Yesterday, the price of gold plunged below $1,300. What does it mean for the gold market?

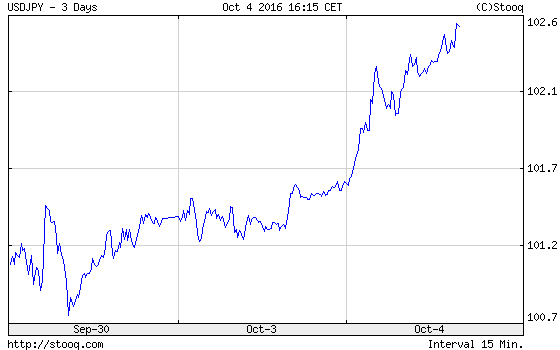

Gold prices slid almost 3 percent to about $1,270 on Tuesday, the lowest level since June. What caused this decline? Well, probably the rebound in the U.S. dollar after upbeat U.S. data sent gold prices lower. The greenback jumped about 1 percent against the Japanese yen, as one can see in the chart below.

Chart 1: The USD/JPY exchange rate from September 30 to October 4.

U.S. manufacturing data was likely the trigger for that jump. As we reported yesterday, the ISM Manufacturing Index rose to 51.5 percent in September after falling into negative territory in the previous month. What was crucial was that the reading beat analysts’ expectations of 50.2 percent. Moreover, the index for new orders increased 6 percentage points to a solid 55.1 percent. Although other data – like U.S. auto sales or U.S. construction spending – were rather soft, investors raised their expectations that the Fed would hike interest rates by the end of the year. The market odds of a December hike increased from 61.7 percent to 63.4 percent.

It’s a bit of an odd situation given the fact that after the release of the construction spending report the GDPNow model forecast of real GDP growth for the third quarter of 2016 declined from 2.4 percent to 2.2 percent. So the forecasts for economic growth are declining while the odds of a rate hike are actually rising. It’s strange, isn’t? It seems that the markets wanted to move the way they did and they just needed an excuse. And when the sell stops were triggered, the sell-off in gold accelerated. The hawkish comments from Richmond Fed President Jeffrey Lacker also could put gold under downward pressure, as he said that there was a strong case for raising interest rates.

To sum up, the price of gold plunged to about $1,285 on a stronger U.S. dollar and triggered sell stops. The decline is very interesting as the forecasts for economic growth actually declined. It implies negative sentiment in the gold market, as the price of the yellow metal fails to rise on positive data, but falls on negative news. On the other hand, markets may now be slightly too optimistic regarding the Fed hike, given the deterioration of the economic outlook. We shall see, now all eyes are on Friday’s payrolls data. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview