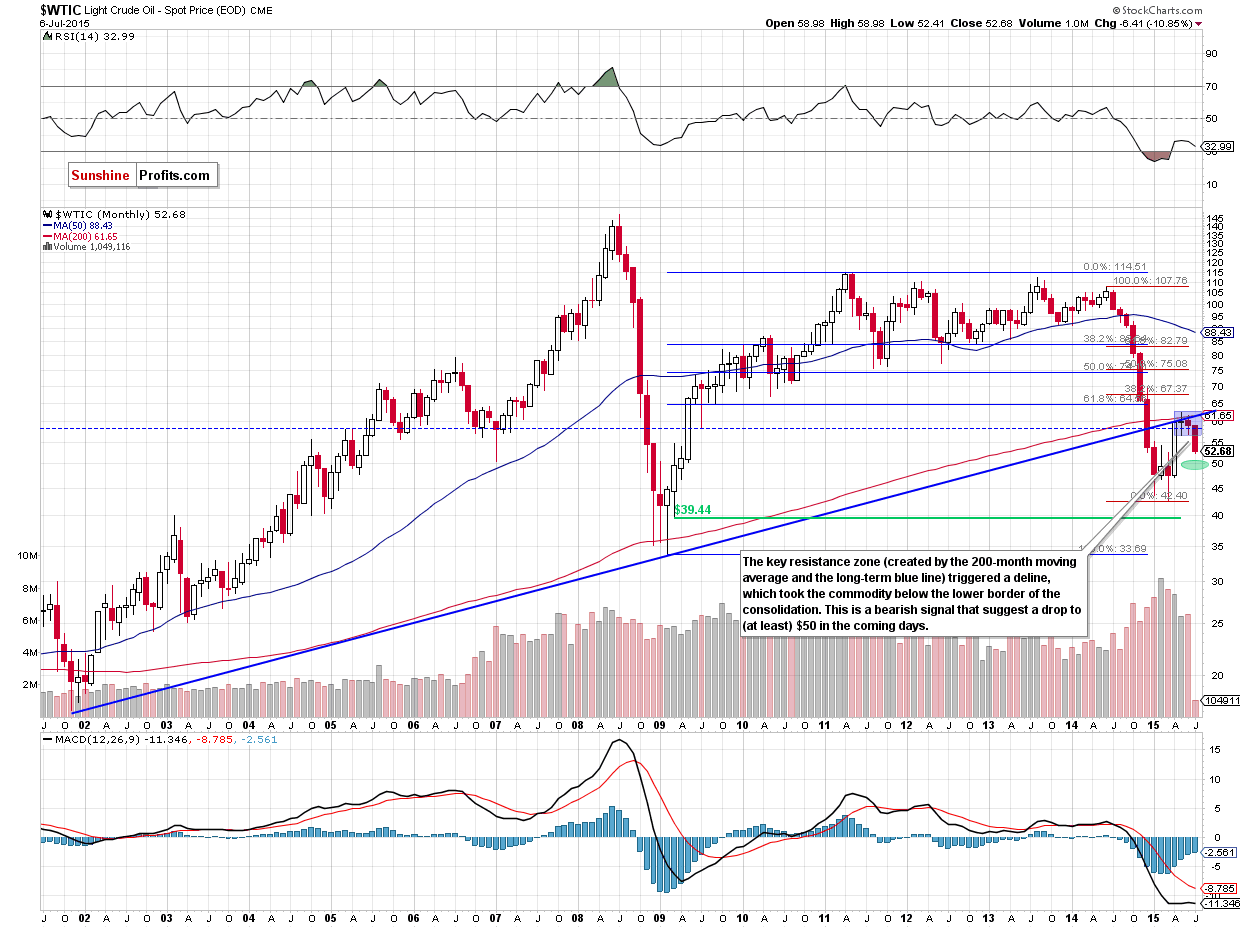

Did yesterday’s move affect the long-term picture? Let’s examine the monthly chart and find out.

On Friday, we wrote the following:

(…) crude oil closed yesterday’s session at $56.50, which means a small breakdown under the lower line of the formation. This is a negative signal, which will be even more bearish if we see a weekly close below this level. If this is the case, and we see such price action, the decline will likely accelerate, which will make our short positions more profitable.

From today’s point of view we see that the situation developed in line with the above scenario and crude oil declined sharply on Monday. With this downswing, light crude confirmed the breakdown below the lower border of the consolidation, which means that we may see a decline to around $50.44, where the size of the downward move will correspond to the height of the formation.

Are there any short-term support levels that could hinder the realization of the above scenario? Not really, because yesterday’s sharp decline took the commodity not only below the support zone created by the Feb highs, but also under the 50% Fibonacci retracement based on the entire Mar-May rally (around $52.47). This means that the next target for oil bears will be the 61.8% Fibonacci retracement around $50.

Summing up, crude oil extended losses under the lower line of the medium-term triangle and confirmed the breakdown below the border of the consolidation (marked on the monthly chart), which makes the overall picture very bearish and suggests lower values of the commodity in the coming week.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: bearish

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts