New orders for manufactured durable goods decreased 0.1 percent in September. What does it imply for the gold market?

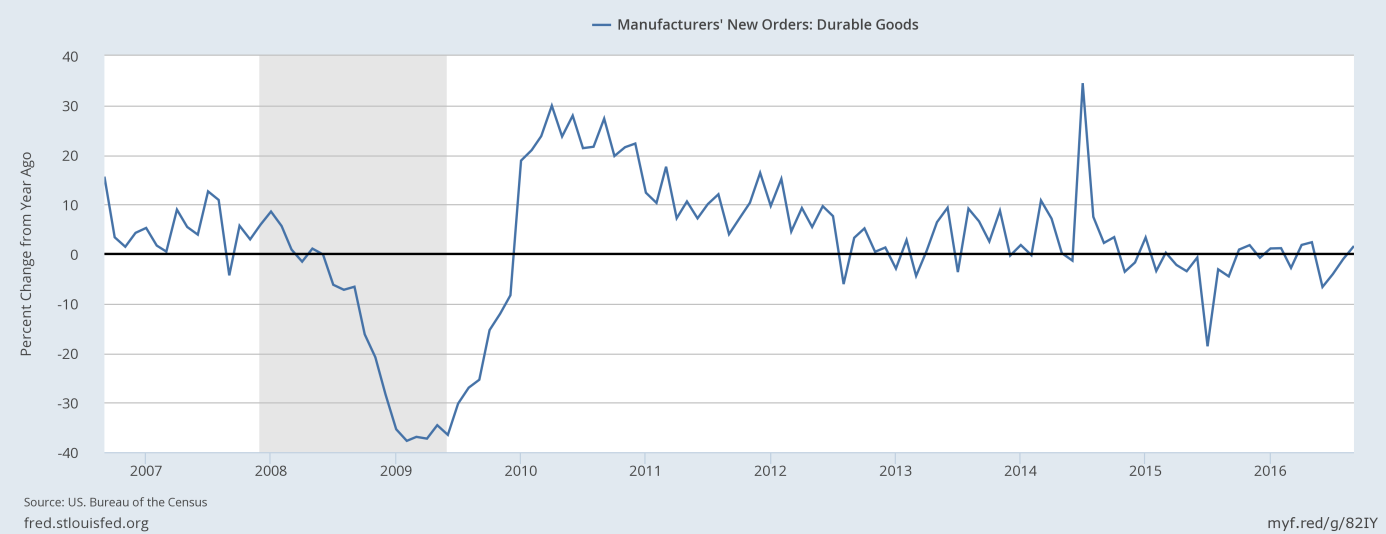

On Thursday, the U.S. Department of Commerce said that new orders for durable goods dropped 0.1 percent, following revised 0.3 percent increase in August. The decline was below the expectations – and it was the first decrease after two consecutive positive months. On an annual basis, new orders rose 1.6 percent in September, however the recent dynamics does not impress, as one can see in the chart below.

Chart 1: New orders for manufactured durable goods from September 2006 to September 2016.

The report was weak, but the decline was caused by a 45 percent plunge in military aircraft. Excluding defense, new orders increased 0.7 percent. However, orders for nondefense capital goods excluding aircraft (core capital goods), which are viewed as a key measure of business investment, fell 1.2 percent, the largest decline since February. It means that business spending – which has been responsible for sluggish economic growth this year – still remains disappointing.

Gold rose slightly yesterday, perhaps due to a weaker than expected reading in September durable goods numbers. However, it was not a negative enough surprise to significantly move markets. And other data from this week – such as pending home sales, new-home sales, Markit PMI – was rather positive (with the exception of consumer confidence which fell to three-month low). Generally speaking, the yellow metal showed this week an interesting resilience. It did not lose ground despite the appreciation of the U.S. dollar against the Japanese yen or the rise in market odds of at least one interest rate hike in December to almost 80 percent. Perhaps, the looming presidential election supports the price of gold, but we cannot exclude other factors, including technical situation. Next week, we will discuss the gold outlook in a more detailed week, when we will have the latest data about traders’ positions at Comex.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview