Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although crude oil moved higher after the market’s open, supported by the Iran oil minister’ commentary, the commodity reversed as a stronger greenback weighed on the price. As a result, light crude lost 0.45% and verified the breakdown under the resistance line. Does it mean that lower values of the commodity are still ahead us?

Yesterday, Iran oil minister Bijan Zanganeh said that OPEC will "coordinate itself," to adapt the country’s return to oil markets as a safeguard for preventing prices from crashing. This news improved oil investors’ sentiment and supported the price, pushing it to an intraday high of $52.07. Despite this improvement, strengthening U.S. dollar stopped further improvement, making crude oil less attractive for investors holding other currencies. As a result, crude oil reversed and erased most of earlier gains, slipping to slightly above Wednesday’s low. Does it mean that we’ll see lower values of the commodity in the coming week? Let’s examine the charts below an find out what are they saying about future moves (charts courtesy of http://stockcharts.com).

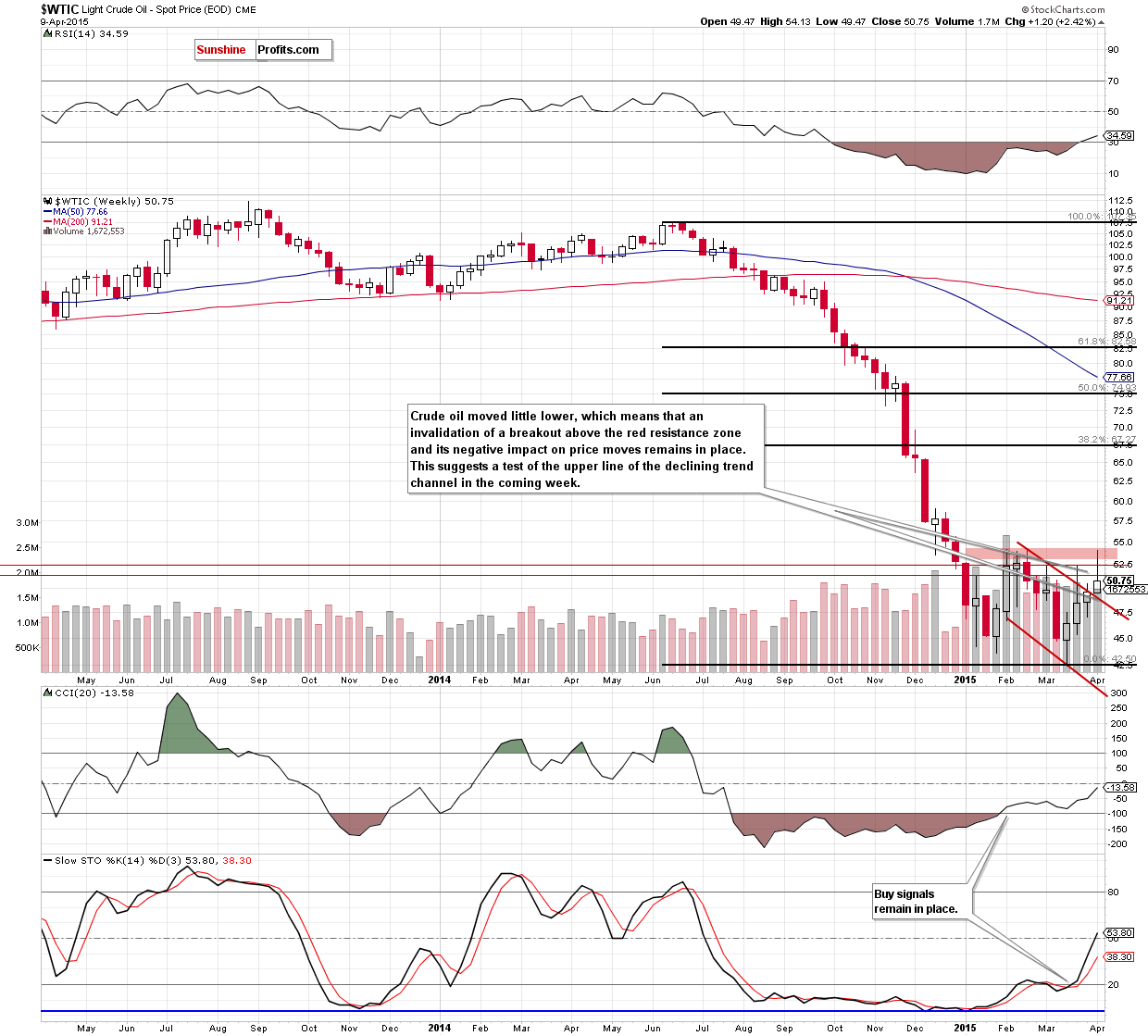

The situation in the medium term hasn’t changed much as crude oil still remains under the resistance zone created by the Feb high and the 76.4% and 78.6% Fibonacci retracement levels. This means that an invalidation of a breakout and its negative impact on price moves remains in play, which suggests a test of this week’s low (at $49.47) or even the previously-broken upper line of the declining trend channel (currently around $49) in the coming week.

Having said that, let’s examine the daily chart.

In our previous Oil Trading Alert, we wrote the following:

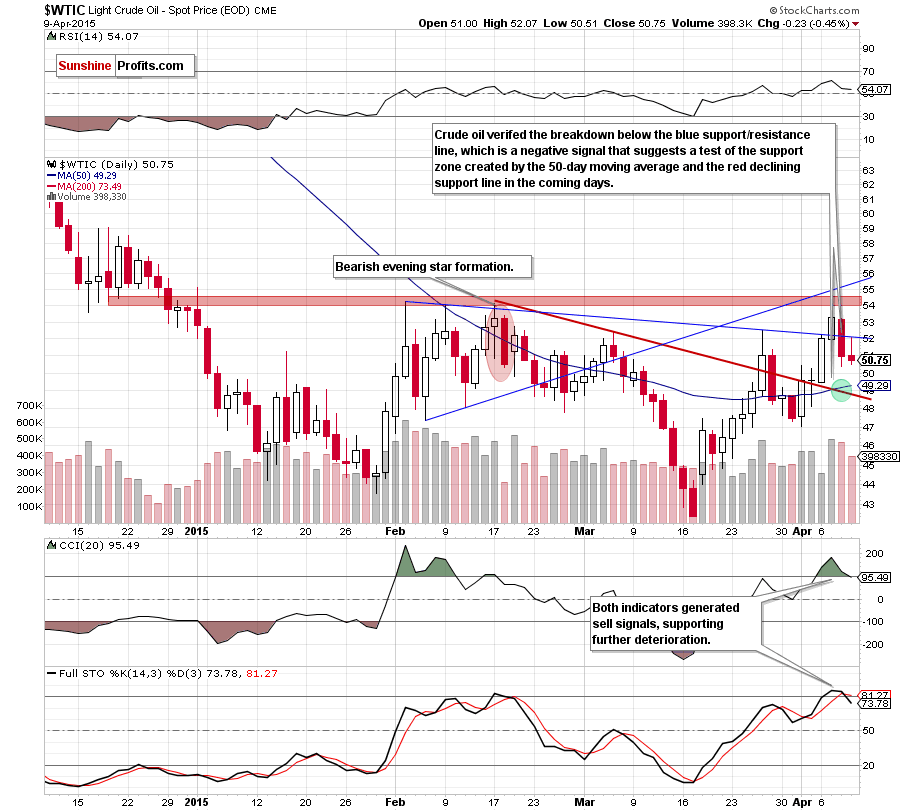

(…) yesterday’s downswing invalidated earlier breakout above the blue support/resistance line, which is a negative sign (…) Additionally, the size of volume that accompanied yesterday’s decline was quite big (compared to what we saw during recent price moves), which suggests that another downswing might be just around the corner (especially when we factor in the current position of the indicators – the CCI and Stochastic Oscillator are overbought, which could translate to sell signals in the near future).

Nevertheless, before we see such price action, the commodity could move little higher and verified yesterday’s breakdown under the blue resistance line because crude oil reached the 50% Fibonacci retracement level (based on the April’s rally), which serves as the support.

Looking at the daily chart, we see that the situation developed in line with the above-mentioned scenario and crude oil verified the breakdown under the blue resistance line. This negative event encouraged oil bears to act, which resulted in a drop to around Wednesday’s low. If the pair moves lower from here, the initial downside target would be around $49.20, where the green support zone (created by the 50-day moving average and the previously-broken red declining support line) is.

At this point, it’s worth noting that the CCI and Stochastic Oscillator generated sell signals, supporting the bearish scenario. Therefore, if this area is broken, the next downside target would be around $46.88-$47.05, where the 61.8% Fibonacci retirement based on the entire recent rally and the bottom of the previous pullback are.

Summing up, crude oil verified the breakdown under the blue resistance line, which suggests further deterioration and a drop to around $49.20, where the green support zone is.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts