Last week, the minutes of the Federal Reserve’s November meeting were released. What do they say about the Fed’s stance and what do they mean for the gold market?

Fed Hike Is Coming

The main message of the recent minutes is that the hike is coming. Why do we believe so? Well, the FOMC members were quite explicit on that matter. Perhaps the key passage is as follows:

Members generally agreed that the case for an increase in the policy rate had continued to strengthen.

And the second most important paragraph:

Most participants expressed a view that it could well become appropriate to raise the target range for the federal funds rate relatively soon, so long as incoming data provided some further evidence of continued progress toward the Committee's objectives.

Surely, the central bankers did not define what ‘relatively soon’ means, but we bet December. Why? There are a few reasons. One of them is credibility. Some participants pointed that that an increase “should occur at the next meeting” to preserve credibility. We totally agree with that. The Fed officials have been talking about the next hike since December 2015. They must deliver it. Otherwise, they risk financial turmoil.

Indeed, the market odds of the interest rate rise in the last month of the year are at 93.5 percent. In other words, investors are nearly certain that the Fed will hike at the next meeting. If the probability were lower, let’s say about 50 percent, the central bank could postpone the upward move, but not at current odds. You see, an interest rate raise has already occurred in a sense. We mean here, of course, the fact that long-term interest rates have risen after the U.S. presidential election. Bond markets have already decided about the hike, the Fed must now simply adjust its interest rates. In other words, with higher real interest rates, the current level of the federal funds rate is too accommodative.

Inflation Is on the Horizon

Moreover, U.S. economic data is encouraging. The FOMC members noted that “the labor market had continued to strengthen and that growth of economic activity had picked up from the modest pace seen in the first half of this year”. And since the Fed’s last meeting on November 1-2, the U.S. economy has shown further improvement. Job gains and retail sales were solid, while the unemployment rate decreased below 5 percent. Durable-goods orders and housing starts surged in October.

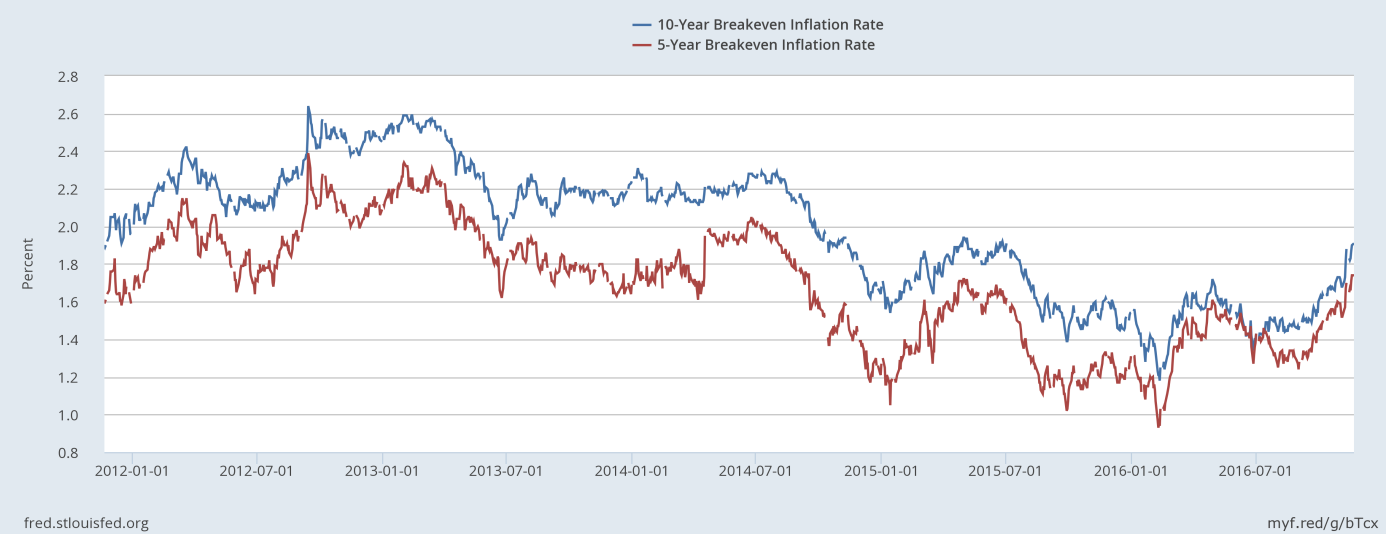

In particular, the rate of inflation increased. The core CPI jumped 2.1 percent, while the overall CPI rose 1.6 percent over the last 12 months, the largest increase since October 2014. And what is perhaps even more important: the market-based measures of inflation compensation have risen significantly since the presidential election. Actually, as the chart below shows, the expected inflation rates derived from inflation-indexed and standard Treasuries have been rising since September, but they jumped after Trump’s victory.

Chart 1: The expected inflation rate derived from 10-year Treasuries (blue line) and 5-year Treasuries (red line) over the last 5 years.

Why the rise in inflation expectations is so important? Well, they are always included into a wide range of information taken into account by the Fed during the assessment of economic conditions:

This assessment would take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Hence, the rise in inflation expectations should make the Fed more eager to hike. Indeed, as we can read in minutes:

Some participants regarded the uptick in market-based measures of inflation compensation over the intermeeting period as a welcome suggestion of further progress toward the Committee's inflation goal.

Therefore, after the recent surge in inflation and inflation expectations the Fed should be even more certain about the progress toward the Committee's 2 percent inflation objective.

Conclusions

We believe that the Fed will hike interest rates in December. The FOMC members have no excuses. They could try to say something about the volatility after the election, but the stock market has not collapsed after Trump’s victory. It surged, actually. Almost all of the Fed officials considered the near-term risks to the economic outlook as roughly balanced. And the U.S. economy has been improving since the last FOMC meeting, with a strengthening job market and rising inflation. The market interest rates have already risen and if the Fed does not keep pace with these increases, it will put its credibility at risk.

The conclusion is not good news for the gold market. However, with such high market odds, the Fed hike in December should be already priced in. Therefore, the impact of the move on the gold market should be limited. A lot depends on the message associated with the likely raise and whether the markets expect the next hike relatively soon or not.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview