The end of the year is the best time for an annual summary. How was 2016 for gold?

We will provide a detailed analysis in the January edition of the Market Overview, but let’s outline the most important points describing the gold market in 2016.

- Gold gained more than 6 percent year-over-year. It’s a much better outcome than last year, when the bullion lost 12 percent.

- However, gold’s performance has been rather disappointed for many investors. And rightly so. The yellow metal missed a lot of opportunities to rally. Or maybe investors wrongly believed in many doom-and-gloom scenarios about the world after Brexit or Trump’s victory in the U.S. presidential election?

- Generally speaking, there were two significant rallies this year: the first was at the beginning of 2016 due to fears about the global economy triggered by China’s stock market turmoil and the consequences of negative interest rates; the second happened in July/July due to worries about the Brexit vote. Eventually, China’s slowdown, NIRP, the British referendum and the U.S. presidential election did not lead to the end of the world. The U.S. economy has been surprisingly resilient, which was probably the biggest headwind for the gold market in 2016.

- These rallies clearly proved that gold is a safe-haven asset. This is good news for gold bulls. But the bad conclusion is that 2016 also showed that gold works as a safe haven only for a limited time, as we pointed out in our article about gold as a safe-haven asset, and rather quickly runs out of steam without new threats.

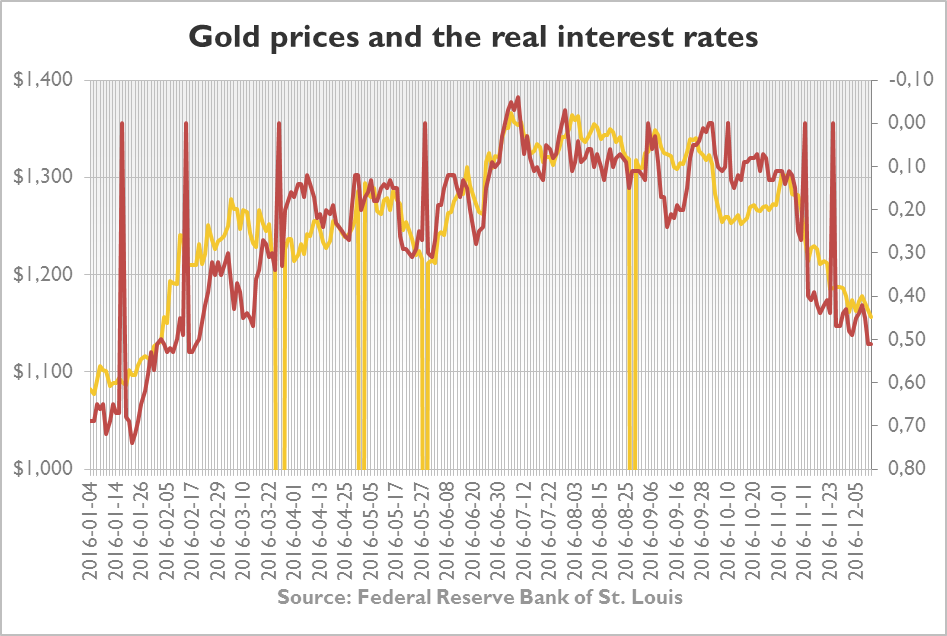

- This is an important hint for long-term gold investors. Just focus on the U.S. dollar’s behavior and the dynamics of real interest rates (we mean fundamental factors here, the technical situation is, of course, also very important in gold investing). 2016 was another year of significant negative correlation between gold and the greenback or between gold and real interest rates. Let’s see the chart below showing the strong link between the price of gold and real U.S. 10-year Treasury yields (values are inverted to better present the correlation).

Chart 1: Price of gold (yellow line, left axis, London P.M. Fix) and U.S. real interest rates (red line, right axis, yields on 10-year Treasury Inflation-Indexed Security, values inverted) in 2016.

- We cannot provide the appropriate chart, but gold prices were also importantly related to the market odds of Fed hikes in the near future. Therefore, gold investors – like it or not – should carefully watch the U.S. monetary policy and its impact on the market sentiment towards precious metals.

- The key takeaway is that 2016 was a fascinating year for the gold market. Inquiring minds could learn a lot in that time, as we did from the correspondence with our readers. Now, let’s left the past behind us and focus on the future. Tomorrow we will provide our predictions for 2017. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview