Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

Although crude oil moved higher after the market’s open supported by a weaker greenback, the commodity reversed and declined to over two-month low in the following hours. As a result, light crude lost 0.65% and closed the day on the key short-term support. Will we see a rebound from here or rather further declines?

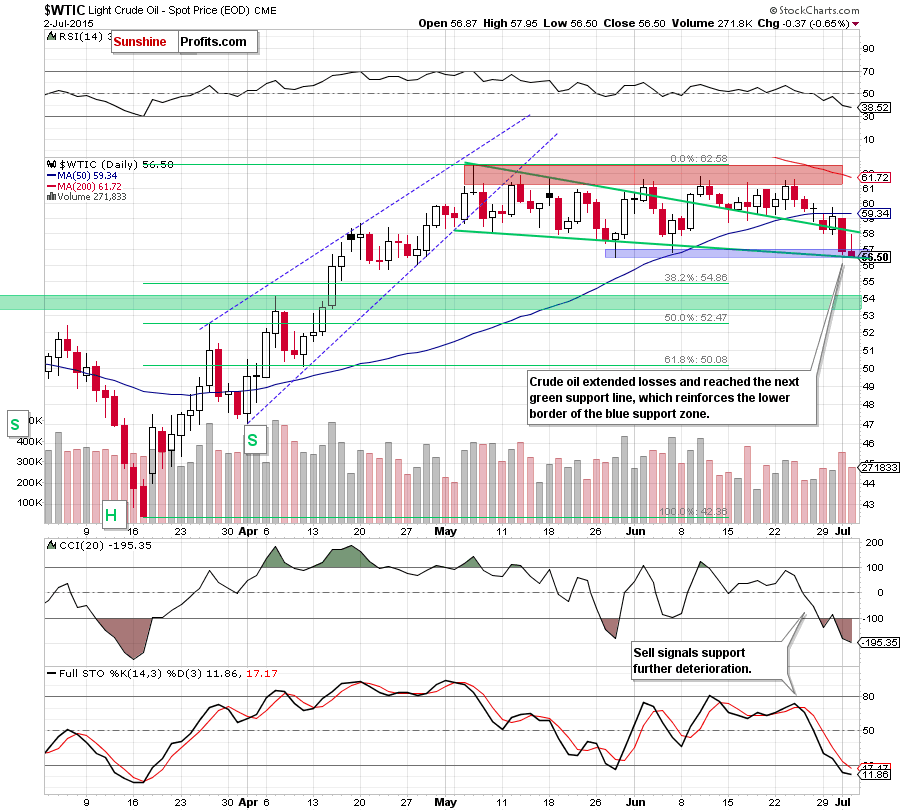

Yesterday, the Labor Department reported that the economy added 223,000 jobs in June, missing expectations for a growth of 230,000. Additionally, a separate report showed that the initial jobless claims in the week ending June 27 increased by 10,000, also missing analysts expectations for a 1,000 drop. Thanks to these disappointing numbers the USD Index moved lower, making crude oil more attractive for buyers holding other currencies. As a result, light crude climbed to an intraday high of $57.95, but then reversed and declined sharply, closing the day on the daily low. What impact did this move have on the very short-term picture of the commodity? (charts courtesy of http://stockcharts.com).

Quoting our previous alert:

(…) the green support line triggered a sharp decline, which took the commodity to our initial downside target – the blue support zone based on the previous lows. Although light crude rebounded from here and climbed to almost $58 earlier today, we believe that this move is just a verification of yesterday’s breakdown under the green support line and the lower border of the medium-term triangle. Why? (…) yesterday’s decline materialized on sizable volume, which means that oil bears are getting stronger. On top of that, sell signals generated by the weekly and daily indicators remain in place, supporting further deterioration in the coming days.

Looking at the daily chart, we see that the situation developed in line with the above scenario and crude oil reversed after an increase to the intraday high. With this downswing, light crude declined to the next green support line, which currently reinforces the blue support zone based on the previous lows.

Although the commodity could rebound from here (similarly to what we saw yesterday), we believe that the long- and medium-term pictures will encourage oil bears to act in the coming week, which will translate to lower values of crude oil.

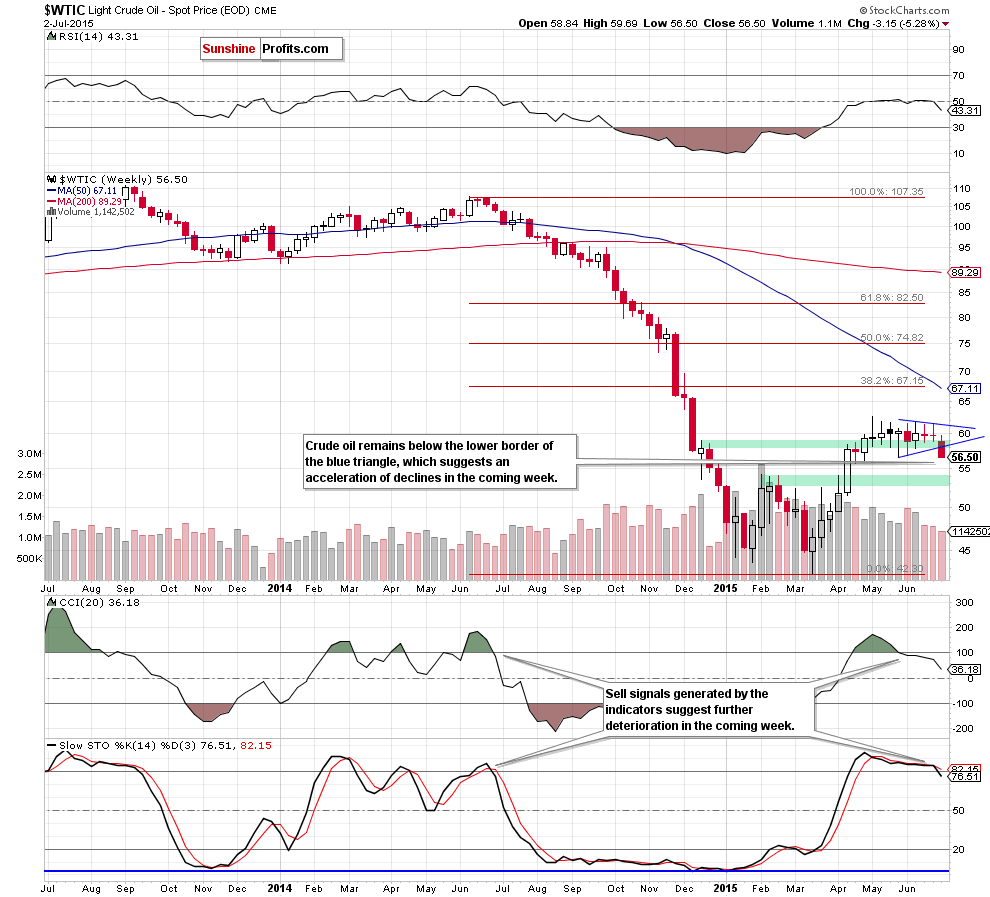

How yesterday’s move affect the medium-term picture? Let’s check.

From today’s point of view we see that crude oil extended losses below the previously-broken lower border of the medium-term triangle, which suggests that our downside target from Tuesday (around $52.34-$54.24, where the green support zone created by the Feb highs is) will be in play in the coming week.

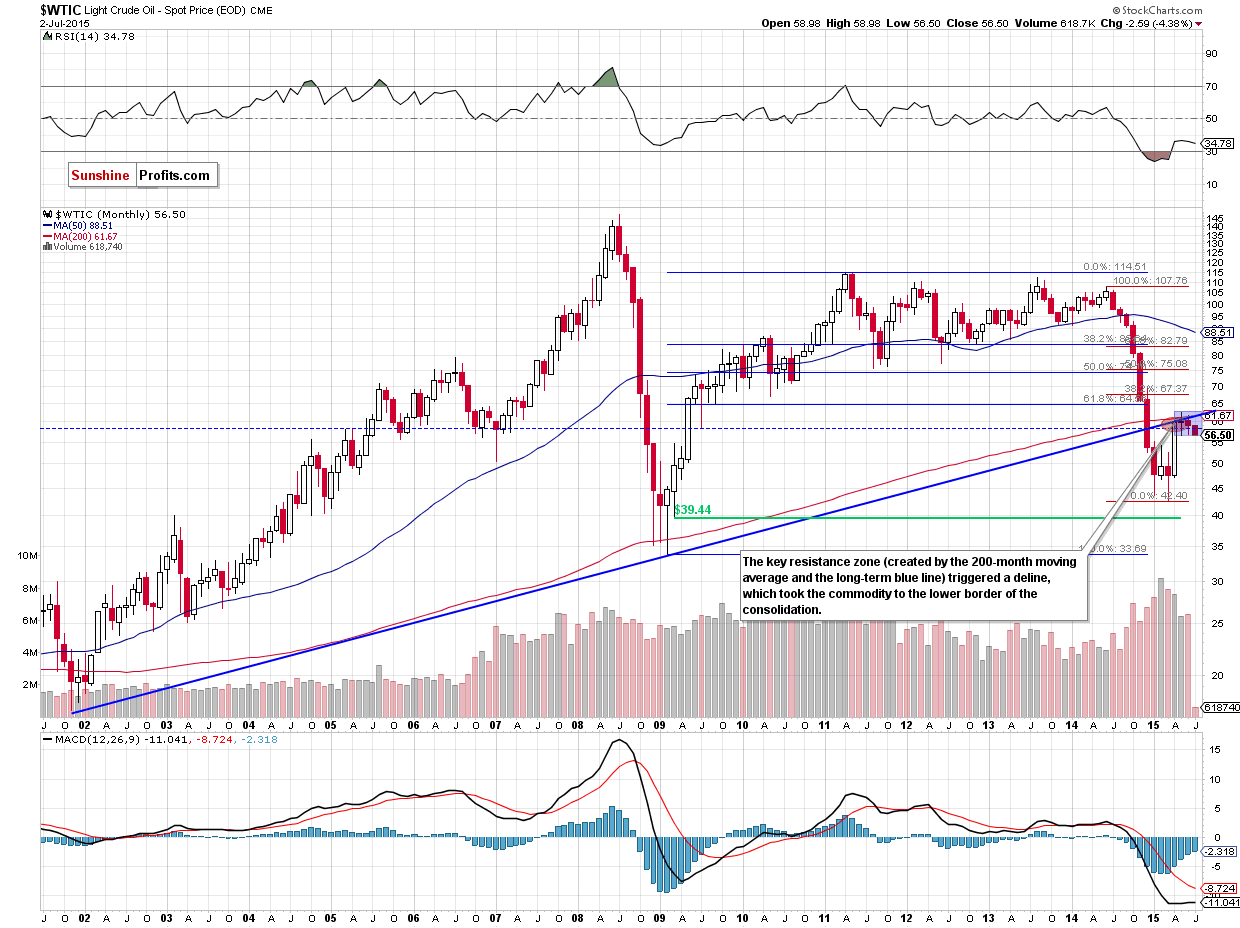

What can we infer from the long-term chart? Let’s find out.

Yesterday, we wrote the following:

(…) crude oil approached the lower border of the blue consolidation, which means that a breakdown below $56.51 will likely trigger further deterioration and a drop to (at least) around $50.45, where the size of the downward move will correspond to the height of the formation.

As you see on the chart, crude oil closed yesterday’s session at $56.50, which means a small breakdown under the lower line of the formation. This is a negative signal, which will be even more bearish if we see a weekly close below this level. If this is the case, and we see such price action, the decline will likely accelerate, which will make our short positions more profitable.

Summing up, crude oil extended losses under the lower border of the medium-term triangle and dropped to the short-term green support line. Although the commodity could rebound from here (similarly to what we saw yesterday), we believe that the long- and medium-term pictures will encourage oil bears to act in the coming week, which will translate to lower values of crude oil (especially if light crude closes the week below $56.51).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts