tools spotlight

-

Two Bearish Confirmations for Junior Miners

May 30, 2022, 9:11 AMThe markets are closed in the U.S., and we’re normally not posting anything on the non-market days, but I thought that I’ll make an exception to provide you with a quick heads-up before tomorrow’s session.

Having said that, let’s take a look at two bearish confirmations that we just got, starting with the gold-USD link.

The USD Index declined somewhat on Friday and in today’s trading (on the futures market).

It also moved very close to its 23.6% Fibonacci retracement level, which is one of the lesser-known retracements, but at times it’s worth paying attention to it – especially during the most powerful uptrends, where even correcting 38.2% of the rally is too much. And based on the fundamental factors (rising real interest rates), the rally in the USD is likely to be a powerful one.

So, the USD Index could bottom any day or hour now. And… That’s not the most important thing from the precious metals investors’ and traders’ point of view. Gold’s relative weakness is.

The most important detail is that while the USDX moved to new short-term lows, gold didn’t. Despite intraday attempts, it refuses to rally.

This gold-USD dynamic is bearish for the following weeks. This is especially the case given that gold already corrected 38.2% of the previous decline, so “technically” the correction might already be over. And the relative weakness vs. the USDX suggests that it is indeed over.

And you know what else should be making new highs?

Junior miners.

Are they making new highs?

No.

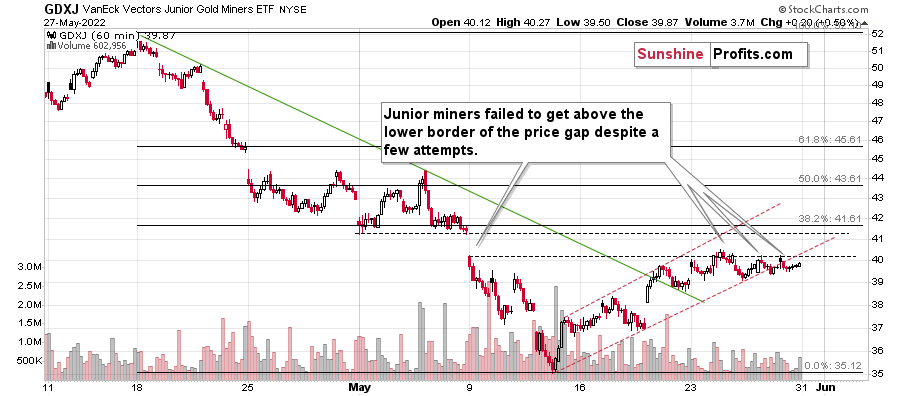

In fact, on the above chart, we can see that juniors failed to close the week at the previous week above the lower border of the previous price gap. The resistance held.

Instead, the GDXJ closed the week below the very short-term trading channel, which means that we just saw a breakdown.

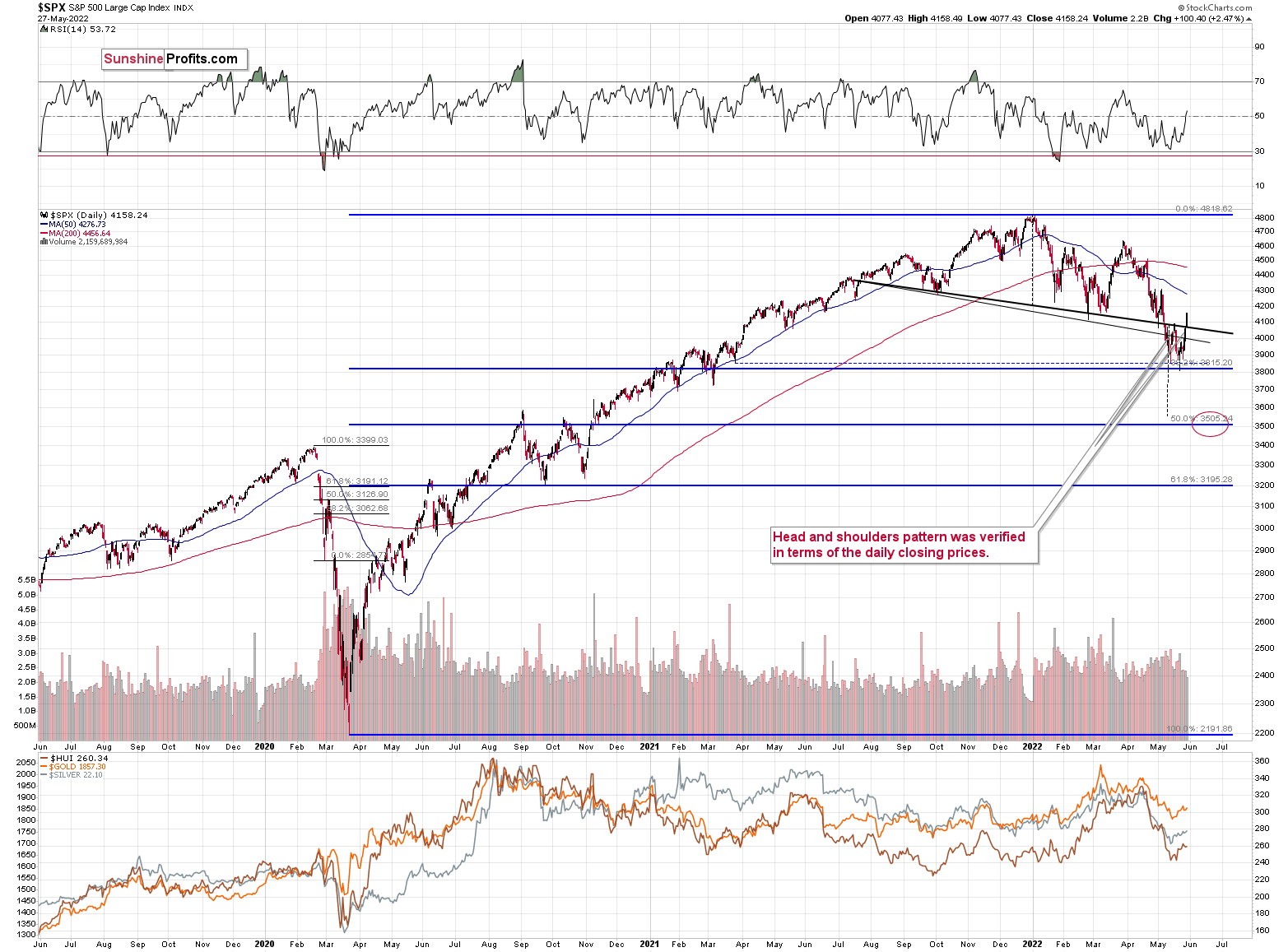

Now, the above performance could have been viewed as “normal” and not “weak” if the general stock market was weak on Friday.

However, exactly the opposite was true!

The S&P 500 moved about 2.5% higher on Friday, so – theoretically – junior miners should have shown some kind of strength. We didn’t see it. Instead, we saw junior miners move back and forth, which is weak performance given the stock market’s rally.

So, gold is weak relative to the USD Index, and junior miners are weak relative to the general stock market. This is a profoundly bearish combination, and I’m very happy to be on the short side of the junior mining stocks trade once again. If I had any second thoughts about the recent profit-taking from the long position and entering into a short one, I would act (and make the switch to the short side) based on the above.

However, since we’ve already done that – my subscribers were warned in advance – we can simply view this as an additional confirmation that the market most likely agrees with us. And it appears likely that our streak of profits will grow bigger in the following weeks (it could be days too, but it’s a tough call to say if the decline will resume immediately).

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Here Is Why I’m No Longer Bullish on Gold Miners

May 27, 2022, 9:07 AMThe medium-term outlook for the precious metals is profoundly bearish – and it’s about time to abandon the short-term bullish ship.

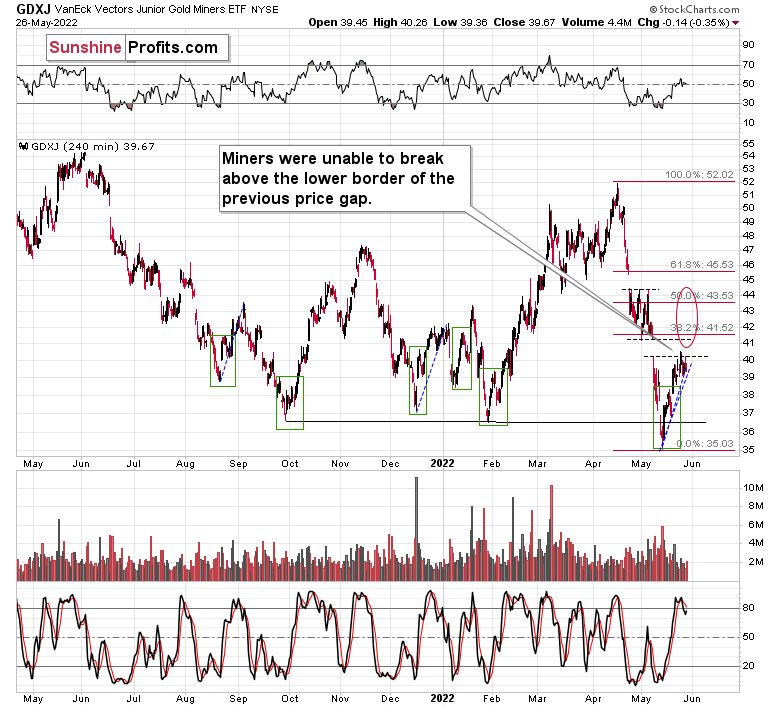

To find out why, let’s take a look at what happened in junior mining stocks.

The miners were unable to break above the lower border of the previous price gap despite the rally in the general stock market that continued yesterday. In fact, junior miners ended yesterday’s session lower.

Yes, gold is still the main driver of the juniors’ prices, but given that the S&P 500 moved up by about 2%, at least some strength in the juniors was expected. And we didn’t see it.

If it all didn’t happen so close to GDXJ’s upside target, and if stocks weren’t so close to their own upside target, it wouldn’t matter much. However, the above was the case, and thus it did matter.

Perhaps junior miners will rally more and even manage to “close the gap” by rallying to its upper border, but… so what? That’s only about $1 – $1.5 higher in the GDXJ, and its already after a ~$4 rally, which means that we’ve caught the majority of the move with our previous long position. In fact, we’ve actually caught the “easy part” of the move.

Congratulations to everyone who managed to profit on this rebound!

I called the recent rally “easy” because when sentiment becomes too extreme, it’s very likely that a correction will follow. Thus, trading it was rather easy. After all, no market moves up or down in a straight line.

Anyway, the “easy” part of the rally is definitely over, and now the rally has either ended or we entered the “difficult” part thereof. “Difficult” because it’s no longer very likely that we’ll see further move higher. Yesterday’s lack of positive reaction to stocks’ rally emphasized that. This is why I was quick to take profits here.

Remember, the strong medium-term downtrend remains intact.

While aiming to gain from a rebound (against a powerful medium-term downtrend) when it’s very likely to take place (based on the sentiment being too extreme) is something justified from the risk to reward point of view (risk is relatively low), the situation changes dramatically in the “difficult” part of the rally. In this case, the risk is big (the reversal could take place at higher prices or it could be already after the reversal…) while the profit potential is limited.

Also, in today’s pre-market trading we might be seeing a sell indication. So far it’s not strong, but still…

Silver futures are up by 1.49%, the GDXJ is up by 0.96% in London trading, the GDX is up by only 0.38% in London trading, and gold futures are up by 0.53%.

Silver has just moved to new monthly high, while gold, the GDX and the GDXJ haven’t (the latter is quite close, though). This means that we’re in a situation where silver is outperforming on an immediate-term basis, while miners are underperforming (the GDX in this case) gold. This is often what we see right before declines.

This doesn’t guarantee that the decline will start today or tomorrow, but it does indicate that it’s likely to take place within the next several days.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Does Anyone Really Believe 0.5% Rate Hikes Will Curb Inflation?

May 26, 2022, 6:38 AM0.5% rate hikes in June and July are likely settled. However, with inflation at 8%+, calming prices with such little action is completely unrealistic.

While investors continue their countdown until the Fed pivots and resumes QE, in some alternative reality, it's perceived as bullish for risk assets. Sure, the short-term sugar high of more free money should uplift sentiment. However, I've noted on numerous occasions that the long-term consequences would be dire.

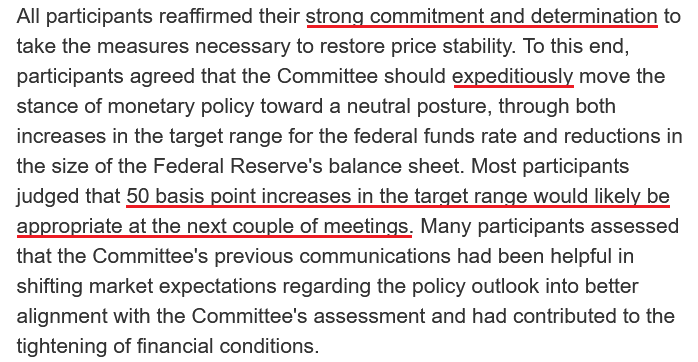

Thus, while investors await a superhero that's unlikely to arrive, the ramifications of unanchored inflation should prove troublesome over the medium term. To explain, the FOMC released the minutes from its May 3-4 monetary policy meeting on May 25. The report revealed:

“Participants judged that it was important to move expeditiously to a more neutral monetary policy stance. They also noted that a restrictive stance of policy may well become appropriate depending on the evolving economic outlook and the risks to the outlook.”

In addition:

“Participants observed that inflation continued to run well above the Committee's longer-run goal and that inflation pressures were evident in a broad array of goods and services. Various participants remarked on the hardship caused by elevated inflation and heightened inflation uncertainty – including eroding American families' real incomes and wealth and making it more difficult for businesses to make production and investment plans. They also pointed out that high inflation could impede the achievement of maximum employment on a sustained basis.”

As a result, 50 basis point rate hikes are now the consensus for “the next couple of meetings.”

Please see below:

Likewise, Fed Vice Chair Lael Brainard conveyed a similar message on May 25. She said:

However, it's important to remember that Fed officials' primary objective is to calm inflation. They don't want to crash the stock, bond, or commodities markets; the latter outcomes are simply collateral damage of what must be done to curb the pricing pressures. To explain, I wrote on Dec. 23:

The Fed’s only hawkish goal is to calm inflation. When inflation was running hot and most Americans bought into the “transitory” narrative, Fed officials exuded confidence. However, when consumer confidence sunk to a 10-year low and inflation became political, the Fed changed its tune. As a result, Powell wants to reduce inflation while tightening as little as possible (3% to 4% inflation may be considered acceptable in 2022).

Thus, the Fed’s hawkish crusade has always been dependent on the path of inflation. Therefore, if inflation fades into the night, officials can turn dovish, and the bull market can resume on Wall Street. To that point, the FOMC minutes also stated:

“Most participants indicated that their business contacts had continued to report that substantial increases in wages and input prices were being passed through into higher prices to their customers. A few participants added that some of their contacts were starting to report that higher prices were hurting sales.

“A number of participants observed that recent monthly data might suggest that overall price pressures may no longer be worsening. These participants also emphasized that price pressures remained elevated and that it was too early to be confident that inflation had peaked.”

As a result, while it’s “too early to be confident,” Fed officials, like investors, continue to search for signs of positive momentum. Moreover, Atlanta Fed President Raphael Bostic said on May 23 that he supports 50 basis point rate hikes in June and July.

“I’m at 50 basis points as long as the economy proceeds as I think it’s going to,” said Bostic. “If inflation starts moving in a different direction than it is right now, I’d have to be open to us moving more aggressively….

“It’s hard to know exactly how far or how hard we are going to push. But I think getting us somewhere in the 2% to 2.5% range by year’s end would be a good place for us to get to.”

However, he also opined that a wait-and-see approach could prove prudent in the months that follow.

Please see below:

Thus, Fed officials are open to pausing their rate hike cycle. For context, Bostic’s expectation of a U.S. federal funds rate “somewhere in the 2% to 2.5% range by year’s end” still implies eight to 10 rate hikes in 2022. Therefore, it’s not dovish.

However, while investors will applaud Fed officials’ willingness to “observe and adapt,” nothing has changed. It was always about inflation, and it’s still about inflation.

For example, Fed officials were split about one rate hike when they made their projections in September. Moreover, in the months before that, they expected to taper their asset purchases in late 2022 and raise interest rates in late 2023. As a result, their read on inflation shouldn’t instill much confidence.

For context, I wrote on Nov. 4:

With Fed Chairman Jerome Powell still searching for his inflationary shooting star, the FOMC chief isn’t ready to label inflation as problematic. “I don’t think that we’re behind the curve,” he said. “I actually believe that policy is well-positioned to address the range of plausible outcomes, and that’s what we need to do.”

The reality is: while Powell has taken the path of least resistance to help calm inflation (the taper), his inability to understand the realities on the ground leaves plenty of room for hawkish shifts in the coming months (interest rate hikes).

Therefore, while the potential for three-straight 50 basis point rate hikes is profoundly hawkish, the Fed still underestimates the challenges that lie ahead. For example, S&P Global released its U.S. Composite PMI on May 24. I noted on May 25:

And:

This data was collected from May 12-23. Therefore, inflation is still running away from the Fed, and three rate hikes (25 basis point increments) have done little to alleviate the pricing pressures.

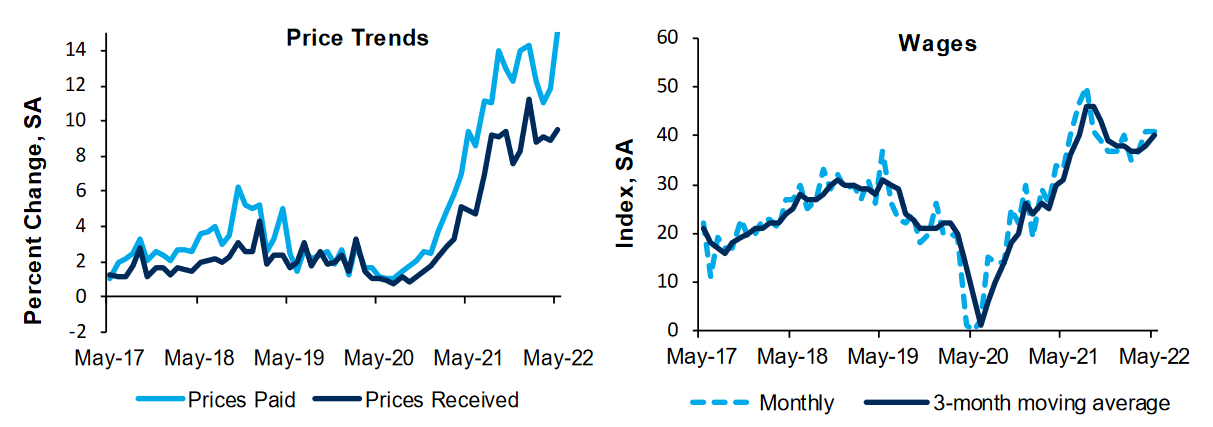

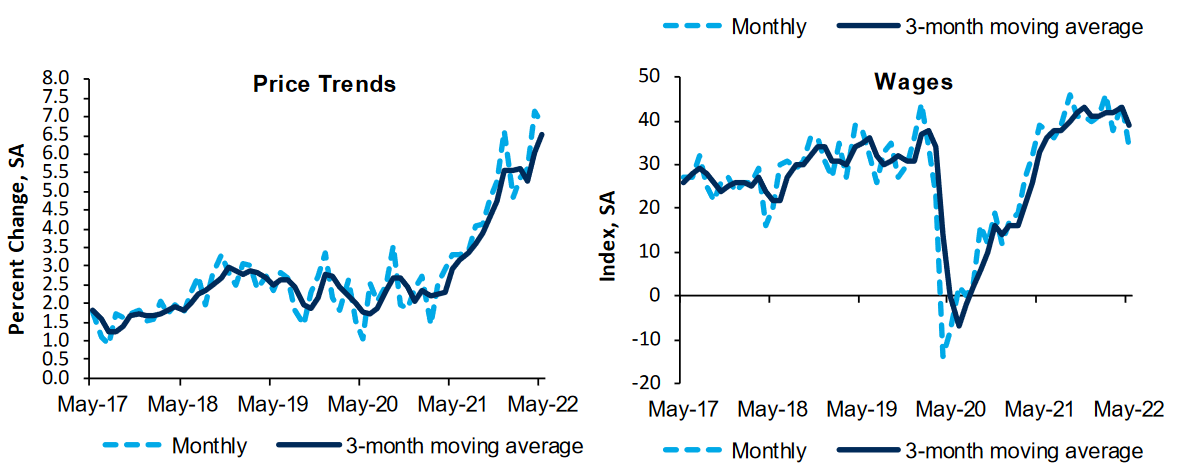

Second, the Richmond Fed released its Fifth District Survey of Manufacturing Activity on May 24. The headline index declined from 14 in April to −9 in May, which is bearish for Fed policy. However, the report also revealed that “The average growth rate of prices paid increased notably in May. Firms also reported higher average growth in prices received in May.”

On top of that: “The wage index also remained elevated, indicating that a large share of firms continue to report increasing wages.”

Please see below:

Likewise, the Richmond Fed also released its Fifth District Survey of Service Sector Activity on May 24. The headline index decreased from 24 in April to 10 in May. However, while the wage index declined, the price indexes remained materially elevated.

Please see below:

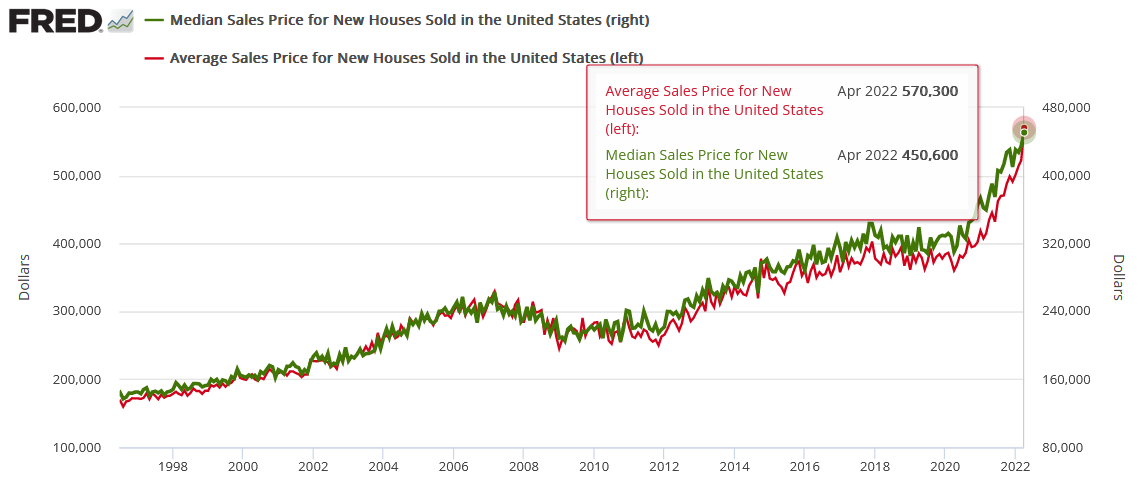

In addition, the U.S. Census Bureau released its residential home sales report on May 24. Moreover, while sales of new single‐family houses declined by 16.6% month-over-month (MoM) in April, the average and median selling prices hit new all-time highs.

Please see below:

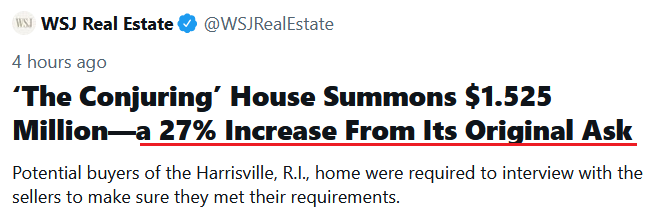

Also, despite three rate hikes by the Fed, are these the kind of headlines that you see when inflation has calmed down?

Source: The Wall Street Journal Twitter

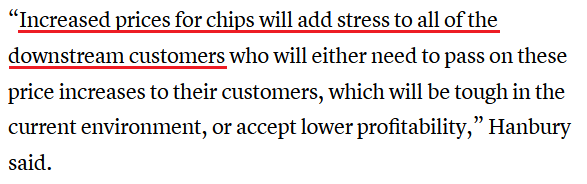

Source: The Wall Street Journal TwitterFinally, Bain semiconductor analyst Peter Hanbury told CNBC on May 24 that the world’s largest foundries — including Taiwan Semiconductor, Samsung and Intel — are considering further price hikes. He said:

“Foundries have already increased prices 10%-20% in the past year. We expect a further round of price increases this year, but smaller (i.e. 5%-7%).”

He added: “The chemicals used in [chip] manufacturing have increased 10%-20%. Similarly, the labor required to build new semiconductor facilities has also seen shortages and increased wage rates.”

As a result, PCs, cars, toys, consumer electronics, appliances, and many other products could sell at higher price points in the near future.

Please see below:

The bottom line? While 50 basis point rate hikes are likely done deals in June and July, a realization will only put the U.S. federal funds rate at 1.83%. With annualized inflation at 8%+, calming the price pressures with such little action is completely unrealistic. In fact, it’s never happened.

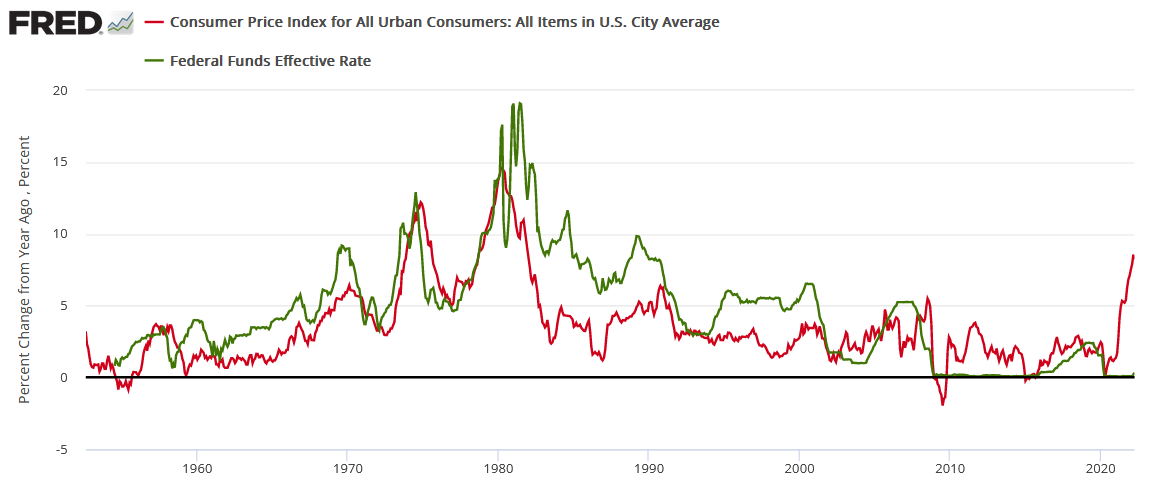

If you analyze the chart below, you can see that the U.S. federal funds rate (the green line) nearly always rises above the year-over-year (YoY) percentage change in the headline Consumer Price Index (the red line) to curb inflation. Therefore, investors are kidding themselves if they think the Fed is about to re-write history.

In conclusion, the PMs declined on May 25, and the GDXJ ETF gave back some of its recent gains. However, the short-term uptrend remains intact, and the rally should continue in the coming days. Conversely, with investors still underestimating the severity of the Fed’s inflation problem, more reality checks should emerge over the next few months. As a result, the PMs’ recent optimism should reverse sharply over the medium term (perhaps quite soon).

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few days. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Is a Final Short-Term Top for Junior Miners Approaching?

May 25, 2022, 7:31 AMAnother day, yet another higher close in the junior miners. And yet another day where profits on our long positions in the latter increased.

Since the GDXJ is so close to our profit-take level, in today’s analysis, I’ll zoom in on this important ETF. As for other markets, my previous analysis remains up-to-date.

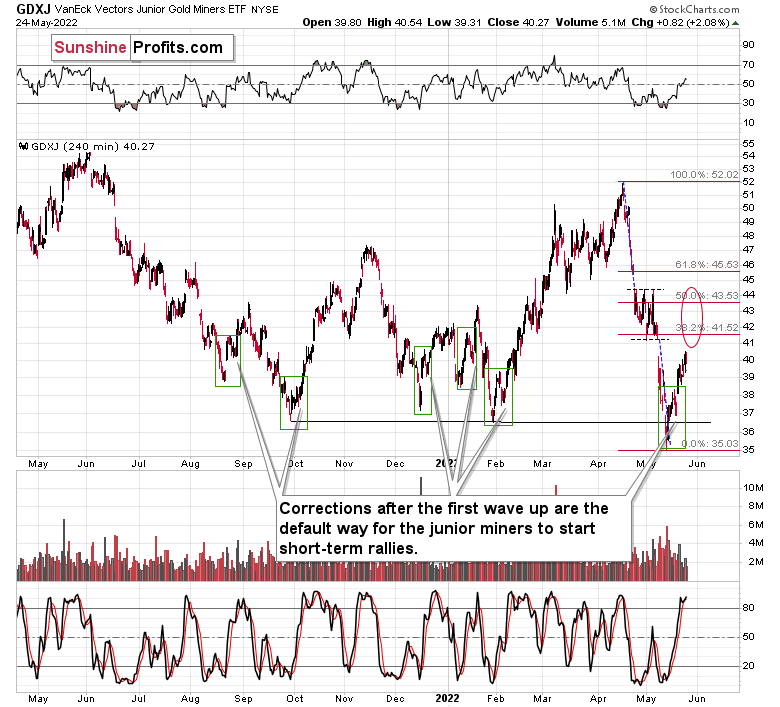

The GDXJ ETF moved up by over 2% yesterday and it’s now very close to our target area. The RSI is also above 50, and it was the case quite a few times in the past, when this meant that the corrective upswing was about to end.

Please note the late-July 2021, early-September 2021, late-December 2021, and mid-January 2022 tops. They were all preceded by a move in the RSI from about 30 to above 50. And we just saw this kind of signal once again.

So, maybe the top is already in?

Actually, if we zoom in, we get an extra clue that suggests that we’re about to see (at least) another brief move higher.

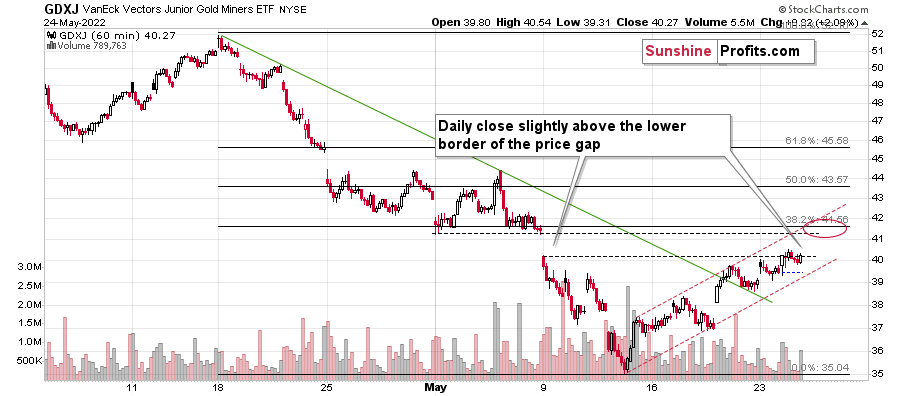

Namely, the GDXJ ETF just closed slightly above the lower border of the early-May price gap. Upper and lower borders of price gaps serve as support and resistance levels. In fact, some people even apply Fibonacci retracements to these levels and create additional support/resistance levels in this way. Still, the borders of the gap are most important.

Now, the resistance provided by the lower border of the price gap was just broken, as the GDXJ just closed slightly above it. And as resistance is broken, the price is likely to move higher and then stop at the next resistance.

The strong next resistance is provided by the upper border of the price gap. It’s not just that, though. This level – before becoming the upper border of the price gap – has already served as support in very early May and then about a week later. Additionally, this level corresponds (approximately) to the 38.2% Fibonacci retracement level based on the entire April-May decline.

Consequently, it’s likely that the next stopping point for GDXJ will be there – slightly above $41. And it could be the case that it’s the final short-term top. As you know, to increase the chances of the trade being realized and profits being cashed in, we have the exit order a bit below this level. It seems that it will be reached shortly.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few days. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM