Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Tuesday, crude oil gained 3.15% as a weaker greenback and the EIA short-term energy outlook supported the price. In this way, light crude closed the day above $61, approaching the recent high, but did this one-day rally change the short-term picture of the commodity?

Yesterday, Greece repaid a €770 million loan installment to the International Monetary Fund, easing worries that the country was on the verge of default, which in combination with a renewed selloff in European government bond pushed the greenback lower, making crude oil more attractive for buyers holding other currencies.

Additionally, the Energy Information Administration in its short-term energy outlook raised its global demand forecasts for the remainder of 2015 by 190,000 barrels per day to 93.28 million bpd. The EIA also estimates that the average price of crude oil in the coming months will be around $54.32 a barrel (up from prior estimates of $52.52) and will increase to around $65.57 a barrel in 2016 (down from $70.07 in previous forecasts). In this environment, light crude rebounded sharply, increasing above $61, but will we see further rally? (charts courtesy of http://stockcharts.com).

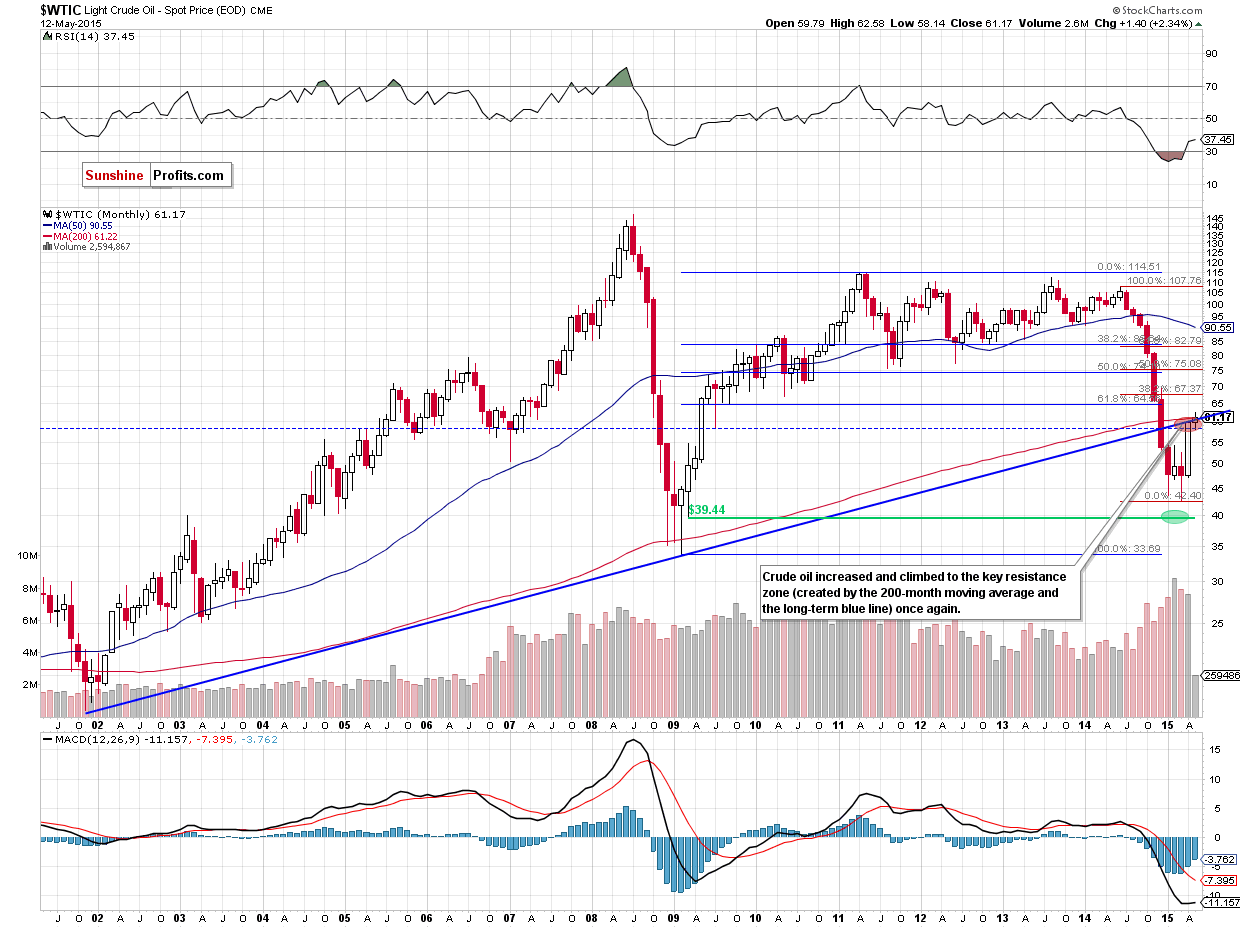

From the long-term perspective, we see that yesterday’s upward move took crude oil to the key resistance zone (created by the 200-month moving average and the long-term blue line) once again. Earlier this month, this solid resistance area stopped further rally, triggering a pullback. Taking this fact into account, we think that history will repeat itself and we’ll see another drop in the coming day(s).

Are there any short-term factors that could encourage oil bears to act? Let’s take a closer look at the daily chart and find out.

In our previous Oil Trading Alert, we wrote the following:

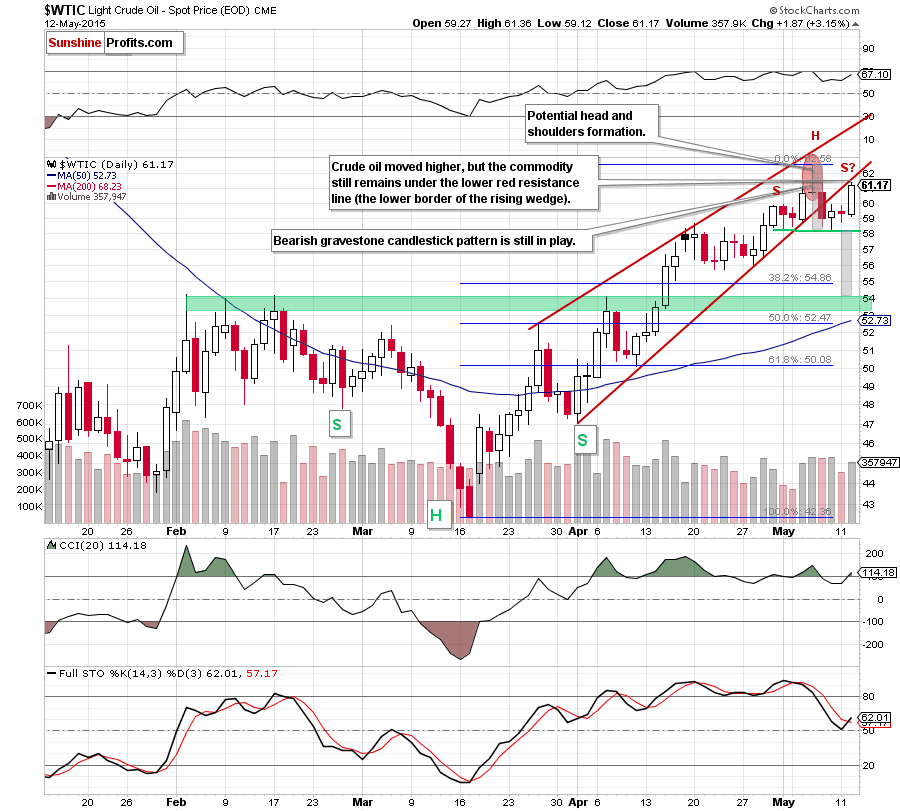

(…) when we take a closer look at the chart, we can notice a potential head and shoulders formation (…) crude oil could increase from here (…), which would build the right shoulder of the formation.

As you see on the daily chart, the situation developed in line with the above scenario and light crude moved sharply higher, creating a potential right shoulder of the formation. With this upswing, the commodity approached the lower red resistance line (the lower border of the rising wedge), but oil bulls didn’t manage to push the price above it. Taking this fact into account, and combining it with the long-term picture, we think that our last commentary is up-to-date:

(…) we can notice a potential head and shoulders formation. If this is the case, and oil bears take advantage of this opportunity, light crude will extend declines and test the strength of the green support zone (created by the Feb highs around $54-$54.24) in the coming days (please note that in this area the size of the downswing will correspond to the height of the formation).

Nevertheless, before we see such price action, crude oil could increase from here (…), which would build the right shoulder of the formation. On top of that, oil bears will have to push the commodity below the green support line based on the May lows (the neck line of the formation is currently around $58.14) before we see an acceleration of the decline.

Finishing today’s alert, please note that yesterday’s volume was smaller than on Friday, which suggests that oil bulls might not be as strong as it seems on the first sight. Nevertheless, we should keep in mind that oil investors will receive the EIA weekly report on crude oil inventories, which could trigger sharp moves in both directions later today (similarly to what we saw a week ago). At this point, it is worth noting that the American Petroleum Institute reported a 2 million drop in crude supplies. Therefore, if today’s EIA report confirms another drop in crude oil inventories, we’ll likely see a test of the last week’s high of $62.58. However, a lower reading (or an increase in domestic supplies) could push the price of crude oil lower (in this case, the initial downside target would be the neck line of the head and shoulders formation).

Summing up, although crude oil moved sharply higher, yesterday’s increase didn’t change the overall picture of the commodity, because light crude is still trading under the solid resistance zone created by the 200-month moving average, the long-term blue line and the lower border of the rising wedge (marked on the daily chart). Additionally, the probability of the formation’s confirmation has increased as yesterday's move can be considered as the right shoulder. All the above, provides us with bearish implications and suggests that another downward move is just around the corner.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts