Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Thursday, crude oil lost 4.13% as a stronger U.S. dollar weighed on the price. As a result, light crude slipped below its major support line and closed the day under $50 once again. What’s next?

Yesterday, although the U.S. Commerce Department showed that U.S. consumer prices dropped 0.7% in the previous month (missing expectations for a decline of 0.6%), the data also showed that durable goods orders increased by 2.8% (above expectations for a 1.7% gain), core durable goods orders without volatile transportation items moved up 0.3% and core consumer prices without food and energy costs increased by 0.2% in January. Thanks to these positive numbers, the USD Index moved higher and increased to an intraday high of 95.41, erasing the recent losses and hitting a fresh three-week high. Thanks to this rally crude oil moved sharply lower and hit an intraday low of $47.80 as a stronger greenback made the commodity less attractive for buyers holding other currencies. Will we see lower values of light crude in the coming days? (charts courtesy of http://stockcharts.com).

In our last Oil Trading Alert, we wrote the following:

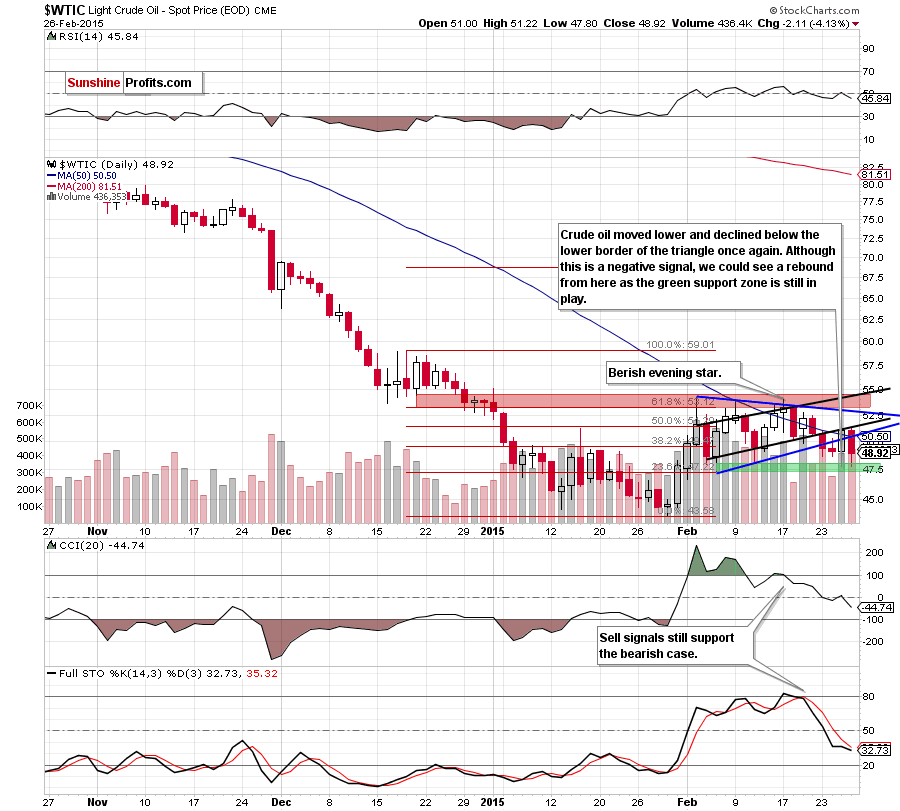

(…) we should keep in mind that yesterday’s move materialized on relatively low volume (compared to the increases that we saw earlier this month - for example Feb 3 or Feb 13), which suggests that oil bulls might not be as strong as it seems a the first glance. Additionally, light crude reached the previously-broken lower black resistance line, which could pause further improvement and trigger a pullback to the lower line of the triangle (currently around $50.15) later in the day.

As you see on the daily chart, oil bears not only took the commodity to our downside target, but also managed to push it under the lower border of the blue triangle, which is a negative signal. With this downswing, light crude reached the green support zone based on the Feb 5 and Feb 11 lows, which triggered a small rebound in the following hours. Will we see further improvement? Let’s take a closer look at the weekly chart and try to find more clues about future moves.

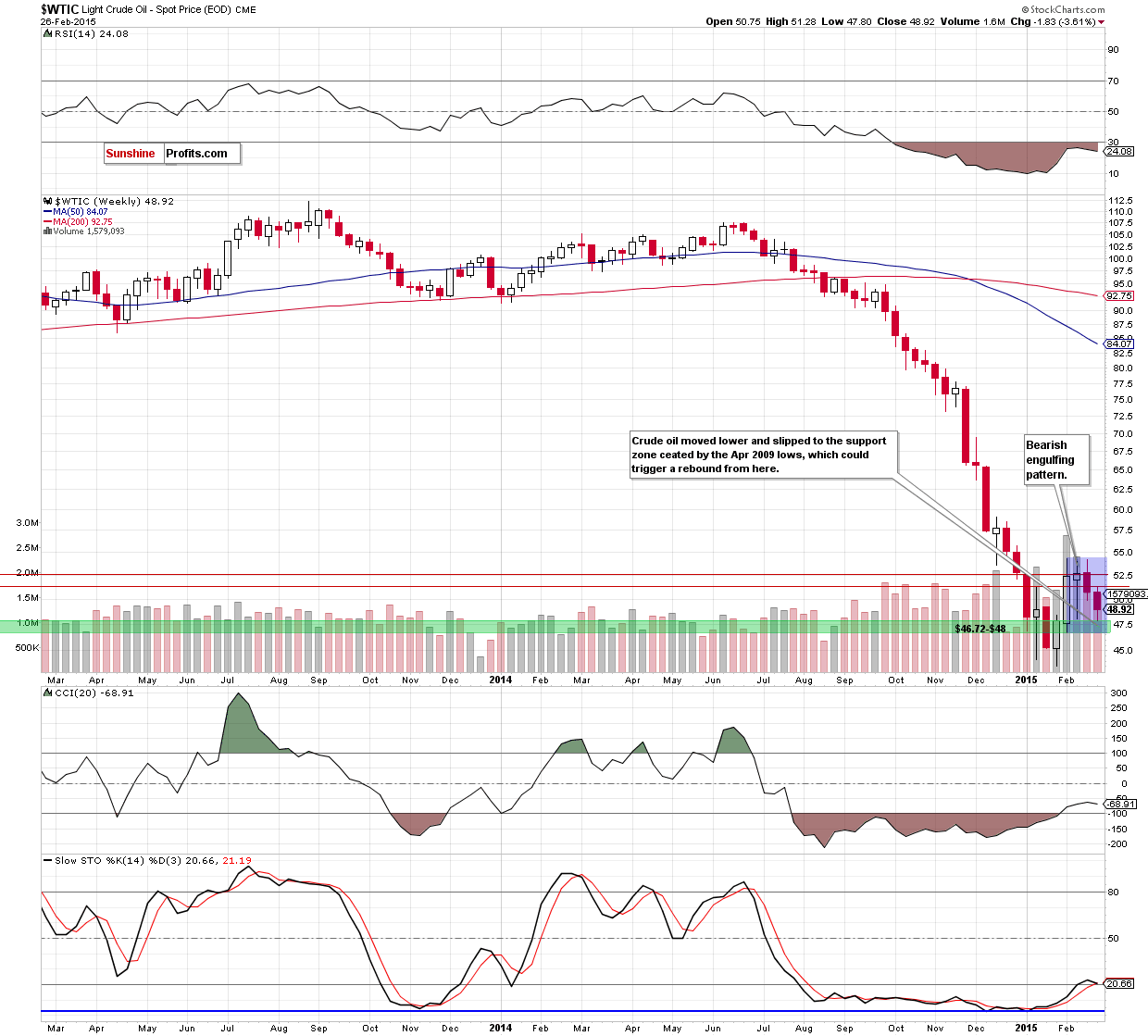

From this perspective we see that yesterday’s downswing took the commodity to the green support zone based on the Apr 2009 lows, which suggests that we could see a rebound from here in the coming week – similarly to what we saw earlier this month. If this is the case, the initial upside target would be around $50.70-$51.70, where the previously-broken blue and black resistance lines (marked on the daily chart) are. If this area is broken, the next target for oil bulls would be the resistance zone created by the 76.4% and 78.6% Fibonacci retracement levels. At this point, it is worth noting that it is reinforced by the bearish engulfing formation, which means that as long as this area is in play further rally is questionable.

Summing up,the highlight of yesterday’s session was another breakdown under the lower border of the blue triangle. Nevertheless, as we have pointed out before, although this is a negative signal, the commodity reached a green support area created by the Apr 2009, Feb 5 and Feb 11 lows, which could trigger a rebound to the previously-broken lines in the coming day(s). Connecting the dots, we still think that opening any position is not justified from the risk/reward perspective as the situation is too unclear.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts