The U.S. yield curve has steepened since the presidential election. What does it mean for the gold market?

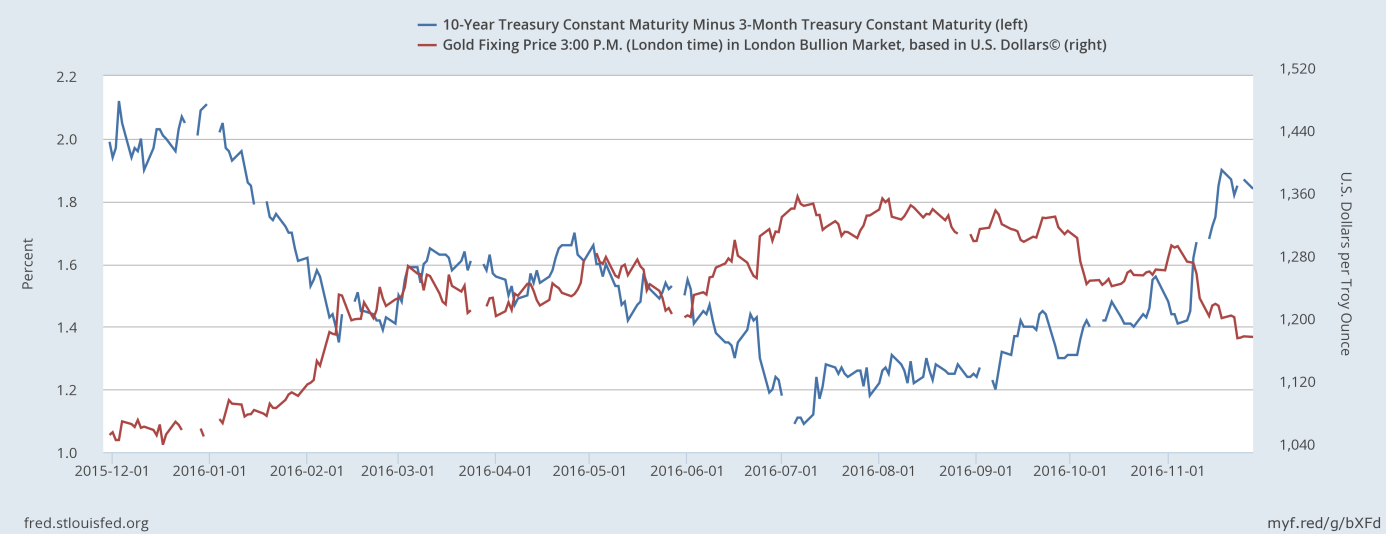

As one can see in the chart below, the difference between short-term and long-term U.S. Treasury yields jumped after the U.S. presidential election. The spread between the 10-year Treasury bond yield and the 3-month Treasury bill yield rose from 1.41 before the election to above 1.80 at the end of November. The chart also shows the negative correlation between the price of gold and the term premium. Indeed, the price of gold declined in that period.

Chart 1: The spread between the 10-year Treasury bond yield and the 3-month Treasury bill yield (blue line, left axis), and the price of gold (red line, right axis, London P.M. Fix) over the last 12 months.

Why was the steepening of the yield curve a headwind for gold? Well, a steeper yield curve usually signals an improving outlook on economic growth and the prospect of rising inflation. Inflation expectations increased but long-term rates climbed even faster, which was definitely negative for the gold market. In other words, the election outcome raised the prospects of fiscal stimulus, which lowered the odds of a protracted deflationary slump. Hence, the steepened yield curve is another bearish fundamental factor for the gold market – along with the appreciation of the U.S. dollar and rising real interest rates. The shiny metal may thus remain under downward pressure in December. GDP growth projected for the fourth quarter of 2016 by the Atlanta Fed GDPNow model is now 3.6 percent, while the market odds of the Fed hike at the next meeting remain above 90 percent. Yesterday, Fed Governor Jerome Powell said that in his view: “(...) the case for an increase in the federal funds rate has clearly strengthened since our previous meeting earlier this month”.

The key takeaway is that the U.S. yield curve has steepened since the presidential election. It is a negative development for the gold market as a steeper yield curve often indicates economic strength (or more optimistic expectations about future growth), which should be bad for safe-haven assets such as gold. Moreover, expectations of improving economic growth imply higher odds of a Fed hike in December, which puts the shiny metal under downward pressure.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview