The Consumer Price Index (CPI) increased 0.2 percent in August. What does it mean for the gold market?

CPI Rise Led by Medical Costs

Consumer prices rose 0.2 percent last month, according to the U.S. Bureau of Labor Statistics. The increase was driven by the jump in the indices for medical care services, medical care commodities and shelter. Medical costs surged 0.9 percent, the largest jump since 1984. The cost of prescription drugs soared more than 1 percent, while housing costs rose 0.3 percent. The core CPI, which excludes volatile food and energy prices, increased 0.3 percent in August, the largest rise since February 2016.

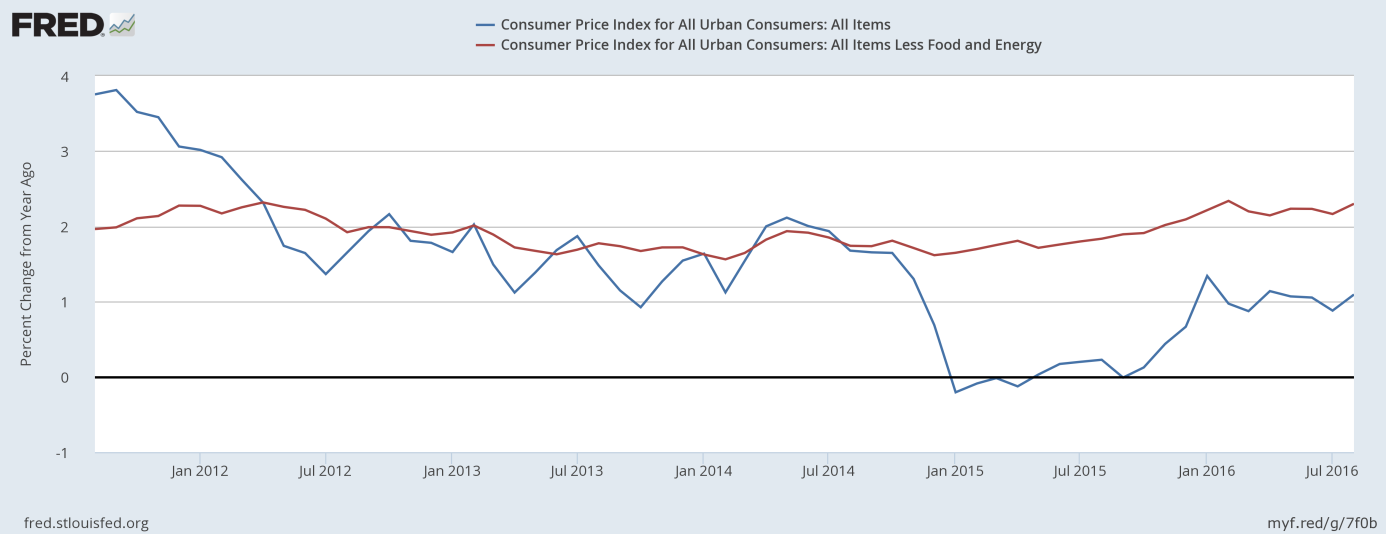

Over the last twelve months, the CPI rose 1.1 percent, while the core CPI index jumped 2.3 percent. Therefore, the inflation rates accelerated, as one can see in the chart below.

Chart 1: CPI (blue line) and core CPI (red line) year-over-year from August 2011 to August 2016.

Will Inflation Force the Fed to Act?

The strengthening of the inflationary pressure should reinforce the Fed hawks’ arguments for an interest rate hike sooner rather than later. However, the current CPI rate is still below the target of 2 percent. And the recent rise was mainly caused by the surge in medical care services, which will not help the economy, as the rising costs of Obamacare may leave consumers with less money for other goods and services. Outside the medical and housing sectors, there really hasn’t been much change in the inflation dynamics in the past few months Additionally, the increase in CPI is negative for wage earners, as real hourly earnings declined 0.1 percent in August. The Fed would like to see wage inflation before any hawkish move. Moreover, U.S. wholesale prices for final demand were unchanged in August, which signals the lack of inflationary pressures in the broader economy. Last but not least, the FOMC will likely not raise rates until it is convinced that the recent weakness in retail sales is only transitory. The market odds of an interest rate hike this week are only 12 percent, according to the CME Group FedWatch Tool.

Inflation, the Fed and Gold

The data on inflation was negative for the gold price, as it should increase slightly the likelihood of a Fed hike in the near future. Indeed, inflation continues to move toward the Federal Reserve’s goal.

At the beginning of this week, the shiny metal is likely to remain under downward pressure from the uncertainty ahead of the central bank meeting. Investors should remember that not only the Fed, but also the Bank of Japan convenes this week. Analysts expect a shift in the Bank of Japan’s policy toolkit and a Fed statement that points more clearly to a rise in interest rates this year. Last week, some rumors emerged that the negative interest rate policy could become the centerpiece of future BoJ monetary easing. Thus, the second half of the week may be quite volatile for the gold market, as the central banks may shake the markets.

We believe that a Fed hike is unlikely, especially if the BoJ further eases its monetary policy. The U.S. central bank failed to telegraph a rate hike (on the contrary, Brainard’s speech was very dovish), therefore it should hold the interest rates steady. Moreover, historically the Fed did not hike interest rates before U.S. presidential elections. The inaction should initially weaken the U.S. dollar down and push the price of gold up. However, the spike may be short-lived, as investors will soon shift their focus on December. The recent behavior of gold prices – especially the inability to rally on good news – suggests that traders are now taking profits on longs and going short.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview