Briefly: In our opinion, a speculative short position (full) in gold, silver and mining stocks is justified from the risk/reward point of view.

Gold moved much lower in the previous years and it’s currently trading relatively close to its previous lows. Some say that the precious metals market has already bottomed and most gold investors agree. Is this really the case?

We don’t think so, and the fact (!) that most gold investors (we mean people who are interested in precious metals and in mining in general) remain bullish confirms that the final bottom is likely not in just yet.

Bottoms are usually formed when (and because) everyone or almost everyone is bearish and they are selling the particular asset or have already sold it.

The above presents the poll that was just conducted on mining.com and as you can see the majority of participants are bullish. That’s normal for a mining-centered website, but if we were at bottom price levels, the amount of people bearish or neutral should be much higher. Consequently, it seems that the final bottom is still ahead.

Before we focus on the short-term outlook (as there were no change in the long-term one), we would like to make sure that you read our previous long-term-oriented alerts about gold price targets, silver price targets, confirmations of the bottom, and gold’s likely post-bottom rally. Having said that, let’s take a look at the short-term gold picture (charts courtesy of http://stockcharts.com).

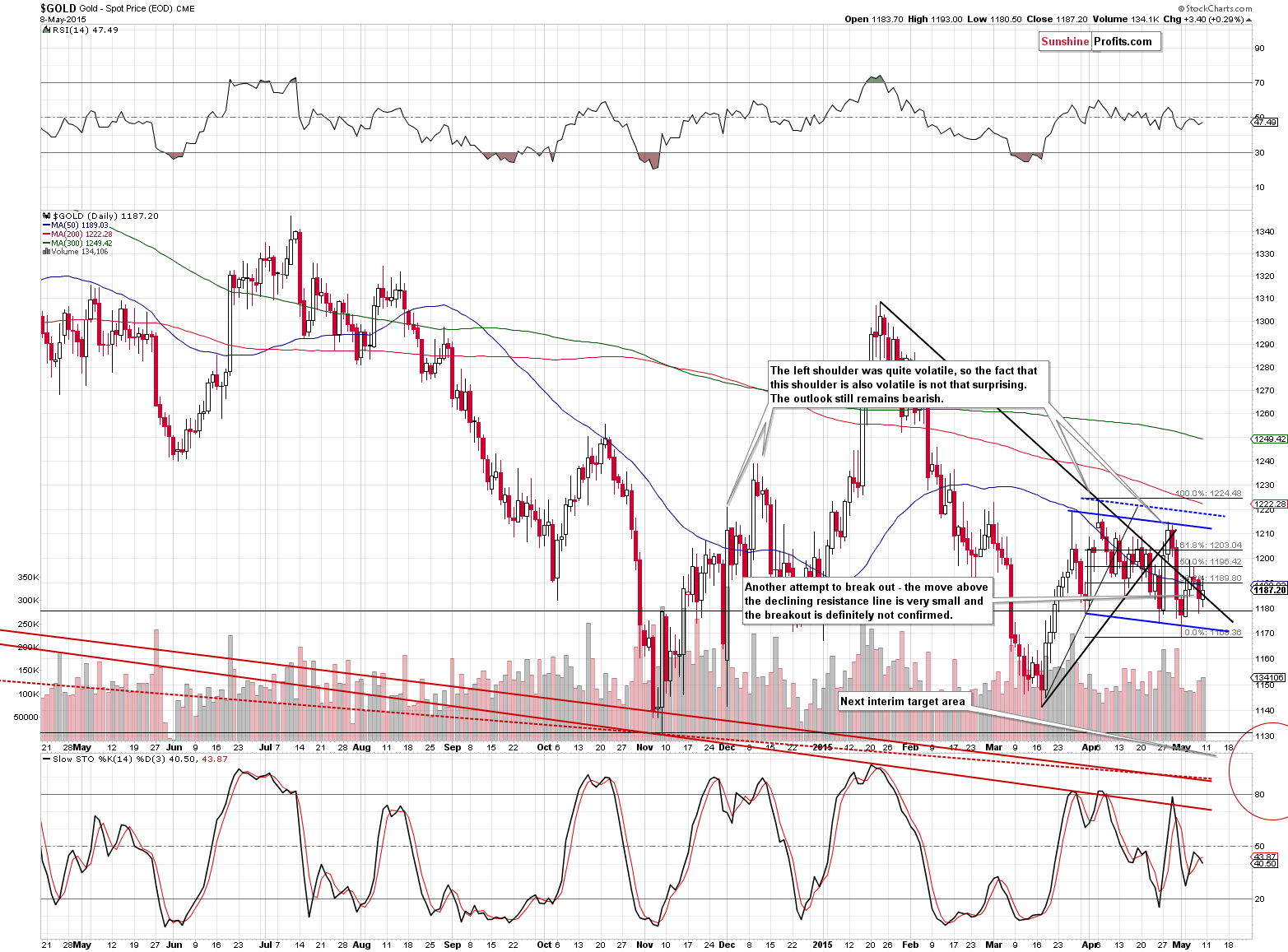

Gold moved a bit higher on Friday and closed above the declining resistance line, but the size of the breakout was very small, so we view it as meaningless (at least until we would see its confirmation) even though the volume was a bit higher than during the previous’ day’s downswing (especially that the volume in mining stocks was low).

The medium-term trend is down and Friday’s session didn’t change much – the outlook remains bearish.

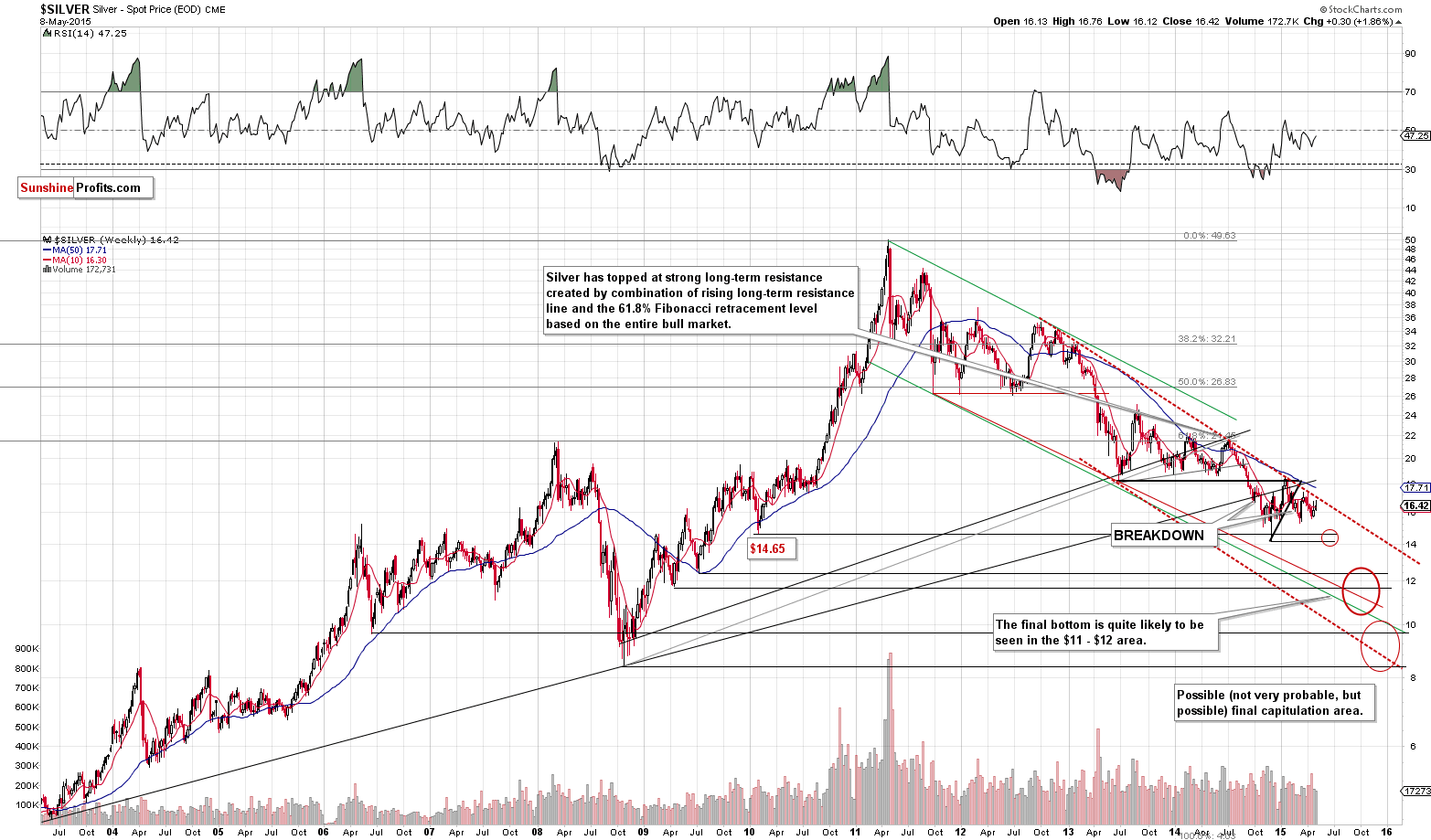

Silver didn’t do much either during both Friday’s session and the entire previous week (overall). The key thing to focus on is that the main trend remains down and that silver is very close to the upper border of the declining trend channel. The implication is that even if silver moves higher, it’s very likely that the move will be only small. If silver declines, however, then it could be a start of a major several-dollar-long decline.

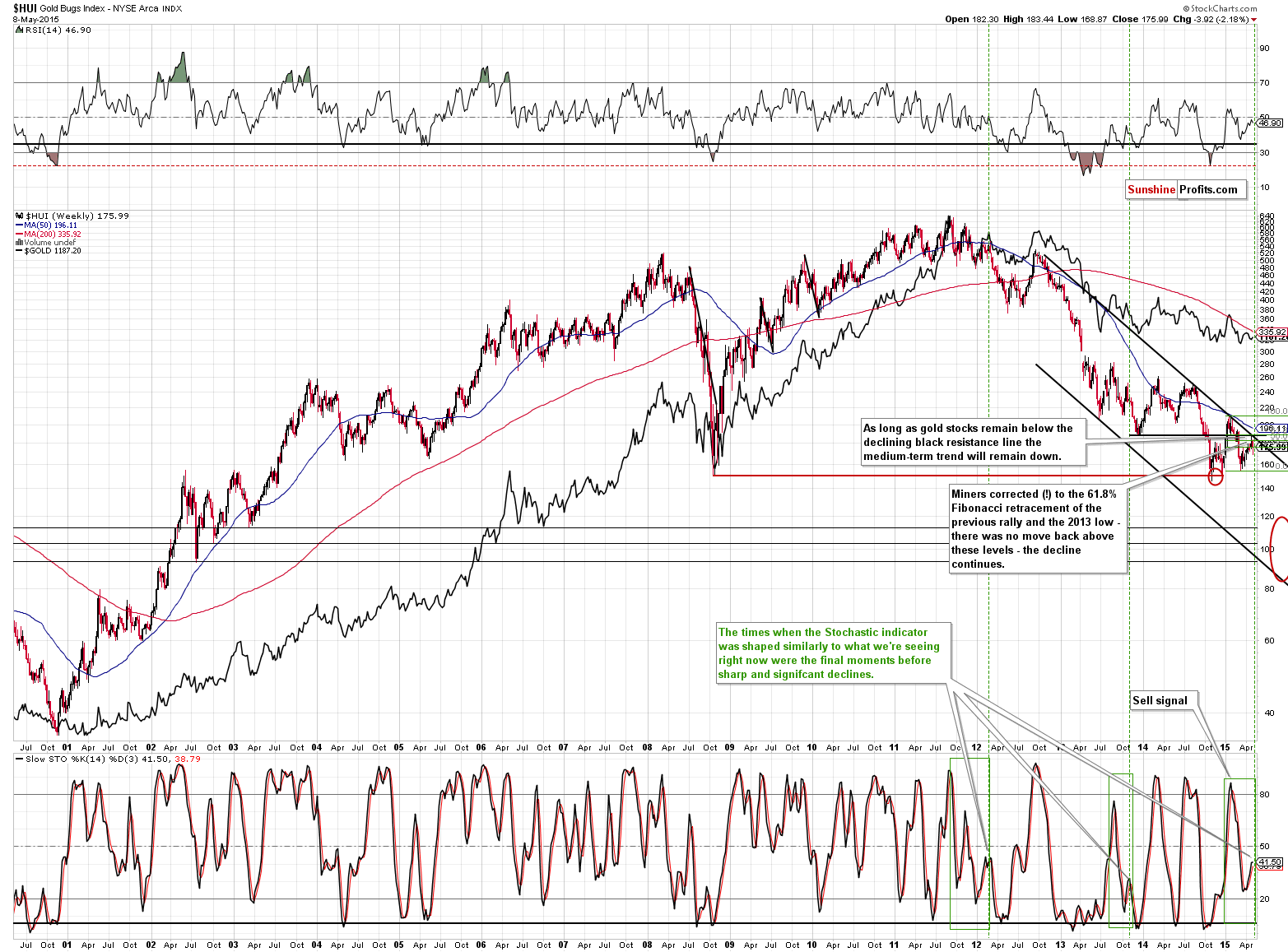

Gold stocks are in a very similar position – they just moved to the combination of resistance levels and very close to the strong, declining resistance line. If they move higher, the potential size of the rally will be relatively small, but if they move lower, they can (and will be likely to) slide much further.

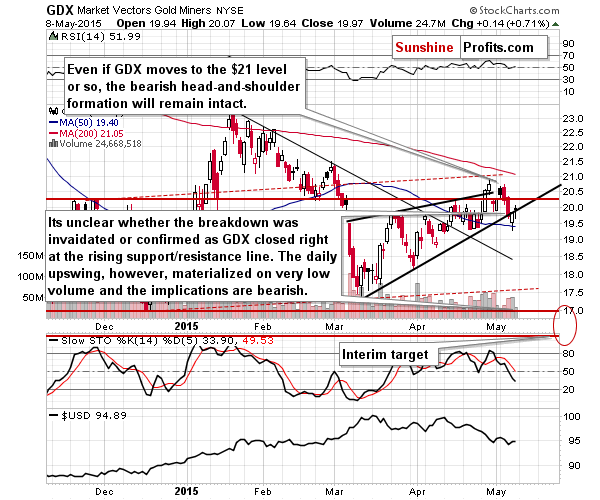

In Friday’s alert we commented on the above chart in the following way:

The price / volume action in mining stocks is rather unclear. On one hand, we saw miners move below the rising support line and then back to it (so it seems that the breakdown already took place and we’re now seeing its verification), but on the other hand, miners closed at the support line, so, in a way, there was no breakdown at all. Overall, we view the breakdown as unconfirmed and without important implications at this time. If miners close the week below the rising support line, then the implications will be strongly bearish, but that’s not the case just yet.

Miners moved a bit higher on Friday but finally once again closed at the rising support/resistance line, so the breakdown is still unconfirmed (it was not invalidated either). The price / volume action, however, is much clearer and bearish as miners moved higher on very low volume.

Speaking of mining stocks, there’s something that we want to bring up, even though we covered it in greater details several months ago. The question that your Editor was quite often asked during his conversations with subscribers (as a part of the free 6-th-premium-anniversary gift) was which mining stocks do we like and what companies we’ll be looking to buy once the final bottom is in. I was a bit surprised by these questions and those who I talked to were a bit surprised by the reply, so I thought that explaining my reply here would be a good idea.

I was a bit surprised by this question, because the rankings that we have on the website for gold stocks and silver stocks have been around for more than 5 years (they are now called Golden StockPicker and Silver StockPicker, but were previously called Leverage Calculators – they looked a bit different, but the algorithm that is used for ranking stocks is unchanged – except for the addition of the CSR criterion in the case of gold stocks – if it’s not used, the algorithm is exactly as it was 5 years ago) and we quite often link to them in the alerts. I was probably surprised because I thought that since I had these tools on the website, then it was obvious that I used them for selecting mining stocks – however, that was based on my (naive?) assumption that everyone puts their money where their mouth is, and it turns out that it’s not a common practice (I learned from the conversations that many analysts say one thing to their readers and do a different thing themselves). Consequently, what seemed obvious to me, wasn’t in fact that obvious in general.

Why was my reply a bit surprising? Because of these tools’ performance – our extensive (if you know more thorough research on rebalancing techniques for mining stocks, please let us know) research shows that a lot of money could have been made by applying a rather simple rebalancing strategy using these tools.

Before moving to the results, I’d like to tell you how I developed these tools. It might be interesting for you as I started this whole thing as an investor, not an academic or a salesman. My main focus was and still is on things that work.

I developed the StockPickers for my own use many years ago, when I wanted to diversify between metals and miners. I started by looking at the results of more popular approaches that my colleagues presented – the classic fundamental analysis combined with geological studies. The things that were key factors were the financial statements and drilling results. It sounded reasonable.

The problem was that when I checked the performance of this approach, of these “mining stock picks,” it turned out that the portfolio built on them performed more or less just like the HUI and XAU Indices (depending on whether it included more gold or silver stocks) – there was no visible outperformance over the long run. Since there was no benefit over investing in companies that the HUI and XAU were comprised of (that was before ETFs became popular), then there was no good reason to bother with picking these stocks at all.

I learned that what was featured as “top picks” were very often simply those companies that managed to perform well out of a much greater number of companies that had been “picks” before. Consequently, while at the first sight it seemed that it was an entire portfolio that was visible as “top picks”, it was really only a part of the portfolio, and since what was not visible did not perform well, the overall performance of the “picks” was simply average. To be clear and honest – that was a long time ago and I might have had “bad luck” selecting the analyses that I checked and I might be biased.

Again, to be clear, I’m not saying that the fundamental approach is wrong or that it can’t be used to successfully analyze a company. However, a long time ago I noticed that the average performance of such picks was not impressive to say the least. I haven’t checked recently, so I don’t want to comment on the performance (or lack thereof) of the analysts who currently use this approach.

I was thinking how it was possible that even those who specialized in the mining business couldn’t find stocks that outperformed on average and I found that there was actually a good reason for it – it’s the amount of companies that has to be analyzed and compared against each other.

Do you know how much time it takes to analyze 1 company thoroughly from the fundamental point of view (by the way, the CFA designation is much more focused on the fundamental side of the market than the technical one)? It takes about 1 month to do it well (to dig through the balance sheets, income statements, cash flow statements, all footnotes, history and previous performance of key employees and management etc.) per company. Assuming that one doesn’t take any time off, they can analyze thoroughly (!) 12 companies per year. Of course, once they have these 12 individual reports, then the odds are that the reports for the first companies would already be outdated. Consequently, you have to make compromises and the “classic fundamental approach” would not be fully employed anyway.

I generally refuse to do important things unless I have done a sufficient amount of research on it (of course, short-term trading is a different matter as the risk is inherent part of that process – it’s about managing it, not its absence) and I’m sure what I’m doing. Since I consider investments a very important thing (especially if I know that it will affect other people), the above approach didn’t resonate with me.

Instead of giving up, I went back to basics.

What do I want from a gold mining company? I want it to magnify gold’s gains. I want the gold stock to provide me with the biggest bang for the buck possible. In other words, I want it to have leverage relative to gold, so that I gain the most by holding it as gold soars. Why and how the company manages to achieve this goal is of secondary importance as long as there is a good probability that the leverage will persist at least for a considerable amount o time.

The very interesting thing about markets is that they move in trends. This is true not only for prices, but also for their ratios and quite often for other relationships. The gold stocks’ performance relative to gold is not an exception (and no, I don’t mean the simple HUI to gold ratio here, but it moves in trends as well, anyway). Consequently if we could somehow isolate the gold stocks’ performance relative to gold and rank them in this order, we would have our top ranking. Leverage is not everything, though, we have to check if the companies on average move in tune with gold, to make sure that it is really the strength of the company (stemming from their gold mining activities) that causes the outperformance and not some temporary, external factors.

Fortunately, I knew quite a lot of statistical mechanisms that I was able to apply. That’s how the rankings were created – with the emphasis on selecting gold and silver stocks that are likely to outperform the underlying metal as they have proven to do so previously.

OK, does it work? It seemed that it worked by reviewing the performance periodically and seeing the results. However, that’s not the kind of test that I’d like to see as a true confirmation. Consequently, last year, we conducted very thorough research on the performance of the StockPickers. It turned out that rebalancing one’s mining stock holdings using the StockPickers gave much better results in the case of both gold stocks (vs. buy-and-hold the HUI Index) and silver stocks (vs. buy-and-hold the XAU Index, which we used as a proxy for silver stocks due to the lack of a better long-term benchmark).

Rebalancing (updating the holdings) gold stocks using the Golden StockPicker every 50 days and rebalancing silver stocks using the Silver StockPicker every 20 days (owning 5 top gold stocks and silver stocks from the ranking) for five years allowed to outperform (in the case of gold stocks) the HUI Index by more than 30% and to outperform (in the case of silver stocks) the XAU Index by more than 90%. That’s the efficiency that surprised subscribers who I was talking with.

These rankings of gold stocks and silver stocks that we use are not directly based on news about equipment that a given company has, nor is the analysis accompanied by fancy pictures of open pit mines or firm handshakes between your Editor and the CEOs of mining companies, but…

These rankings work and they proved that it’s not a one-time event but stable performance. The theory behind the tools proved to be able to generate additional gains. We can’t promise that the tools will perform just as well in the future, but it seems very likely, in our opinion.

Overall, since the situation didn’t really change yesterday, we can summarize today’s alert in a similar way to what we wrote previously:

Summing up, the medium-term decline is not threatened by last week’s or Monday’s temporary upswing – it seems it was simply delayed (and it seems that we may not need to wait for much longer). The outlook hasn’t changed, so the odds are that the profits that we have on the short position in the precious metals sector will become even bigger in the following weeks.

We will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short (full position) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (!) target prices:

- Gold: initial target price: $1,115; stop-loss: $1,253, initial target price for the DGLD ETN: $87.00; stop loss for the DGLD ETN $63.78

- Silver: initial target price: $15.10; stop-loss: $17.63, initial target price for the DSLV ETN: $67.81; stop loss for DSLV ETN $44.97

- Mining stocks (price levels for the GDX ETN): initial target price: $16.63; stop-loss: $21.83, initial target price for the DUST ETN: $23.59; stop loss for the DUST ETN $10.37

In case one wants to bet on lower junior mining stocks' prices, here are the stop-loss details and initial target prices:

- GDXJ: initial target price: $21.17; stop-loss: $27.31

- JDST: initial target price: $14.35; stop-loss: $6.18

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

S&P 500 index got closer to its late April all-time high. Will this uptrend accelerate?

Stock Trading Alert: Investors' Sentiment Improves Again Following Jobs Data Release - Will It Last?

On Friday, crude oil moved lower after the market’s open weakened by a stronger U.S. dollar. Despite this move, the commodity reversed and rebounded in the following hours, gaining 0.85% and closing the day above $59, but did this upswing change anything?

Oil Trading Alert: Is Crude Oil’s Rally Over?

We saw a relatively violent rebound to the upside yesterday. While yesterday’s move was visible, it didn’t really bring Bitcoin above $250. Did the move change anything in the short-term outlook?

Bitcoin Trading Alert: Is Bitcoin in Bullish Territory?

=====

Hand-picked precious-metals-related links:

Indian people hold 20,000 tonnes of gold

=====

In other news:

Has Krugman been proved wrong on austerity?

China cuts interest rates for third time in six months as economy sputters

Why Europe will never give up Greece: Faber

Yellen just disproved the biggest Fed conspiracy theory

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts