The U.S. economy added 156,000 jobs in September. What does it imply for the Fed policy and the gold market?

Second Weak Report in Row

Total nonfarm payroll employment rose only by 156,000, according to the U.S. Bureau of Labor Statistics. Analysts expected 168,000 jobs created. Thus, the actual number was a second disappointing payroll report in a row, after 167,000 revised job gains in August. Although the change for August was revised up from +151,000 to +167,000, employment gains in July and August combined were 7,000 less than previously reported, due to a downward revision for July from +275,000 to +252,000. It implies that job gains in the last three months have averaged 192,000. Job gains were concentrated in professional and business services and health services. Manufacturing, government and transportation and warehousing reduced jobs. Mining was neutral for job creation.

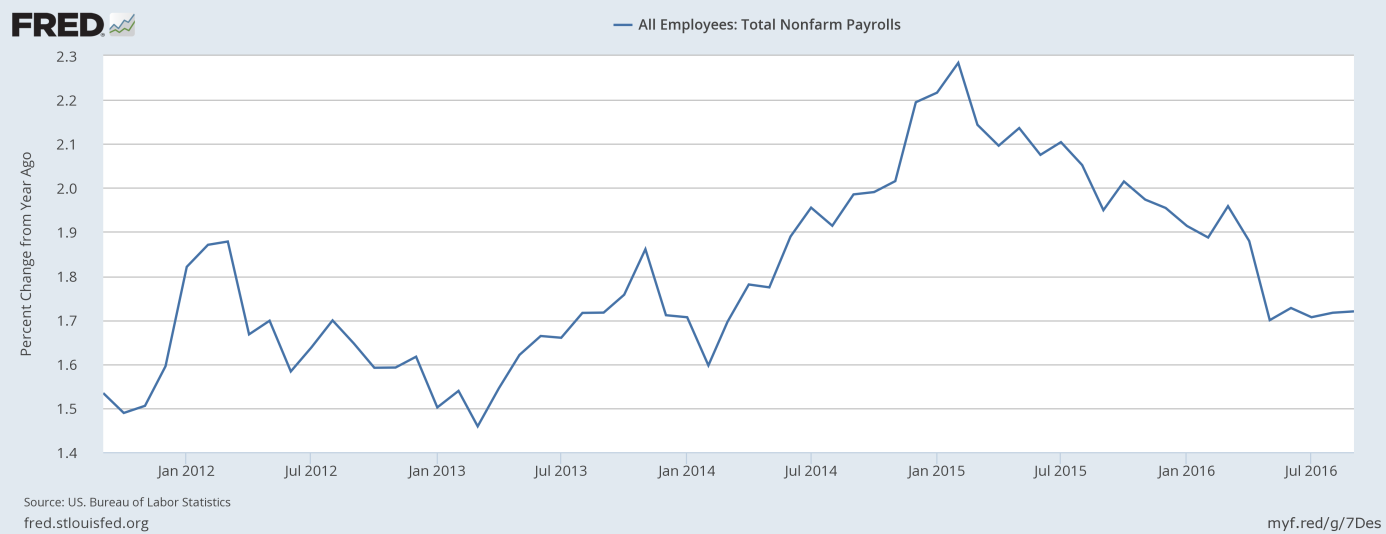

The report indicates that the pace of hiring in the U.S. slowed down in the autumn after huge gains earlier in the summer. The chart below shows that the last report is a continuation of a downward trend in job gains (on an annual basis) which started in February 2015. Thus far this year, job growth has averaged 178,000 per month, compared with an average of 229,000 per month in 2015.

Chart 1: Total nonfarm payrolls (percent change from year ago) over the last five years.

Other Labor Market Indicators

Other labor market indicators were hardly changed. The unemployment rate edged up from 4.9 percent to 5 percent. The labor force participation rate increased from 62.8 percent to 62.9 percent, while the employment-population ratio rose from 59.7 percent to 59.8 percent. The average workweek increased by 0.1 hour to 34.4 hours, while the average wage rose 6 cents to $25.79. On an annual basis, the hourly pay increased 2.6 percent, indicating some upward wage pressure. The jump in wages should be welcomed by the FOMC members, in contrast to a reduced workweek.

Gold Rose Initially, but Fell Afterwards

The disappointing payrolls should theoretically be positive for the gold market. It was a second weak report in a row, which may prompt the Fed to adopt a more dovish stance. Indeed, the price of the shiny metal jumped around $10 to $1,265 after the release of the employment report. However, it declined afterwards, and managed to gain only $2.40 on Friday.

What could have been the direct reason behind gold’s anemic reaction to the disappointing payrolls (besides a weak technical picture that’s been pointing to lower gold prices for weeks)? The probable answer is that Stanley Fischer, the Fed’s Vice Chairman, gave a hawkish speech after the release of the Employment Situation Report. He basically shrugged off a weak report:

“Recent reports pertaining to the labor market, including Friday's release, have been solid, showing continued improvement. So far this year, payrolls are reported to have increased by 180,000 per month. That is down from last year's gains of 230,000 per month but well above what is needed to provide jobs for new entrants into the labor force (…) All told, with the unemployment rate not far from levels that most Federal Open Market Committee (FOMC) participants view as normal in the longer run and the rise in the participation rate, I see the U.S. economy as close to full employment, with some further improvement expected.”

Therefore, although job gains were below expectations, they were large enough to please the FOMC members and keep them on course to hike interest rates in December. It is definitely bad news for the yellow metal, which had an awful week. However, the increasing likelihood of a December rate hike has likely run its course by now. Therefore, other factors may have bigger impact on short-term price swings in the price of the yellow metal.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview