Last week, interesting pieces of data on housing and manufacturing were released. What do they imply for the gold market?

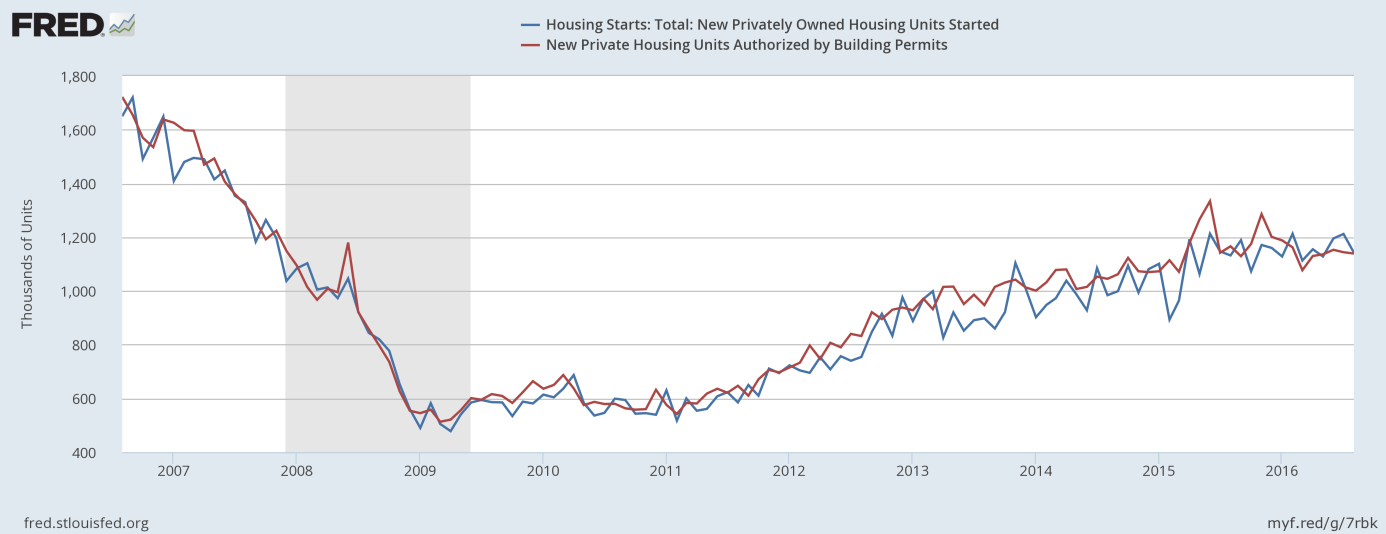

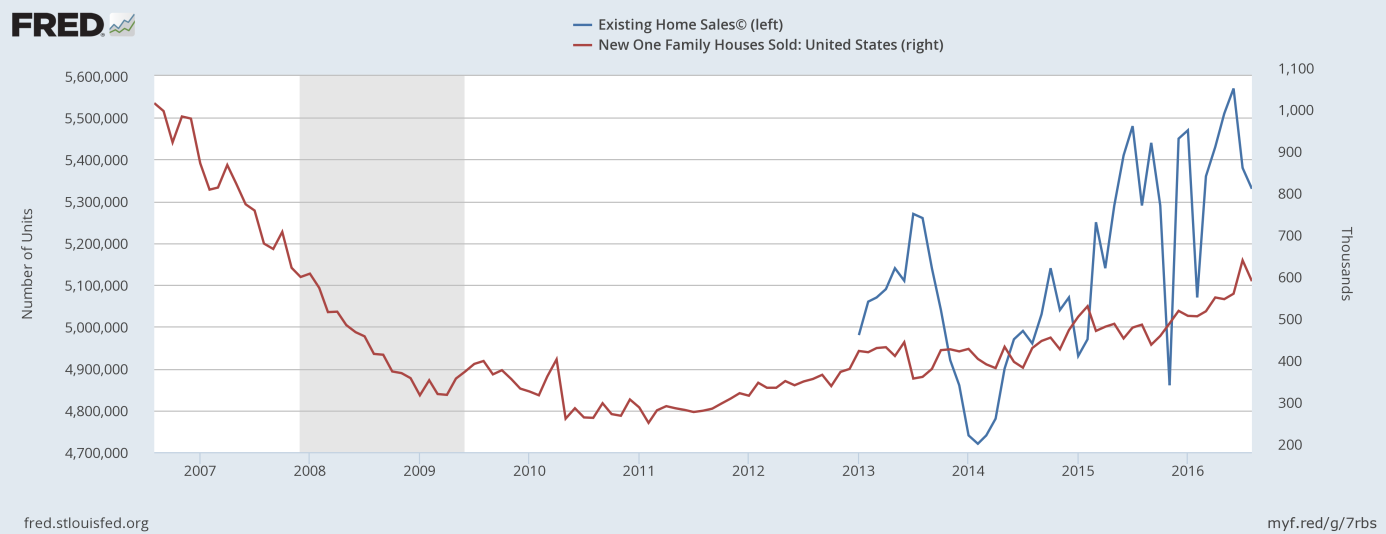

We have recently focused on the last FOMC meeting and the presidential debate. Let’s look now at the new bunch of U.S. economic data. August was generally a negative month for the housing market. Housing starts declined 5.8 percent on a monthly basis and 0.9 percent over the year. Permits were flat in August when compared to July, but 2.3 percent lower over the twelve months. Existing-home sales also declined 0.9 percent in August. It was the second monthly decline in a row. The only bright spot were new-home sales, which… dropped 7.6 percent in August. However, the decline was smaller than expected. Investors have to remember that July marked the highest number since late 2007. Generally speaking, the broader trends remain rather positive, as one can see in the charts below.

Chart 1: Housing starts (blue line) and building permits (red line) in thousands of units from 2006 to 2016.

Chart 2: Existing homes sales (blue line, number of units, left axis) and new-home sales (red line, in thousands, right axis) from 2011 to 2016.

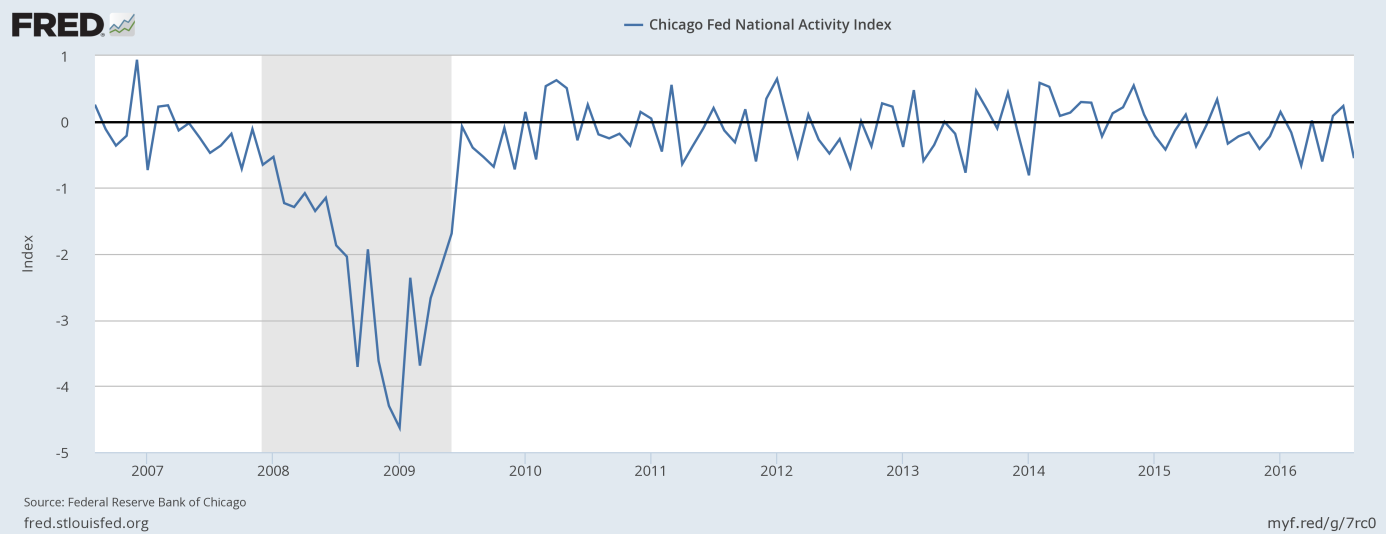

U.S. manufacturing is certainly in much worse shape than housing. On Thursday, the Chicago Fed National Activity Index fell to a negative 0.55 for August from a slightly downwardly revised positive 0.24 for July. Therefore, it is another measure which paints a negative picture of U.S. national economic activity, as one can see in the chart below. However, it does not seem to be the most reliable indicator, as it has flirted with recessionary levels since the end of the Great Recession.

Chart 3: The Chicago Fed National Activity Index from 2006 to 2016.

The weakness in the manufacturing sector was so big that it pushed leading indicators into negative territory in August, as the Conference Board’s leading economic index fell 0.2 percent. Last but not least, the Markit flash U.S. manufacturing purchasing managers’ index declined from 52 in August to 51.4 in September (however, the rate of the expansion of the U.S. service sector picked up during September).

To sum up, the recent data shows that everything goes as usual: the housing sector is recovering from the depth of the crisis, while the manufacturing sector is still facing important problems, flirting with the recessionary levels. Therefore, the recent pieces of news should not move the gold market significantly. The forthcoming reports on durable goods orders, personal income and outlays and non-farm payrolls are likely to exert a greater impact. Generally, the economic conditions remain fragile. As a reminder, the Fed downgraded its forecasts of real GDP growth this year. And the PMI surveys suggest that the U.S. economy will grow just 1 percent in the third quarter. Hence, it seems that there is more upside potential in the gold market in the long term. However, the price of gold dropped yesterday. The decline could be a result of the rise in the index of consumer confidence in September to the highest number since the Great Recession or stronger risk appetites in the wake of a perceived victory of Hillary Clinton over Donald Trump in the first presidential debate, as we wrote yesterday. It is worth noticing that the rise in consumer confidence may decrease Trump’s odds as he criticizes the Democratic economic policies. If people are more confident in the economy, they are more likely to vote for the status quo.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview