Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Crude oil moved higher after the market’s open supported by news of Saudi Arabia King Abdullah's death and bullish Chinese and U.S. data. Despite these supportive factors, the commodity reversed as investors digested that there will be no change in Saudi's policy. In this way, light crude lost 2.64% and declined below $46 once again, breaking under the lower border of the consolidation. What does it mean for the commodity?

One of the most important Friday’s events was news of Saudi Arabia King Abdullah's death, which fuelled speculation over a possible change in the kingdom’s policy in the oil market. As a reminder, in recent months Saudi Arabia didn’t cut production to bolster the price, but has continued pumping oil to defend market share. In this environment, the commodity dropped to the levels that we saw in 2009 as abundant supplies have flooded the market in the face of weak demand. Therefore, this leadership transition in combination with the preliminary HSBC China manufacturing PMI’s increase (to 49.8 in January, beating a final reading of 49.6 in the previous month) and bigger-than-expected U.S. home sales supported the commodity and pushed it to an intraday high of $47.76.

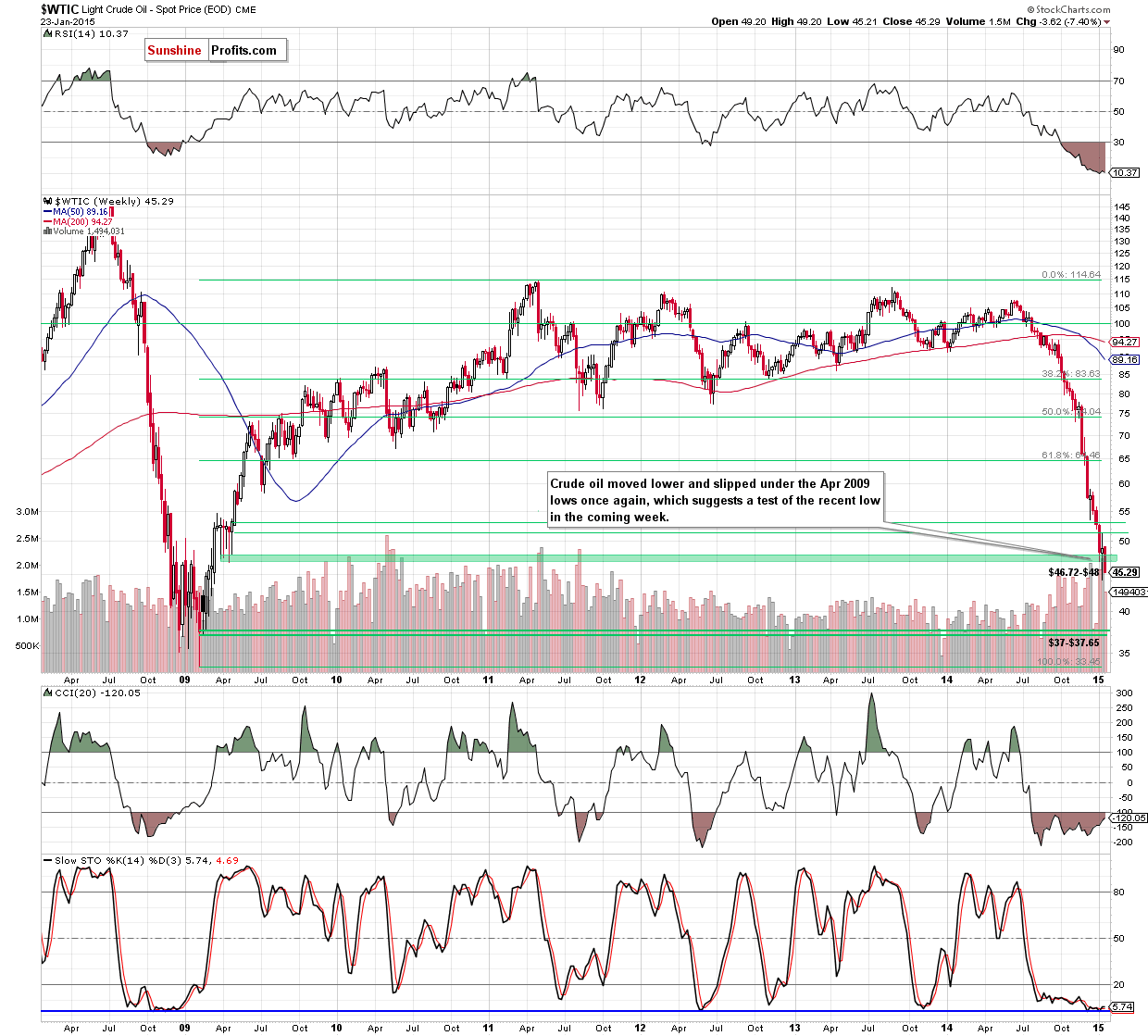

Despite this supportive factors, crude oil reversed and declined sharply after investors digested that there will be no change in Saudi's policy as the new king shares King Abdullah's views and will support oil minister Ali al-Naimi. As a result, light crude slipped below $46 per barrel once again. Does that mean that new lows are still ahead us? (charts courtesy of http://stockcharts.com).

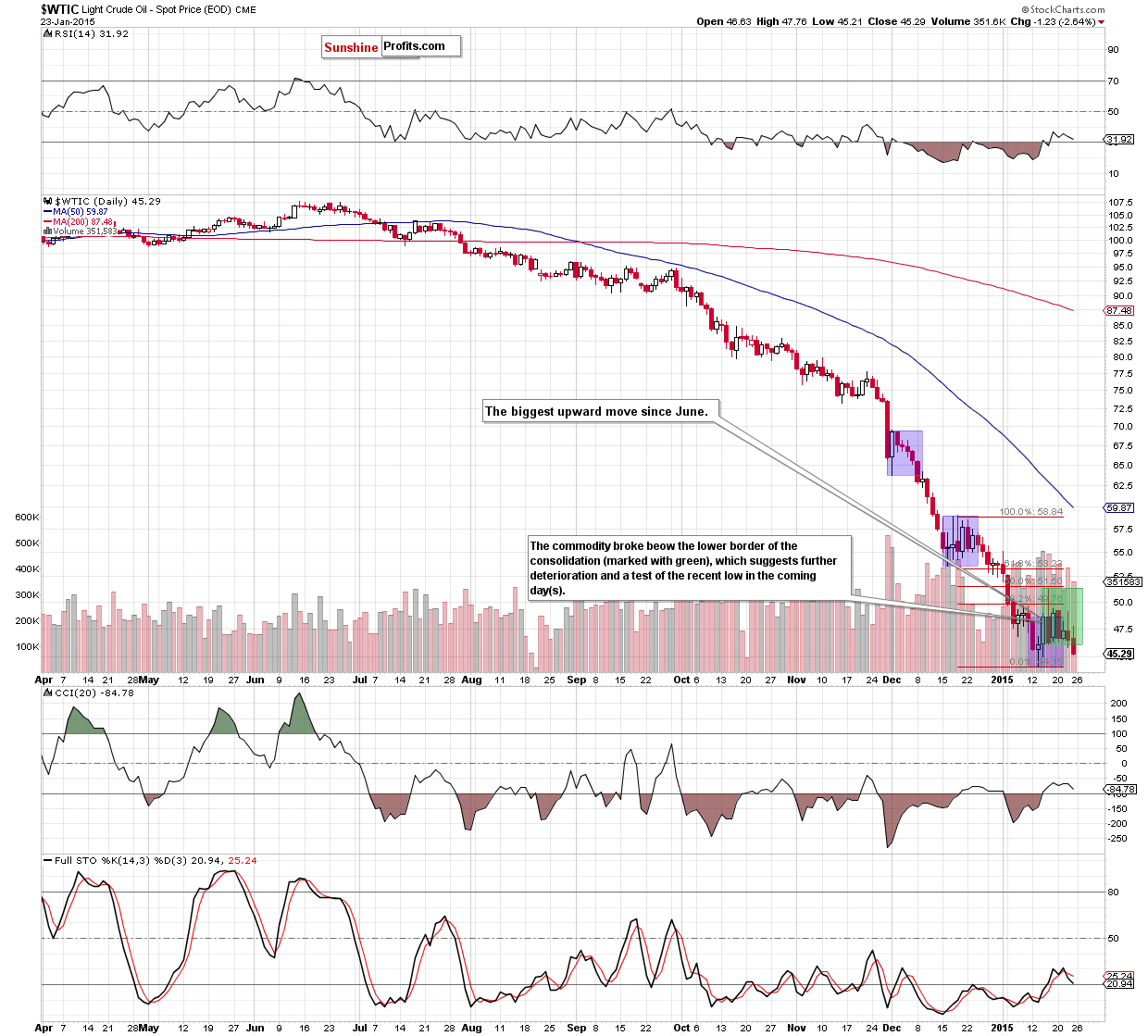

The first thing that catches the eye o the daily chart is a breakdown below the lower border of the consolidation (marked with green), which is a bearish signal that suggests further deterioration in the coming day(s). At this point, it’s worth noting that we saw similar situations several times in the previous months (we marked them with blue). Back then, after short-lived consolidation, the commodity broke under the lower line of the formation, which triggered further deterioration and resulted in fresh, multi-month lows. Additionally, recent downswings materialized on big volume, which confirms the strength of oil bears and increases the probability of realization of the above scenario in the near future. Finishing today’s alert, we should also keep in mind what we wrote on Friday:

(…) the last week’s rally was the biggest upward move since June. In all previous cases, bigger corrections (marked with blue) were just another stops before new lows.

Taking all the above into account, and combining it with the medium-term picture (the commodity is still trading under the Apr 2009 lows), we believe that lower values of light crude and a test of the recent low are likely.

Summing up,the most important event of Friday’s session was the breakdown under the lower border of the consolidation, which suggests further deterioration and a test of the recent low in the coming day(s).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion):No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts