Briefly: Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective.

Today’s alert is going to be short as there were no changes yesterday (and in today’s pre-market trading) in case of both: gold and silver and we also didn’t see any meaningful changes in case of the USD Index. Despite the above, we can draw implications from yesterday’s session.

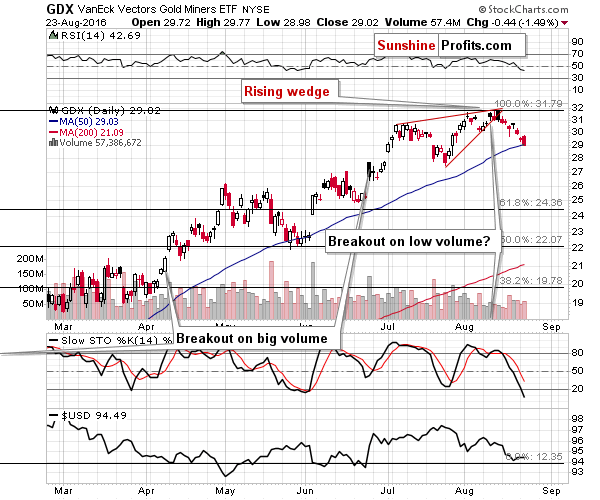

The reason is that mining stocks declined without gold’s lead and the decline in miners took place - once again - on relatively significant volume. Let’s take a closer look (charts courtesy of http://stockcharts.com).

This is yet another sign of miners’ underperformance, which confirms the bearish outlook.

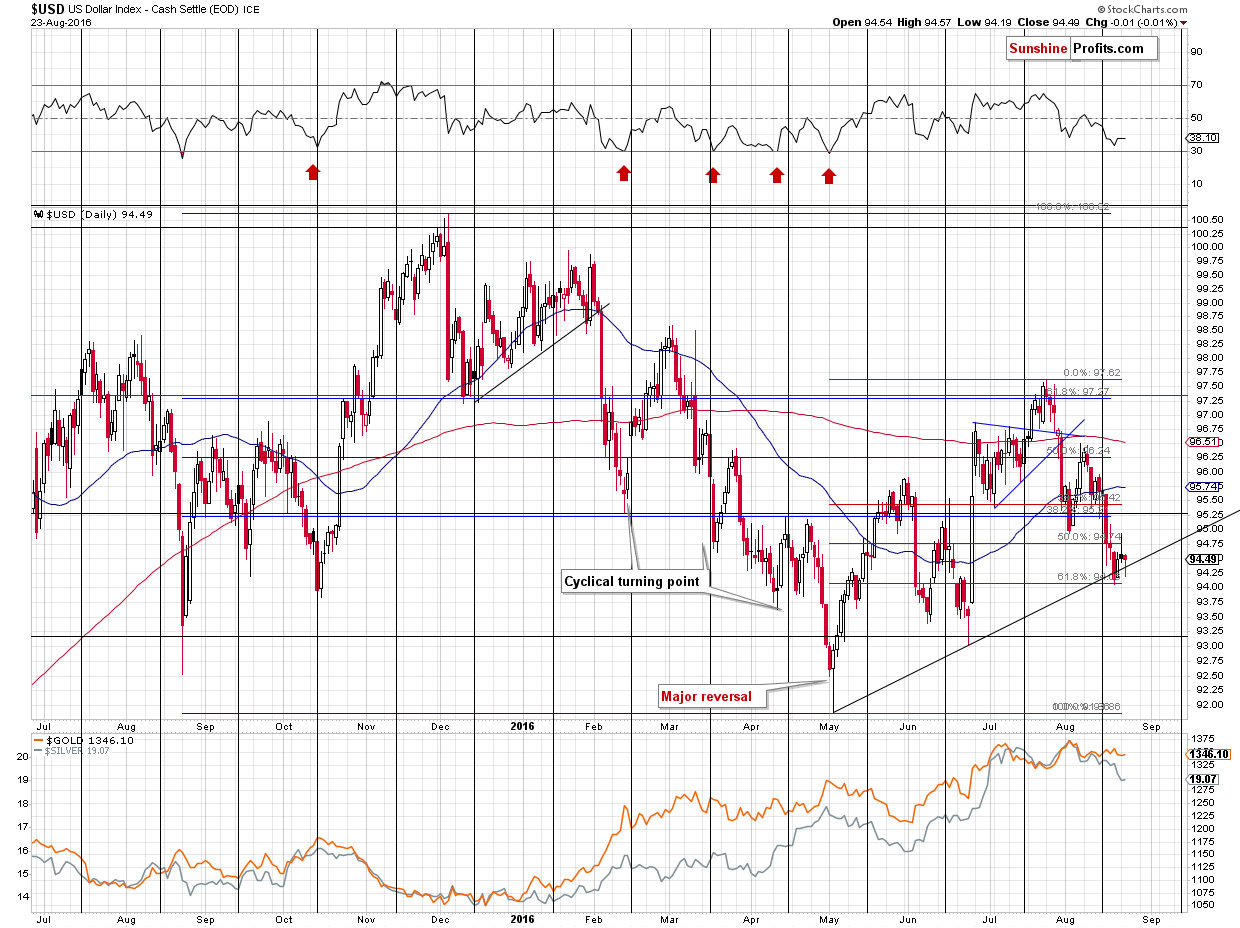

One additional thing that we would like to emphasize is that the outlook for the USD Index remains bullish.

The USD Index moved to the rising support line and the 61.8% Fibonacci retracement level a few days after the turning point and the since the tiny breakdown was invalidated, there was no new one in terms of daily closing prices. The USD Index moved a bit below the rising support line yesterday, but finally ended the session rather unchanged. The implications are bullish because the support line held up so well.

Summing up, Summing up, the analogy to the 1983 decline remains in place and so do many bearish signals discussed previously. Based on the invalidation of the breakdown in the USD Index, it seems that the decline in the USD and the rallies in gold, silver and mining stocks are over. The outlook for the precious metals sector is very bearish for the following weeks.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following entry prices, stop-loss orders and initial target price levels:

- Gold: initial target price: $1,006; stop-loss: $1,423, initial target price for the DGLD ETN: $74.37; stop-loss for the DGLD ETN $34.91

- Silver: initial target price: $13.12; stop-loss: $21.63, initial target price for the DSLV ETN: $39.78; stop-loss for the DSLV ETN $14.34

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $33.17, initial target price for the DUST ETF: $16.38; stop-loss for the DUST ETF $3.77

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $54.29

- JDST ETF: initial target price: $14.39; stop-loss: $3.22

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

On Sunday, Fed Vice Chairman Stanley Fischer delivered a speech entitled “Remarks on the U.S. Economy” at the Aspen Institute in Aspen, Colorado. What can we learn from it?

Fischer Speech in Aspen and Gold

Although today’s data showed that Germany’s manufacturing PMI declined to a two-month low of 53.6 and Germany’s services PMI dropped to a 15-month low of 53.3, missing analysts’ expectations, the euro moved higher against the greenback in the following hours. How did this increase affect the technical picture of the exchange rate?

Forex Trading Alert: EUR/USD Rebounds despite Weak Data

We saw a weak move to the upside in the last couple of days. Does this change anything as far as the short-term outlook is concerned? Read this alert to learn our take on the subject.

Bitcoin Trading Alert: Any Change in Short-term Outlook?

=====

Hand-picked precious-metals-related links:

Can the gold industry avoid the sins of the past?

Glencore Agrees $670 Million Deal to Sell Australian Gold Output

=====

In other news:

U.S. Index Futures Are Little Changed as Investors Await Yellen

Productivity in the U.S. Looks Bad, But It's Golden Compared With Global Peers

U.S. economy's biggest problem now: the smartphone?

Panama Papers Prompt Race for Tax Haven Dollars Before Crackdown

Turkey Begins Major Syria Offensive With Kurds, IS in Sights

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts