Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Thursday, crude oil lost 2.61% as the combination of a stronger greenback and a comeback of concerns over a supply glut weighed on the price. In these circumstances, light crude re-approached the Jan lows, but then rebounded. What’s next?

Yesterday, the USD Index, which tracks the performance of the greenback against the basket of major currencies, erased almost all Wednesday’s losses, making crude oil more expensive for buyers holding other currencies. On top of that, Kuwait’s oil minister Ali al-Omair said that current market conditions have forced OPEC to maintain its production level. He added that Kuwait "will be very happy if other producers cut output," but the world's 10th largest oil producer can't afford to "lose its share in the market." In this environment, light crude slipped to an intraday low of $44.77, but then rebounded, closing yesterday’s session at $45.61. Where the commodity head next? (charts courtesy of http://stockcharts.com).

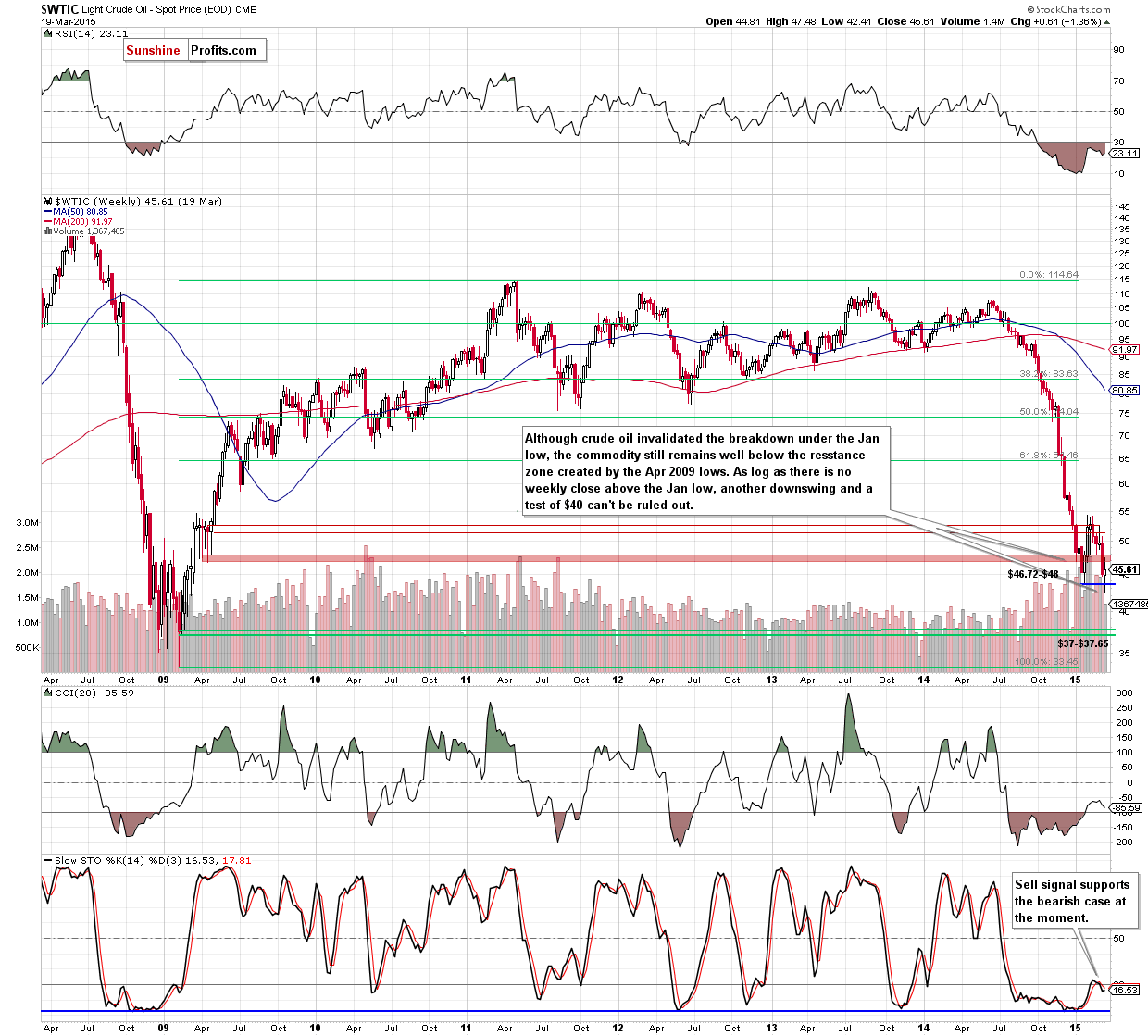

Looking at the above chart, we see that although crude oil rebounded and invalidated the breakdown under the Jan low, the commodity is still trading below the resistance zone created by the Apr 2009 lows. Therefore, we believe that as long as there is no weekly close above the Jan low another downswing and a test of $40 can’t be ruled out.

Can we infer something more about future moves from the daily chart? Let’s check.

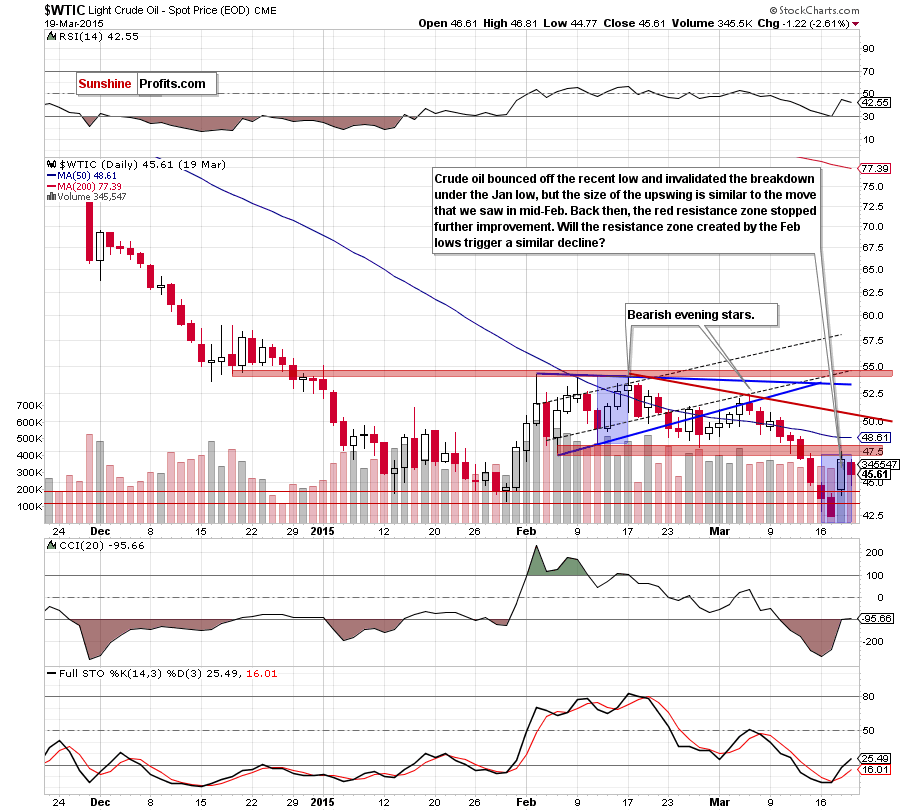

From this perspective, we see that crude oil bounced off the recent low and invalidated the breakdown under the Jan low, but the size of the upswing is similar to the move that we saw in mid-Feb (both moves marked with blue). Back then, the red resistance zone created by the Dec lows stopped further improvement and encouraged oil bears to act. Taking into account the fact that history repeats itself, it seems that we could see similar pause in the coming days as the resistance zone created by the Feb lows is currently in play.

Nevertheless, when we factor in the current position of the daily indicators (the CCI and Stochastic Oscillator generated buy signals), it seems that oil bulls will try to push the commodity above this resistance area in the coming day(s).

What is the bullish scenario? If they succeed, and crude oil closes the day above Feb lows, the initial upside target would be the previously-broken 50-day moving average (currently at $48.61). If it is broken, we might see an increase to the red declining resistance line based on the recent highs (around $50.50 at the moment) or even to $52.40, where the Mar 5 high is.

What is the bearish scenario? The resistance zone created by the Feb lows withstands the buying pressure and we’ll see a pullback from here to the recent low. If it is broken, the next target for oil bears will be the barrier of $40 or even the green support zone (marked on the weekly chart) around $37-$37.65, where the Feb 2009 lows are.

Summing up, although the size of the recent upswing is similar to the move that we saw in mid-Feb, the resistance zone created by the Feb lows (and also the resistance area based on the Apr 2009 lows) is still in place, keeping gains in check. In our opinion, oil bulls’ behavior in this area will indicate if we will see a realization of the bullish or bearish scenario in the coming days.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

On an administrative note, please note that there will be no Oil Trading Alerts next week, but the alerts will be posted normally the week after (beginning Monday, March 30). Thank you for your understanding.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts