Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Thursday, crude oil extended Wednesday’s losses as the IEA report and worries over supply glut continued to weigh on investors’ sentiment. In this environment, light crude lost 0.68% and closed the day below $60. How low could the commodity go in the coming week?

Yesterday, crude oil moved little higher after the markets open (supported by a weaker greenback), but despite this improvement, Wednesday’s IEA report (which showed increased output among OPEC nations and several unexpected non-OPEC members) and worries over supply glut pushed the commodity lower. Where will light crude head next in the coming week? (charts courtesy of http://stockcharts.com).

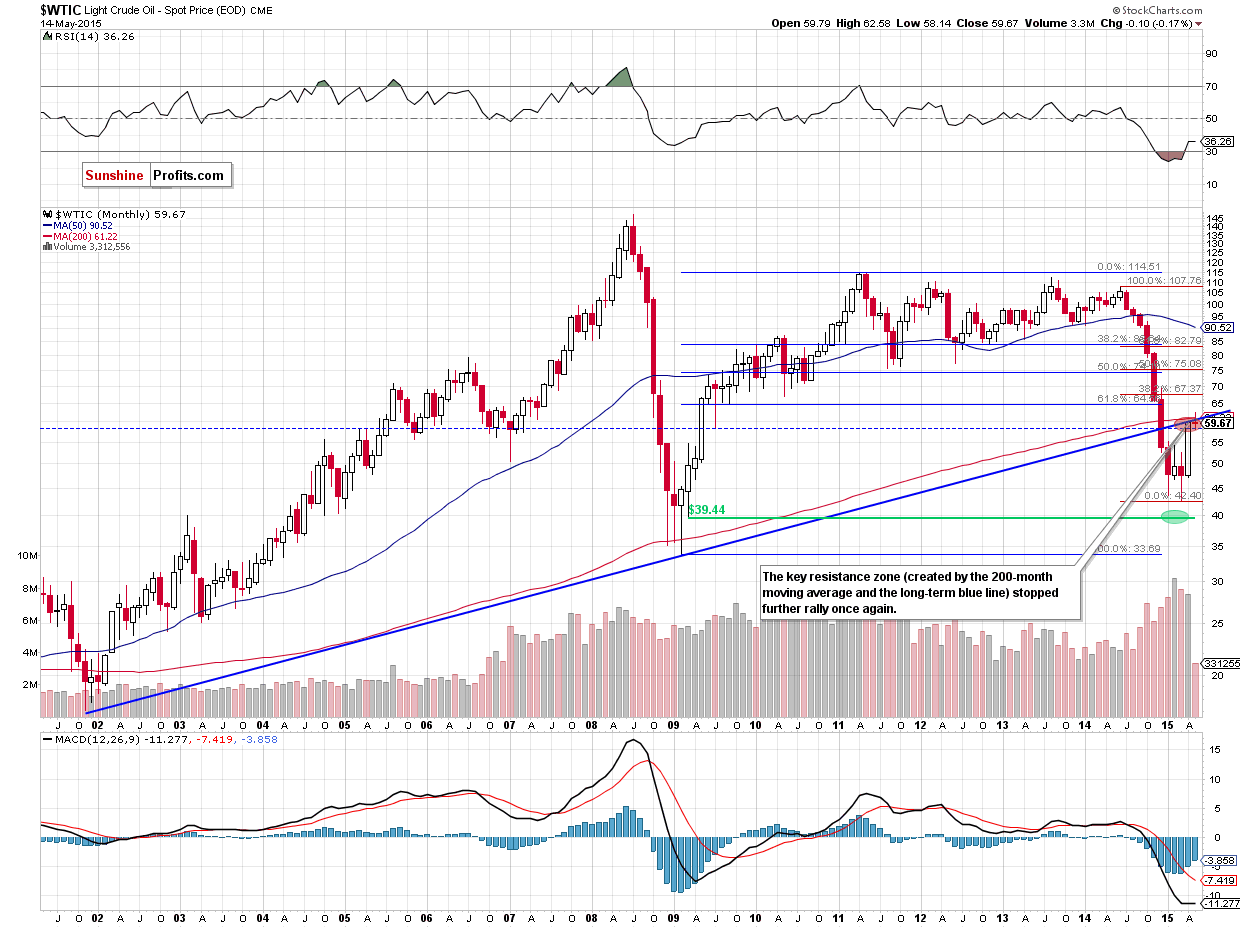

From this perspective, we see that crude oil is still trading under the key resistance zone (created by the 200-month moving average and the long-term blue line), which means that as long as there is no breakout above this area higher values of the commodity are not likely to be seen and further deterioration is more likely than not.

Having said that, let’s take a closer look at the daily chart and find out what impact did yesterday’s downswing have on the very short-term picture.

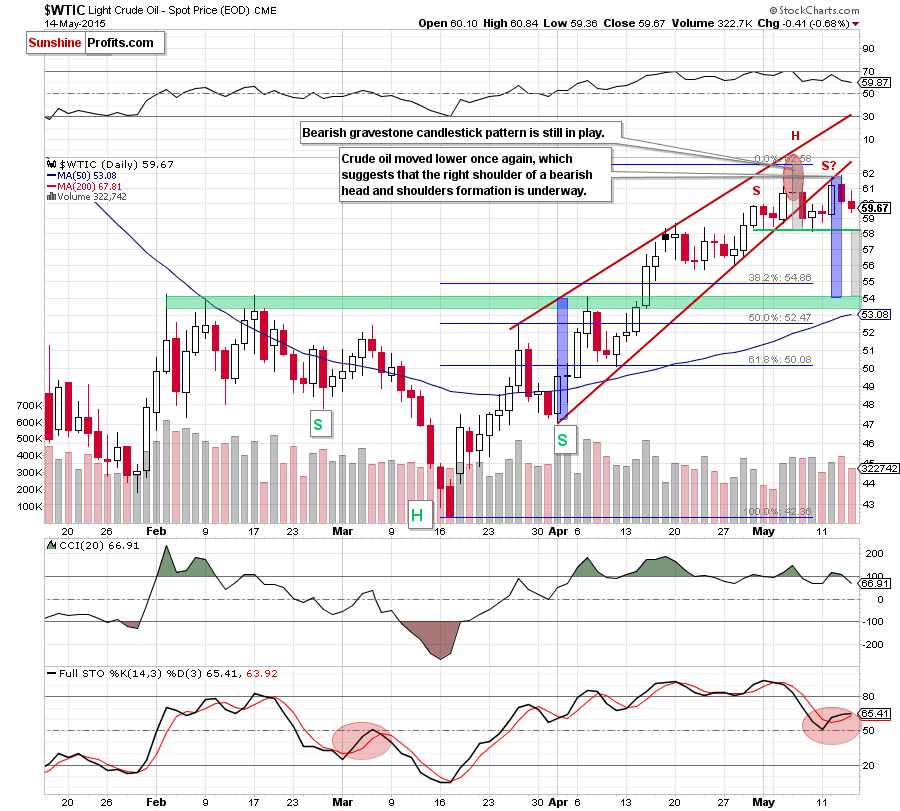

Looking at the daily chart, we see that crude oil extended losses, which suggests that the right shoulder of a bearish head and shoulders formation is still underway. Additionally, the gravestone candlestick formation and sell signals generated by the RSI and CCI are still in play, supporting the bearish case. At this point, it is worth noting that although the Stochastic Oscillator generated a buy signal earlier this week, it wasn’t reliable. Why? When we take a closer look at the above chart, we notice that we saw similar situation at the beginning of March. Back then, a buy signal generated by the indicator triggered a very short-lived upswing, which erased some of earlier drop. Despite this move, the commodity reversed and declined sharply after a sell signal, which suggests that we could see further deterioration in the coming week.

On top of that, we would like to draw your attention to the fact that crude oil broke below the lower border of the rising wedge, which suggests a drop to the green support zone created by the Feb highs (in this area the size of the downward move will correspond to the height of the formation). Taking all the above into account, and combining with the long-term picture, we believe that what we wrote in our Oil Trading Alert posted on Tuesday is still up-to-date:

(…) we can notice a potential head and shoulders formation. If this is the case, and oil bears take advantage of this opportunity, light crude will extend declines and test the strength of the green support zone (created by the Feb highs around $54-$54.24) in the coming days (please note that in this area the size of the downswing will correspond to the height of the formation).

Nevertheless, before we see such price action, crude oil could increase from here (…), which would build the right shoulder of the formation. On top of that, oil bears will have to push the commodity below the green support line based on the May lows (the neck line of the formation is currently around $58.14) before we see an acceleration of the decline.

Summing up, crude oil extended losses, which suggests that the right shoulder of a bearish head and shoulders formation is still underway. If this is the case, and the commodity moves lower from here, we’ll see a drop to the initial downside target around $58.14, where the neck line of the formation is.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts