Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, crude oil lost 3.06% as the combination of bearish EIA weekly report and news that Barclays cut its oil-price forecasts for 2015 weighed on the price. As a result, light crude declined sharply, hitting a fresh multi-year low. What’s next?

Yesterday, the U.S. Energy Information Administration reported that U.S. crude oil inventories rose by 8.9 million barrels in the week ended January 23, missing expectations for an increase of 4.1 million barrels. Total U.S. crude oil stockpiles stood now at 406.7 million barrels as of last week, the highest level since 1982. Despite these bearish numbers the price of the commodity didn’t decline immediately after the report’s release. This lack of reaction was mostly related to Tuesday’s API data, which showed a 12.7-million-barrel gain in crude-oil supplies. Nevertheless, the EIA also reported that U.S. crude production increased and weekly output hit 9.2 million barrels a day last week, which is a record high on weekly data dating to 1983. Production in the region around Cushing, Okla., also rose, which exacerbated fears over a glut in supplies.

On top of that, Barclays cut its average price for West Texas Intermediate to $42 a barrel from $66, saying that it expects a long period of oversupply stretching at least into early 2016. In this environment, light crude extended declines and hit a fresh 2015 low of $44.08. Will we see further deterioration?(charts courtesy of http://stockcharts.com).

In our Oil Trading Alert posted on Jan 23, we wrote the following:

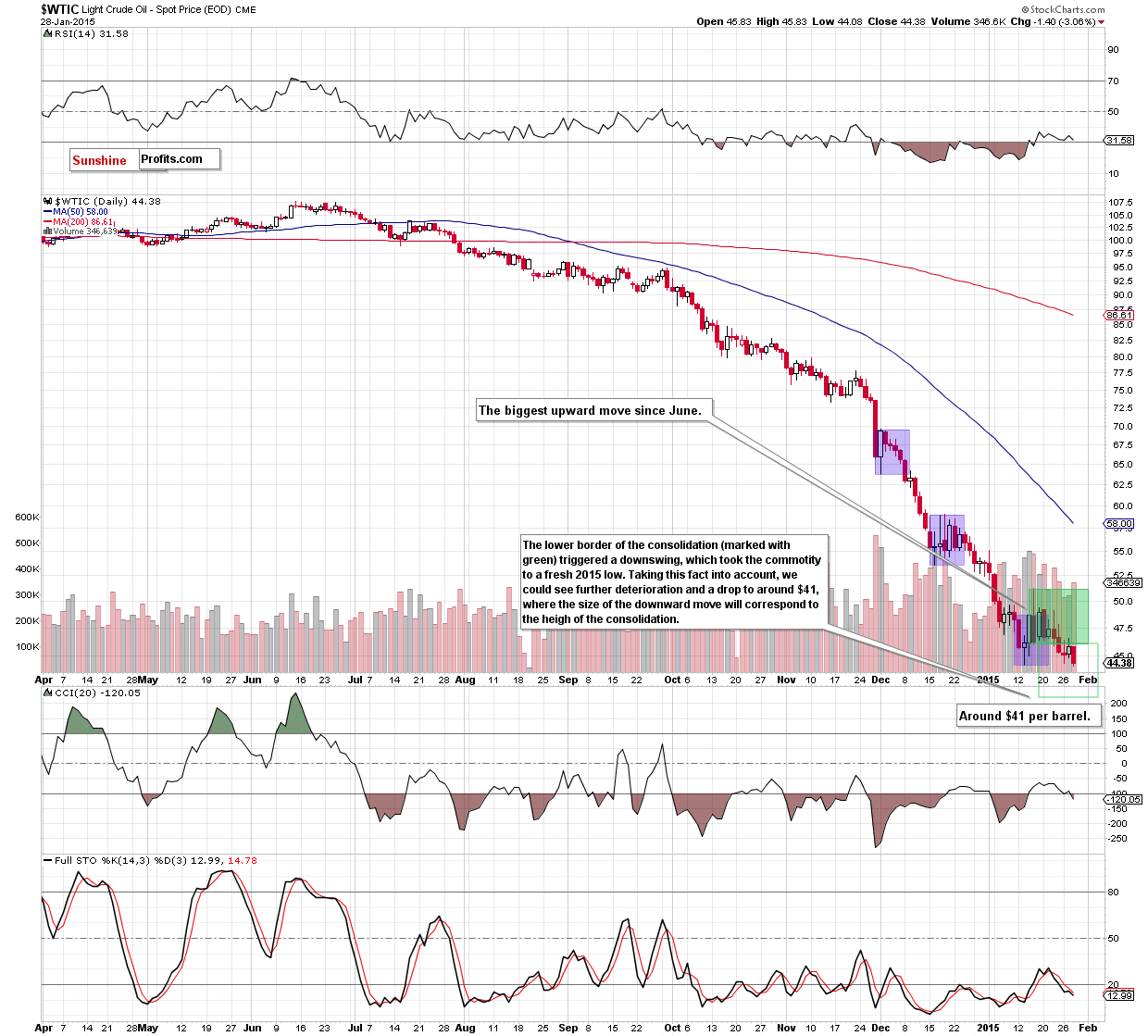

(…) the last week’s rally was the biggest upward move since June. In all previous cases, bigger corrections (marked with blue) were just another stops before new lows.

On Monday, we added:

(…) a breakdown below the lower border of the consolidation (marked with green), (…) is a bearish signal that suggests further deterioration in the coming day(s). At this point, it’s worth noting that we saw similar situations several times in the previous months (we marked them with blue). Back then, after short-lived consolidation, the commodity broke under the lower line of the formation, which triggered further deterioration and resulted in fresh, multi-month lows. (…) Taking all the above into account, and combining it with the medium-term picture (the commodity is still trading under the Apr 2009 lows), we believe that lower values of light crude and a test of the recent low are likely.

Additionally, in our Tuesday’s summary, we wrote:

(…) from today’s point of view it looks like crude oil verified the breakdown below the lower border of the consolidation, which suggests further deterioration

On the daily charts, we see that the situation developed in tune with the above-mentioned scenario and crude oil slipped to a fresh 2015 low of $44.08. Although the commodity closed the day above the previous low and invalidated the breakdown under this level, we should keep in mind that this is a positive sign only on an intraday basis. When we take a closer look at the daily closing prices, we clearly see that yesterday’s close was the nearest since years. Taking this fact into account, and combining it with the breakdown below the lower border of the consolidation (marked with green), we think that lower values of light crude are still ahead us. This scenario is also reinforced by the size of volume, which accompanied yesterday’s move – it was much bigger than a day before, which confirms the strength of oil bears.

How low could the commodity go? As you see on the daily chart, the initial downside target for oil bears will be around $41 per barrel, where the size of the downward move will correspond to the height of the formation.

Nevertheless, before we summarize today’s alert we’ll check whether yesterday’s downswing affected the medium-term picture or not.

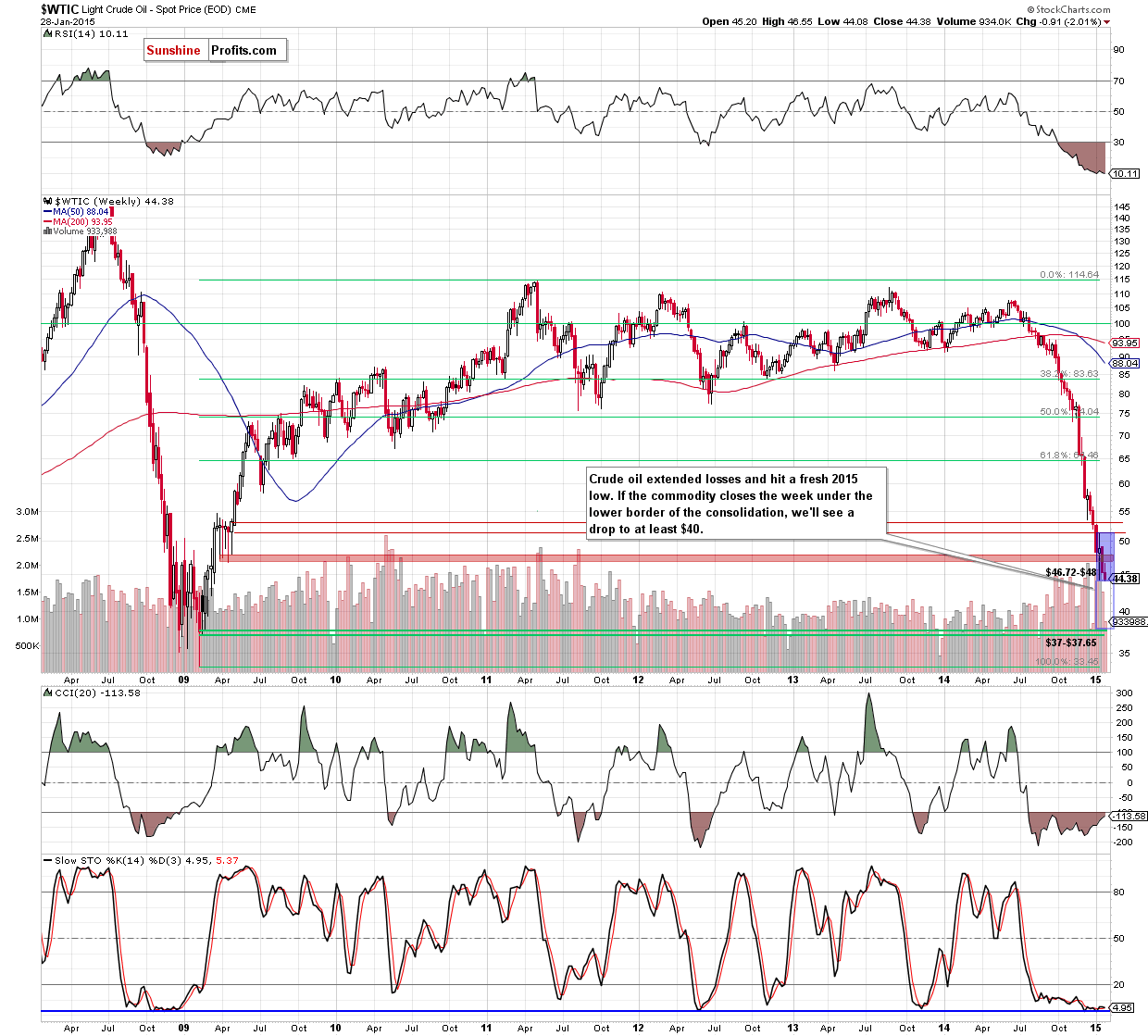

From this perspective, we see that yesterday’s drop pushed light crude below the lower border of the consolidation (marked with blue). Although the commodity rebounded and closed the day above this important support line, we should keep in mind that if we see a weekly close below it, oil bears will show their claws and took crude oil not only to $40-$41, but we could also see a decline to the next support zone around $37-$37.65, where additionally the size of the move will correspond to the height of the formation.

When can we expect a reliable trend reversal? We think that the best answer to this question will be a quote from our previous Oil Trading Alert:

(…) In our opinion, a trend reversal (and an upward move to the Dec highs around $60) will be likely only if we see a breakout above the solid resistance zone (created by the previously-broken 76.4% and 78.6% Fibonacci retracement levels marked with green on the weekly chart and the 50% Fibonacci retracement based on the mid-Dec-Jan decline), which won’t be followed by a fresh low. Until this time, the above-mentioned bearish scenario is still in play.

Summing up, crude oil extended losses and ht a fresh 2015 low. Although the commodity rebounded slightly, invalidating the breakdown below the previous low, we think that lower values of light crude are still ahead us. If this is the case, the initial downside target for oil bears will be around $40-$41 per barrel. However, if this area is broken, we could see a decline even to $37-$37.65 in the coming week(s).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts