Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Monday, crude oil lost 0.40% as weak Chinese data, a stronger greenback and ongoing worries over Libyan and Iraqi export levels weighed on the price of the commodity. In this environment, light crude closed another day below the recent high, but is is enough to trigger further deterioration?

Yesterday’s data showed that China's HSBC final manufacturing PMI dropped to 48.9 in April (compared to 49.6 in March and down from a preliminary reading of 49.2), fueling concerns over a slowdown in the world's second largest oil consumer. Additionally, higher Libyan exports, record Iraqi exports in April and OPEC’s oil output at its highest level in two years continued to weigh on investors’ sentiment. On top of that, yesterday, the U.S. Census Bureau reported that factory orders increased by 2.1%, beating expectations for a 2.0% gain, which supported the greenback, making crude oil less attractive for buyers holding other currencies. Thanks to these circumstances, the commodity moved lower and closed another day below the recent high. Will we see further deterioration in the coming days? (charts courtesy of http://stockcharts.com).

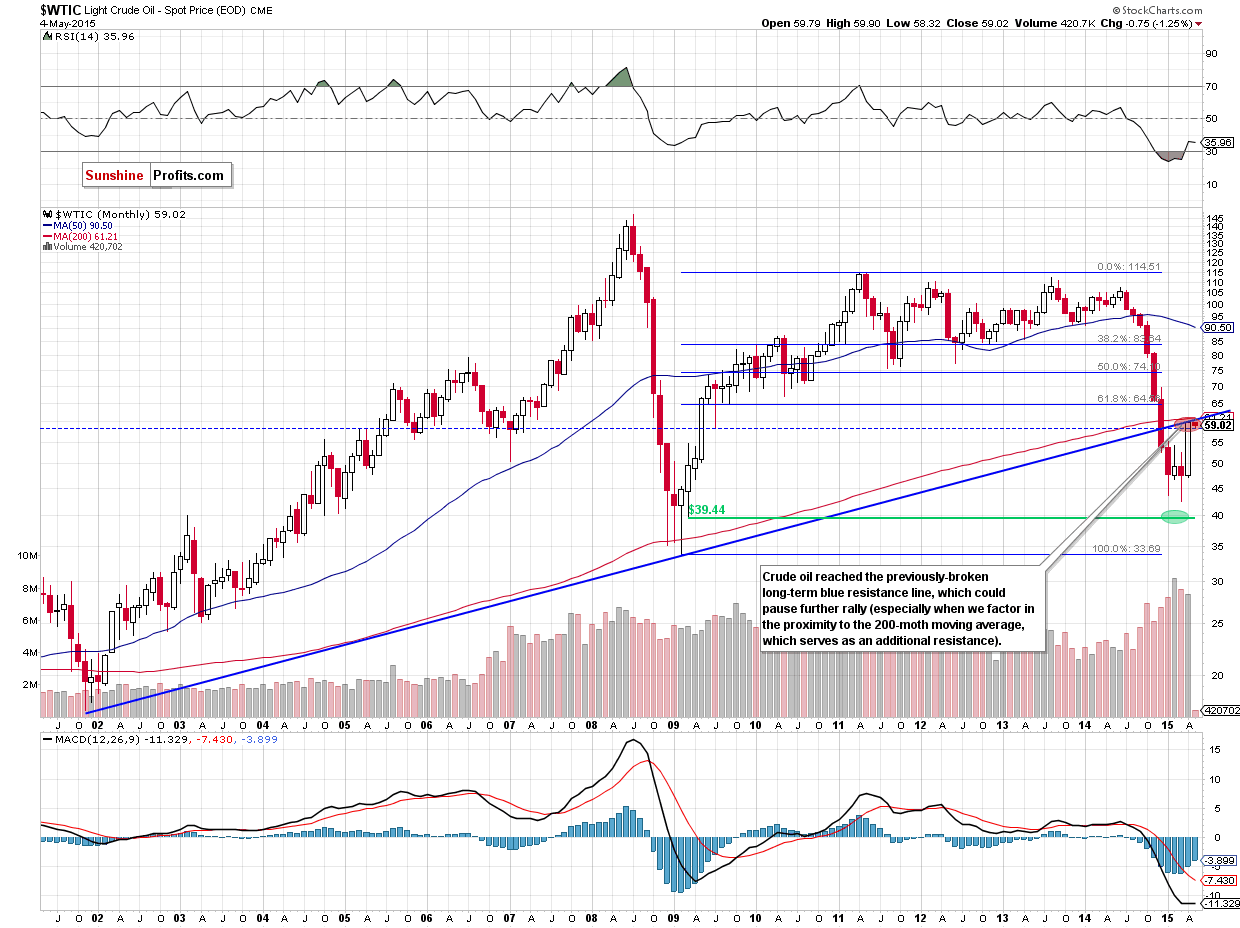

The siuation in the long term hasn’t changed much as crude oil is still trading under solid resistance zone created by the previously-broken long-term blue resistance line and the 200-mont moving average. Therefore, what we wrote yesterday is up-to-date:

(…) we believe that as long as there is no breakout above this area further improvement is not likely to be seen and correction of the recent rally should not surprise us.

Having said that, let’s focus on the very short-term changes.

In our previous Oil Trading Alert, we wrote the following:

(…) the commodity closed the day below the previous high, invalidating earlier breakdown (similarly to what we saw on Wednesday). This is a negative signal, which suggests that further deterioration is just around the corner (…)

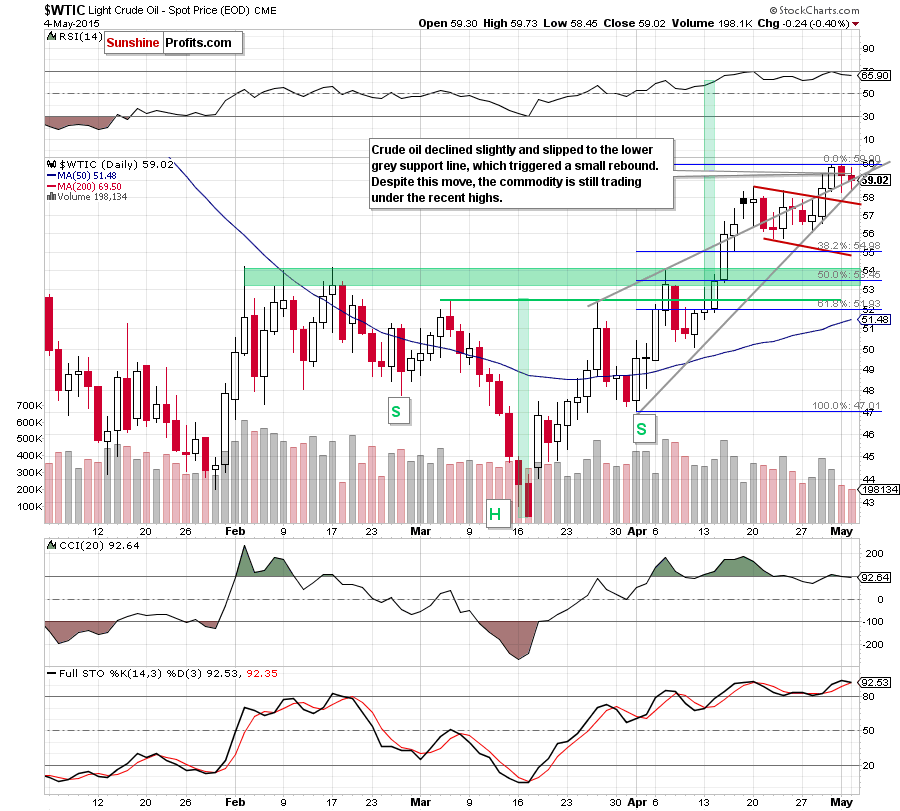

Looking at the daily chart, we see that crude oil declined slightly and slipped to the lower grey support line, which triggered a small rebound. In this way, light crude closed the day on the upper grey line, which makes the very short-term picture unclear.

Taking this fact into account we should consider two scenarios. On one hand, if the commodity moves higher from here, we’ll see another test of the resistance zone (marked on the monthly chart) and the barrier of $60 in the coming day(s).

On the other hand, if oil bears manage to push the commodity below the lower grey support line, the initial downside target would be around $57.70, where the upper border of the declining trend channel is. If it is broken, we could see a drop to around $55, where the lower line of the formation and the 38.2% Fibonacci retracement (based on the Apr rally are. Finishing today’s alert it is worth to noting that the RSI and CCI generated sell signals, while the Stochastic Oscillator is very close to doing the same, which in combination with the proximity to the above-mentioned solid resistance zone gives oil bears additional reasons for action (especially if the barrier of $60 holds).

Summing up, although crude oil declined slightly, the size of the pullback is too small to change the very short-term picture and the overall situation remains unclear – especially when we take into account the fact that the commodity is trading in a narrow range. Nevertheless, we still believe that as long as there is no breakout above the solid resistance zone created by the long-term blue resistance line and the 200-month moving average further improvement is not likely to be seen and correction of the recent rally can’t be ruled out.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts