Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

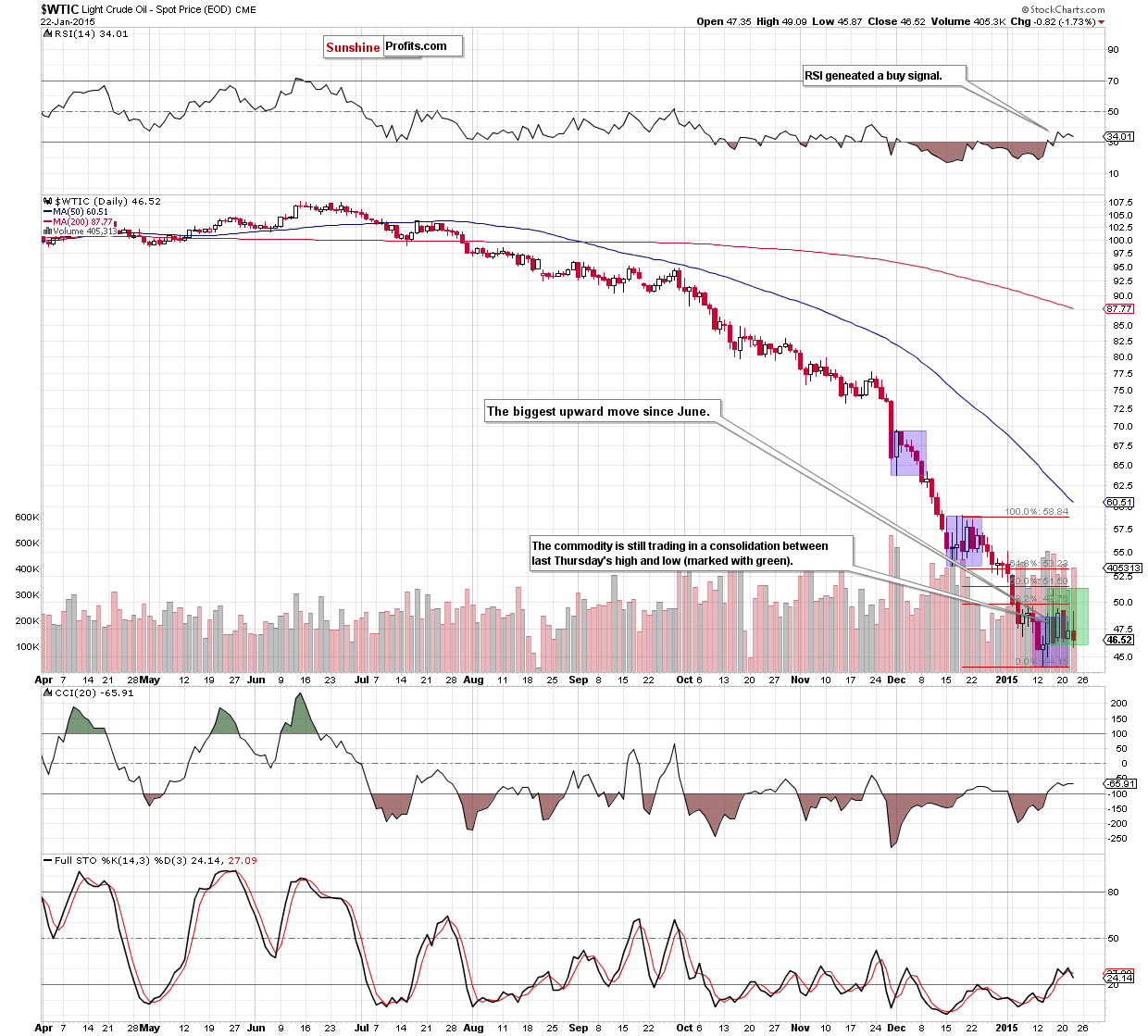

On Thursday, crude oil lost 1.73% after EIA weekly report showed a larger-than-expected increase in domestic oil supplies. As a result, light crude slipped under the Apr 2009 lows once again. Will we see the commodity under $45 in the coming days?

Yesterday, the U.S. Energy Information Administration showed in its weekly report that U.S. crude oil inventories rose by 10.1 million barrels in the week ended January 16, missing expectations for an increase of 2.7 million barrels. At this point, it’s worth noting that it was the biggest build in U.S. crude inventory in at least 14 years and they stood at their highest level for the season in at least 80 years (397.9 million barrels).

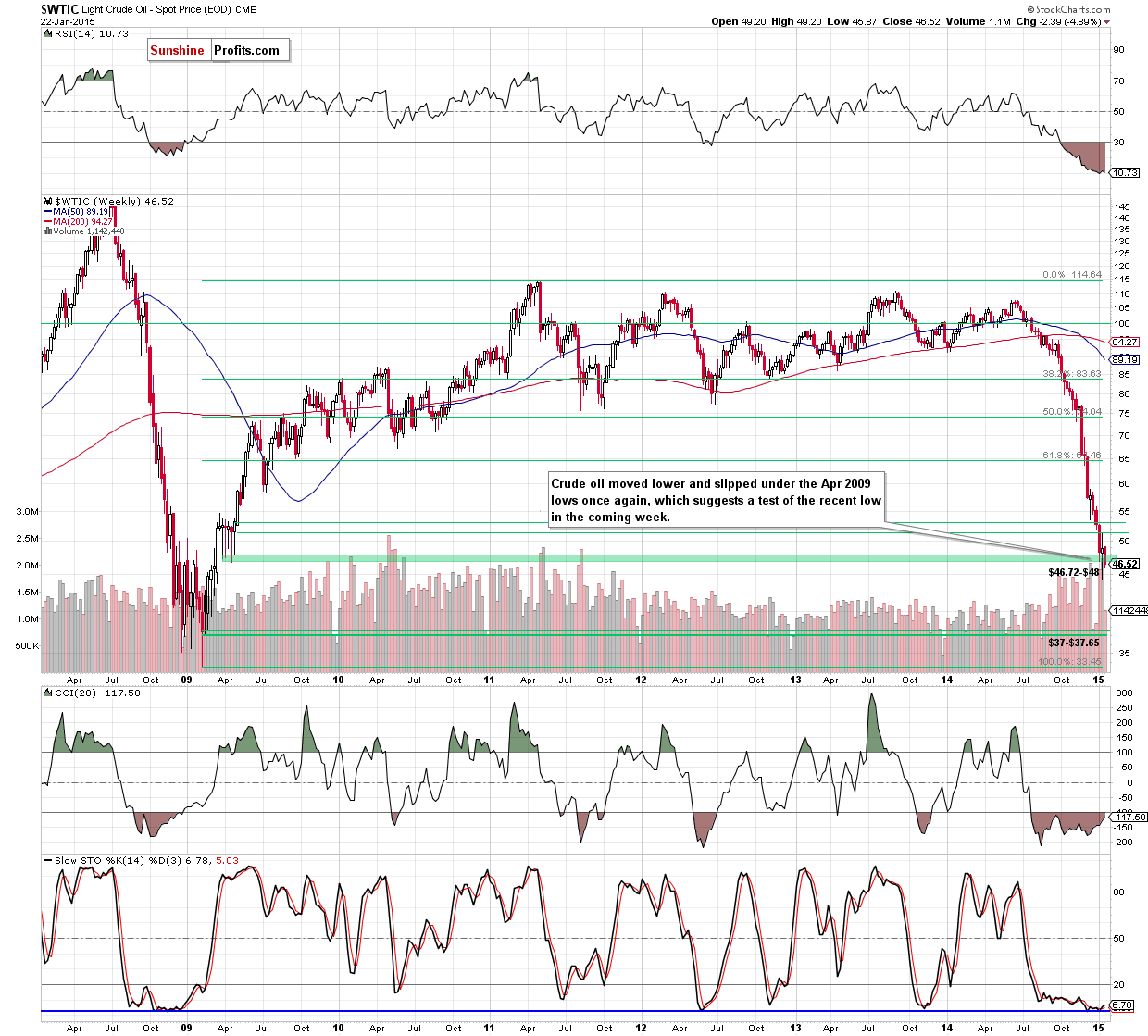

On top of that, the European Central Bank launched its large-scale buying of government bonds, a policy known as quantitative easing program. ECB will purchase €60 billion per month, starting in March and continuing until late 2016. Additionally, ECB kept its main lending rate unchanged at 0.05% and a separate rate on overnight bank deposits stored with the central bank at minus 0.2%, which means that banks will have to pay a fee to keep surplus funds at the ECB. In response to this news, the USD Index shoot up and climbed above 94.50, making crude oil more expensive for buyers using foreign currencies. In this environment, the commodity reversed and declined sharply, slipping below the Apr 2009 lows once again. Does that mean that new lows are still ahead us? (charts courtesy of http://stockcharts.com).

Looking at the above charts, we see that although crude oil moved higher after the market’s open, the commodity reversed and declined sharply, slipping under the Apr 2009 lows. Taking this fact into account, we believe that our last commentary is up-to-date:

(…) the commodity is still trading in a consolidation between the last Thursday’s high and low (…) the upper line of the formation is reinforced by the previously-broken 76.4% and 78.6% Fibonacci retracement levels (marked with green on the weekly chart) and the 50% Fibonacci retracement based on the mid-Dec-Jan decline. Additionally, the last week’s rally was the biggest upward move since June. In all previous cases, bigger corrections (marked with blue) were just another stops before new lows. Taking all the above into account, we believe that as long as crude oil is trading under these levels, another pullback and a test of the recent low is likely.

Before we summarize today’s alert, please note that yesterday’s downswing materialized on huge volume (compared to the previous day’s increase). This is a negative signal, which confirms the strength of oil bears and increases the probability of realization of the above scenario in the coming (days).

Summing up, crude oil moved lower and dropped below the Apr 2009 lows, which suggests further deterioration. Nevertheless, it seems to us that the bearish scenario and a test of the recent low will be more likely if the commodity drops under the lower border of the consolidation marked on the daily chart. Please keep in mind that a trend reversal will be likely only if we see a breakout above the resistance zone (created by the previously-broken 76.4% and 78.6% Fibonacci retracement levels and the 50% Fibonacci retracement based on the mid-Dec-Jan decline), which won’t be followed by a fresh low. When the next powerful rally emerges it will likely create a tremendous buying opportunity, however at this time the evidence that we have don’t support this scenario to the degree that is necessary to push the risk/reward ratio into the levels that would justify opening long position. Simply put, the risk of another downswing is too big for us to mention opening long positions in crude oil. As always, we’ll keep you – our subscribers – informed.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts