Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although crude oil increased above $50 supported by a weaker greenback, the commodity erased some gains as the Genscape, Inc report weighed on investors’ sentiment. As a result, light crude gained 0.50%, but did this increase change anything in the short-term picture of the commodity?

Yesterday, the USD Index pulled back from an 11-and-a-half year high against a basket of other major currencies as investors took profits from the recent rally. Thanks to this drop, crude oil has become more attractive for buyers holding other currencies, which resulted in an increase to an intraday high of $50.79. Despite this improvement, light crude erased some gains as Genscape, Inc report showed that last week supply inventories at the Cushing Oil Hub in Oklahoma rose by 1.7 million barrels. This means that supply levels at Cushing are less than 3 million barrels below a record-high. Therefore, if inventories grow at its current rate, Cushing will likely reach full capacity by the middle of next month, which could translate to lower prices of the commodity. Before we see a confirmation/invalidation of the above let’s check what we can infer from today’s charts are saying about future moves (charts courtesy of http://stockcharts.com).

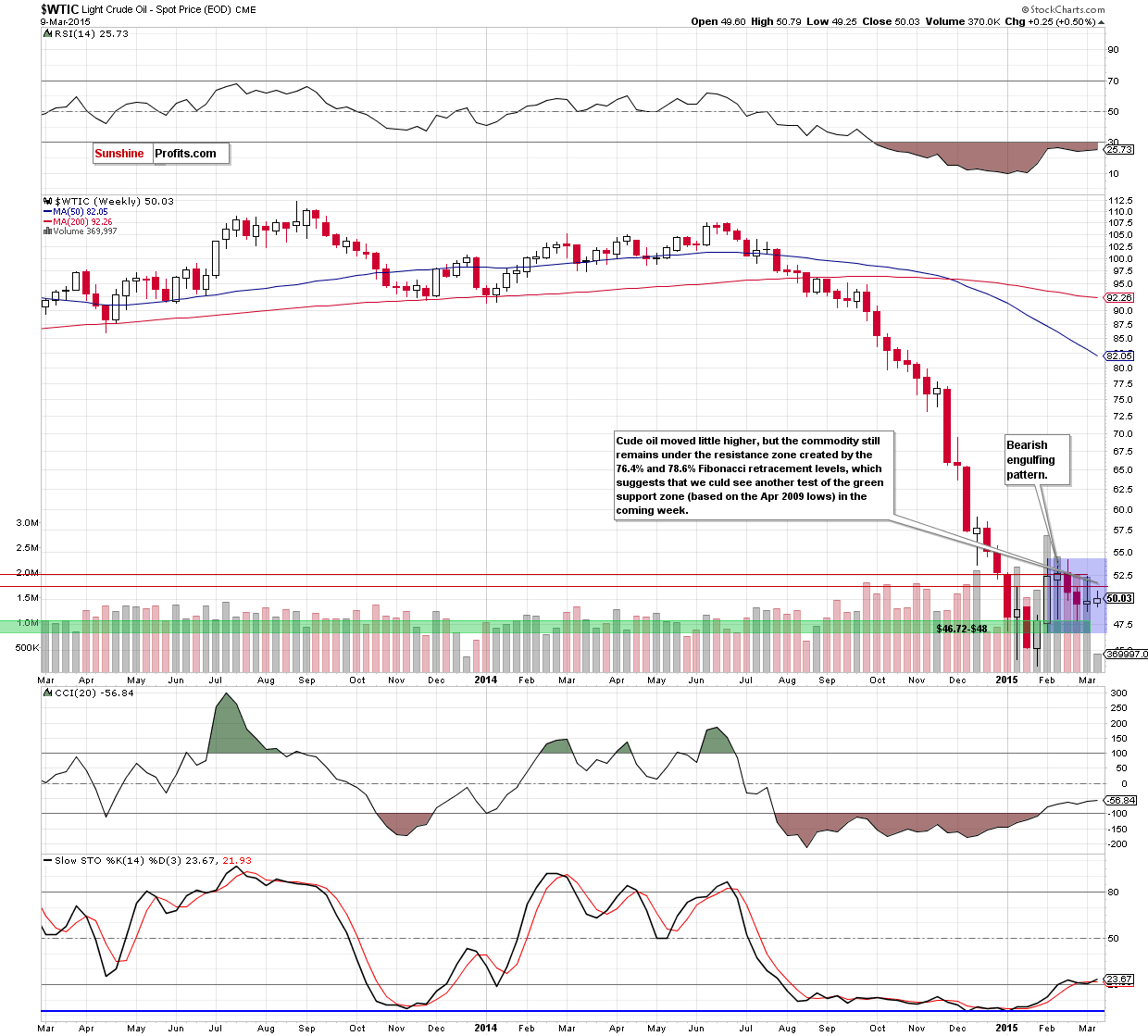

Looking at the weekly chart, we see that although crude oil moved little higher, the overall situation in the medium term remains unchanged as crude oil still remains under the resistance zone created by the 76.4% and 78.6% Fibonacci retracement levels, which suggests that we could see another test of the green support zone (based on the Apr 2009 lows) in the coming week – similarly to what we saw at the end of the previous month.

Did yesterday’s increase change the very short-term picture? Let’s check.

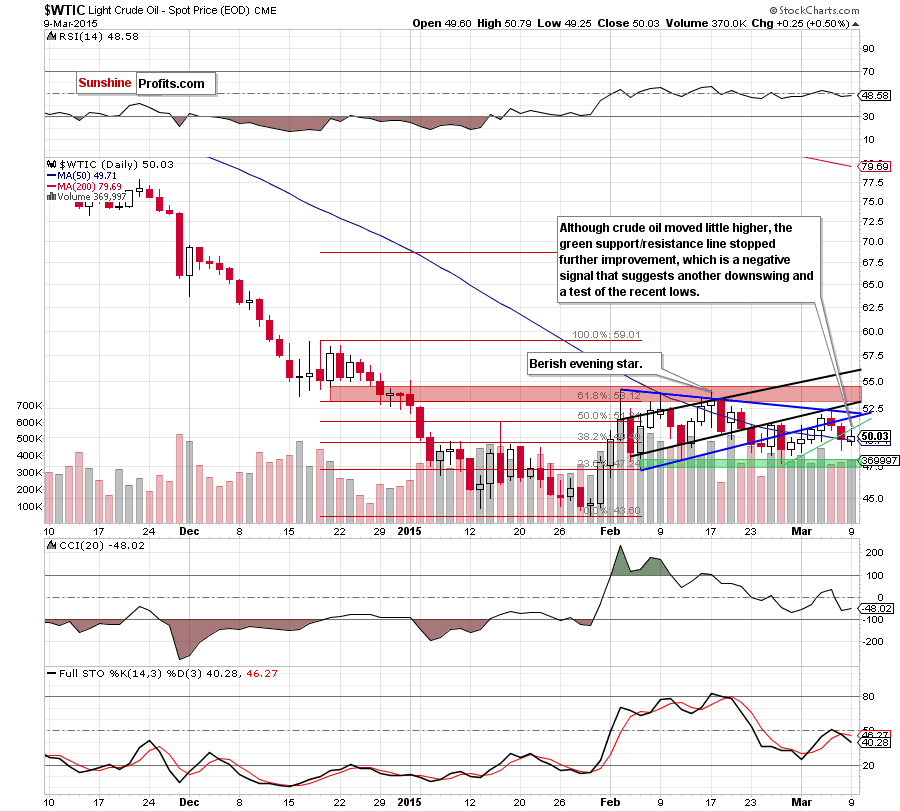

From this perspective, we see that crude oil moved higher, but this move didn’t change anything as the commodity didn’t even manage to break above the green support/resistance line. This is a negative signal, which suggests that further improvement is questionable as oil bulls are too weak to invalidate the breakdown under this nearest resistance. Additionally, the Stochastic Oscillator generated a sell signal, suggesting another downswing. If this s the case, our bearish scenario from yesterday’s Oil Trading Alert will be in play:

(...) we should keep in mind that (...) the strong resistance area created by the borders of the blue triangle still will be in play. Therefore, in our opinion, as long as there is no comeback above these lines (and the black resistance line) further improvement is not likely to be seen. Additionally, if this zone withstands the buying pressure, crude oil will test of the green support zone (created by the Feb 5 and Feb 11 lows) around $47.36-$48.05 once again in the coming days.

Summing up,although crude oil increased slightly, oil bulls were too weak to invalidate the breakdown under the green support/resistance line (not to mention about the invalidation of the breakdown below the borders of the blue triangle). This is a negative signal, which in combination with a sell signal generated by the Stochastic Oscillator, suggests another downswing and a test of the green support zone in the coming day(s).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts