U.S. delinquency rates on commercial and industrial loans are rising. What does it imply for the gold market?

The U.S. delinquency rate on commercial and industrial loans, which measures the percentage of such loans that have delinquent payments, increased from 1 percent to 1.5 percent in the first quarter of 2016. The absolute rise seems to be small, but it was a 50 percent jump on a relative basis.

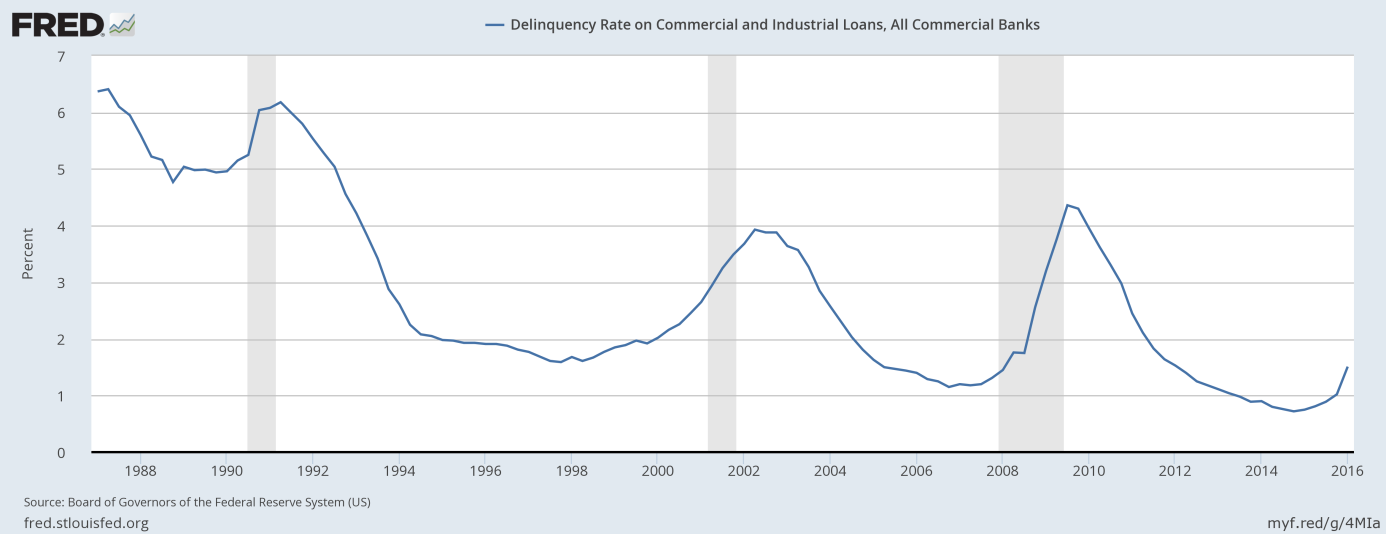

The delinquency rate is an important indicator as a rise in it has always been a warning signal for a recession, as one can see in the chart below.

Chart 1: Delinquency rate on commercial and industrial loans from 1987 to 2016.

The jump in delinquency rates coincided with the December Fed hike. After such a move, the U.S. dollar 12-month Libor increased from about 0.8 to 1.3 percent, pushing some borrowers into bankruptcy.

By the way, U.S. commercial bankruptcy filings in June soared 35 percent compared with a year ago, the eighth month of year-over-year increases in a row, and 29 percent in the first half of the year. And the U.S. high yield default rate jumped to 4.9 percent, the highest level in 6 years, mainly due to defaults by junk-rated energy companies. The rise in delinquency rates and bankruptcies indicates tighter credit conditions and a turn in the credit cycle. The December Fed hike and slowing economy may thus burst the credit bubble fueled by the zero interest rate policy.

On the other hand, investors should remember that the delinquency rates on all bank loans are declining. Other indicators of financial conditions remain favorable. And credit cycles are not an exact science – a rise in delinquency rates on commercial and industrial loans may not be followed by a recession immediately, if at all. However, investors should not neglect the rising corporate defaults.

To sum up, corporate America is experiencing financial problems, as delinquency rates on commercial and industrial loans, as well as commercial bankruptcy filings, are rising. It should increase the risk of a recession and decrease the risk sentiment. Thus, the safe-haven demand for gold should rise, at least if the situation suddenly deteriorates (although this week we observe more risk taking in the markets, which has been negative for the shiny metal). Apropos of the U.S. delinquency rate, investors should remember that this indicator is at extreme levels in Italy and the country might revive the euro crisis again, which also should be positive for the yellow metal.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview