tools spotlight

-

Cabin Crew, Prepare for Landing: Gold Miners Plane Goes Down

May 12, 2022, 7:54 AMOnce again, practically everything that I wrote in Monday’s analysis, Tuesday’s analysis, and yesterday's analysis remains up-to-date.

In yesterday’s analysis, I wrote the following about the stock market:

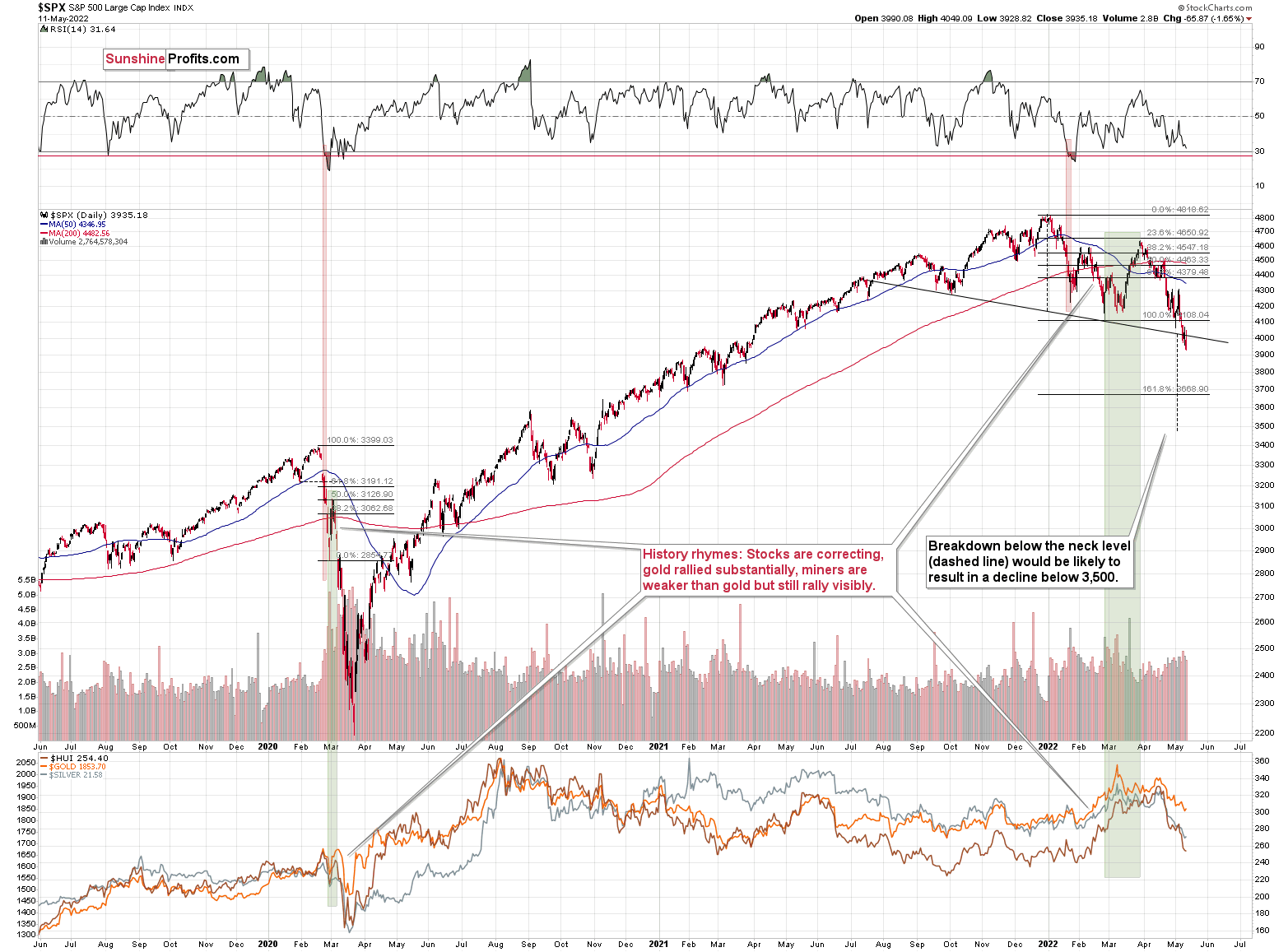

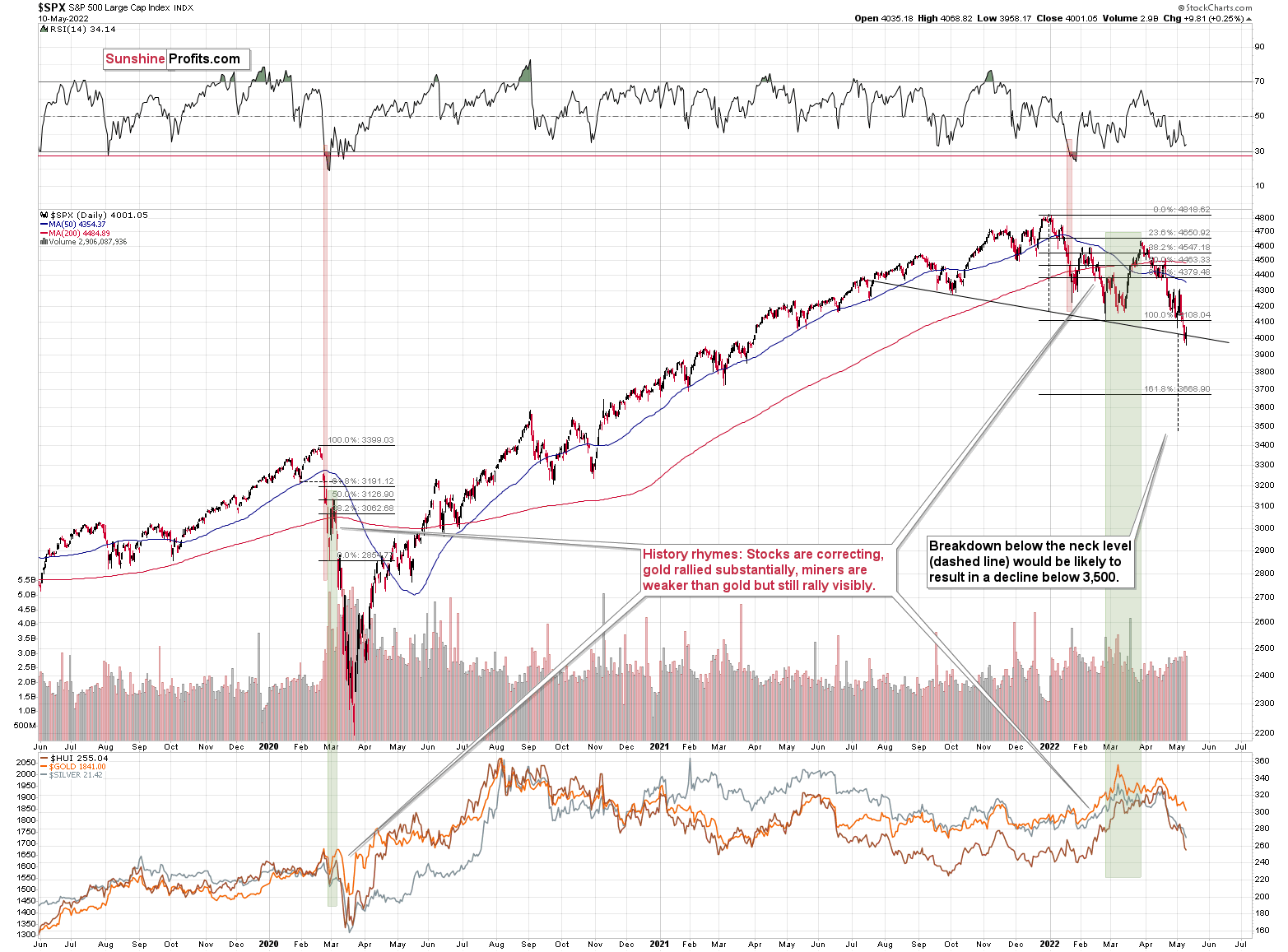

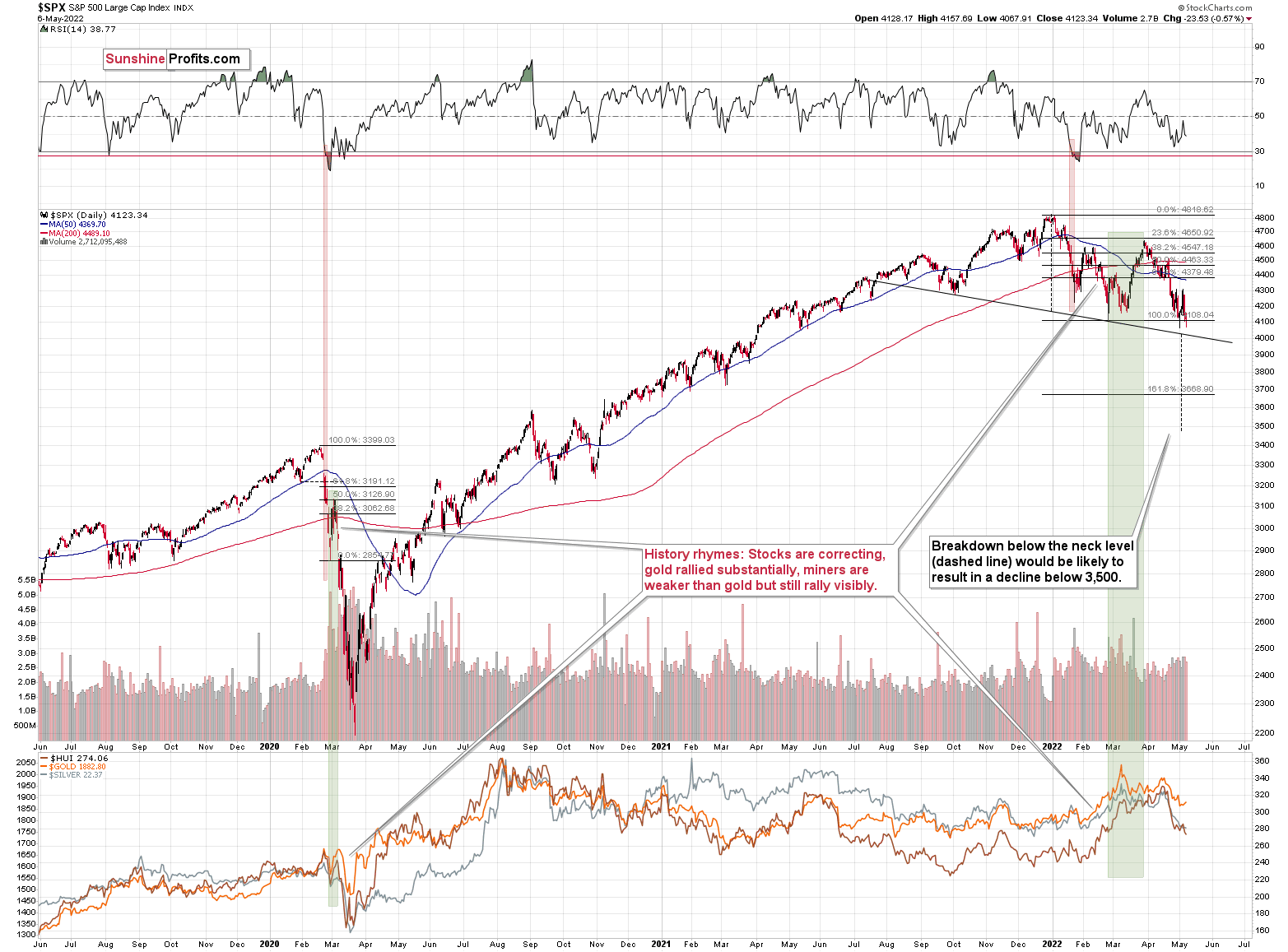

Speaking of the general stock market, it moved slightly higher yesterday (in terms of closing prices), but the move was not significant enough to invalidate the breakdown below the neck level of the head-and-shoulders formation. Therefore, the breakdown is now almost confirmed, and the situation is already more bearish than it was yesterday.

At the moment of writing these words, stocks are once again trying to rally, but so far the rally is not as big as yesterday’s pre-market rally that was just erased. Thus, I doubt that stocks will be able to avoid falling in the near term.

The S&P 500 is currently confirming a breakdown below its head and shoulders pattern. Once confirmed (just one more close below the neck level is required), the formation will be complete, and the next target will be below 3,500. So, yes, I expect the S&P 500 to decline below its 2021 lows in the near future.

Despite yesterday’s attempt to move higher, stocks closed the day below the neck level of the head and shoulders pattern for the third consecutive day. The bearish H&S pattern was confirmed, just as I expected.

The implications are bearish, and while the target based on this formation is slightly below 3,500, it wouldn’t surprise me to see a rebound from about 3,800 – that’s where the 38.2% Fibonacci retracement is located. I previously wrote about it in the following way:

Is there any nearby support level that would be strong enough to stop this short-term decline? Yes: it’s the 38.2% Fibonacci retracement level based on the 2020-2022 rally.

Back in 2020, the very first decline erased 50% of the preceding rally, but back then the market was much more volatile than it is right now, so it’s understandable.

If we see a decline to the 38.2% Fibonacci retracement and then a comeback to the previously broken neck level of the head and shoulders pattern, it would fit practically everything that I wrote above and in the previous days / weeks.

It would trigger another immediate-term decline in silver and mining stocks in the near term, wchich would be followed by a (quite likely tradable) rebound.

So, it seems that the general stock market is quite close to its near-term target area but not yet at it – another move lower appears likely.

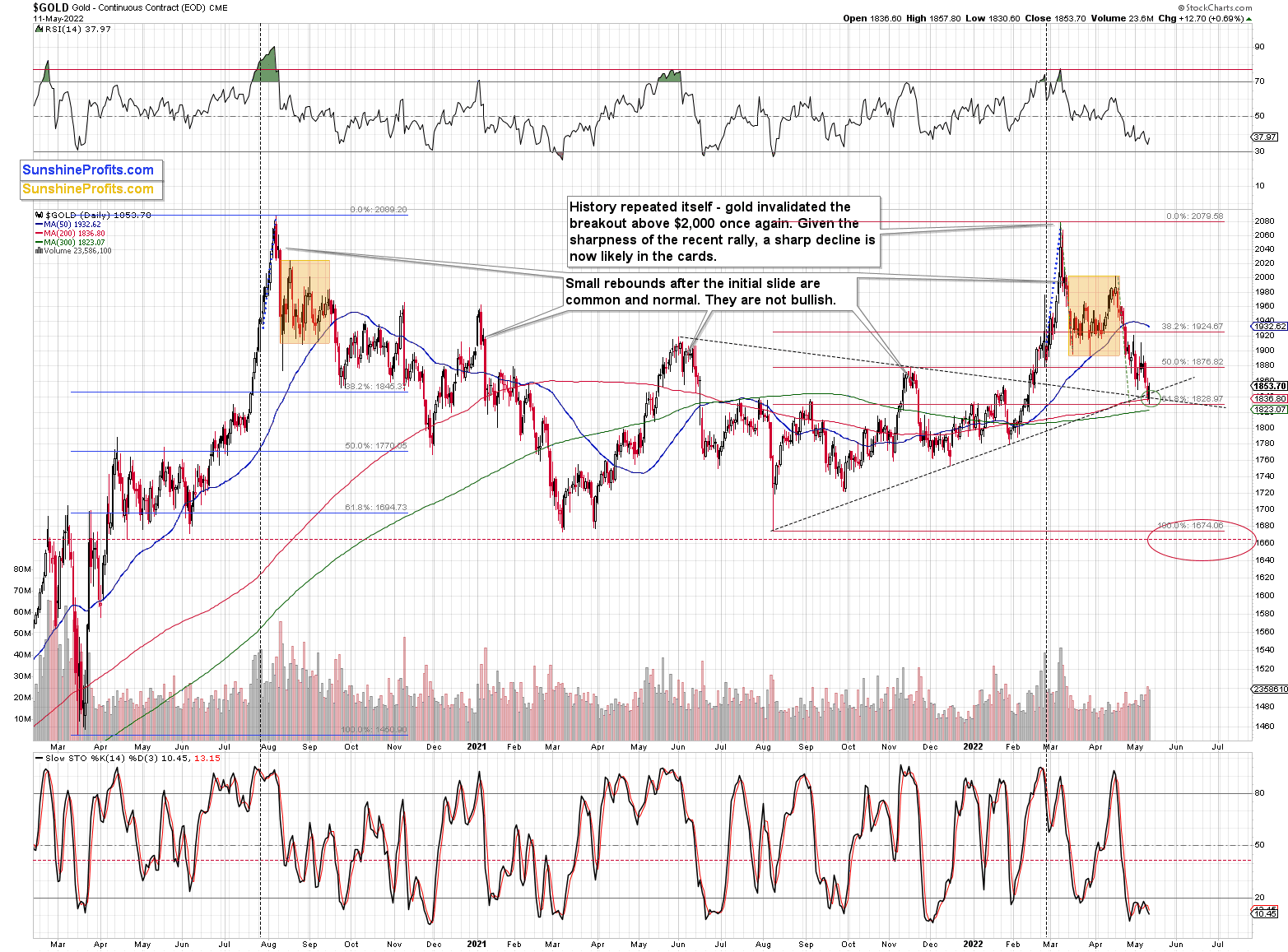

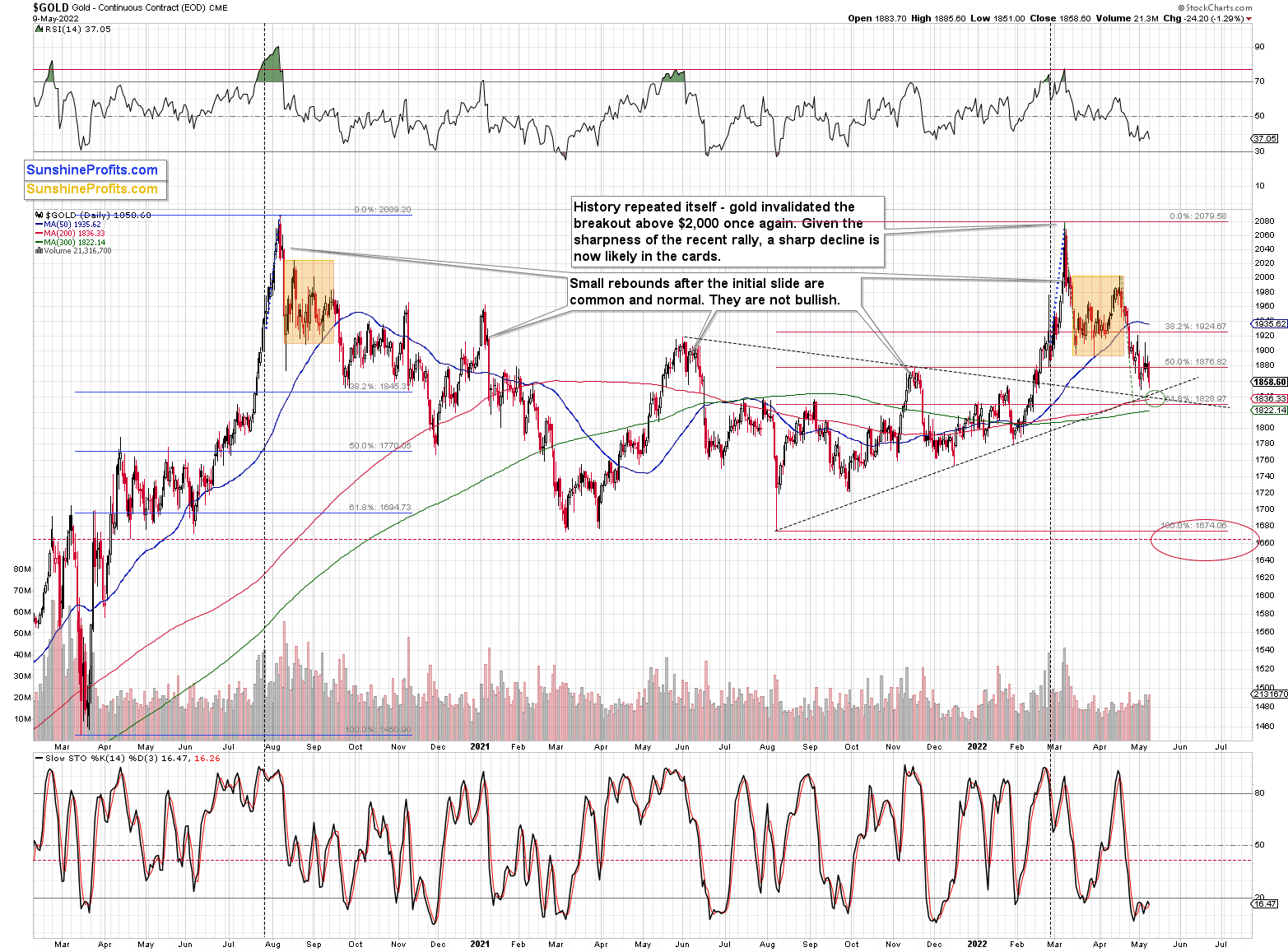

Having said that, let’s take a look at the other (usually main) determinant of the driver of junior mining stock prices – gold.

In yesterday’s analysis, I commented on the gold chart in the following way:

As gold moved right to the middle of my target area, it seems that it might not want to move much lower before correcting. However, it’s still possible that the bottom would form over several days, and if the stock market declines during that time, junior miners could decline despite the lack of declines in gold.

If the above is the case, then once the stock market moves back up, juniors will likely soar back with vengeance, like a coiled spring that’s finally able to expand. For now, it seems that the general stock market will take juniors lower (in the very near term, that is).

Please take one more look at the part that I put in bold. The stock market declined yesterday, while gold moved higher. What did the mining stocks do? The GDX ETF was slightly lower and the GDXJ ETF was slightly higher, but overall they didn’t do anything despite the intraday attempt to rally.

The above is in perfect tune with the current situation in gold and stocks. As gold rallied yesterday, and it moved a bit lower once again in today’s pre-market trading (~$7 at the moment of writing these words), it’s likely forming a broader bottom here. Since stocks (S&P 500 futures) are trading lower (they are down by 0.5%) in today’s pre-market trading, it seems that junior miners are about to get another bearish push.

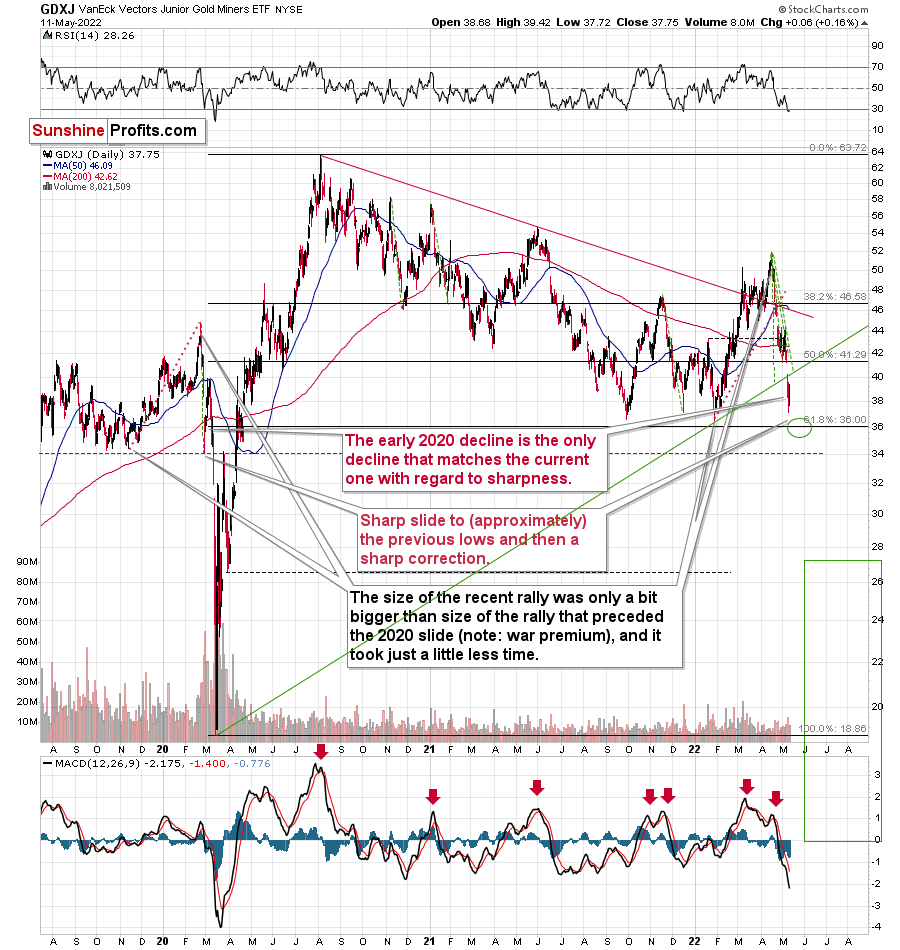

As stocks are likely to move a bit lower before correcting, so are junior miners. This means that practically everything that I wrote about their performance and outlook remains up-to-date – the market simply agreed:

In short, just like in the case of silver, I decided to move our exit prices lower – a bit below the previous lows.

Why? Because that’s where there’s the next really strong support – provided by the 61.8% Fibonacci retracement and because it seems that the general stock market will decline a bit more before correcting.

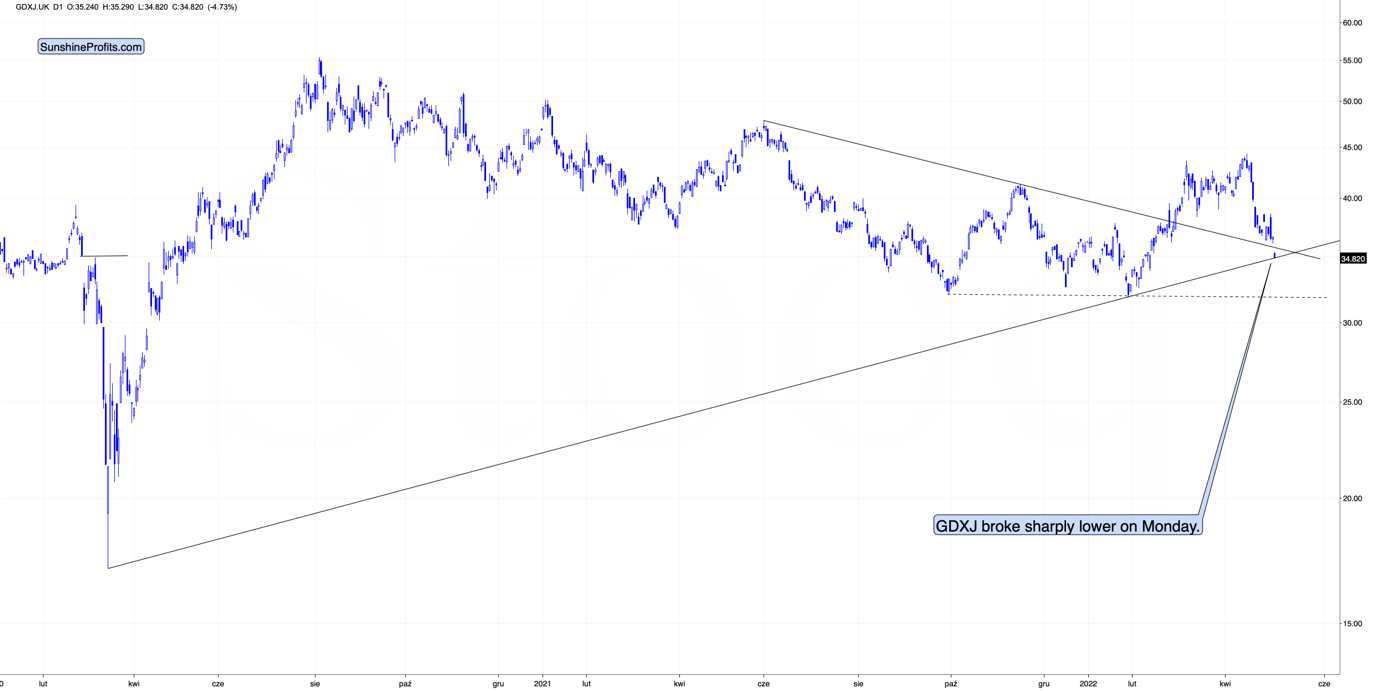

I mean, I expected juniors to decline along with the general stock market, but the huge size of juniors’ decline was more than I had expected to happen during just one session compared to what happened in the S&P 500.

If stocks have more to fall (much more than just a repeat of yesterday’s decline) and gold could repeat its yesterday’s decline, it seems that junior miners could more than repeat their slide. Since they fell by over $3 yesterday, juniors can now decline by at least another $3. This would bring them below their previous lows and below the previous target of about $37.

In fact, given the strength of the momentum, I wouldn’t even rule out the scenario in which miners slide to ~$34. Then again, let’s not forget that miners tend to show some kind of strength before rallying, so the pace of their decline would be likely to diminish before the turnaround. Therefore, expecting the sharpness of the decline to continue all the way down is not realistic. Consequently, ~$36 seems more realistic as a short-term downside target than $34 is.

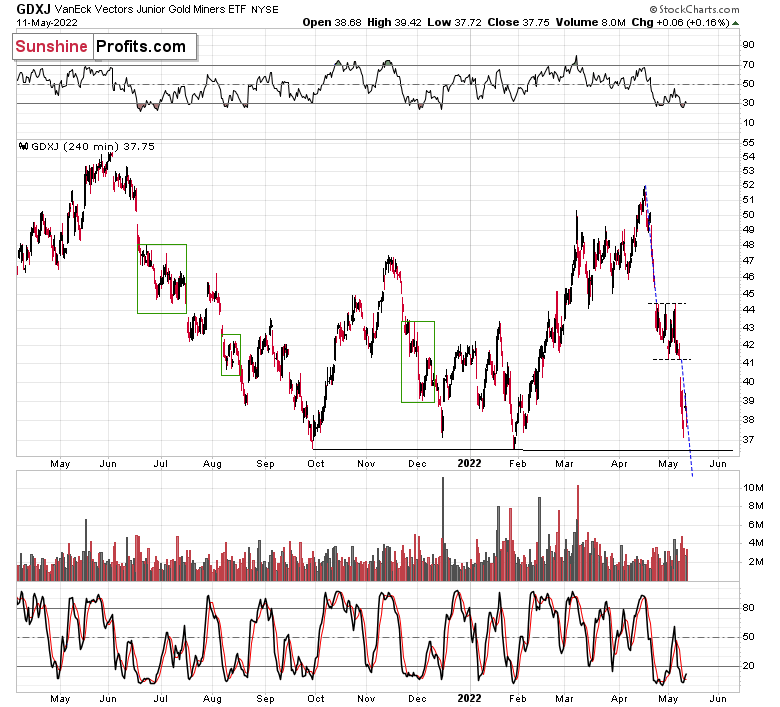

Besides, the GDXJ’s 4-hour chart also suggests a move to this area.

Consolidations tend to be followed by price moves that are similar to the moves that preceded them. Applying this to the letter provides us with a target that’s slightly below $36.

To summarize the technical part of today’s analysis, it seems that junior miners will move to their short-term target soon, which will enable us to exit the current short positions in them and (if one wants to do so, that is) to enter temporary long positions to benefit from the likely rebound.

As soon as the target levels are reached in the case of the GDXJ, I think that exiting short and entering long positions will be justified from the risk to reward point of view (regardless of whether you get a confirmation from me). Please note that the move to ~$36 could be sharp, and it could be reversed on an intraday basis.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

If You Held a Short Position in Silver, You Hit the Bull’s-Eye

May 11, 2022, 9:05 AMIn short, practically everything that I wrote in Monday’s analysis and yesterday’s analysis remains up-to-date. The profit-take levels in silver were hit, so those of you who chose to hold a short position in silver have likely reaped nice profits yesterday. Congratulations!

In yesterday’s analysis, I commented on silver in the following way:

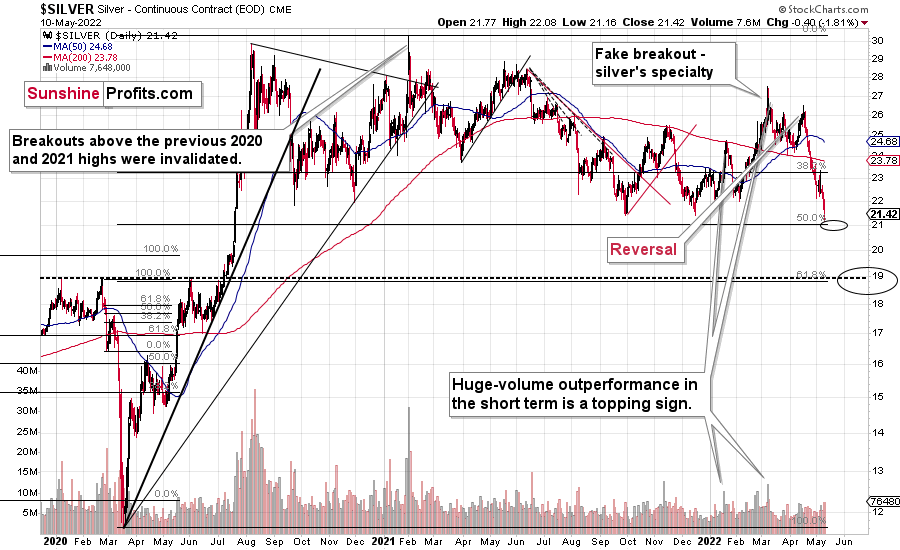

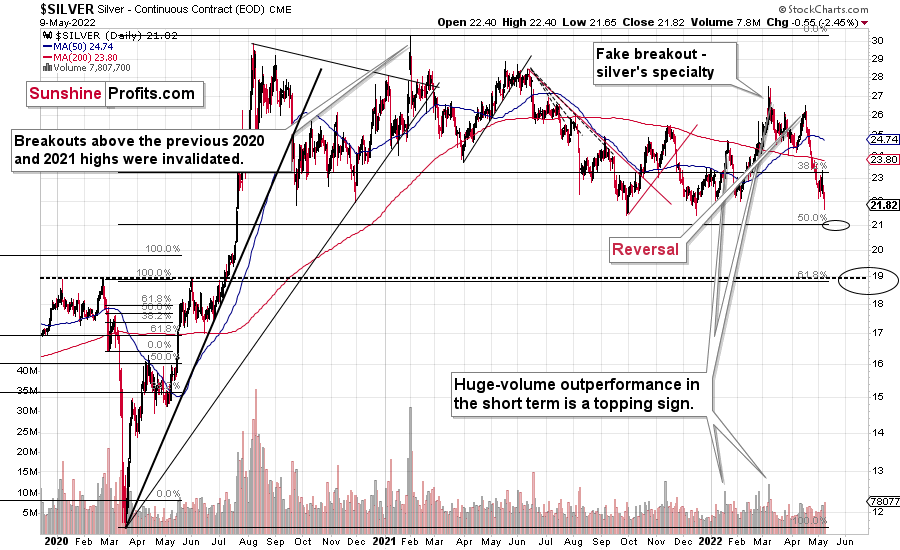

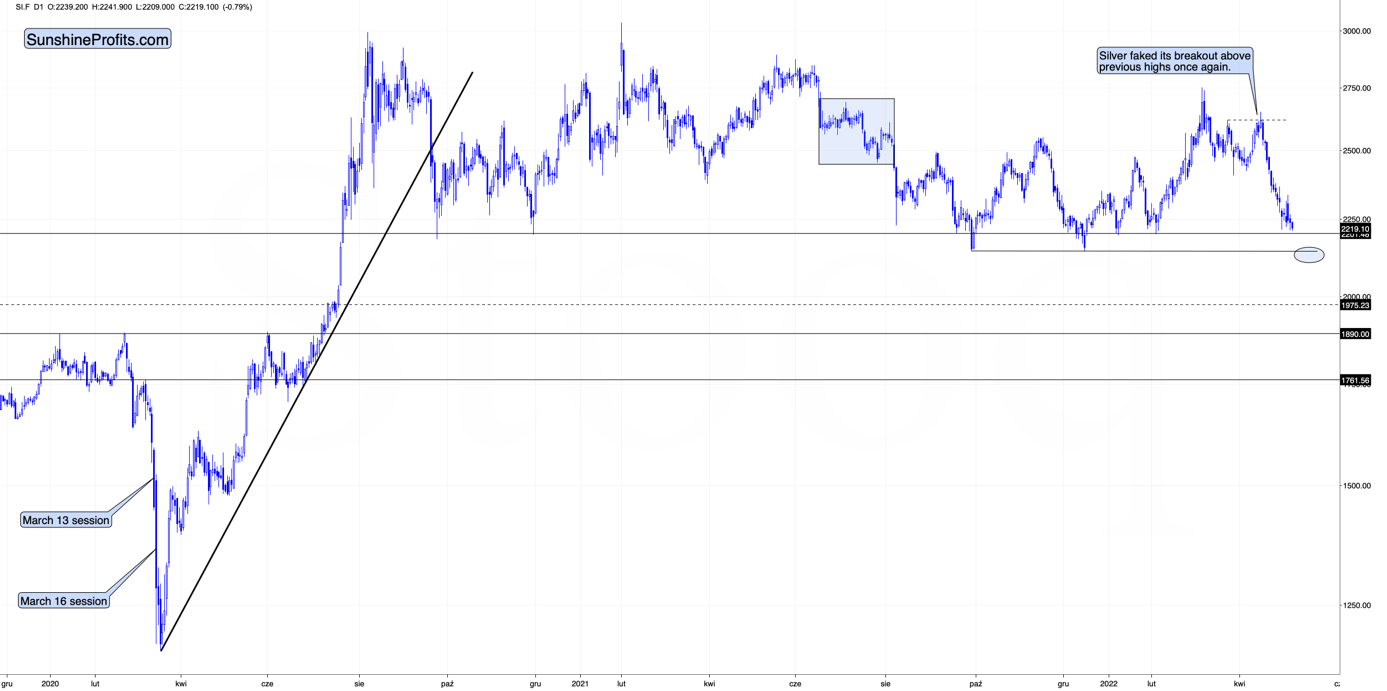

The white metal moved lower, and its intraday low was just 2 cents above our profit-take price.

Since gold is likely to move lower, and the general stock market is likely to move lower, I’m moving the downside target lower – slightly above the 50% Fibonacci retracement level based on the entire 2020-2021 decline. That’s the next strong support that’s below the 2021 lows, and that would more or less correspond to the size of the above-mentioned short-term decline in gold (at least that seems realistic to me).

The downside target that I featured was $21.23 (for silver futures, which some might choose to call a form of “paper silver”, by the way), and it was reached yesterday – the intraday low was $21.16. The downside targets for related ETFs were reached too. Will silver soar immediately? This might or might not be the case, as the general stock market might decline some more in the near future. Since silver (and mining stocks) are quite correlated with the former, they could move even lower.

Still, it doesn’t mean that it’s worthwhile to stay in position at all times. Since silver moved so close to its 50% Fibonacci retracement level yesterday, it could be a situation where the downside is very limited and the upside (for the short term) is bigger. For now, I’m not suggesting going long (to profit not only on the decline but also on the rebound), but this might change very soon.

Please note that despite all the “peak silver”, “silver is manipulated so it has to rally”, and “silver shortage” theories, the white metal is now much lower than it was when it got really popular – in early 2021. Don’t get me wrong: I think that the silver price will move into the three digits, but I would like to emphasize that just because something is likely to happen eventually doesn’t mean that it has to happen right away. Silver’s purchasing power can decline before soaring, and that’s exactly what it's been doing for more than a year now. It doesn’t seem that the medium-term decline in silver is already over.

Speaking of the general stock market, it moved slightly higher yesterday (in terms of closing prices), but the move was not significant enough to invalidate the breakdown below the neck level of the head-and-shoulders formation. Therefore, the breakdown is now almost confirmed, and the situation is already more bearish than it was yesterday.

At the moment of writing these words, stocks are once again trying to rally, but so far the rally is not as big as yesterday’s pre-market rally that was just erased. Thus, I doubt that stocks will be able to avoid falling in the near term.

The S&P 500 is currently confirming a breakdown below its head and shoulders pattern. Once confirmed (just one more close below the neck level is required), the formation will be complete, and the next target will be below 3,500. So, yes, I expect the S&P 500 to decline below its 2021 lows in the near future.

On May 6, I wrote:

Still, it doesn’t mean that we can’t get another brief rally in the meantime. In fact, the head and shoulders formations are often immediately followed by a brief corrective upswing – one that takes the market close to or right back to the previously broken neck level of the H&S pattern. Seeing this kind of rally would perfectly correspond to the scenario in which S&P rallies when the RSI indicator reaches 30, and it would perfectly match other potential price moves that I mentioned earlier today.

In other words, if stocks decline somewhat and then correct, it could translate into the same thing in gold, silver, and mining stocks. Given the stronger link between stocks and silver and miners’ duo, the latter could correct more visibly.

On Friday (May 6), the S&P 500 had its lowest daily close of the year. While investors might not see many technical patterns, they’ll definitely notice something like that. That’s bearish – it could trigger some panic selling among investors, and today’s pre-market decline indicates that it might already be taking place.

Interestingly, last Friday’s session was a daily reversal, so it seems that stocks should be rallying today, but… they are not. Technically, it’s the futures market that shows declines, not the index itself, but futures can be used as the index’s proxy here.

That’s where the situation gets really interesting. There were very few cases when a daily reversal was followed by a decline below the reversal’s low. In fact, in the recent past, there were just two such cases, and I marked them with red rectangles. In both cases, short-term declines followed. What’s notable is that this was the way in which the January decline started, and the decline that followed was sizable.

If stocks are about to decline (continuing their recent decline), then they would do so after a consolidation that took the form of a flag. Thus, the price would be likely to fall by about the same amount as it had fallen before the pattern. One could argue when the previous short-term decline started (at the recent top or at the very recent top before the decline accelerated), but overall, it seems that stocks would be likely to decline below the neck level of their head and shoulders formation, and then decline some more.

Is there any nearby support level that would be strong enough to stop this short-term decline? Yes: it’s the 38.2% Fibonacci retracement level based on the 2020-2022 rally.

Back in 2020, the very first decline erased 50% of the preceding rally, but back then the market was much more volatile than it is right now, so it’s understandable.

If we see a decline to the 38.2% Fibonacci retracement and then a comeback to the previously broken neck level of the head and shoulders pattern, it would fit practically everything that I wrote above and in the previous days / weeks.

It would trigger another immediate-term decline in silver and mining stocks in the near term that would be followed by a (quite likely tradable) rebound.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

The Future of the Dollar Seems So Bright It’s Blinding Gold

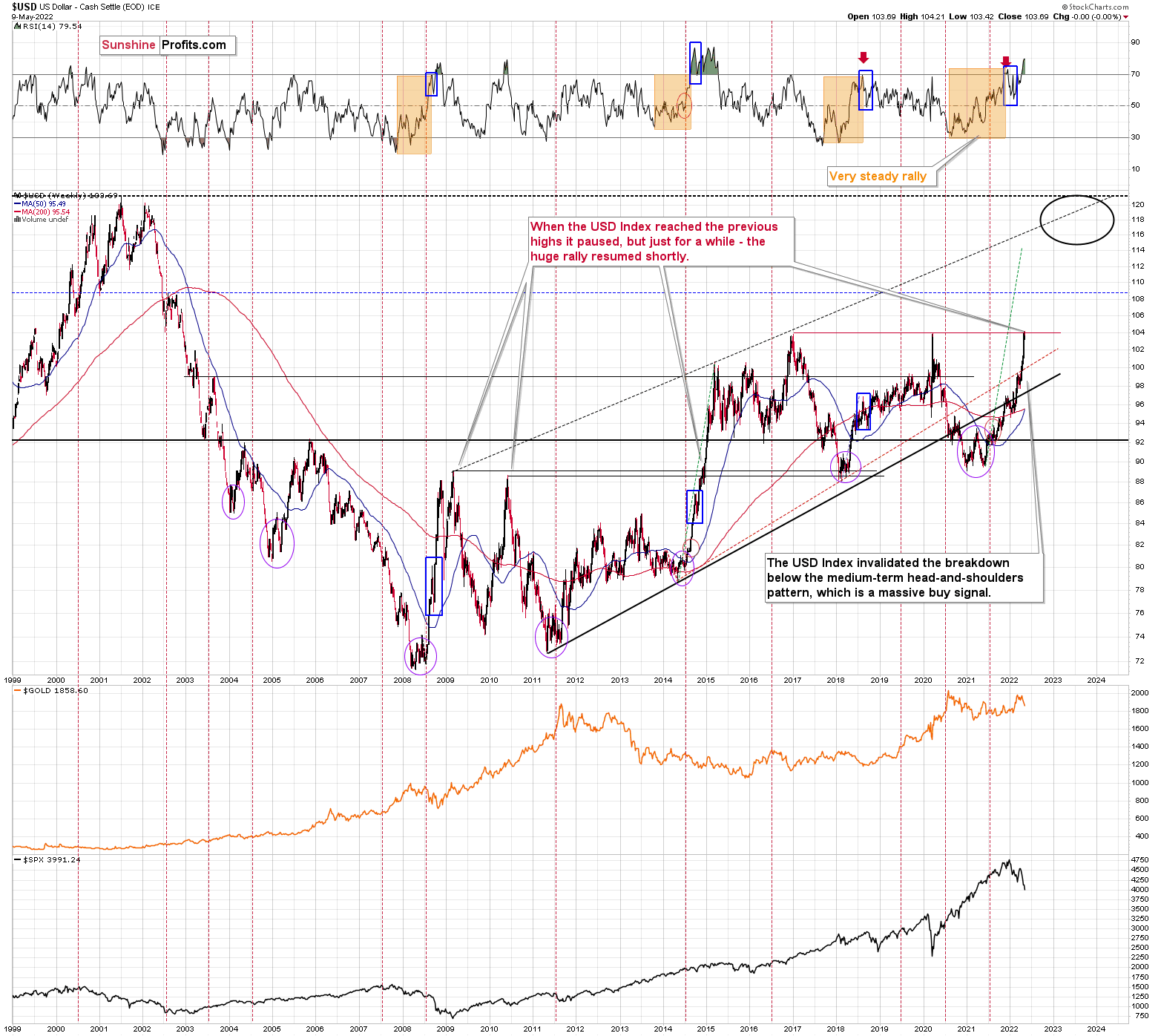

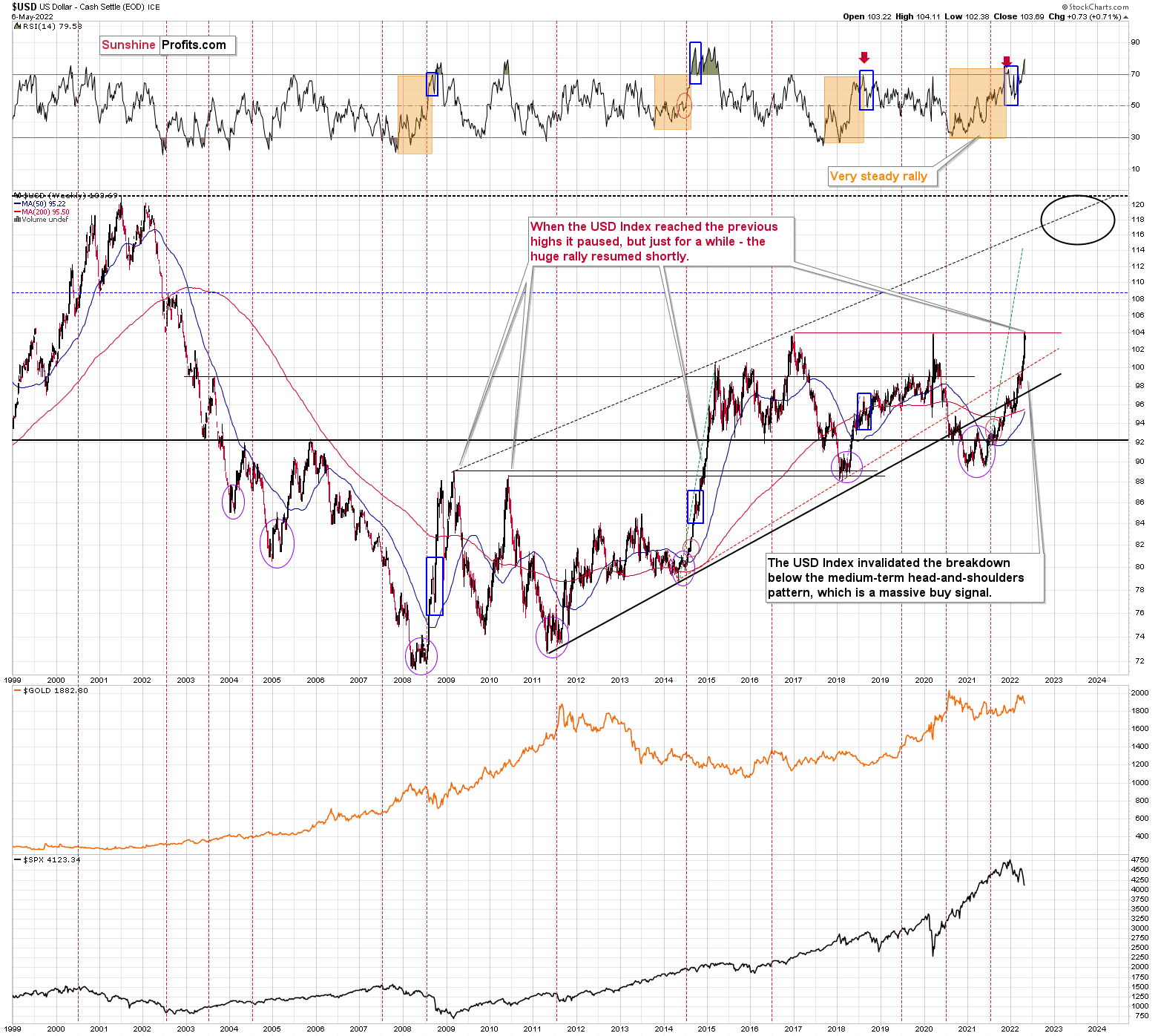

May 10, 2022, 8:56 AMWhile the USDX rushes up without looking back, gold is running... out of power. What could the next dollar highs mean for the precious metals market?

In short, practically everything that I wrote in yesterday’s analysis remains up-to-date. Based on the relative valuations and pre-market price movement, I wrote that junior miners were likely to decline below their rising support line, and I moved the exit price for the current short position in the GDXJ lower (it seems that it will gain even more shortly).

Indeed, the GDXJ fell like a stone in the water, and it pierced through the above-mentioned support line without looking back. Thanks to remaining in the short position, we were able to benefit from the breakdown below the support line.

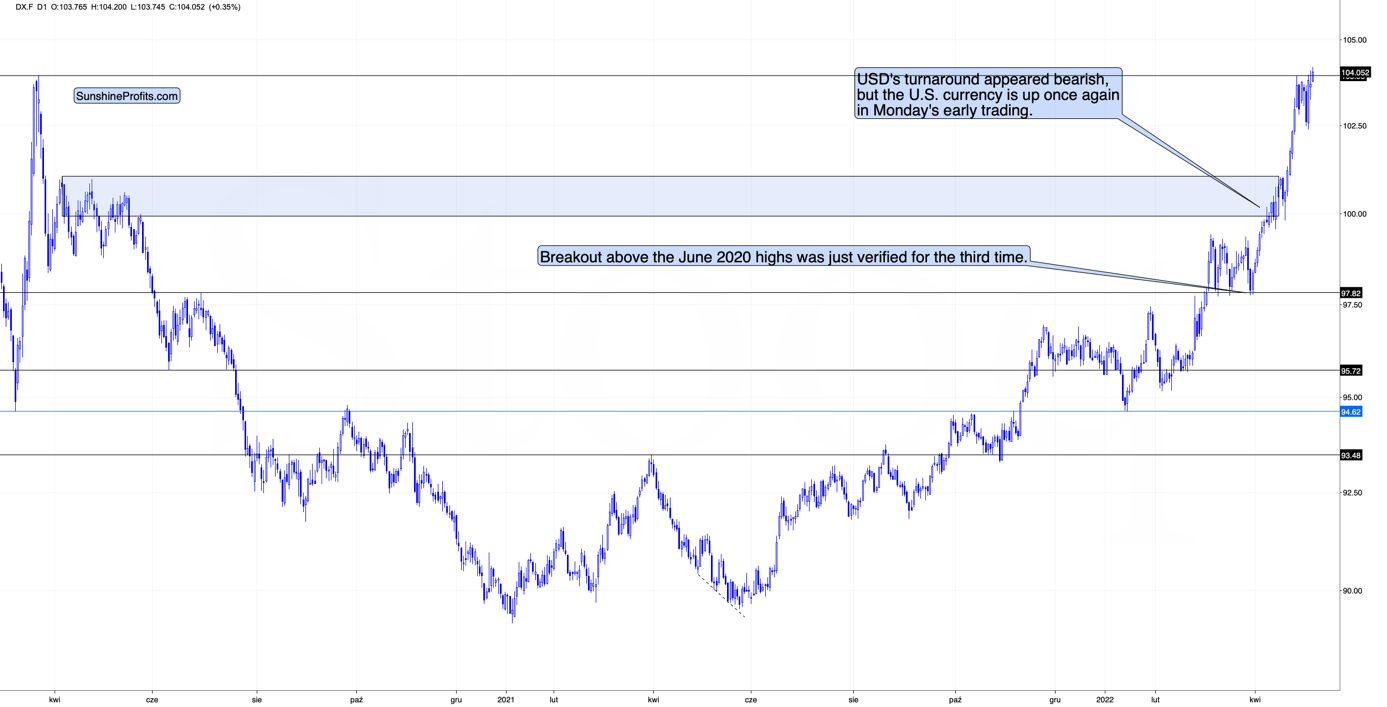

What’s next? Well, what was likely yesterday remains likely today. Markets appear to be approaching, but not yet at, their short-term corrections. Let’s take a closer look, starting with the USD Index.

As you can see above, the USD Index just moved above its 2020 high and above its recent highs, but it failed to close in the green. Actually, the USDX declined slightly during yesterday’s session. So, while gold was initially strong relative to the USDX, it ended up being very weak. This tells us that if the USD Index moved a bit higher here, gold might launch another quick decline.

Given how the USD Index performed after a similar breakout (in 2014), it seems that we might see a corrective move soon (perhaps after an additional rally). I previously described it in the following way:

I would like to add one important detail. Back in 2014, the USD Index didn’t correct after reaching its previous high. It corrected after moving above it. The higher of the highs was the March 2009 high, at 89.11.

The higher of the recent highs is at 103.96 right now, so if the analogy to 2014 is to remain intact, the USD Index could now top at close to 104.5 or even 105.

Yesterday’s high was 104.2, so the USDX could still move higher before correcting.

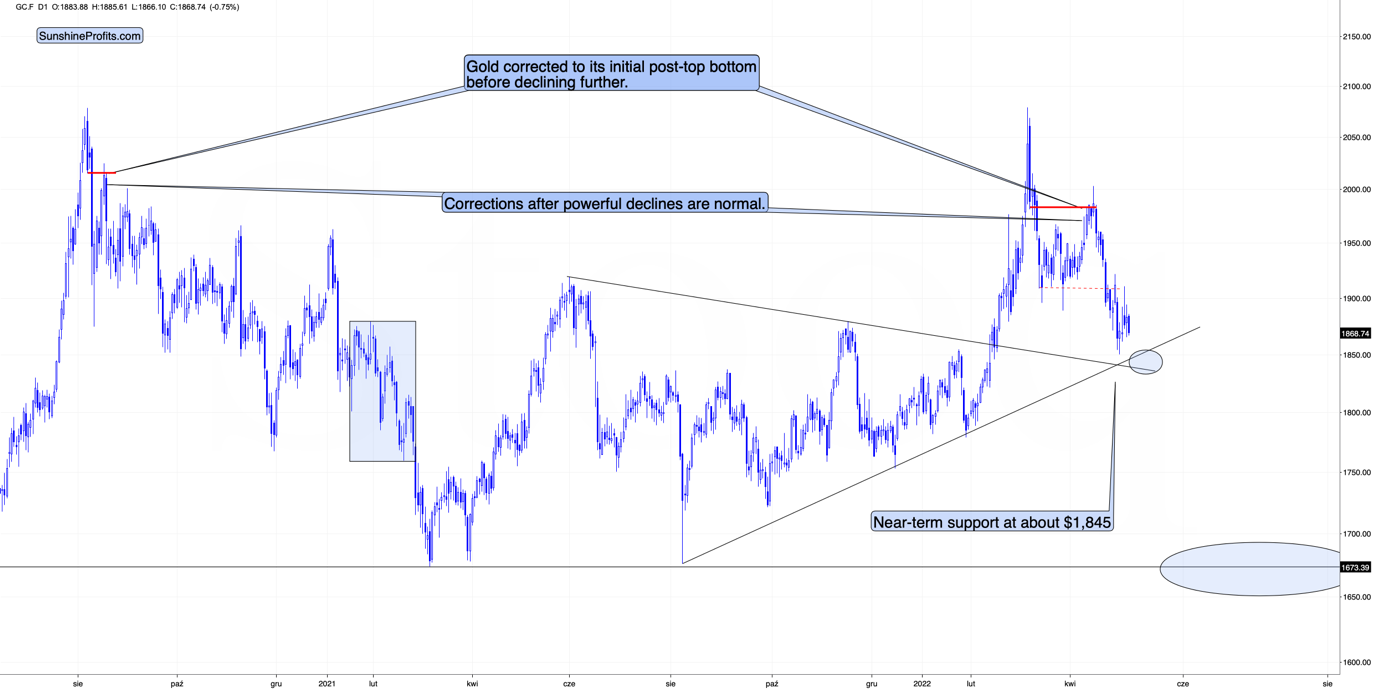

Gold moved lower – to its previous lows – but didn’t reach its downside target area (marked with green), where we have a few support levels:

- rising support line,

- declining support line,

- early-2022 high,

- the 61.8% Fibonacci retracement based on the 2021-2022 rally at about $1,829,

- 200- and 300-day moving averages (back in March 2020, gold bottomed between both averages).

Also, the RSI indicator is close to 30 but not yet at it.

Consequently, if gold declines some more here, it will have very good reasons to rally in the short term, but it doesn’t have those reasons yet.

The situation in silver is also very interesting.

The white metal moved lower, and its intraday low was just 2 cents above our profit-take price.

Since gold is likely to move lower, and the general stock market is likely to move lower, I’m moving the downside target lower – slightly above the 50% Fibonacci retracement level based on the entire 2020-2021 decline. That’s the next strong support that’s below the 2021 lows, and that would more or less correspond to the size of the above-mentioned short-term decline in gold (at least that seems realistic to me).

It seems that mining stocks are likely to slide in the very near term too – and then they are likely to correct (probably providing an opportunity for a quick long position), quite possibly sharply.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Short-Term Strength: Gold Holds Up Despite New Highs in the USDX

May 9, 2022, 8:18 AMFriday’s analysis took a rather extensive form, so now I’ll briefly introduce today’s technical part.

Practically everything that I wrote about the medium-term (bearish) outlook for the precious metals sector remains up-to-date. Only the short-term situation was somewhat unclear.

Given Friday’s movement and today’s pre-market trading, the situation has been clarified. Of course, it doesn’t mean that what I’m going to describe is bound to happen, but it does mean that a certain near-term outcome just became more likely.

Let’s take a closer look at the charts for details.

As you can see above, the USD Index just moved above its 2020 high and above its recent highs. This is a major breakout. However, given how the USD Index performed after a similar breakout (in 2014), it seems that we might see a corrective move soon (perhaps after an additional rally). I previously described it in the following way:

I would like to add one important detail. Back in 2014, the USD Index didn’t correct after reaching its previous high. It corrected after moving above it. The higher of the highs was the March 2009 high, at 89.11.

The higher of the recent highs is at 103.96 right now, so if the analogy to 2014 is to remain intact, the USD Index could now top at close to 104.5 or even 105.

So far, today’s pre-market high is 104.2, so the USDX could still move higher before correcting.

The important detail about today’s early trading is that while the USD Index moved above its recent highs, gold didn’t move below its recent lows.

It remains above the recent highs and not that far from its downside target area, provided by the rising and declining support lines, as well as by the very recent lows.

From gold’s perspective, the short-term (!) downside appears limited.

From USD’s perspective, the short-term (!) upside appears limited.

We see that gold is acting relatively strong today given what’s happening in the USDX. This is a bullish combination for the short term and suggests that a short-term bottom in gold is near. Of course, the medium-term trend remains bearish nonetheless.

Interestingly, while gold didn’t move to new short-term lows, silver and junior mining stocks did.

Silver moved just slightly lower, but that was enough for it to move below the previous local lows.

The support provided by the recent lows is quite close (marked with a blue ellipse), but silver is not there yet.

Here’s what the GDXJ ETF is doing in today’s London trading.

It declined sharply and moved to the rising support line based on the 2020 and 2022 lows. This level is what I described (on the analogous version of the above chart, based on the prices from the U.S.) as something that could stop the current short-term decline.

So, will the GDXJ bottom today or is it bottoming (from the European point of view) right now?

To better answer that question, let’s take a look at the likely reason for today’s silver and miners’ weakness – the general stock market.

Before moving to the overnight changes, let’s recall what I wrote about stocks on Friday:

After the immediate “phew-its-not-a-0.75-rate-hike rally”, we saw a “hold-up-rates-are-still-soaring-aaah-decline”. Is the relief rally already over?

That, ladies and gentlemen, is the key question right now.

It could be the case that one rally is over, but it doesn’t mean that another one couldn’t start from just slightly lower levels.

The S&P 500 is currently forming a (potential so far) head and shoulders pattern, and once it moves below its neck level (slightly above 4,000), the formation will be complete, and the next target will be below 3,500. So, yes, I expect the S&P 500 to decline below its 2021 lows in the near future.

Still, it doesn’t mean that we can’t get another brief rally in the meantime. In fact, the head and shoulders formations are often immediately followed by a brief corrective upswing – one that takes the market close to or right back to the previously broken neck level of the H&S pattern. Seeing this kind of rally would perfectly correspond to the scenario in which S&P rallies when the RSI indicator moves to 30, and it would perfectly match other potential price moves that I mentioned earlier today.

In other words, if stocks decline somewhat and then correct, it could translate into the same thing in gold, silver, and mining stocks. Given the stronger link between stocks and silver and miners duo, the latter could correct more visibly.

The chart below features the S&P 500 futures chart.

On Friday, the S&P 500 had its lowest daily close of the year. While investors might not see many technical patterns, they’ll definitely notice something like that. That’s bearish – it could trigger some panic selling among investors, and today’s pre-market decline indicates that it might already be taking place.

Interestingly, Friday’s session was a daily reversal, so it seems that stocks should be rallying today, but… they are not. Technically, it’s the futures market that shows declines, not the index itself, but futures can be used as the index’s proxy here.

That’s where the situation gets really interesting. There were very few cases when a daily reversal was followed by a decline below the reversal’s low. In fact, in the recent past, there were just two such cases, and I marked them with red rectangles. In both cases, short-term declines followed. What’s notable is that this was the way in which the January decline started, and the decline that followed was sizable.

if stocks are about to decline (continuing their pre-market decline), then they would do so after a consolidation that took the form of a flag. Thus, the price would be likely to fall by about the same amount as it had fallen before the pattern. One could argue when the previous short-term decline started (at the recent top or at the very recent top before the decline accelerated), but overall, it seems that stocks would be likely to decline below the neck level of their head and shoulders formation, and then decline some more.

Is there any nearby support level that would be strong enough to stop this short-term decline? Yes: it’s the 38.2% Fibonacci retracement level based on the 2020-2022 rally.

Back in 2020, the very first decline erased 50% of the preceding rally, but back then the market was much more volatile than it is right now, so it’s understandable.

If we see a decline to the 38.2% Fibonacci retracement and then a comeback to the previously broken neck level of the head and shoulders pattern, it would fit practically everything that I wrote above.

It would trigger a sizable decline in junior mining stocks in the near term.

If so, then it’s unlikely that junior miners are bottoming right now, as one might expect based on the chart that I featured earlier today. Instead, it seems that the GDXJ might indeed have managed to decline to its previous 2022 lows and then correct sharply from there.

In order for gold to reach its target, it only needs to decline by as much as it has already declined today.

However, in order for the general stock market to reach its downside target, it would need to decline several times as much as it has already declined today.

In today’s pre-market trading, junior miners are taking the stock market’s bearish lead. Consequently, they could decline much more than just as much as they already have today.

Therefore, the scenario in which junior miners move to their previous lows before bouncing is currently the most important one, in my opinion. Consequently, I’m lowering the exit prices for the current short position, in order to capitalize on a bigger move lower.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM