Briefly: In our opinion speculative short positions (half) are currently justified from the risk/reward perspective.

Gold declined yesterday and so did silver, but the mining stocks managed to move higher. A similar situation was a bullish sign several days ago, so the question is if this has just as bullish implications at this time.

In short, it’s not a clearly bullish sign, so we don’t think that much changed yesterday. Let’s move right to the charts (charts courtesy of http://stockcharts.com).

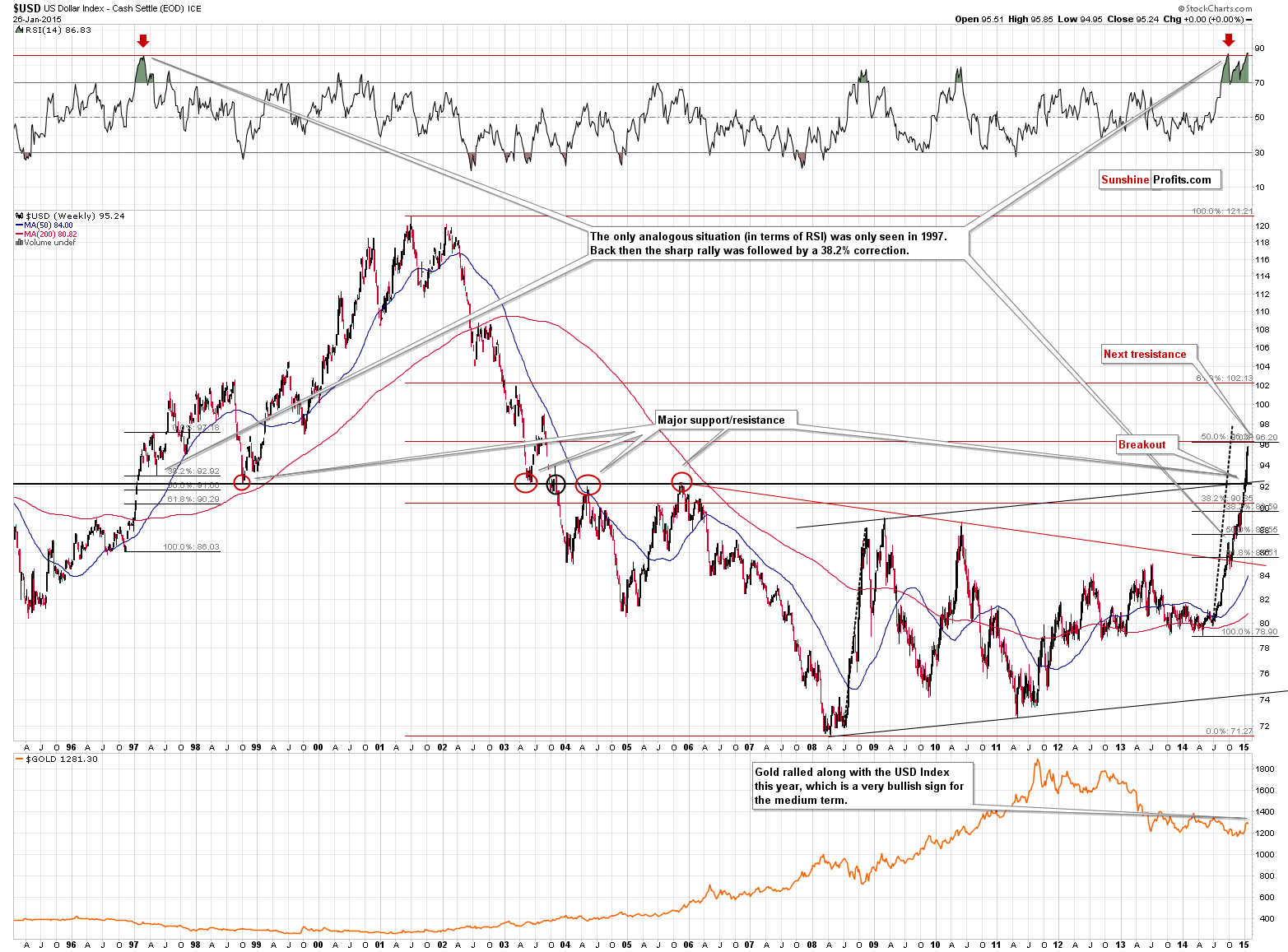

Our previous comments on the USD Index and its link to gold remain up-to-date:

The USD Index rallied just like we’d been expecting it to. The breakout above the 2005 high was confirmed so the next move was likely to be to the upside and we didn’t need to wait long to see one. The USD Index soared as the euro declined on the QE news. The interesting thing about this rally is that it’s likely not over, as no resistance level was reached yesterday and the next significant resistance is above 96. That’s where we expect the USD Index to stop for longer or perhaps where this rally would end. The former seems more likely at this time.

Why didn’t gold decline despite a move higher in the USD Index? Because it was not the inherent strength of the U.S. dollar that caused the move – it was the weakness of the euro (let’s keep in mind that the USD Index is a weighted average of various USD-linked currency rates and the EURUSD pair has the weight of over 50%). Investors were getting out of the euro and some of them were buying U.S. dollars and some of them were buying gold – hence both assets went up.

Now, the USD Index moved much higher yesterday, but gold didn’t move much, which could mean that gold actually did not show strength by holding up well in spite of the USD’s rally, but that it showed weakness by not rallying more given the declining value of the euro.

Overall, we think the implications for gold are bearish at this time for the short term. Naturally, the European QE is a bullish piece of news for gold in the medium- and long term.

Please note that since gold was not driven by weakness in the USD Index, but by the European QE announcement, it doesn’t have to be the case that if the USD index corrects, gold will rally. It could be the case that the USD Index will move above 96 and correct, but gold won’t rally at that time, but rather correct as well.

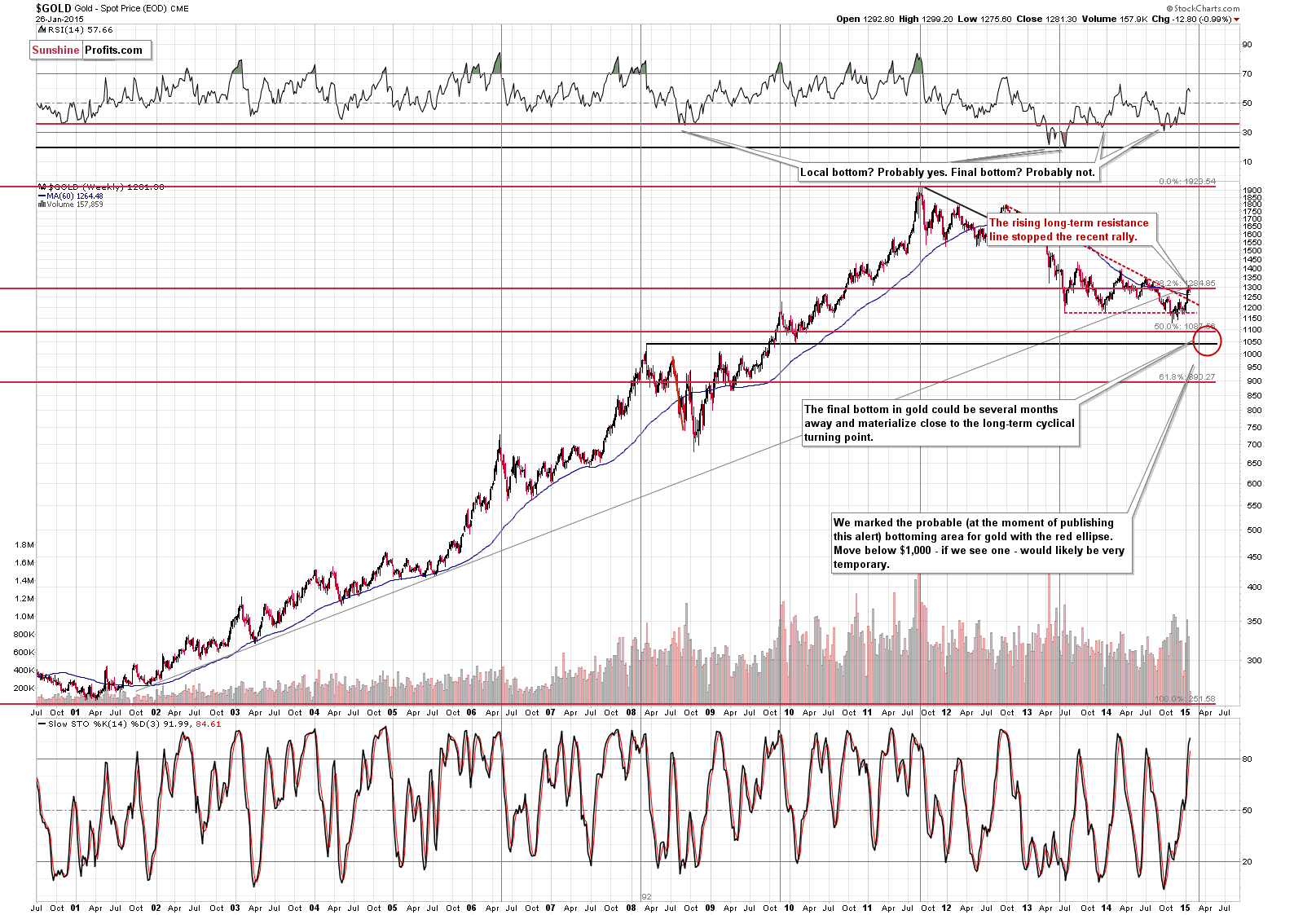

Gold is back below the rising long-term resistance line and the 38.2% Fibonacci retracement based on the entire 2001 – 2011 rally. The previous breakouts were invalidated and the outlook is bearish.

Gold could be on its way to form the final bottom close to the long-term cyclical turning point.

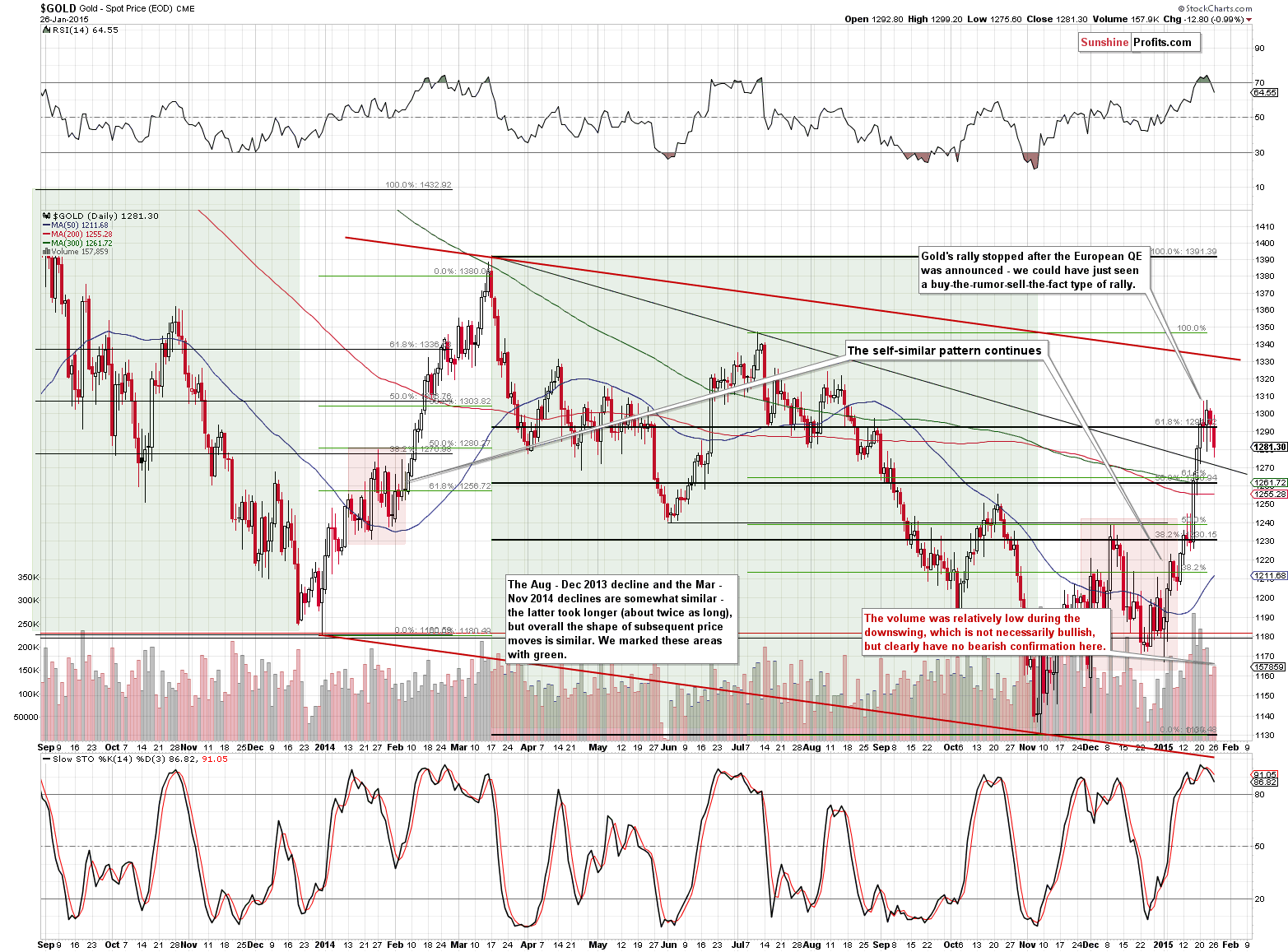

Our previous comments remain mostly up-to-date:

We finally saw some strength in gold, which might seem encouraging until you recall what caused the move. The move was “supposed to” be bigger given the announcement. The size of the move is something that looks like it’s about to be erased and the breakout seems likely to be invalidated. At this time we think that 2 additional daily closes would be required above the 61.8% Fibonacci retracement until we can say that the breakout is confirmed and that higher prices are likely.

Gold is already lower and back below the 61.8% Fibonacci retracement. The invalidation is a bearish signal on its own and is quite likely to lead to further declines. The short positions in the precious metals sector that we opened based on Thursday’s closing prices (gold closed at $1,302 on Thursday; the alert was sent/posted before the markets opened on Friday) are already profitable.

Will gold fall further? If we see a close back below the declining support line (based on the March and July 2014 highs) it will be a sign that we will see further declines without an additional move higher before that. At this time, the situation is not extremely bearish for the short term. Please note that gold declined on relatively low volume, which means that we don’t have a bearish confirmation here.

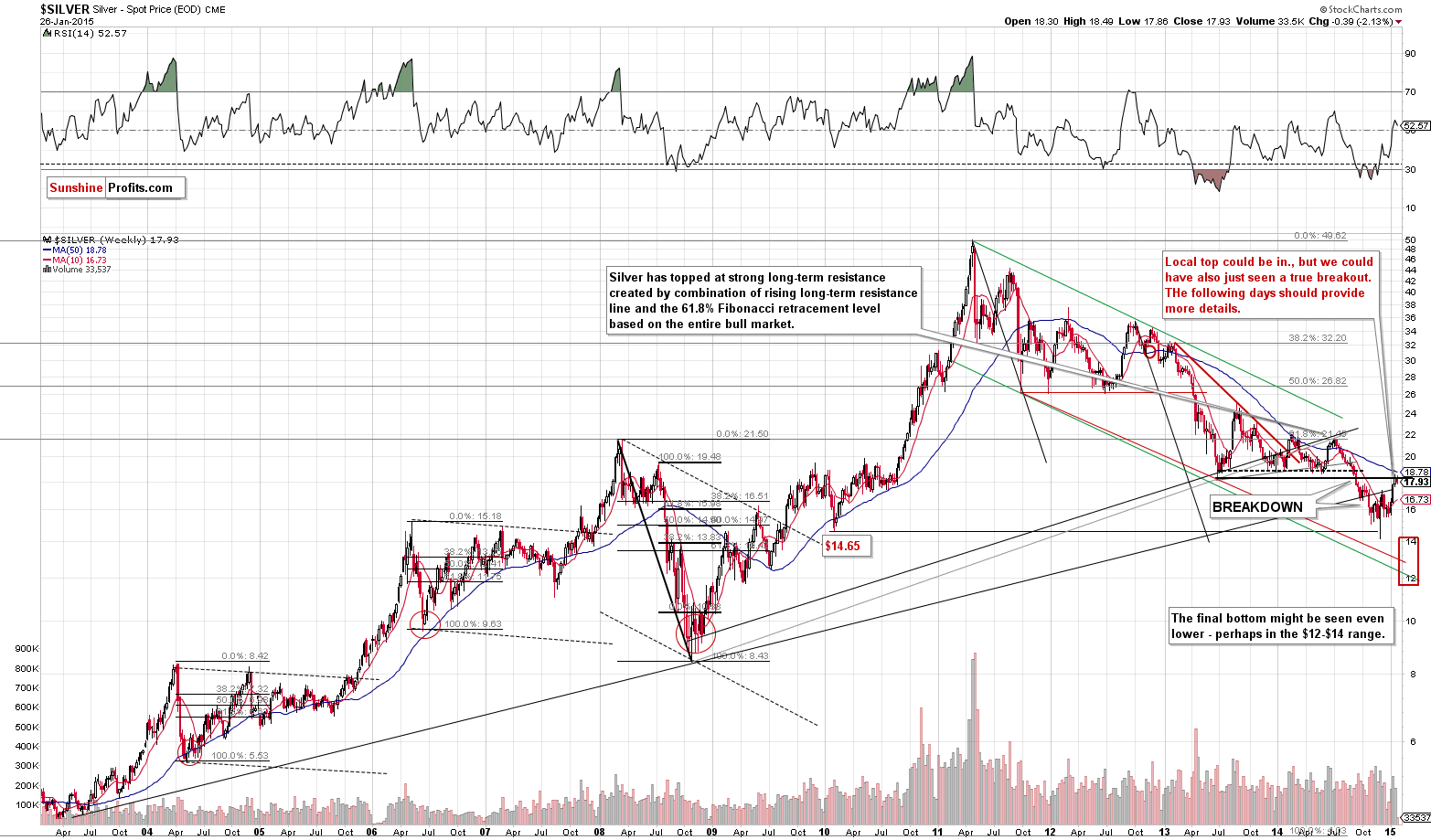

Our yesterday’s comments on silver remain up-to-date:

We have just seen an invalidation of the breakout as silver moved visibly back below the 2013 low. We wrote about silver’s “ability” to “break out” before declining once again multiple times in the past so those who have been following our analysis for some time should not be surprised by this invalidation. The implications are bearish.

The white metal closed visibly below the 2013 low so the outlook is bearish.

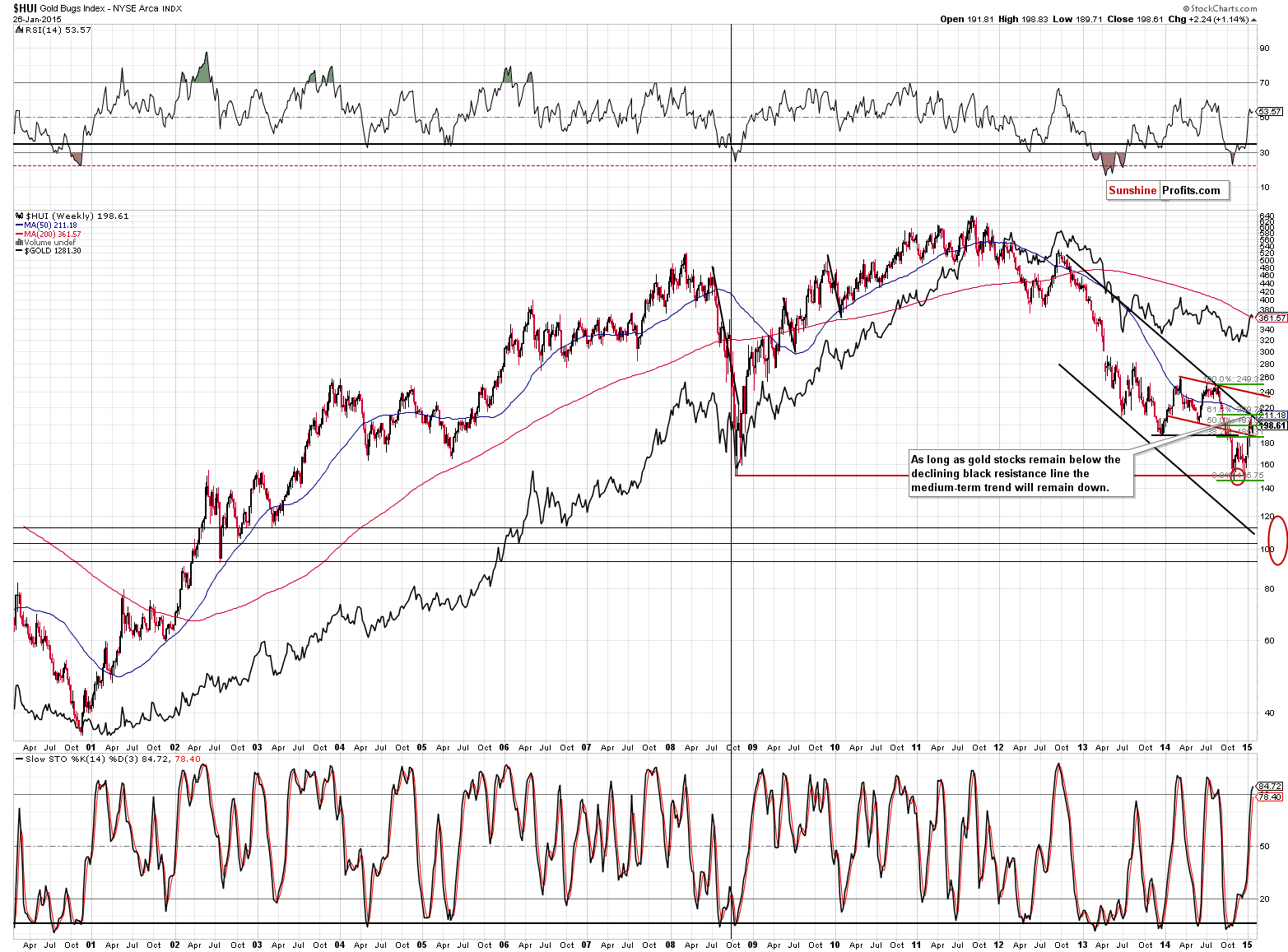

Gold stocks showed some strength yesterday, but there was no breakout above the key resistance line.

Without a breakout, our previous comments still remain up-to-date:

The 3 important resistance levels intersect close to the 210 level: the 61.8% Fibonacci retracement, the 50-week moving average, and – most importantly – the declining long-term resistance line. If gold stocks manage to break and confirm the breakout above this level, it might serve as a confirmation that another major upswing is underway. For now, the current rally looks similar to the corrections that we saw in July 2013, in late-2013 to early-2014, and in June 2014.

This resistance (combination of resistances) was reached (…). The HUI Index is either about to break out or about to decline once again. Since there has been no breakout so far, the odds are that it will decline once again.

We already saw a decline yesterday (which was more visible than the one seen in gold), so we have a small indication that we’ll see another decline shortly. To be honest, that’s not a strong indication. Since gold stocks reached a strong resistance after a visible rally, then a pullback is to be expected and is not necessarily a sign of big weakness. It is more bearish than not, though.

Yesterday, gold stocks had a good reason to rally (Euro-QE announcement) but they didn’t – they declined. Consequently, it seems that the decline was indeed indicating weakness in the precious metals market.

As soon as the HUI Index moves back below its 2013 low and this move is confirmed, it will make further – significant – declines much more likely.

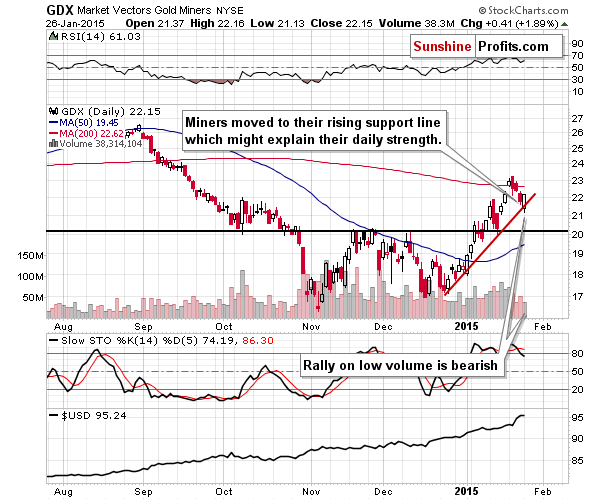

What about yesterday’s strength?

Mining stocks had a good technical reason to rally – they reached their rising support line. Consequently, the rally is not an unexpected or important development – it’s a way that one could expect a decline to take place – to see pauses when support levels are reached. The important thing here is that the miners’ “strength” is not really bullish, because yesterday’s rally took place on low volume. This is a bearish sign for the short term.

Overall, the situation didn’t change yesterday and we can summarize it in the same way as we did yesterday:

Summing up, based on the announcement of the QE program in the Eurozone, the situation in the precious metals market improved for the medium and long term, but based on the gold’s, silver’s and – most importantly – mining stocks’ reaction, the outlook deteriorated for the short term. Today’s bearish action in the precious metals confirms the above.

It seems that keeping the short positions in the precious metals is justified from the risk/reward perspective at this time as the profits on them are likely (in our opinion) to become even bigger. The trade is risky, so we are still using a limited amount of capital. We will likely increase it if we see additional bearish confirmations in the coming days.

We will be re-evaluating these positions on a daily basis and if we think that the situation no longer justifies keeping small short positions, we’ll let you know. As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (our opinion): Short positions (half) in gold, silver and mining stocks with the following stop-loss orders and initial (!) target prices:

- Gold: initial target level: $1,245; stop-loss: $1,318, initial target level for the DGLD ETN: $64.60 ; stop loss for the DGLD ETN $55.00

- Silver: initial target level: $16.73 ; stop-loss: $18.63, initial target level for the DSLV ETN: $55.63 ; stop loss for DSLV ETN $41.94

- Mining stocks (price levels for the GDX ETN): initial target level: $20.40 ; stop-loss: $24.23, initial target level for the DUST ETN: $15.55 ; stop loss for the DUST ETN $9.28

In case one wants to bet on lower junior mining stocks' prices, here are the stop-loss details and initial target prices:

- GDXJ: initial target level: $25.43 ; stop-loss: $32.17

- JDST: initial target level: $10.50 ; stop-loss: $5.19

Long-term capital (our opinion): Half positions in gold, half positions in silver, half position in platinum and half position in mining stocks.

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The falling commodity prices may be the canary in the coalmine. The gold is not like other commodities; however, its behavior depends strongly on the U.S. dollar. What are the prospects for the greenback? Will the current cycle of Fed’s relative tightening (compared to BoJ and ECB) and the unwinding of the emerging markets carry trade lead to the next Asian crisis? Should we expect another Russian crisis? What would such scenarios mean for the gold market?

What Would an Emerging Markets Crisis Mean for the U.S. Dollar and Gold?

=====

Hand-picked precious-metals-related links:

Goldman Sachs expects gold prices to rise in near term

Barclays: Gold rally to burn out

German Probe Finds No Signs of Manipulation in Gold Market

Netherlands Increases Gold Holdings for First Time Since ’98

Gold exposure is rising fast – too fast?

Money still pouring into gold ETFs

=====

In other news:

ECB's Bond Purchases Will Bring U.S. Closer to Raising Rates

Exclusive: EU aims to complete capital markets union by 2019 - document

Greece's Crazy Leftists Have a Good Idea

Is the dollar a ticking time bomb?

UK economy slows as Europe's 'dark clouds' gather

Russia announces anti-crisis plan after rating downgrade

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts