Briefly: In our opinion, no positions in gold, silver and mining stocks are justified from the risk/reward perspective. In other words, it seems that taking profits off the table is justified from the risk to reward point of view.

Gold, silver and mining stocks moved higher yesterday, but the size of the rally was not huge (at least it is not yet) and it was another day during which the PM sector didn’t decline. The back and forth movement and decreased volatility appear to be temporary as this kind of performance is something that we’ve seen during both consolidations and bottoms. Which way will the precious metals sector go?

Before replying to the above question, let’s emphasize that it’s not the most important question at this time. The most important thing to keep in mind is that earlier this year precious metals likely rallied as a correction after a very big decline, but the final bottom has probably not been seen so far as the investors’ sentiment hasn’t reached extremely bearish levels. Now it appears that this big corrective upswing is over and metals and miners are moving lower. Consequently, whether we have a short-term correction from here or not is not extremely important if we are going to see lower precious metals prices in the coming months.

Having said that, let’s take a look at the charts (charts courtesy of http://stockcharts.com).

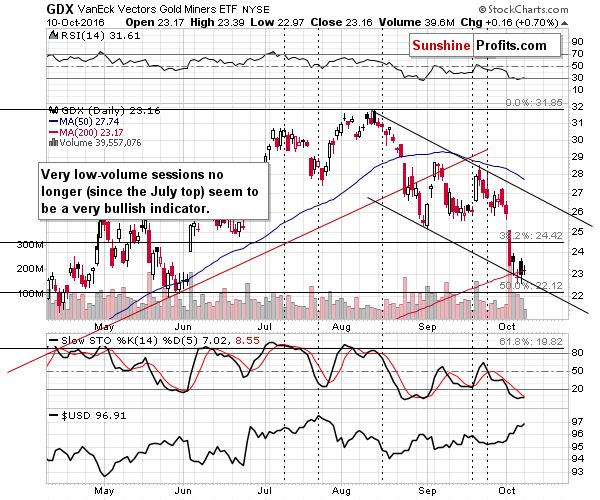

Starting with mining stocks, we see that they moved a bit higher on very low volume. This had previously meant that a bottom was likely in, but it changed when the uptrend changed into a downtrend (and even a bit before as the final top was formed in August, but the rally had more or less ended in July – the move above the July lows in August was insignificant). We now have a situation in which very low volume can imply nothing (like in early July and late September), a rally (like in late July and mid-September) or a decline (like in mid-August). The overall implications are now neutral.

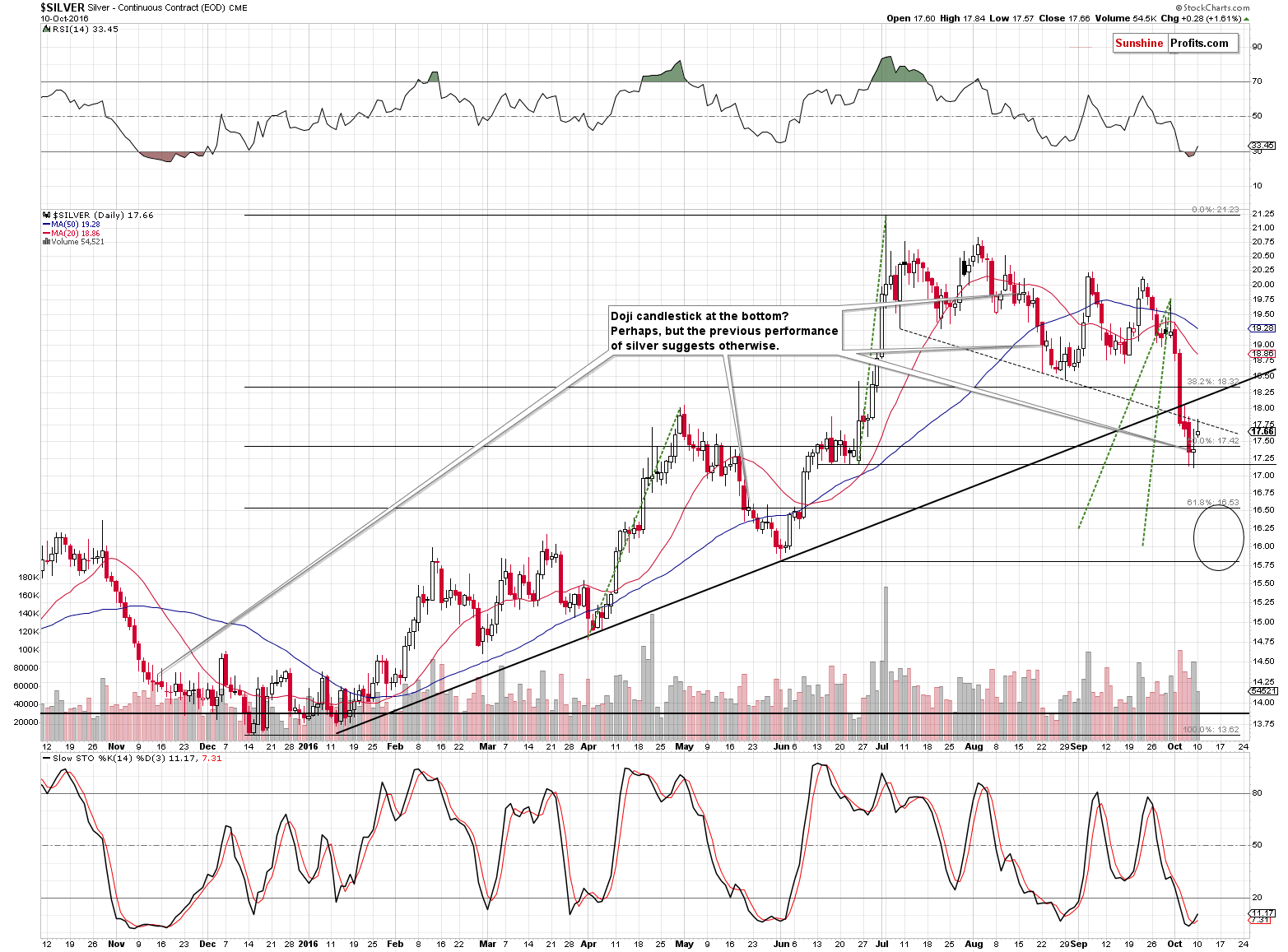

What happened in silver? It rallied and outperformed both gold and miners, which can be viewed as a bearish sign (silver tends to outperform in the final parts of a rally or right before the plunge in the case of horizontal trends), especially that silver didn’t invalidate any breakdown. The white metal moved to the declining, dashed support line and moved back down. That’s a verification of a breakdown, not its invalidation. The bearish implications remain in place for the medium term.

On a side note, we received a question about the support in silver created by the 200-day moving average. Our reply is that this moving average in silver is not really effective as support. Please note that during the 2011 - 2016 decline, silver moved below it several times and it only served as support in mid-October 2012 and April 2016 (and once approximately in early 2016). On all other occasions (late 2011, early 2012, late 2012, early 2013, early 2014, mid-2014, mid-2015, late 2015), silver more or less ignored the 200-DMA. Consequently, since nothing happened in the majority of the cases, we don’t think it’s a major factor this time either. Other factors (discussed today and in the previous several alerts) seem to be much more important.

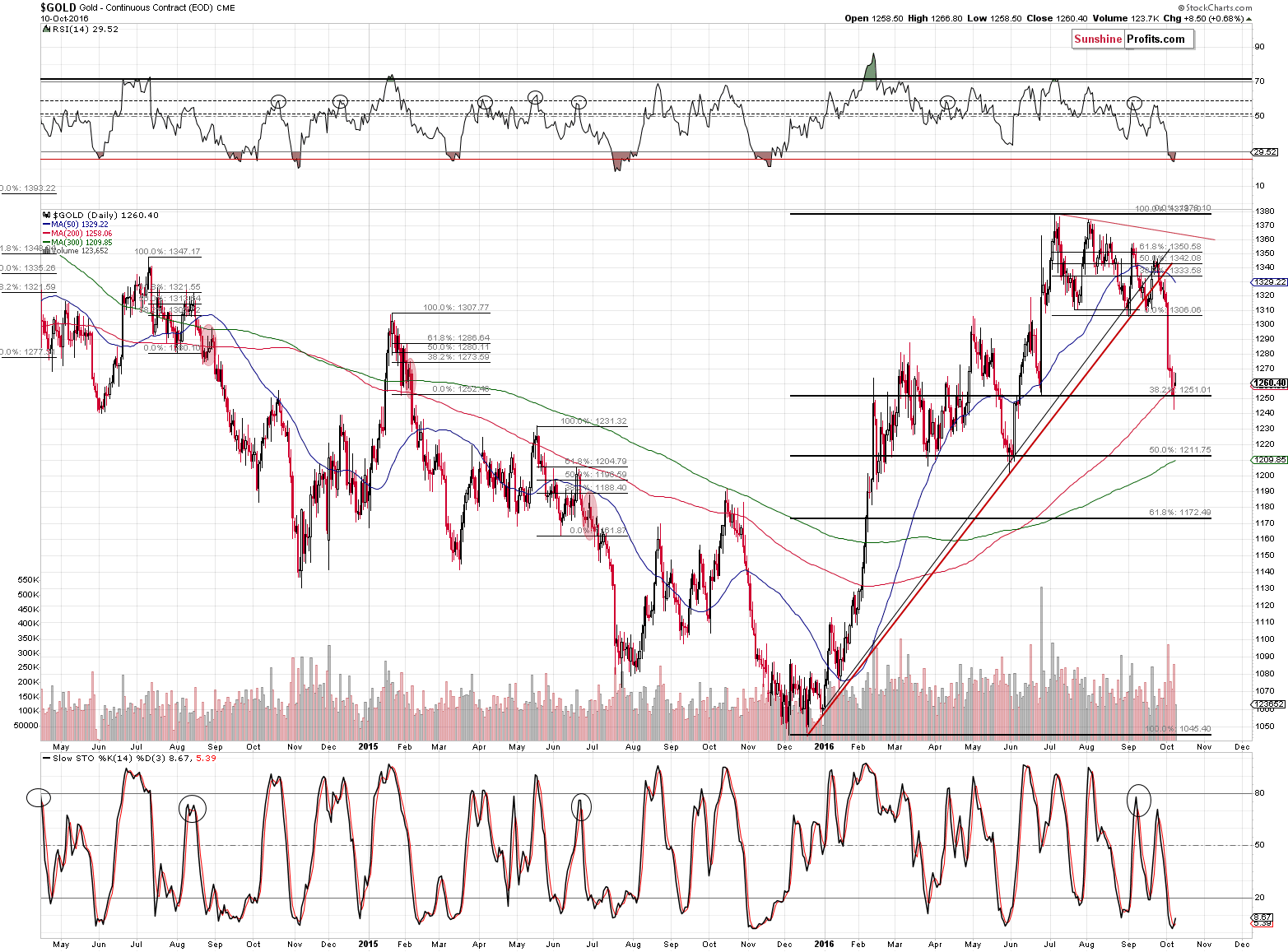

Gold moved a bit higher on relatively low volume. It appears to be a pause after a huge decline, not a big, volatile comeback.

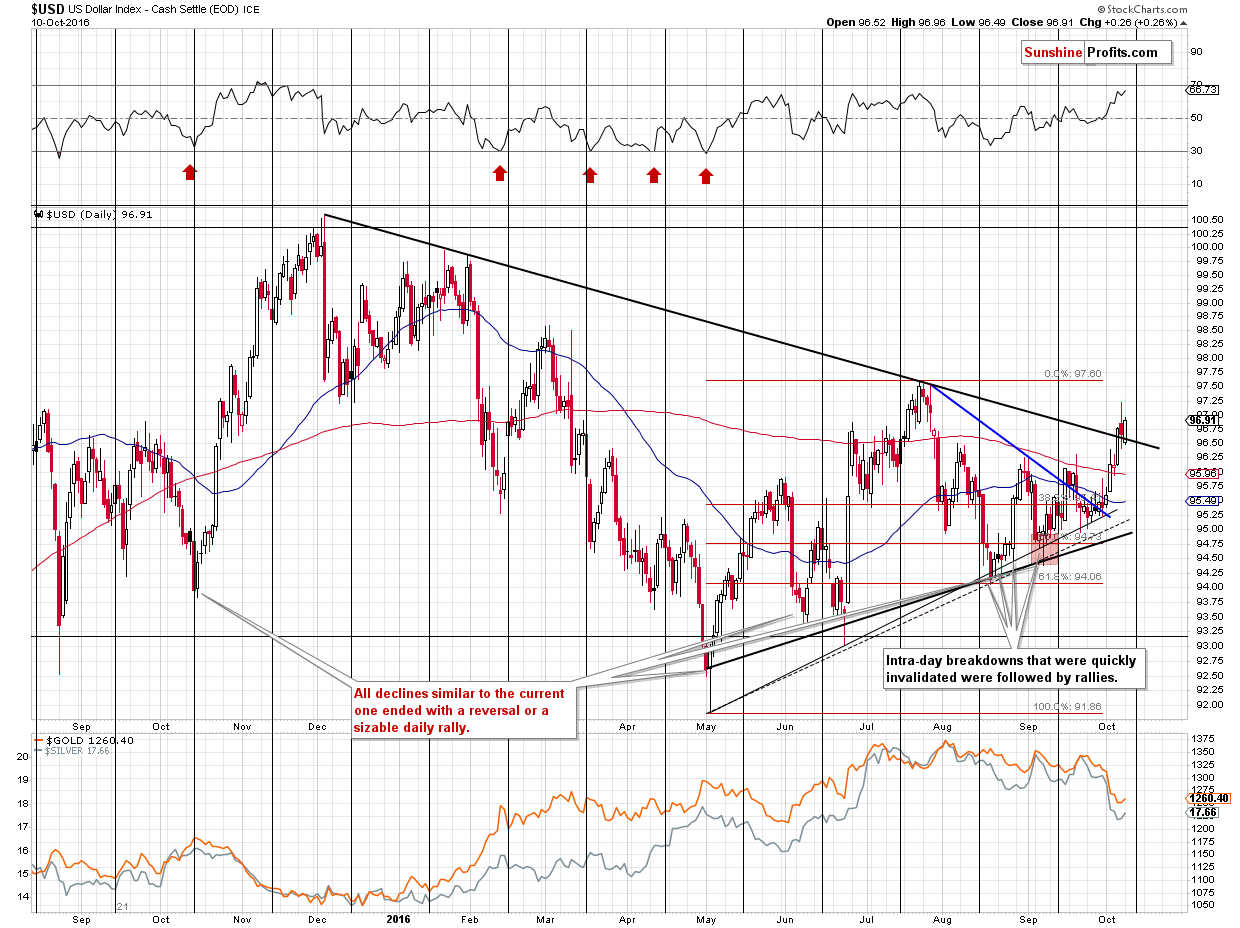

The key thing right now appears to be the situation in the USD Index and its relationship with metals.

Until today’s pre-market action, it didn’t seem like a big deal that metals moved a bit higher despite a move higher in the USD. The size of the phenomenon was limited and PMs were likely to pause regardless of what’s going on in the USD.

However, in today’s pre-market trading, USD moved higher by another 0.30 and metals didn’t respond at all. The next strong resistance for the USD Index is at the July tops (at about 97.60). At the moment of writing these words, the USD Index is at about 97.23, which is quite close to the above-mentioned target.

If the USD Index just repeats it’s today’s performance (the 0.30 move that we’ve seen so far), it would be almost at the July highs and we could see a reversal – especially that the turning point is just around the corner.

If gold and silver don’t want to respond to USD’s rally, they are quite likely to respond to USD’s decline (the above indicates that people don’t seem to be willing to sell at this time, which means that buyer can easily outnumber them).

In addition to the above, we just saw a confirmation (third consecutive close) of the breakout above the declining black line. This line stopped the rally in July (which was the biggest rally in the USD this year) and we just saw a confirmed breakout above it, which is a big deal. As discussed earlier, the cyclical turning point is just around the corner, so the USD may not be able to rally very high (the July tops seem to be a probable target) before a turnaround and a corrective decline, but still, the outlook for the following weeks has just improved. This means that the implications for the precious metals sector became more bearish for the following weeks, but at the same time, we could see a rebound in PMs and miners as the USD corrects.

Consequently, we the odds for decline’s continuation in the following days declined from about 70%-80% to about 45%, which is means that keeping a position opened at this time is too risky.

If we get a rebound in gold, silver and miners, we will probably re-enter the positions at higher prices, and if we don’t see a significant rebound, we’ll get back to the short positions when gold and silver once again respond to USD’s signals, which means getting back in the positions at lower risk. Either way, exiting the short positions temporarily appears justified from the risk to reward point of view at this time.

Summing up, due to the recent strength in the precious metals relative to the USD Index and the likely turnaround in the latter (perhaps after an additional rally, but since PMs no longer react USD’s upswings, it doesn’t really matter), it seems that exiting the short positions and taking profits off the table is now justified from the risk to reward point of view. We originally featured these short positions on September 30. Gold had closed at $1,317 on that day, and the closing prices for silver and GDX were $19.21 and $26.43, respectively. Yesterday, GDX closed over $3 lower, silver closed over $1.50 lower, and gold closed over $50 lower. In case of the DUST ETF, the profits are almost 50%.

We may have a good opportunity to re-enter the short position at higher prices, but if the risk/reward ratio suggests opening long prices, we’ll likely proceed as well. We will be monitoring the market for opportunities and report to you accordingly.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): No positions

Long-term capital (core part of the portfolio; our opinion): No positions

Insurance capital (core part of the portfolio; our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

On Sunday, there was the second presidential debate between Hillary Clinton and Donald Trump. What could this event bring for the gold market?

Second Presidential Debate and Gold

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold slips as prospect of Dec U.S. rate hike increases

Why are Indians losing their love of gold?

Bonus payment agreement ends strike at Freeport’s mine

=====

In other news:

Fed's Evans sees benefits to overshooting inflation target

China banks may need $1.7 trillion injection as credit quality worsens -S&P

Saudi Aramco eyes 2018 for listing, says CEO

Putin’s promise to join OPEC output freeze may not rebalance market, Goldman says

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts