During Thursday’s press conference, Draghi sounded very optimistic. What does this imply for the gold market?

Draghi Was Optimistic

We have already discussed the ECB’s decision and Draghi’s introductory statement to his press conference. Let’s now dig into the question and answer session, as it covered many interesting things. What caught our attention was Draghi’s extraordinary optimism. He reiterated a few times that the ECB’s asset purchase programs were effective, or even “fully effective”. Draghi downplayed the rising imbalances in TARGET2, the risks of negative interest rates, as well as the downgraded macroeconomic projections. He said that changes to the ECB’s economic forecasts were “not substantial, as to warrant a decision to act”. Draghi also pointed out that “right now the transmission mechanism is really working very well. It’s never worked better”.

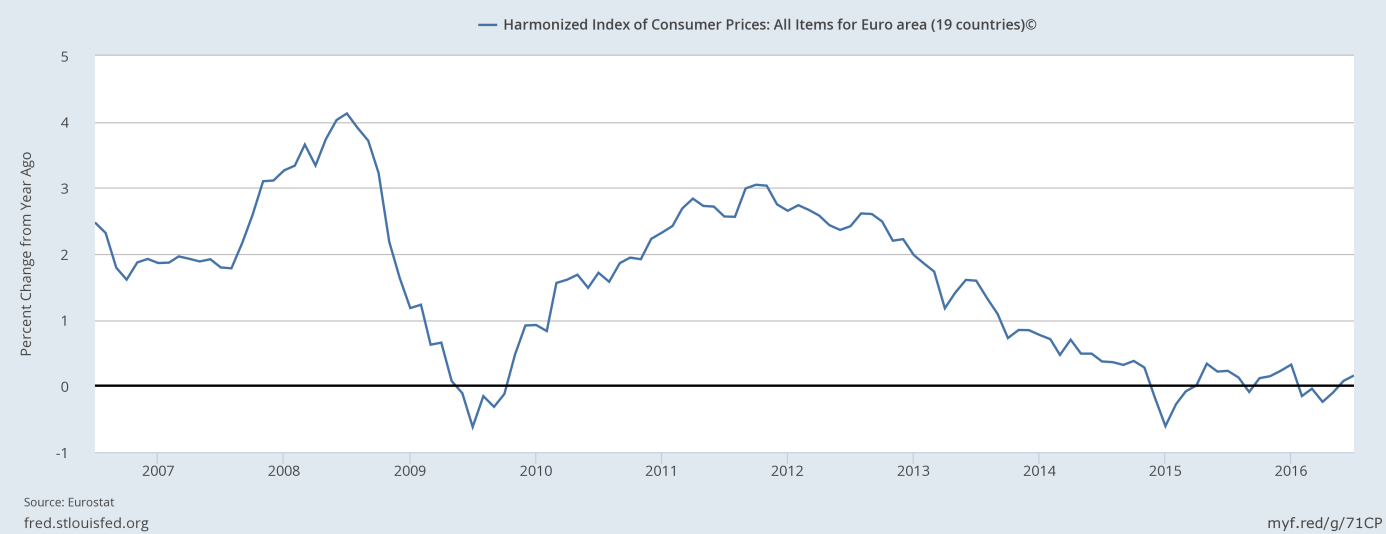

Yeah, right. The ECB did a great job. The only problem is that inflation has been much below the target since 2013, as one can in the chart below. Did we mention that keeping inflation under control is the only goal of the ECB?

Chart 1: The inflation rate in the Euro area from 2006 to 2016.

Expect Dovish Actions, Though

Draghi gave a few hints that new stimulus is possible in the near future. For example, he pointed out:

“Even today's discussion reiterated basically the unanimous commitment of the Governing Council to reach the inflation rate objective. So I would say there is no question about – as I think I've said on other times – the will to act, the capacity to act, and the ability to do so (…) If warranted, we will act by using all the instruments available within our mandate."

Moreover, Draghi said that he tasked the relevant committees with evaluating the options that ensure a smooth implementation of asset purchase programs. He had used similar language at the October 2015 meeting, which was followed by an easing package a few weeks later. Therefore, although Draghi disappointed investors again, the ECB is likely to expand, or extend its asset purchase program, as the stock of eligible bonds will run out.

Call for Fiscal Policy

As usually, Draghi called for structural reforms and fiscal stimulus in the Euro area. He stated that “fiscal policies should also support the economic recovery”. Draghi referred to a recent announcement made by policymakers at the G-20 summit in China:

“And I think what I just read on the G-20 is a quite powerful statement of commitment. The G-20 … It's not central bankers, it's governments; it's finance ministers. So they committed in their statement to use all policies, structural policies, fiscal policies, tax policy and to make government expenditure more friendly, which is something that all of you have heard me saying several times”.

Draghi has been talking about needed fiscal policy action for years. Recently, Yellen joined him in his calls, arguing in Jackson Hole the need for fiscal policy to play a more significant role.

Conclusions

The key takeaway is that Draghi, like practically all central bankers, is too optimistic with regard to the effectiveness of monetary policy and neglects its side effects. Although the last ECB’s meeting did not bring any changes, Draghi kept the door open for more stimuli this year. The extension of the ECB’s quantitative easing while the Fed is tightening (at least, it talks a lot about it) should strengthen the U.S. dollar, which would be negative for the gold market. On the other hand, if governments respond to Draghi’s calls by expanding fiscal stimulus, it may support the price of gold, provided, however, that it deteriorates the long-run fiscal sustainability.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview