-

Trade Management: Risk Reduction Before the Weekend

November 11, 2022, 12:02 PMAvailable to premium subscribers only.

-

What the USDX Shows Will Happen to Oil Soon

November 9, 2022, 9:41 AMLess than a month from now – on December 5 – an embargo on maritime exports of Russian crude oil to the European Union will come into force, as I explained in my last article.

As a result, global oil supply is expected to tighten significantly, with Russia being the world’s largest exporter of oil and fuels.

Therefore, energy markets are bracing for turbulence, as they may face a new storm of volatility.

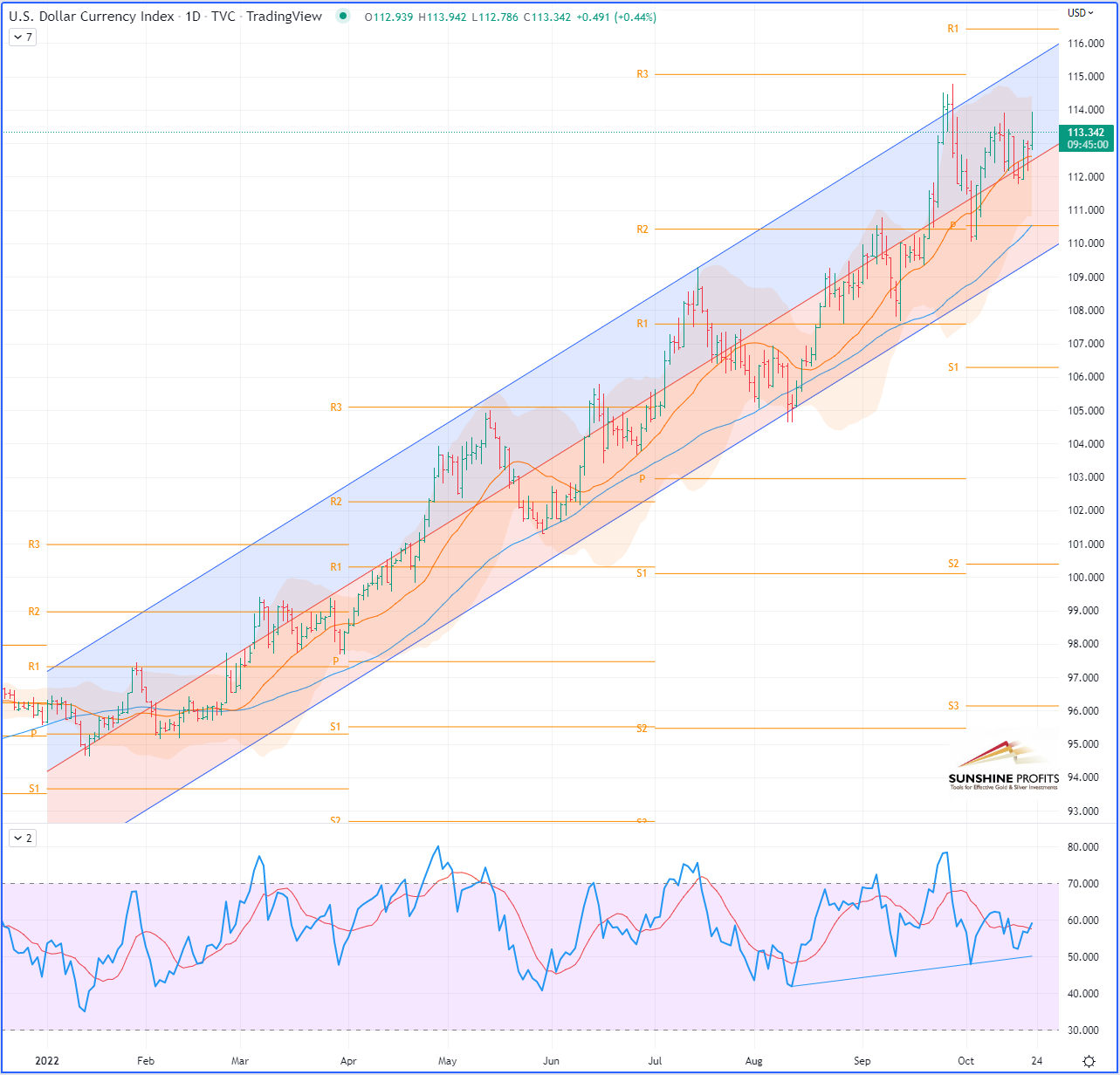

On the macroeconomic view, the US Dollar Currency Index – still weakening against a basket of major currencies – starts looking down from the balcony to revisit some lower floors:

US Dollar Curency Index – 2021-2022 (zoomed out)

US Dollar Curency Index – 2021-2022 (zoomed out)While currently moving slightly outside the lower band of the 2022 regression channel, its previous swing low from October has just been taken over as the DXY is now progressing within a newly forming downward regression channel starting from the end of the last quarter.

US Dollar Currency Index (DXY) CFD (daily chart) for 2022 (zoomed in)

US Dollar Currency Index (DXY) CFD (daily chart) for 2022 (zoomed in)Let’s zoom into a 4H chart to get a larger picture:

US Dollar Currency Index (DXY) CFD (4H chart)

US Dollar Currency Index (DXY) CFD (4H chart)Here is the big picture for the WTI Crude Oil chart, after zooming out over the weekly timeframe:

WTI Crude Oil (CL) Futures (Continuous, weekly chart)

WTI Crude Oil (CL) Futures (Continuous, weekly chart)The long-term structure looks rather bullish for the black gold – with an upward trend that could be triggered as the greenback may start to explore lower floors.

At the moment, if we consider the past two sessions this week alone, both assets are correlated rather positively (both falling at the same time).

But this short-term correlation may start to turn negative if we see further weakening on the US dollar, which would have the effect of propelling commodities, starting with energy. But gold can also benefit from this, as investors may switch to the yellow metal as a new safe-haven.

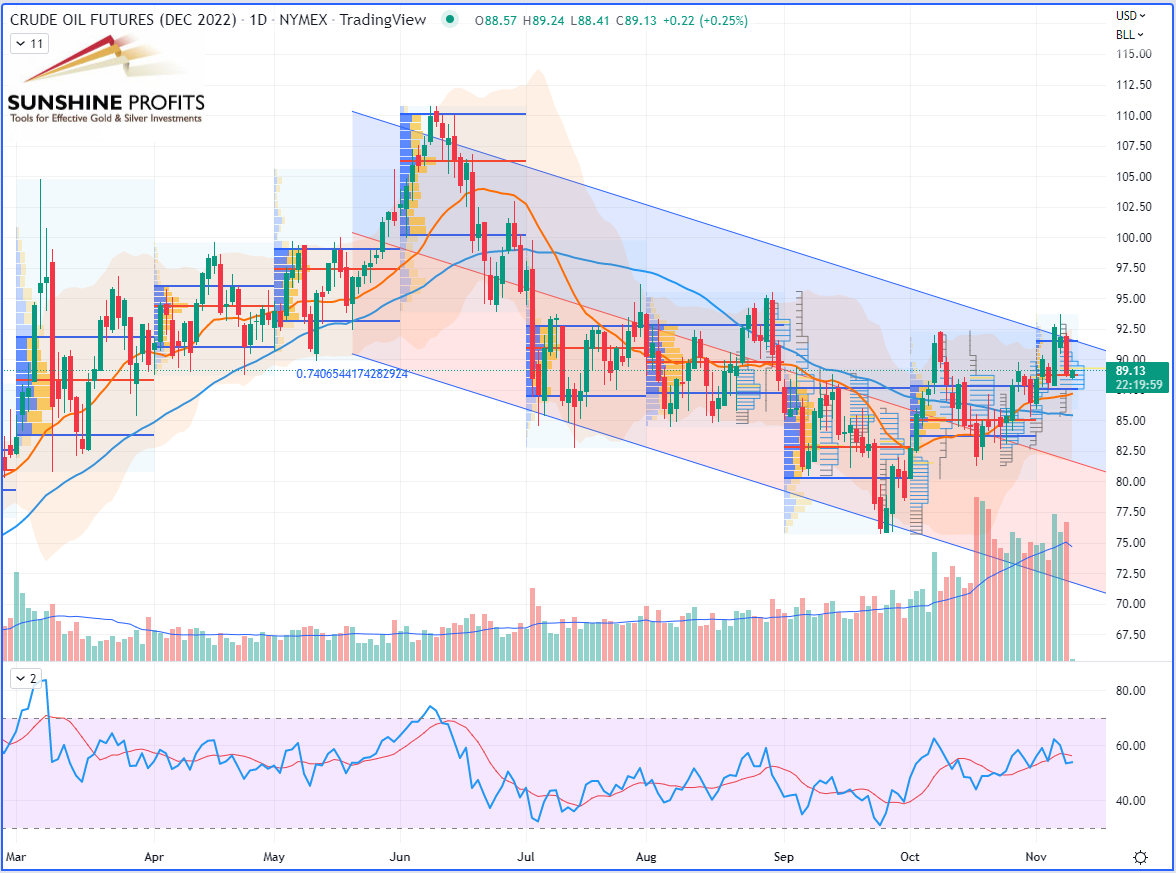

WTI Crude Oil (CLZ22) Futures (December contract, daily chart)

WTI Crude Oil (CLZ22) Futures (December contract, daily chart)If oil prices fell on Tuesday (Nov 8th), it was mainly because they were weighed down by disappointing indicators in China and a resurgence of the epidemic which threatens demand in the country, one of the engines of global demand.

Demand in China – the country that imports the most crude in the world and also the second consumer of oil (after the United States) – is particularly unstable since the health authorities assured that the strict zero-Covid health policy would continue to be applied.

Moreover, as financial market players are increasingly concerned about the state of the global economy, the latest commercial data from China, which also highlighted a significant slowdown, seems to have proven them right.

WTI Crude Oil (CLZ22) Futures (December contract, 4H chart)

WTI Crude Oil (CLZ22) Futures (December contract, 4H chart)This is the scenario I’m expecting will play itself out. Now, please tell me about yours!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

Is Crude Oil Switching into Bullish Territory Now?

November 4, 2022, 11:31 AMOil prices are trading this Friday at their highest in nearly a month, benefiting from the looming tighter supply as an effect of market speculation around potential zero-Covid policy relief in China.

Available to premium subscribers only – New trading projections on Crude Oil Futures DEC22

In addition to the reduction in the OPEC+ production target of 2 million barrels per day for the month of November, the EU embargo and the planned cap on the price of Russian oil add to the pervasive tension in the market.

In addition, the G7 member countries and Australia have agreed to set a fixed cap for the price of Russian oil rather than a variable rate in the interests of clarity, while the United Kingdom has aligned itself with the European Union by prohibiting British ships and service providers from contributing to the maritime transport of Russian oil sold above the fixed price set by the G7 and Australia.

In fact, the services covered by the ban include crude oil transport insurance, a type of insurance called protection and indemnity (P&I) essential for oil tankers covering risks ranging from wars to environmental damage for amounts that can be colossal. Actually, the United Kingdom holds 60% of this market.

On the other hand, the US dollar has weakened today against a basket of major currencies:

US Dollar Currency Index (DXY) CFD (daily chart)

On the WTI Crude Oil chart, by zooming out over the weekly chart, here is what we have now:

WTI Crude Oil (CL) Futures (Continuous, weekly chart)

So here on the long-term horizon, the overall structure of the crude oil market shows an upward trend. Until today we were in a bearish trend on the daily chart (in a mid-term horizon), however, by rallying above its previous month’s high, the WTI might be signaling a trend change by switching into bullish territory again.

Given the recent disagreements between Saudi Arabia-led OPEC+ – reducing its output of crude production – and the United States just as they are entering their mid-term elections, we could expect some manipulations on the oil futures market to push prices lower, the same way it has been done in the gold market over the past 20 years or so. However, the main difference here lies in the fact that the crude oil futures market – unlike the gold market which is mainly used for hedging purposes, portfolio diversification and speculation through paper trading – entails a much larger share of physical deliveries by major market players, which is what makes it more difficult to manipulate.

That’s all, folks, for today – Have a nice weekend!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

WTI Crude Oil Is Stuck in a Choppy Trading Environment

October 21, 2022, 10:05 AMOil prices ended the week caught between the headwinds of a tighter global supply and a lacklustre economic outlook eroding consumers' purchasing power.

Macroeconomics

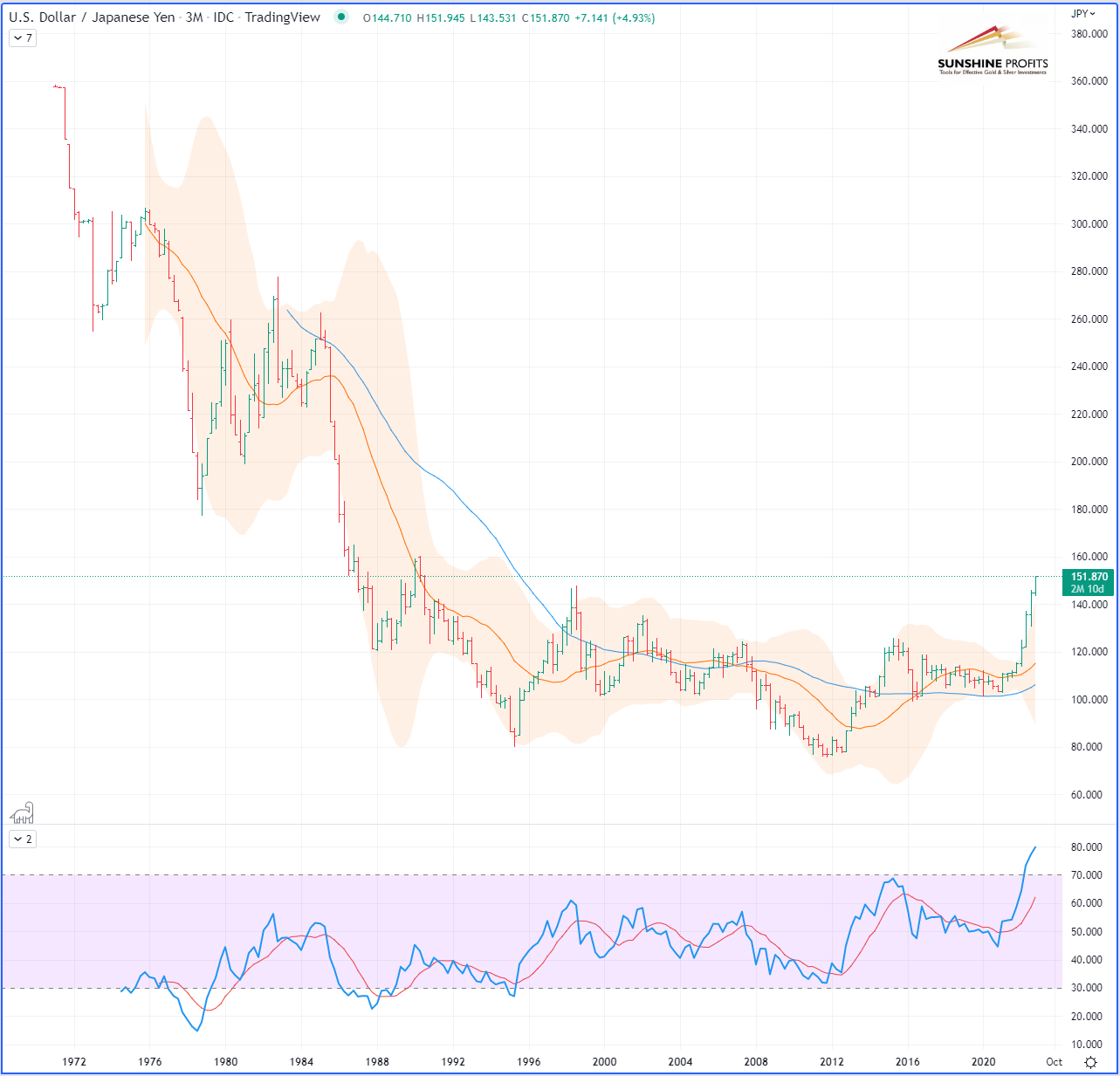

On Thursday, the greenback took off over the value of 150 Japanese yen – a symbolic price mark – for the first time since the 1990s.

A strong dollar reduces foreign investors' purchasing power in other currencies and thus demand. Therefore, the Fed reinforced expectations that the central bank could raise rates aggressively early next month, which should contribute to a significant slowdown in activity and demand. As for inflation, it barely fell in the United States in September over one year, to 8.2% against 8.3% in August.

U.S. Dollar Currency Index (DXY), daily chart

Fundamental Analysis

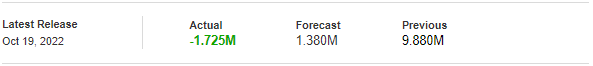

Crude prices have oscillated between losses and gains this week as concerns over the global economic slowdown clash with caution over tighter supply. The market seems to be receiving mixed signals now, with falling US oil inventories indicating increased demand in the country, while weak economic signals are having an adverse impact (on prices).

U.S. Crude Oil Inventories

On Wednesday, the Energy Information Administration's (EIA) released the weekly change in crude oil stocks, showing a drop of 1.725M barrels, while the forecasted figure predicted 1.380M barrels in excess.

(Source: Investing.com)

Geopolitics

Belarus could take further steps towards direct involvement in the war in Ukraine, As food corridor talks continue between representatives from the United Nations and Russia in order to maintain an agreement on the departure of ships from Ukrainian ports. A "hidden mobilization" would be underway after the announcement of the creation of a joint military group between Russia and Belarus, according to the independent Belarusian newspaper "Nacha Niva". So far, the Belarusian army has not participated in the fighting on Ukrainian territory. Since the beginning of the conflict in Ukraine, Belarus has served as a logistics platform for its Russian ally.

Technical Charts

WTI Crude Oil (CLZ22) Futures (December contract, daily chart)

RBOB Gasoline (RBZ22) Futures (December contract, daily chart)

Brent Crude Oil (BRNZ22) Futures (December contract, daily chart) – Contract for Difference (CFD) UKOIL

That’s all, folks, for today. Have a nice weekend!

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist -

WTI Crude Oil – First Target Hit Successfully!

October 12, 2022, 12:04 PMAvailable to premium subscribers only.

Today's premium Oil Trading Alert includes details of our new trading position. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Sebastien Bischeri,

Oil & Gas Trading Strategist

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM