Briefly: In our opinion speculative short positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective. We are keeping the stop-loss levels at their current levels, which means that we are effectively keeping some gains locked and at the same time we’re allowing the profits to increase.

…And fails once again. Gold moved back and forth during yesterday’s session, but ultimately closed a bit lower. The decline was even more visible in mining stocks – are we about to see much lower precious metals prices?

Quite likely, yes. If we don’t see a big slide in the coming days, only further trading sideways or a small move higher, it will not change the bearish outlook anyway.

Let’s start today’s analysis with the gold market (charts courtesy of http://stockcharts.com).

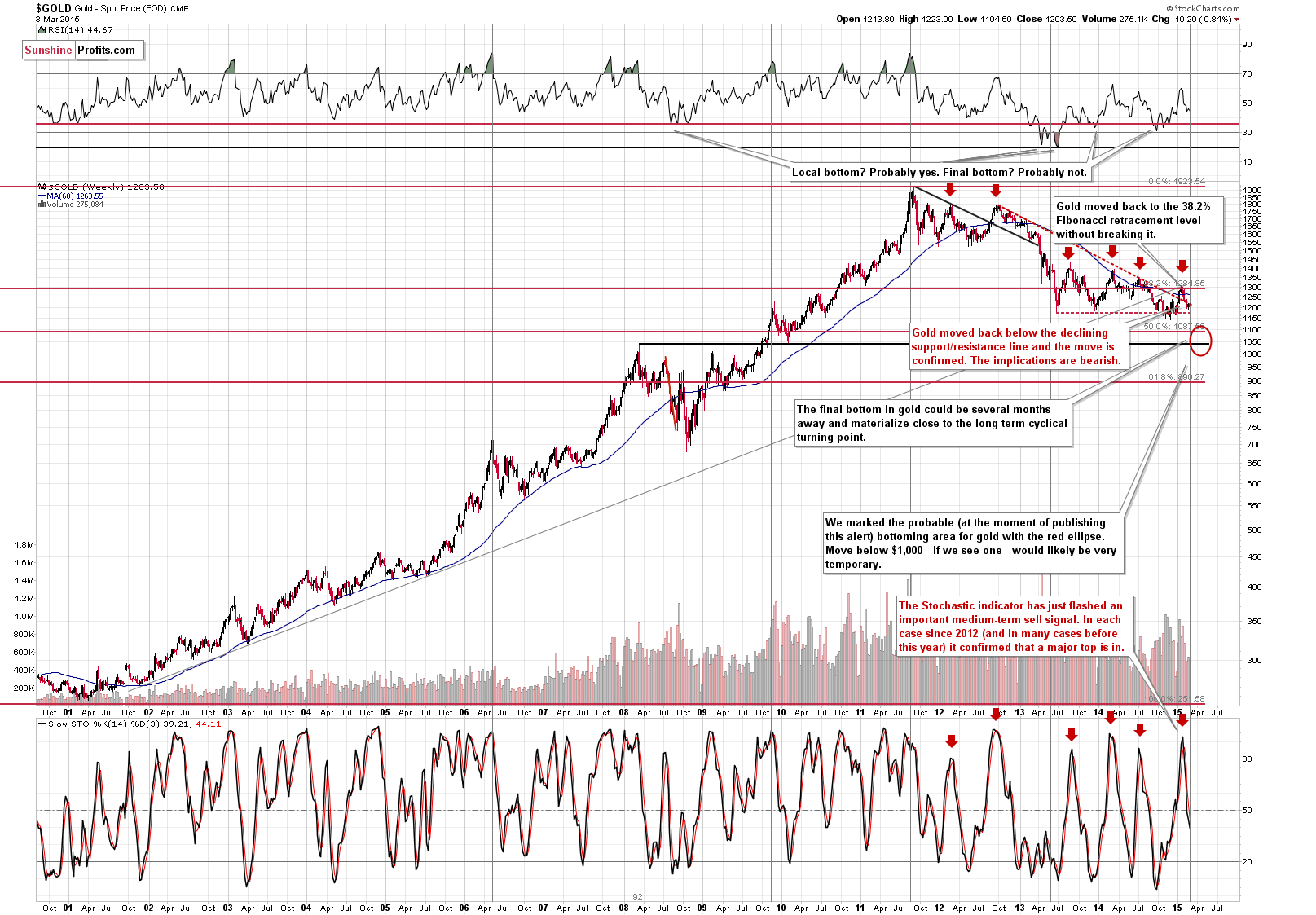

Gold remains below the declining red dashed resistance line, so the trend remains down. The sell signal from the Stochastic indicator based on the weekly closing prices remains in place and the implications are bearish.

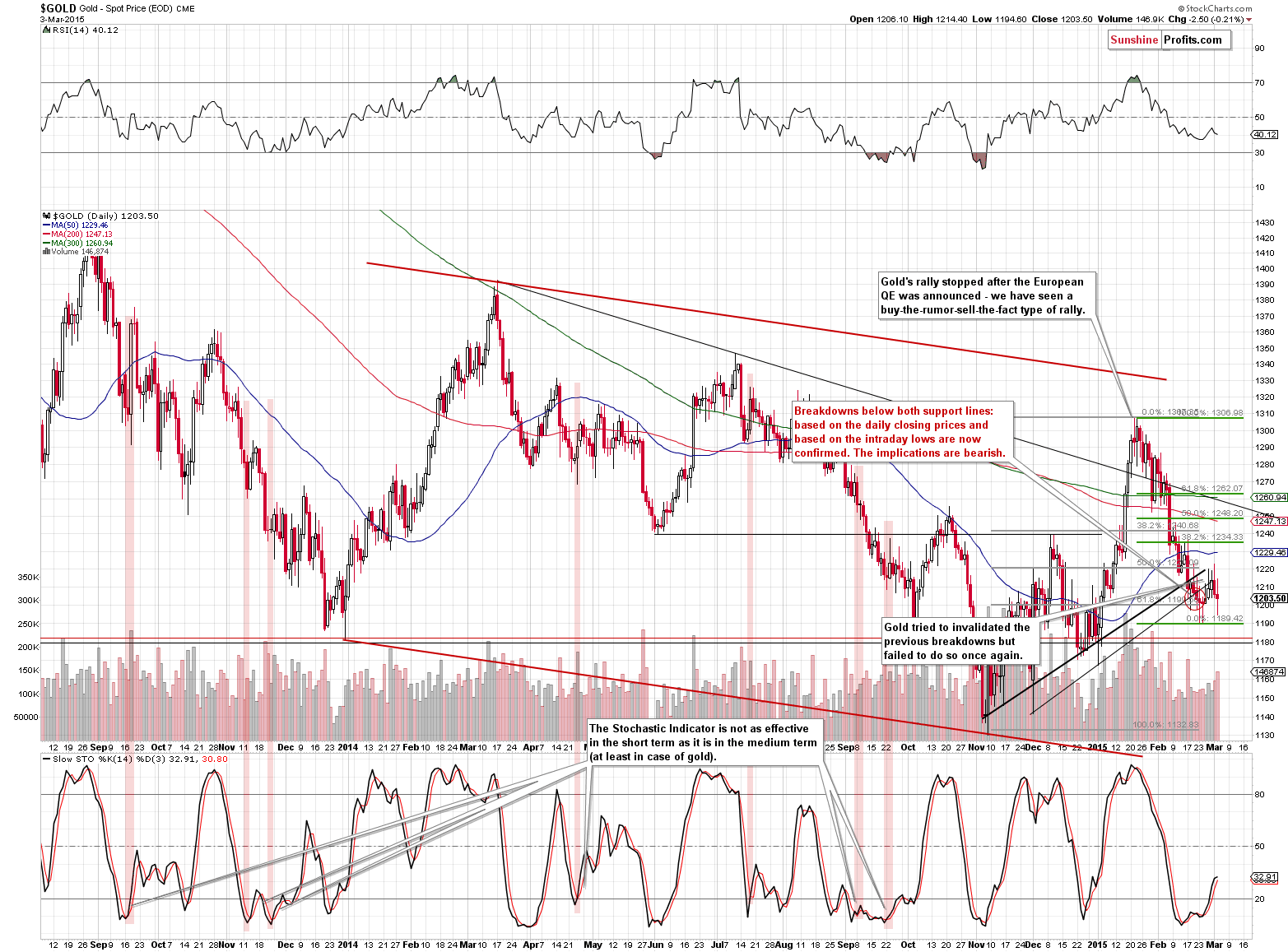

On the above short-term chart we see that gold has been declining on increasing volume this week, which is another bearish sign. The breakdown below both rising support/resistance lines is more than confirmed and we saw a visible pause after gold reached our $1,200 interim target – the decline seems ready (or almost ready) to continue.

Our previous comments on the above chart remain up-to-date:

Please note that we are not ruling out a more visible corrective upswing at this point. The retracement levels based on this month’s decline are marked in green. The first retracement is at about $1,235, so even if gold moves to this level, it will not change anything. In fact, even gold moving to $1,262 would still be viewed as an upward correction at this time (we don’t think that it will move as high, though).

Regardless of the possible upward correction (based on today’s pre-market action, it’s already taking place), it seems that keeping the short position intact is still justified from the risk/reward perspective. The reason is that we are after major sell signals and breakdowns and a possible move back above the previously broken levels would need to be confirmed before having bullish implications. The correction could end quickly and be followed by a big slide (say $1+ decline in silver) that one would not be able to take advantage of by being out of the market. The breakdowns and medium-term sell signals justify preparing for the above while enduring small upswings.

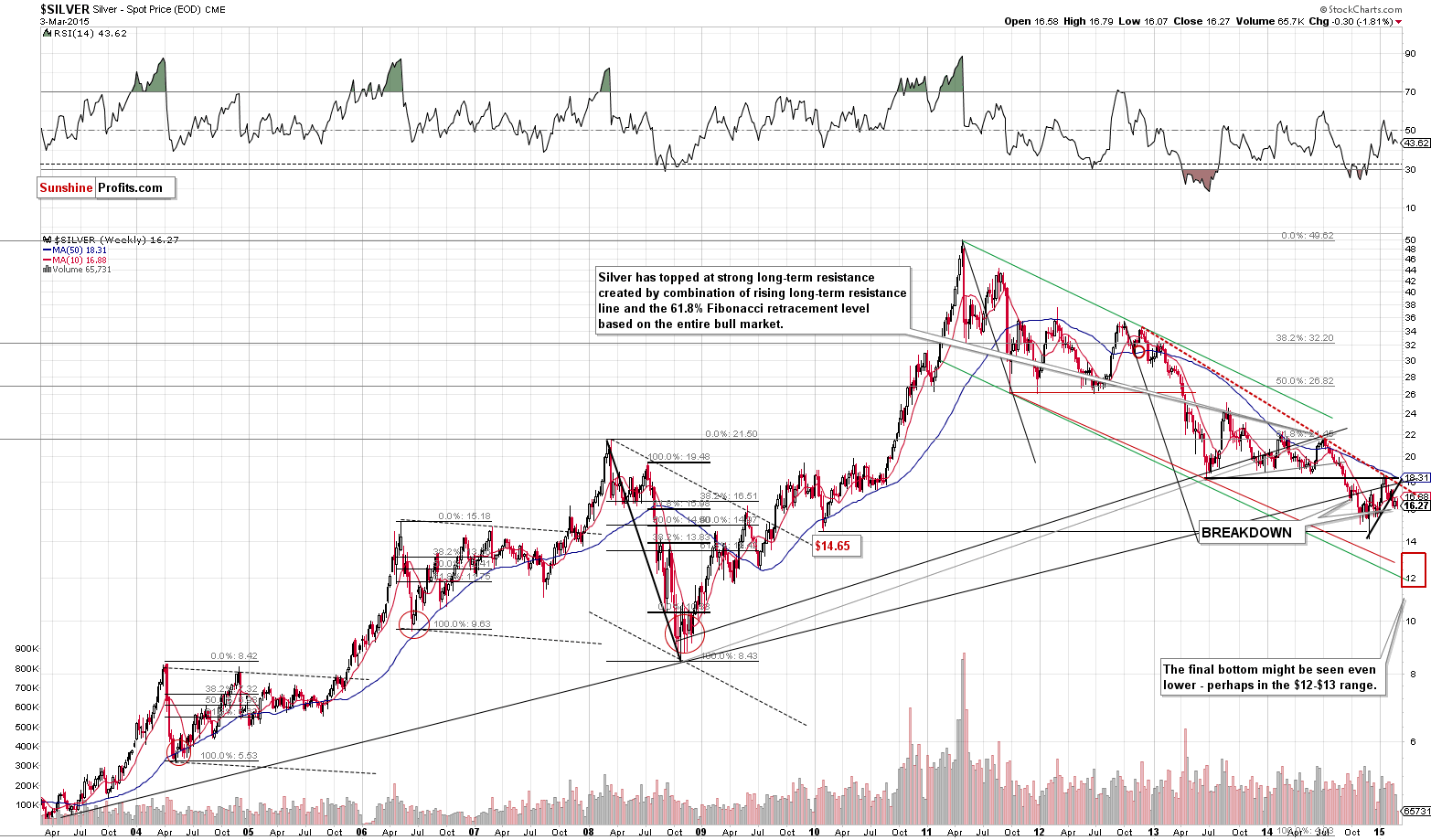

Meanwhile, all that we wrote regarding the above silver chart previously remains up-to-date:

Meanwhile, the situation in the silver market didn’t change at all yesterday. Silver is after an important breakdown and it’s likely to decline in the following days or weeks. Please note that the fact that silver didn’t decline yet is not a sign of strength. It’s the natural way of silver to react – it very often either moves very sharply or stays in the same place for an extended time. Based on the recent breakdown, it seems that the next move will be to the downside.

Silver remains below the rising short-term resistance line and the declining long-term resistance line. Consequently, the outlook remains bearish.

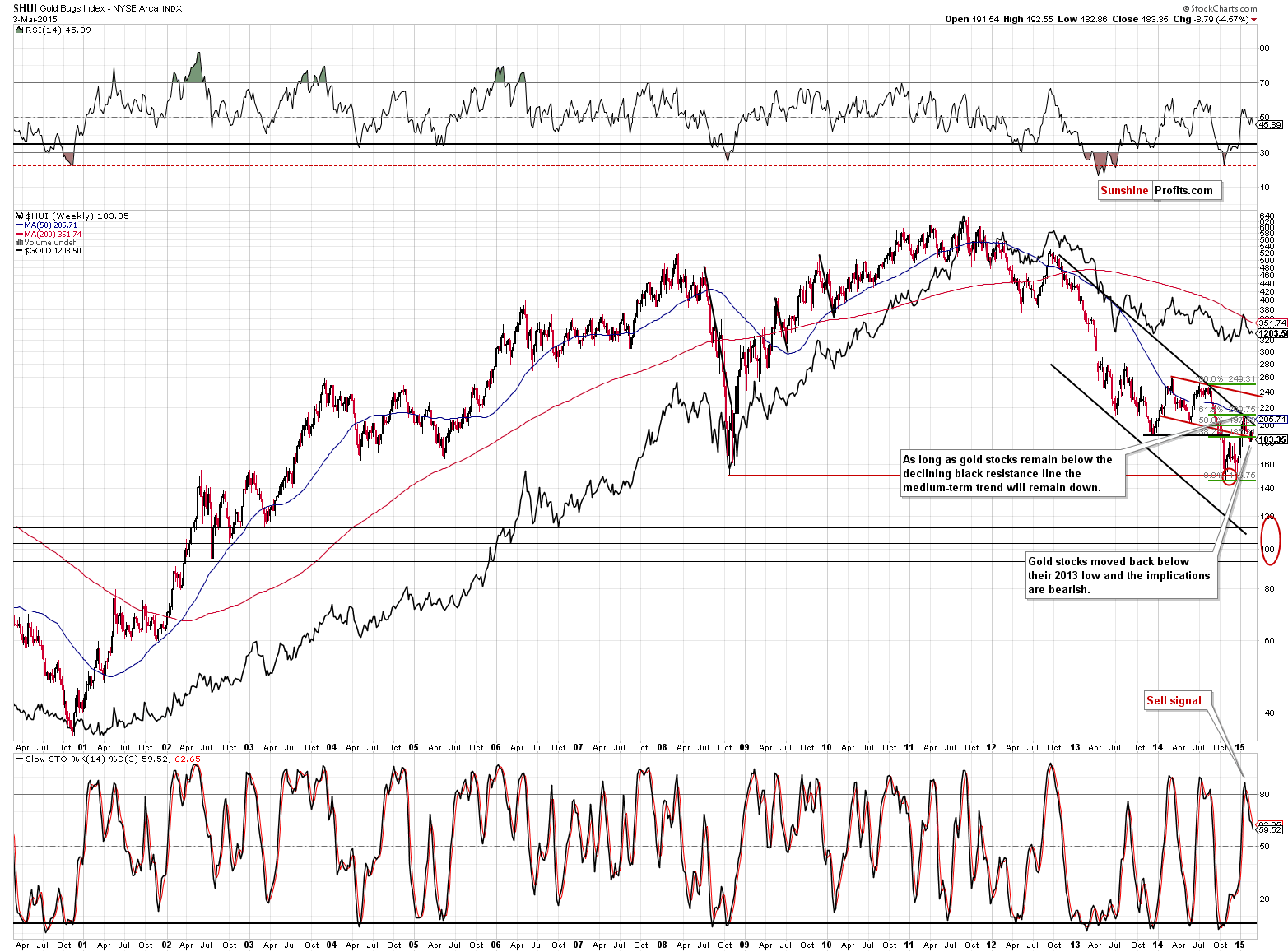

Meanwhile, we wrote the following about the HUI Index:

(…) it seems that this decline is not over and that miners have further to fall. (…) The key declining resistance line is currently at about 200, so the odds are that even if gold stocks move higher, they will not move above this level.

However, we have not seen a move higher in the last few days – we saw declines, also yesterday, when gold stocks declined more than gold. Overall gold has declined by 0.84% so far this week and the HUI Index has declined by 4.57%. The previous outperformance of gold stocks has evaporated and gold miners are once again declining, also relative to gold. The implications of the above are bearish and we can say the same about the HUI’s visible move back below the 2013 low.

Overall, we can summarize the situation in the precious metals market in the same way as we did previously:

Summing up, while we are already seeing some kind of corrective upswing, it doesn’t seem to be justified from the risk/reward perspective to adjust the current profitable positions. The profits may get smaller temporarily, but the odds are that they will become even greater as the medium-term trends remain down and the medium-term sell signals remain in place.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (our opinion): Short positions (full) in gold, silver and mining stocks with the following stop-loss orders and initial (!) target prices:

- Gold: initial target level: $1,180; stop-loss: $1,254, initial target level for the DGLD ETN: $75.23; stop loss for the DGLD ETN $63.16

- Silver: initial target level: $15.70; stop-loss: $17.63, initial target level for the DSLV ETN: $66.25; stop loss for DSLV ETN $45.40

- Mining stocks (price levels for the GDX ETN): initial target level: $18.40; stop-loss: $22.17, initial target level for the DUST ETN: $18.99; stop loss for the DUST ETN $11.32

In case one wants to bet on lower junior mining stocks' prices, here are the stop-loss details and initial target prices:

- GDXJ: initial target level: $23.37; stop-loss: $28.37

- JDST: initial target level: $12.30; stop-loss: $7.00

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

While we are waiting for the details on the ECB’s QE (will be published on Thursday) and the U.S. non-farm payroll report (will be revealed on Friday), it is worth analyzing a piece of news, which passed almost unnoticed. The long established London Gold Fix is going to be replaced by the new electronic LBMA price-discovery process on March 20th this year. Why do we believe that all gold investors should be aware of that fact?

Gold News Monitor: The LBMA Gold Price will replace the Gold Fixing Price

On Tuesday, crude oil gained 1.73% ahead of U.S. supply data. As a result, light crude closed the day above the level of $50, but did this increase change anything in the short-term picture?

Oil Trading Alert: More Of The Same – For Now

Although USD/JPY moved higher earlier today, Etsuro Honda’s (an economic adviser to Prime Minister Shinzo Abe) commentary about implementing additional monetary easing measures by the Bank of Japan triggered a reversal and pushed the greenback lower. As a result, the exchange rate paused its rally slightly below the key resistance zone. Where it head next? North or south?

Forex Trading Alert: USD/JPY Pauses Rally

=====

Hand-picked precious-metals-related links:

Gold appetite in February highest in nearly a year

American Eagle Gold Bullion Sales Plunge in February Following Weak 2014 Sales

Perth Mint's silver sales drop to 10-month low in Feb

Australia’s gold output the highest in over 10 years

Sale AngloGold’s only option – Barclays

=====

In other news:

Draghi Split From Yellen Drives Treasury Premium to 25-Year High

Contrarian call? Why you should be wary on Europe

Yellen: Poor values may undermine bank safety

India lowers rates in second unscheduled cut this year

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts