Briefly: In our opinion, a speculative short position (full) in gold, silver and mining stocks is justified from the risk/reward point of view.

The price of gold hasn’t done much lately – it’s been moving back and forth without any significant implications. However, the perception changes when one compares it to what it was likely to do at this time of the year.

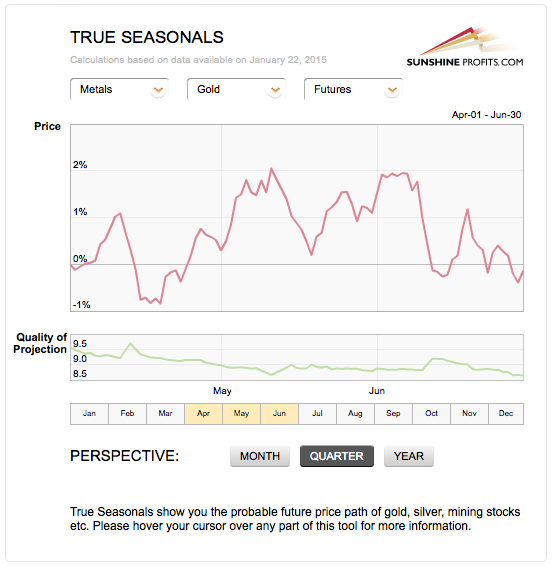

Gold was “supposed to” be rallying in the past few weeks as that’s what gold usually does at this time of the year (if we factor in the effect of the expiration of derivatives). The above True Seasonal chart shows that the second half of April and the first part of May are usually periods when gold performs well. We haven’t seen this kind of performance lately. What does it tell us about gold? Whenever an asset doesn’t respond to positive factors, it suggests that this asset will respond to negative ones and in a quite significant way. True Seasonal tendencies are a quite important factor and gold’s lack of real rally recently is a bearish signal on its own and has bearish implications.

Interestingly, the final part of the early-May rally usually ends on May 11th, which generally means that the rally is quite likely over or very close to being over. Since there was no rally recently, the above suggests that we may start to see the negative impact of the True Seasonal tendencies, instead of the positive one. As we wrote above, the implications are bearish.

Other than that, we don’t have much new to say about the situation in the precious metals market, as not much happened yesterday and what we wrote in the previous days remains up-to-date. The only relatively new thing that we can comment on is the short-term picture featuring mining stocks (charts courtesy of http://stockcharts.com).

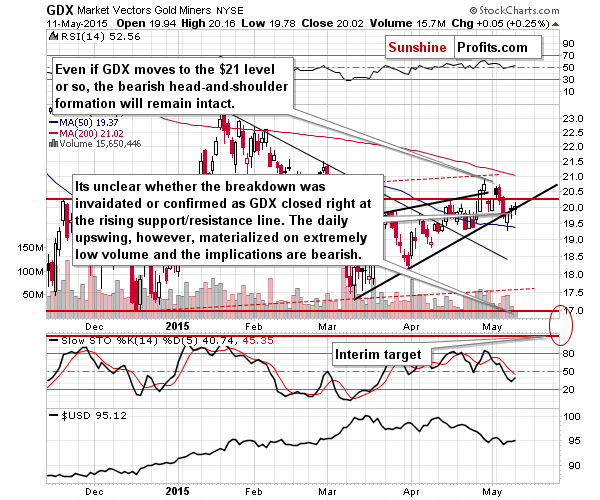

In yesterday’s alert we commented on the above chart in the following way:

Miners moved a bit higher on Friday but finally once again closed at the rising support/resistance line, so the breakdown is still unconfirmed (it was not invalidated either). The price / volume action, however, is much clearer and bearish as miners moved higher on very low volume.

During Monday’s session miners moved a bit higher on volume that was even lower than the one seen on Friday – it was extremely low. This has been a very bearish sign for the short term in the previous months, and in some cases in the past such price/volume action preceded big declines, so the implications here are bearish.

Other than that, we don’t have much to add to what we wrote in the previous several alerts – those comments remain up-to-date.

Overall, since the situation didn’t really change yesterday, we can summarize today’s alert in a similar way to what we wrote previously:

Summing up, the medium-term decline is not threatened by last week’s or Monday’s temporary upswing – it seems it was simply delayed (and it seems that we may not need to wait for much longer). The outlook hasn’t changed, so the odds are that the profits that we have on the short position in the precious metals sector will become even bigger in the following weeks.

We will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short (full position) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (!) target prices:

- Gold: initial target price: $1,115; stop-loss: $1,253, initial target price for the DGLD ETN: $87.00; stop loss for the DGLD ETN $63.78

- Silver: initial target price: $15.10; stop-loss: $17.63, initial target price for the DSLV ETN: $67.81; stop loss for DSLV ETN $44.97

- Mining stocks (price levels for the GDX ETN): initial target price: $16.63; stop-loss: $21.83, initial target price for the DUST ETN: $23.59; stop loss for the DUST ETN $10.37

In case one wants to bet on lower junior mining stocks' prices, here are the stop-loss details and initial target prices:

- GDXJ: initial target price: $21.17; stop-loss: $27.31

- JDST: initial target price: $14.35; stop-loss: $6.18

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The April employment report was published on Friday. What does it mean for the U.S. economy and the gold market?

Gold News Monitor: April U.S. Nonfarm Payrolls Are Mixed

=====

Hand-picked precious-metals-related links:

China Is About To Shock The World With Its Gold Holdings

Silver no longer the poor man’s gold as solar demand surges

AngloGold Ashanti back to black

=====

In other news:

No respite in sell-off of low-risk bonds

Greece Dodges Economic Bullet With Progress Toward Deal

Bank parents or main units seen pleading guilty over FX: sources

Get ready for another oil price dip: Goldman Sachs

"Huge Disconnect Between Physical & Futures" Suggests Commodity Rally Won't Last, Barclays Warns

Big banks flag dangers of financial bubble in oil and commodities

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts