The U.S. economy added 161,000 jobs in October. What does it imply for the Fed policy, presidential elections, and the gold market?

October Lower than Expected, but August and September Revised Upward

Total nonfarm payroll employment rose only by 161,000, according to the U.S. Bureau of Labor Statistics. Analysts expected 178,000 jobs created. Thus, the actual number was again disappointing. However, employment gains in August and September were revised upward and were 44,000 more than previously reported. It implies that job gains in the last three months have averaged 176,000. Job gains were again concentrated in professional and business services and health services. Manufacturing, mining and retail trade reduced jobs.

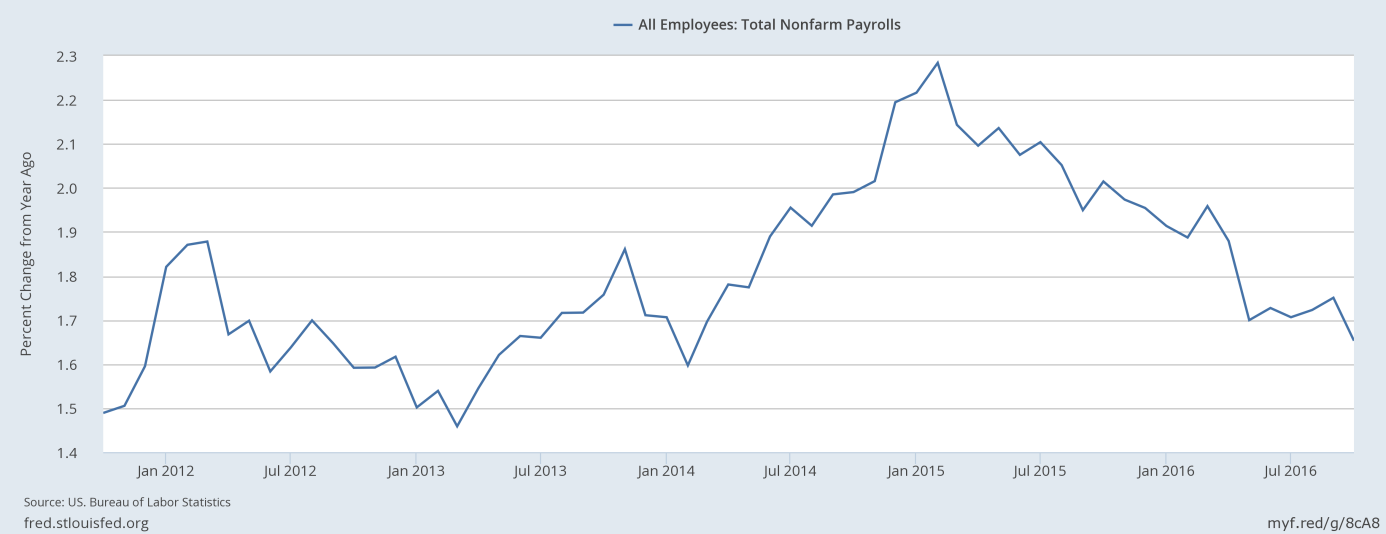

The report confirms earlier signs that the pace of hiring in the U.S. slowed down in the autumn after summer gains. The chart below shows that the last report is a continuation of a downward trend in job gains which started in February 2015. The annual pace of job gains declined to 1.65 percent in October from the previous month. Thus, job growth has averaged 181,000 per month so far this year, compared with an average of 229,000 per month in 2015.

Chart 1: Total nonfarm payrolls (percent change from year ago) over the last five years.

Other Labor Market Indicators

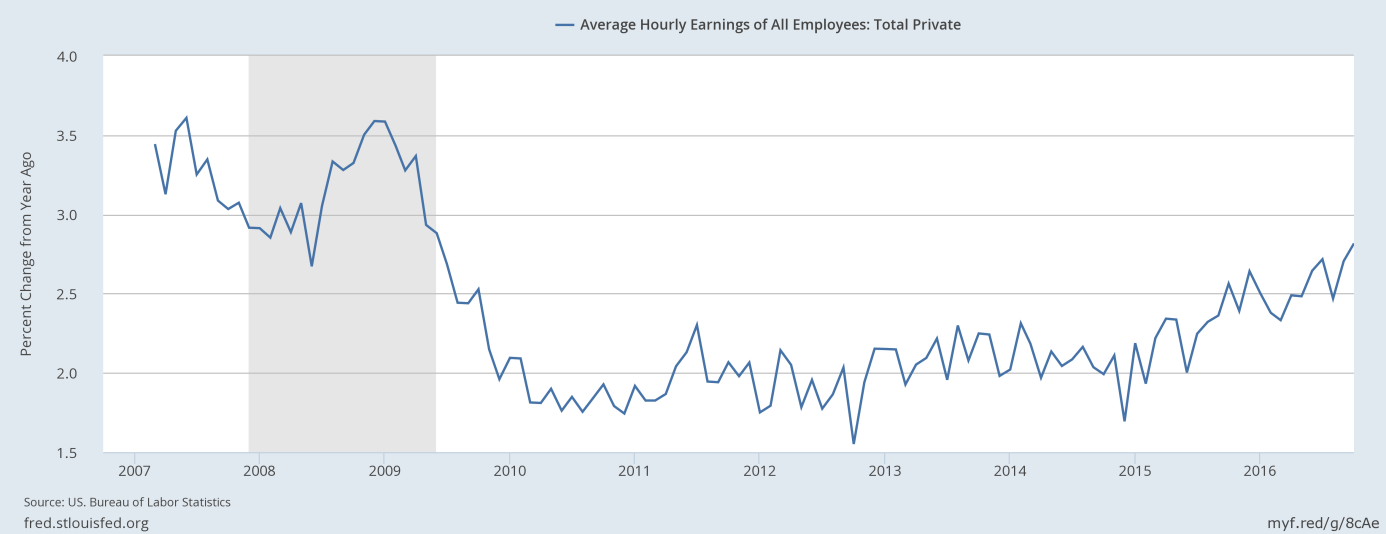

Other labor market indicators, with an exception of the average wage, were hardly changed. The unemployment rate edged down from 5 percent to 4.9 percent. The labor force participation rate decreased from 62.9 percent to 62.8 percent, while the employment-population ratio declined from 59.8 percent to 59.7 percent. The average workweek was unchanged, while the average wage in the private sector rose 10 cents to $25.92, following an 8-cent increase in September. On an annual basis, the hourly pay increased 2.8 percent, which reflects some upward wage pressure. The jump in wages should be welcomed by the FOMC members.

Gold Declined Initially, but Rose on Friday

On balance, the recent Employment Situation Report was positive. The job gains were below expectations, but the pace of hiring is solid enough to give the Fed further evidence justifying the interest rate hike in December. Moreover, the job gains for August and September were revised upward, the unemployment rate fell below 5 percent, while the average wage rose at the fastest pace since 2009, as one can see in the chart below.

Chart 2: Average hourly earnings of all employees in the private sector (as percent change from year ago) from 2006 to 2016.

Therefore, the latest job report should theoretically be negative for the gold market. It may prompt the Fed to adopt a more hawkish stance and strengthens the odds of Hillary Clinton against Donald Trump. Indeed, the report is the last piece of economic data that could affect the election – and the solid data should be positive for Clinton, as she is the candidate from the incumbent party.

Although the price of gold declined immediately after the release of the report, it quickly rebounded and even gained 1.8 percent in New York on Friday. It shows the current resilience of gold, which is supported by the uncertainty over the outcome of the presidential election. It seems that positive jobs data were simply overshadowed by the focus of the markets on the election. Right now, fear is high. Before the surprising Brexit vote, markets had not fully priced the negative scenario in. Investors do not want to repeat the same mistake before the election. It is positive for the gold market right now, however, after the election the uncertainty should ease a bit, especially if Clinton wins (unless the result is contested by Trump), which could lead to some correction in gold. Actually, gold retreated on Monday after the FBI cleared Clinton, which gave her a boost.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview