Yesterday, there was a massive U.S. economic data dump. What does the release of several reports imply for the gold market?

Thursday’s morning was full of U.S. economic reports. First of all, personal consumption expenditures increased 0.2 percent last month after a revised 0.4 percent jump in October, according to the Bureau of Economic Analysis. The move was slightly below expectations due to stagnation in incomes. Indeed, personal incomes were flat in November, following a revised 0.5 increase in previous month. Importantly, there was a 0.1 percent decrease in wages and salaries in November.

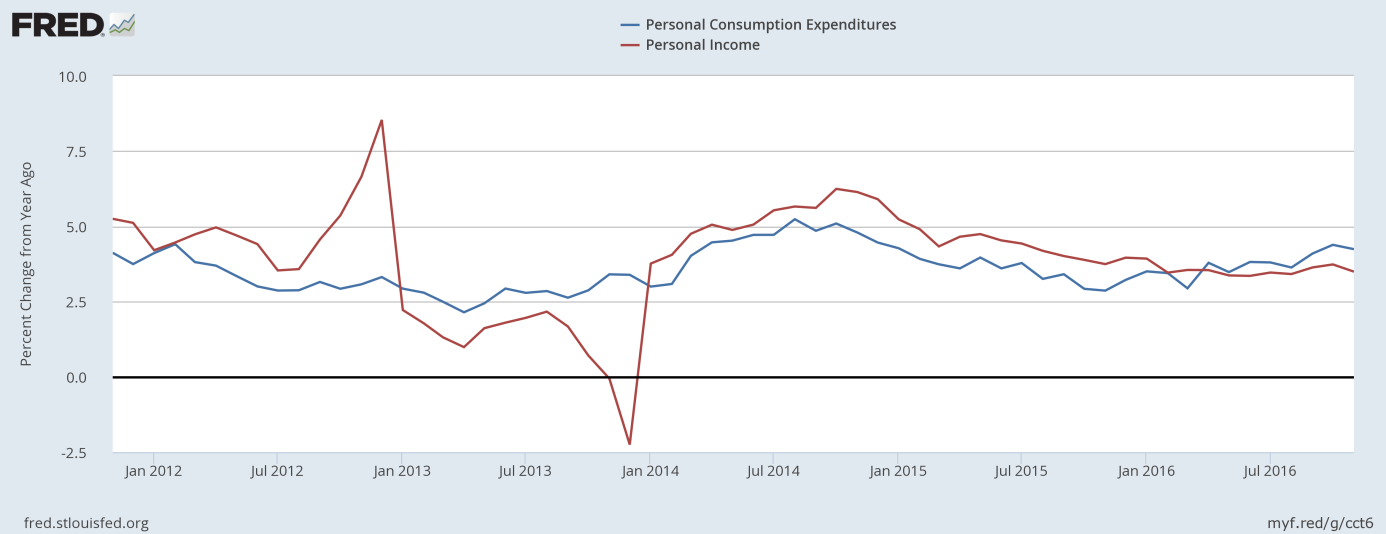

The increase in personal outlays was driven by a 0.3 percent jump in spending for services, which offset a 0.6 percent drop in spending for durables. On an annual basis, consumer spending rose 4.24 percent. As one can see in the chart below, consumer spending has slightly slowed down in November after a strong third quarter, reflecting probably the slowdown in the personal incomes, which increased 3.5 percent year-on-year, following 3.7 percent increase in previous month. Such slowdown should be positive for the gold market, as it casts doubts about the acceleration of the U.S. economy. However, one month of relative weakness after a few rather strong months is not very disturbing.

Chart 1: Personal consumption expenditures from 2011 to 2016 (as percent change from year ago).

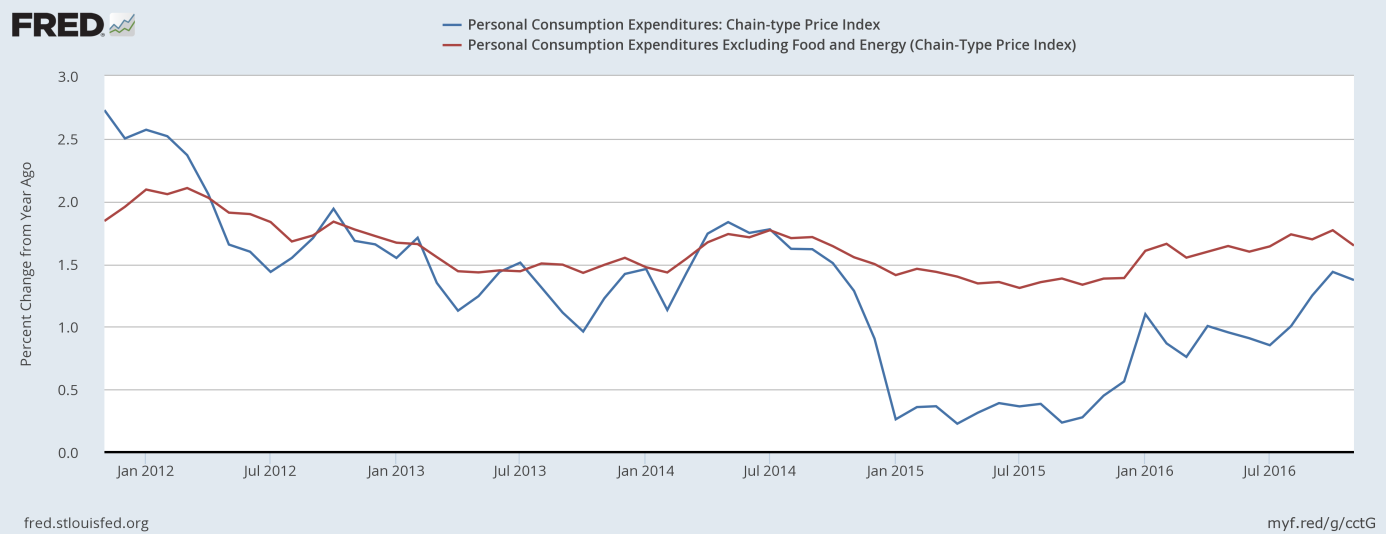

Second, the inflation pressure weakened in November, as one can see in the chart below. Both the PCE price index and the core PCE price index were unchanged last month, after a 0.3 and 0.1 percent increase in October, respectively. On an annual basis, the PCE price index jumped 1.37 percent, which means the slight slowdown from a 1.44 percent increase in October. The core index excluding food and energy prices rose 1.65, following a 1.77 jump in the previous month. Therefore, the inflation rate moved away from the Fed’s 2-percent target. It should be good news for the gold market, as lower inflation should restrain the U.S. central bank from adopting more aggressive stance.

Chart 2: PCE Price Index (blue line) and Core PCE Price Index (red line) as percent change from year ago, from 2011 to 2016.

Third, other pieces of economic data released yesterday were rather negative, with one exception. Although the U.S. GDP growth in the third quarter was revised up from 3.2 percent to 3.5 percent, the GDPNow model forecast for the economic growth in the fourth quarter – which is much more important than past growth, especially that the growth in the third quarter was supported by a temporary boom in the exports of soybean – was cut from 2.6 to 2.5 percent. Moreover, the orders for durable goods fell 4.6 percent in November, following a 4.8 percent jump in the previous month (however, the details of this report are better than the headline). Additionally, the Chicago Fed national activity index dropped to -0.27 in November, from an upwardly revised -0.05 in the previous month, while the Conference Board’s Leading Economic Index was flat in November, signaling that the U.S. economy may not accelerate in the first half of 2017, despite markets’ expectations.

The bottom line is that the recent bunch of U.S. economic data paints a slightly disappointing picture, on balance. We mean ‘disappointing’ relative to expectations, since the U.S. economy will continue expanding, but the acceleration is unlikely. Actually, there may be a slowdown in the fourth quarter of 2016 when compared to the previous quarter. This should be positive news for the gold market, as the current bearish trend is partially caused by the euphoria in the financial markets which expect the acceleration in economic growth during the Trump’s presidency. It may happen, of course, however Trump is yet to take office. And given the level of optimism in the markets, he could fall short of expectations quite easily, which would be positive news for the gold market. Until then, the outlook for gold looks rather bearish, especially that the price of the yellow metal did not manage to rally in a sustainable way after today’s weak economic data.

Merry Christmas!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview