Briefly: In our opinion, no speculative positions in gold, silver and mining stocks are justified from the risk/reward perspective.

Silver outperformed gold on an intra-day basis yesterday, while miners declined substantially, underperforming gold. This is a very bearish combination – have we just seen a top in PMs?

In short, that’s somewhat likely (likely enough not to keep long positions intact). Ideally, we would like to see rally’s continuation on low volume along with a reversal in the USD Index, but there are also other ways in which the bearish confirmation could arrive and we’ll keep monitoring the market for details.

In the meantime, let’s discuss what exactly happened yesterday that changed the short-term outlook from bullish to rather unclear (charts courtesy of http://stockcharts.com). To a large extent, today’s alert will be based on yesterday’s second alert as not much happened after we sent the latter. We wrote the following:.

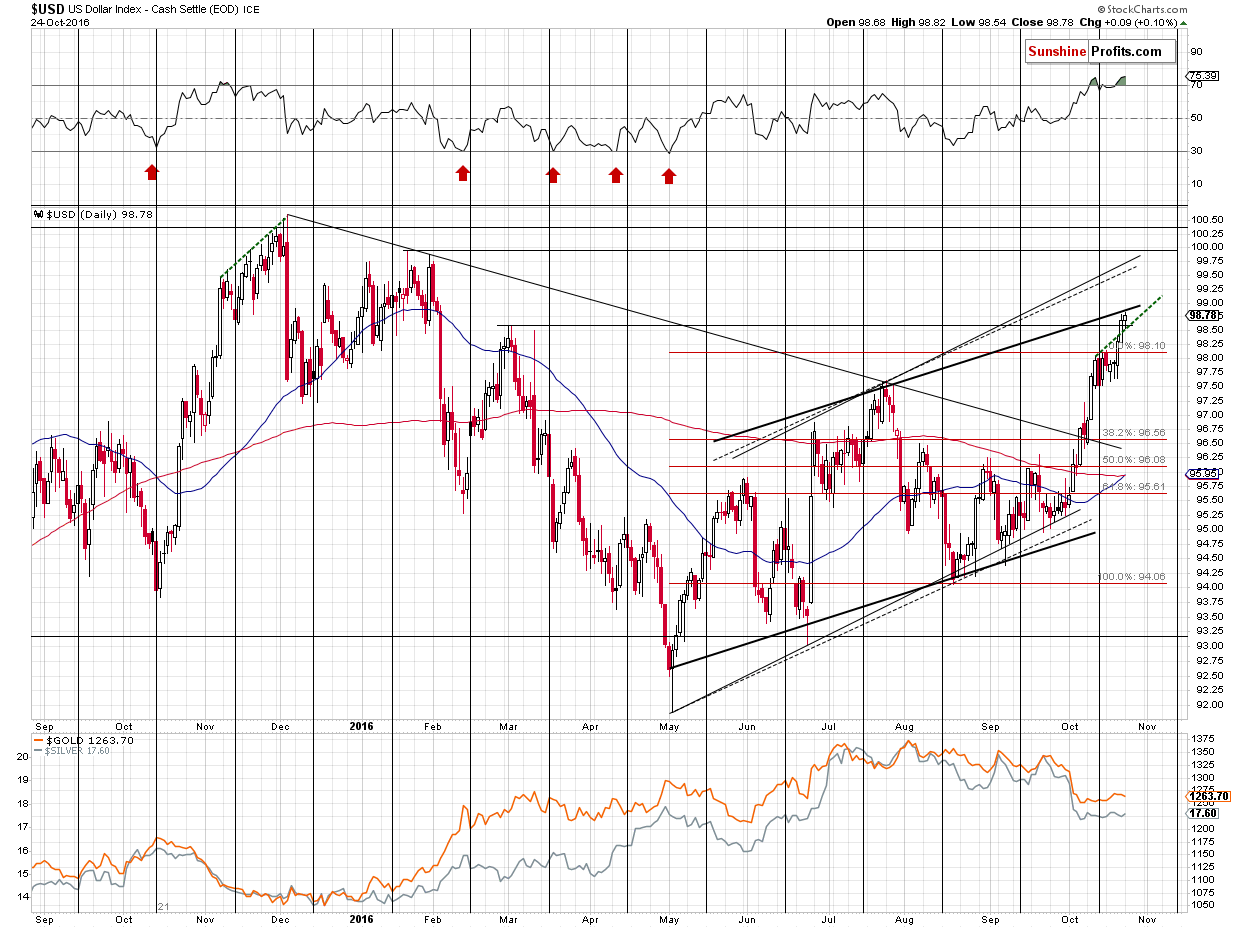

Why? The less important reason is that the short-term outlook for the USD Index became less clear - USD is after a breakout above the July high and also after a breakout above the March high. It could now rally up to 100 or so without another major decline. The most important thing about the situation in the USD Index is that the short-term decline became much less probable (it was highly probable and now is only somewhat probable).

As you can see on the above chart, the USD Index not only broke above the March highs – it also closed above it for the second day. Some traders already view the breakout as confirmed and once we get the third closing without an invalidation today, the breakout will be fully confirmed. The implications would be bullish as the next strong resistance will be very close to the 100 level. The implications for the precious metals market would be bearish.

The more important reason is that until today, the above didn’t seem to have important implications on PMs as metals and miners continued to show strength even in light of USD’s rally AND there were no meaningful bearish signs for the short term. Today we saw the latter. Mining stocks are underperforming gold to a sizable extent (even despite a move higher in the main stock indices) and silver outperformed on a very short-term basis. The white metal rallied just before the markets opened in the US only to erase the rally shortly after the opening bell.

The above kind of relative performance (underperformance of miners along with quick outperformance of silver) is what we tend to see right at local tops in precious metals.

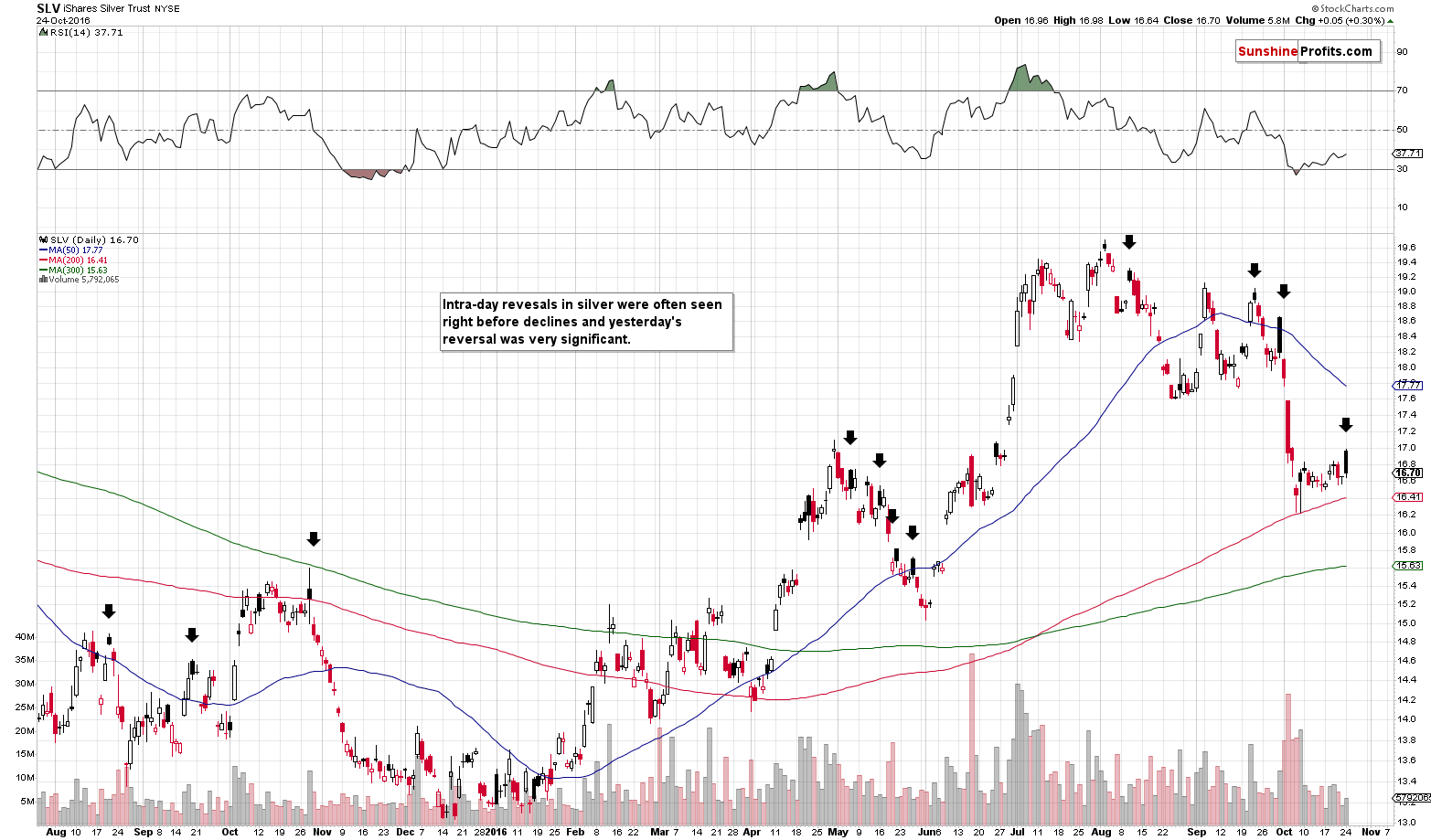

Let’s take a closer look at silver through SLV as a proxy – it will emphasize the intra-day action seen during the US trading hours.

Yesterday’s session looks just like the one that we saw on September 30 – right before the big October plunge started. The similarity is to significant to be ignored, especially that gold didn’t rally as much (intra-day) and miners underperformed.

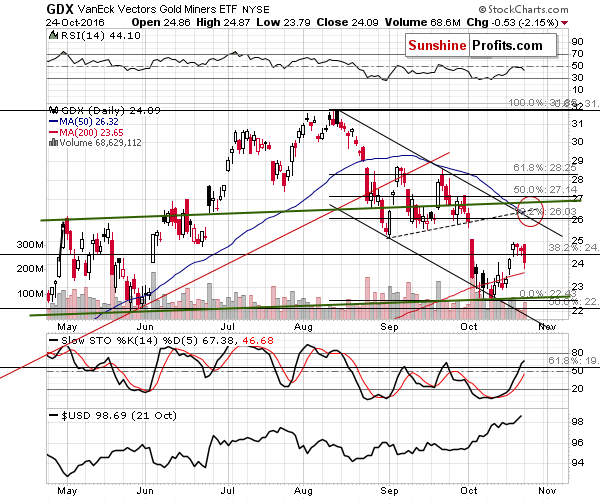

Mining stocks declined over 2% and it’s significant because of a few reasons.

The first one is the underperformance, which we already discussed.

The second one is the way miners’ short-term rallies were shaped. Please look at all visible short-term upswings on the above chart: the one in April, the one in the first half of June, the one in the second half of June and early July, the one in the second half of July and the first half of August, the one in early September and the one in late September.

They all have one important thing in common. Once we saw a single daily decline that was significant (even without discussing detailed numbers, take a look at the chart – at the first sight, you can see that the daily declines in mid-June are significant whereas the decline in the very early June is not), the entire short-term rally was over. The only thing that sometimes followed was a move back to the previous high or a very tiny breakout above it, which was invalidated anyway and followed by a decline. Yesterday, we saw the first significant daily decline since this short-term rally started. Consequently, we should not expect much higher prices in the coming days – conversely, we should expect another downswing to follow rather sooner than later.

Summing up, we saw a few important bearish signs for the short term and consequently, the outlook changed from bullish to rather neutral in the short term. Once we get additional bearish confirmations and / or the current bullish ones disappear (metals are still holding up very well given the action in the USD Index), we will most likely open short positions, but it’s too early to do so now (the risk associated with any position seems to high at this time). Naturally, if we get more bullish indications, we’ll consider going long precious metals.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): No positions

Long-term capital (core part of the portfolio; our opinion): No positions

Insurance capital (core part of the portfolio; our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

This month, the London Bullion Market Association published a new edition of its quarterly journal called “Alchemist.” What can we learn from this publication?

How Global Uncertainty Impacts the Gold Market?

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold inches up as dollar eases, Fed rate hike prospects weigh

Top Gold Buyer Sees Demand Slumping on ‘Black Money’ Curbs

As Yuan Sinks, Goldman Flags Scope for Gold Demand in China

WGC: Gold Investor October 2016

=====

In other news:

Ratings Inflation Is Back, Subprime Style

Fed Inclined to Raise Rates If Next President Pumps Up Budget

Negative rates not so easy: Swedbank CEO

Mohamed El-Erian: Markets shrugging off elections on central banks faith, for now

Copper prices not so accurate a predictor of US recessions, Wells Fargo says

The Euro-Area Economy Is Beating Expectations

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts