Retail sales rose 0.8 percent in October. What does it mean for the gold market?

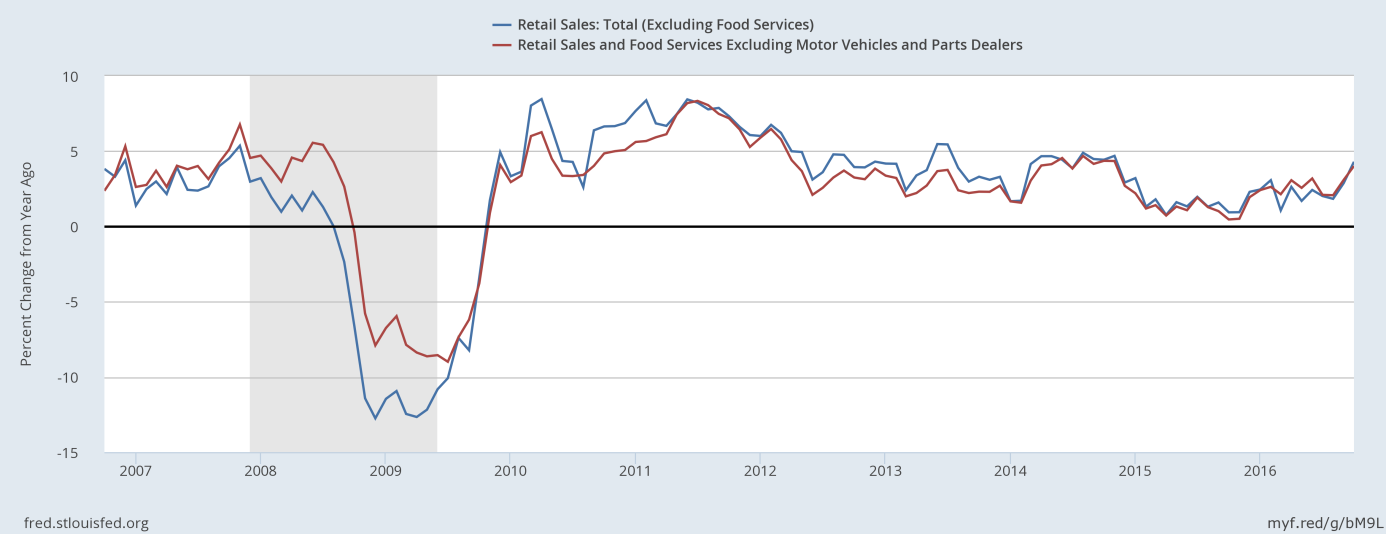

Let’s take a break from the presidential election and analyze the recent U.S. economic data. Sales at U.S. retailers increased 0.8 percent last month, according to the U.S. Department of Commerce. The rise followed the 1.0 percent increase in September (after a upward revision from 0.6 percent) and was bigger than expected. On an annual basis, retail sales rose 4.3 percent, while retail sales excluding motor vehicles jumped 4 percent. As one can see in the chart below, the annual pace of growth of retail sales accelerated this year and signals a good start in the fourth quarter.

Chart 1: Retail sales excluding food services (blue line) and retail and food services excluding motor vehicles and parts dealers (red line) as percent change from year ago, from October 2006 to October 2016.

Indeed, the GDPNow model forecast for real GDP growth for the fourth quarter of 2016 edged up from 3.1 percent to 3.3 percent after the release of the retail sales report. Therefore, the Fed interest rate hike in December is very likely. Actually, it is almost certain, as the market probability of such a move increased from 85.8 percent to 90.6 percent, according to the CME Group FedWatch. Thus, brace yourself, the hike is coming! In theory, it is not good news for the gold market, but the upward move could be already priced in. The price of gold actually rose yesterday, which may be a bullish sign after the terrible week.

When it comes to other data, the Empire State Index increased 8.3 points to 1.5 in November, turning positive for the first time in four months. And the cost of imported goods rose 0.5 percent last month. Although it may increase the attractiveness of gold as an inflation hedge, it would reaffirm the current narration of reflation, which seems to be negative for the yellow metal. Moreover, higher inflation should translate into a more hawkish Fed.

The take-home message is that retail sales rose 0.8 percent in October, signaling a positive fourth quarter for the U.S. economy. The Empire State Index turned into positive territory, while the import price index surged. All these pieces of data are not good for the gold market. However, gold prices shrug off positive U.S. data, holding on to positive gains, which may be a bullish signal (or a stabilization in the bonds markets simply outweighed other factors).

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview