Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

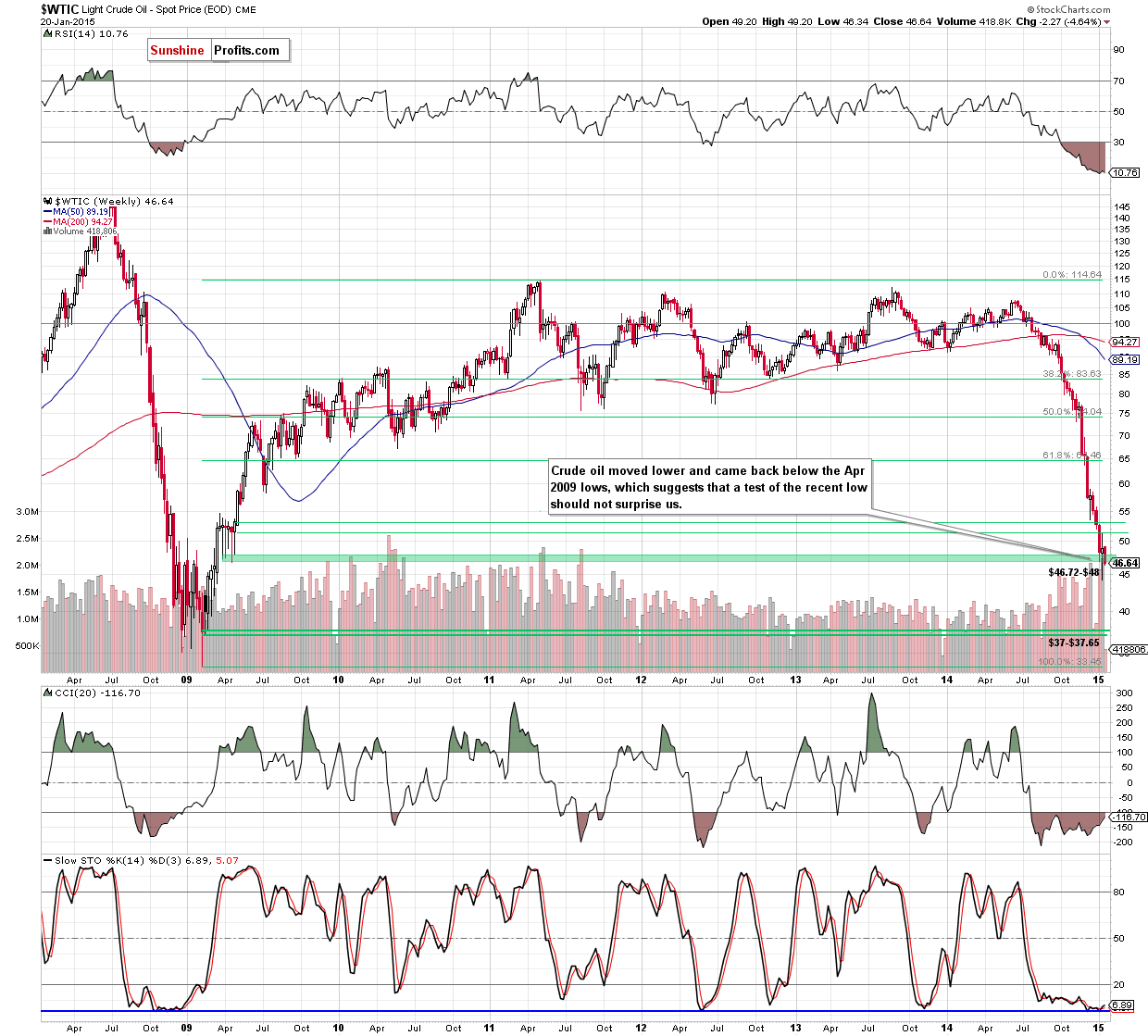

On Tuesday, crude oil lost 4.64% as the combination of the International Monetary Fund decision to cut its 2015 global economic forecast, disappointing Chinese data and news from Iraq weighed on the price. In these circumstances, light crude reversed and slipped under the Apr 2009 lows once again. Will we see a test of the recent low in the coming days?

On Monday, the International Monetary Fund cut its global economic forecast by 0.3 percentage points for this year and next, projecting a 3.5% growth in 2015 and 3.7% for 2016. Additionally, on Tuesday, Chinese data showed that economic growth in 2014 in the No. 2 oil consumer slowed to 7.4%. On top of that, Iraqi oil output hit a record in December, while Iran's Oil Minister Bijan Zanganeh said that the price of the commodity could drop even to $25 a barrel without supportive OPEC action. These circumstances added to worries that global oil demand won’t be able to keep up with supply and pushed the price of crude oil to an intraday low of $46.34. Will we see further deterioration? (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

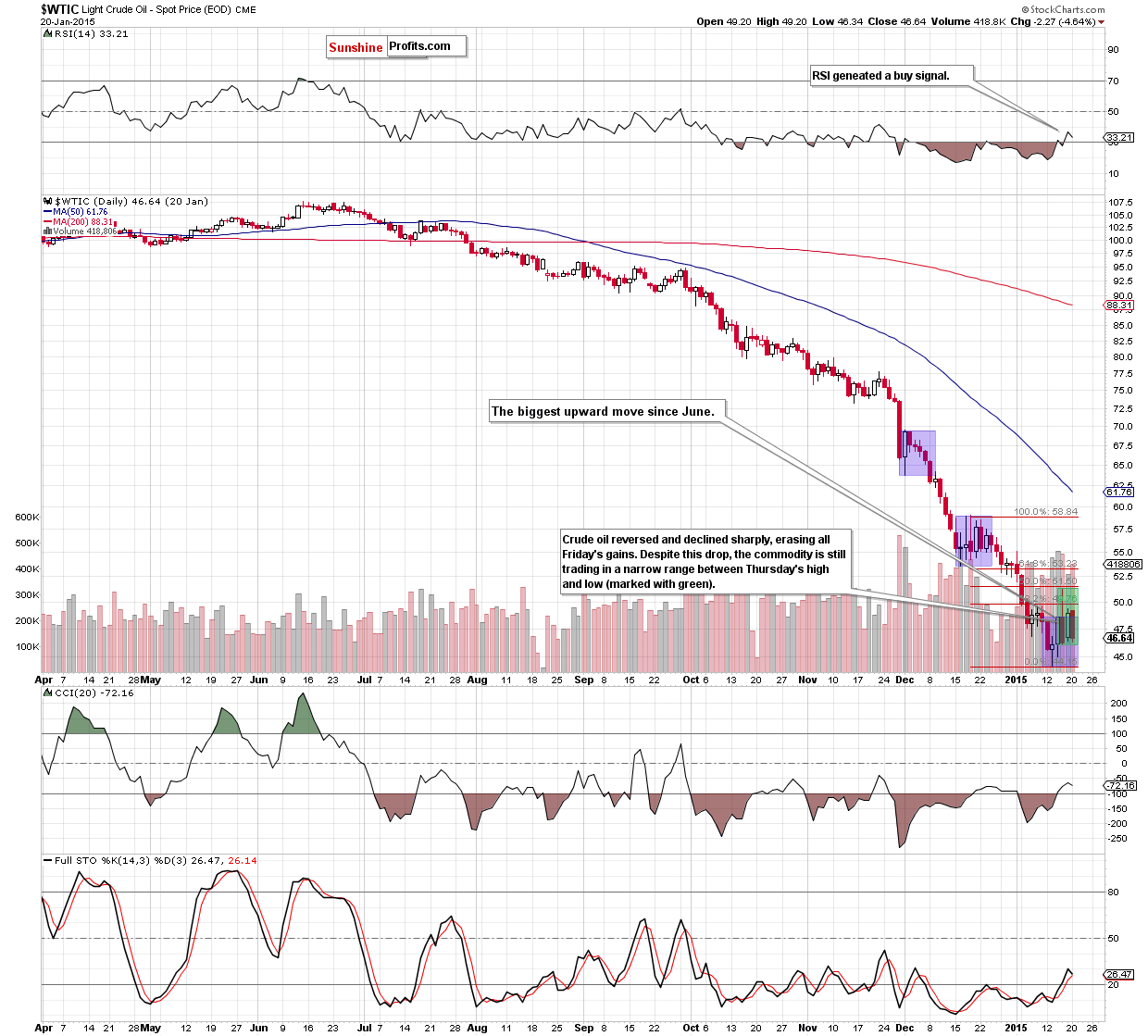

(...) Friday’s increase materialized on relative low volume (compared to what we saw in the first half of the week), which means that oil bulls might be not as strength as it seems at the first glance. Additionally, the commodity is still trading under the 50% Fibonacci retracement based on the mid-Dec-Jan decline, which keeps gains in check. On top of that, the last week’s rally is the biggest upward move since June. In all previous cases, bigger corrections (marked with blue) were just another stops before new lows.

(...) in our opinion, as long as crude oil is trading under Thursday’s high and the 50% Fibonacci retracement another pullback and a test of the Apr 2009 lows in the coming day(s) should not surprise us.

Looking at the daily chart, we see that the situation developed in tune with the above-mentioned scenario as crude oil reversed once again and declined. With this downward move, the commodity erased all Friday’s gains and came back below the Apr 2009 lows, which s a negative signal that suggests further deterioration. Additionally, the size of volume that accompanied yesterday’s decline was rather significant, which confirms the bearish outlook.

The above means one thing – that basically nothing changed yesterday. The outlook was mixed and it is mixed today as well. There are no changes on the long-term picture either. Consequently, we can summarize today’s Oil Trading Alert in the same way as we’ve summarized the yesterday’s one:

Summing up, the commodity is still trading under the 50% Fibonacci retracement based on the mid-Dec-Jan decline. Therefore, we think that a trend reversal (and an upward move to the Dec highs around $60) will be likely only if we see a breakout above this key resistance, which won’t be followed by a fresh low. Until this time, another pullback in the coming day(s) should not surprise us.

When the next powerful rally emerges it will likely create a tremendous buying opportunity, however at this time the evidence that we have don’t support this scenario to the degree that is necessary to push the risk/reward ratio into the levels that would justify opening long position. Simply put, the risk of another downswing is too big for us to mention opening long positions in crude oil. As always, we’ll keep you – our subscribers – informed.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts