Briefly: In our opinion speculative short positions (half) in gold, silver, and mining stocks are justified from the risk/reward perspective.

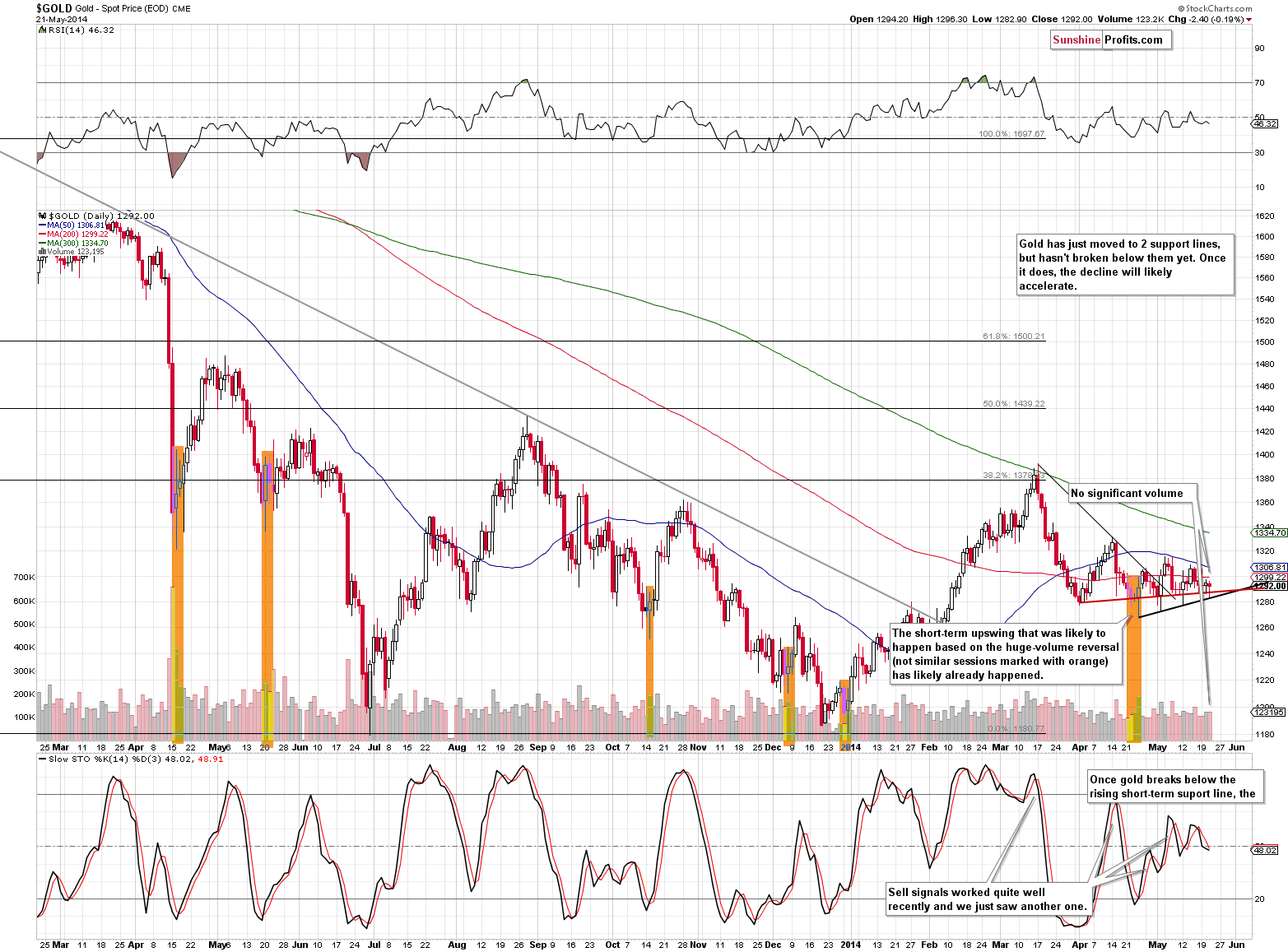

The history repeats itself and we have just seen another example confirming this statement. Gold once again moved higher initially but failed to hold its gains even until the end of the session. This made yesterday’s session very similar to May 19. The intra-day high was once again lower. Before discussing this situation, let’s take a look at the USD Index (charts courtesy of http://stockcharts.com.)

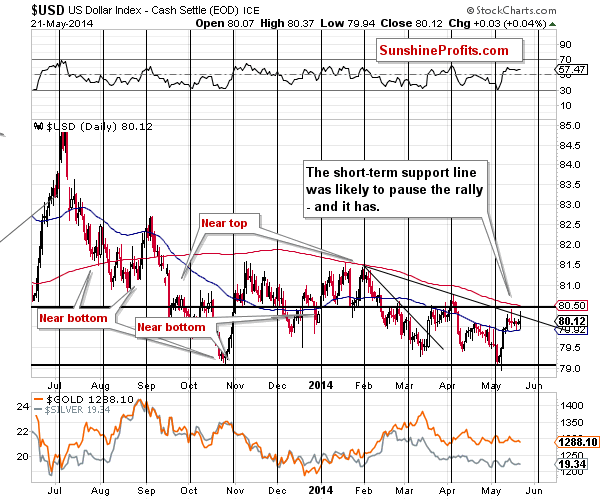

The USD Index moved a bit higher yesterday, which made the situation more bullish – that was a first daily close above the declining resistance line. We don’t think that this move makes the breakout confirmed yet – we’ll wait for 2 more consecutive closes above this line before saying that. However, it’s some kind of improvement and the implications for the precious metals market are a bit more bearish. They will likely be much more bearish once the breakout in the USD is confirmed.

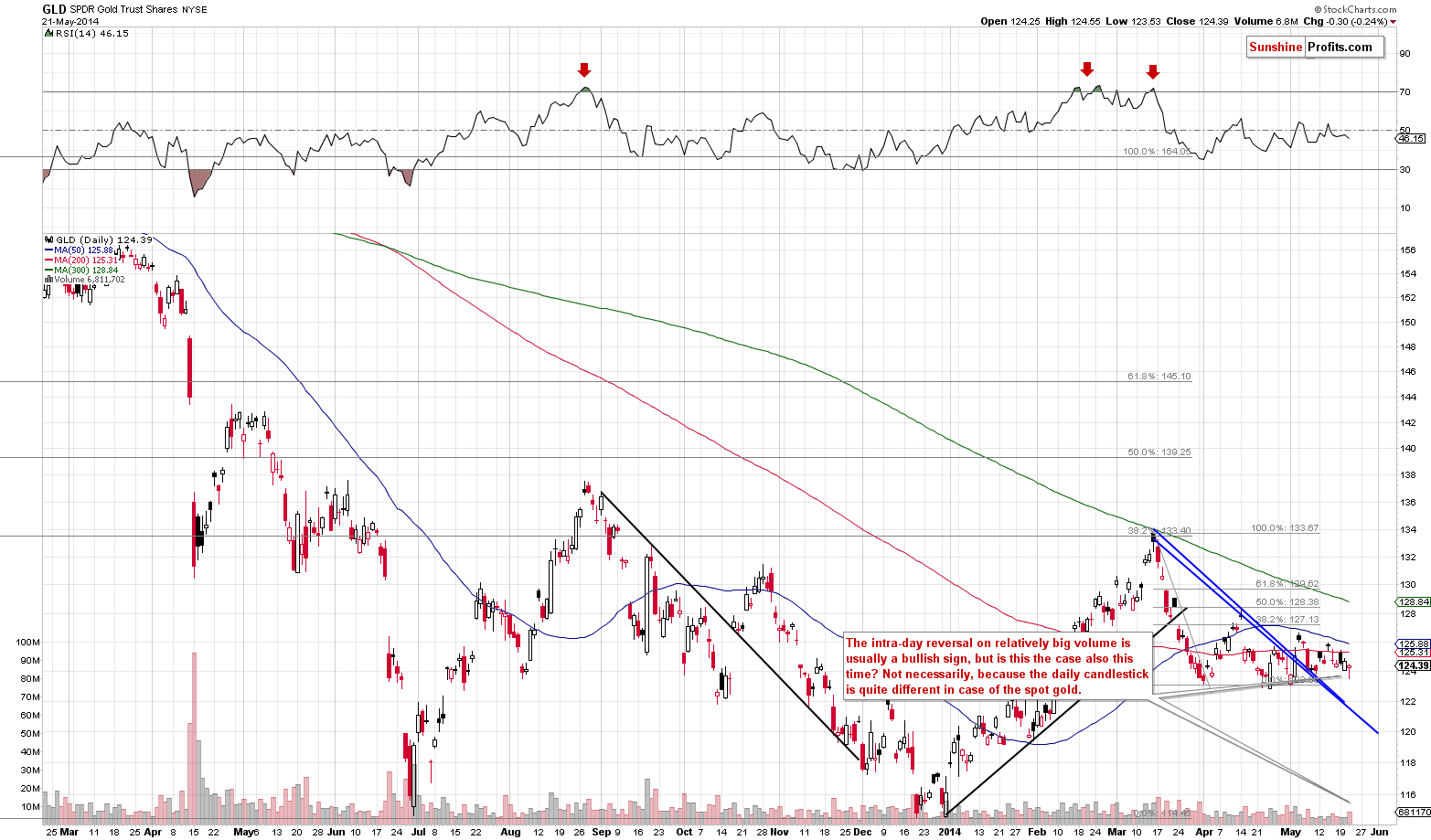

Yesterday we wrote that the intra-day reversal that had taken place on relatively big volume was much less significant than it appeared at the first sight because it was not confirmed by spot gold and because gold was simply reflecting the U.S. dollar’s movement. We wrote that the strength that we could see here would likely be temporary. It turned out that the rally that this reversal generated was indeed very small and temporary.

We saw another lower intra-day high in gold, and the move higher materialized on low volume. We’re once again seeing this bearish combination. If the USD Index confirms its breakout, gold might finally break below the short-term support.

How far can it go initially? Our best guess at this particular moment (this might change as the situation develops) is the $1,200 level or close to it. One of the ways to estimate the size of a given move is to assume that the move following the consolidation (which we’ve been seeing since the beginning of April) will be similar to the one preceding it. In this case, the move following the breakdown could be similar to the March decline, and such a move would take gold close to the $1,200 level. This level is very close to the 2013 lows, so we expect gold to pause there (but not to end the decline).

There’s one more sign that suggests that we may not have to wait much longer for the next move lower.

Silver’s cyclical turning point is just around the corner and the most recent short-term move was up thanks to Thursday’s rally. Consequently, reversing direction means a decline in this case. The turning points work on a near-to basis, so we can expect the next move lower in the following days (even if it doesn’t happen right away).

Summing up, the outlook for gold, silver, and mining stocks remains bearish, but not extremely bearish, which means that we don’t increase the size of the short position just yet. Precious metals are not responding strongly to the dollar’s rallies so far, but it seems that investors and traders are simply waiting for a confirmation of the breakout in the USD Index (there have been cases when the metals’ reaction was delayed in the past). Plus, silver’s strong performance and the lack thereof in the case of mining stocks, plus lower highs in gold and mining stocks, are a bearish combination.

To summarize:

Trading capital (our opinion): Short positions (half) in: gold, silver, and mining stocks with the following stop-loss orders:

- Gold: $1,326

- Silver: $20.30

- GDX ETF: $25.20

Long-term capital: No positions.

Insurance capital: Full position.

Please note that a full speculative position doesn’t mean using all of the speculative capital for this trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts