Retail sales rose 0.5 percent in May. What does it imply for the Fed policy and gold market?

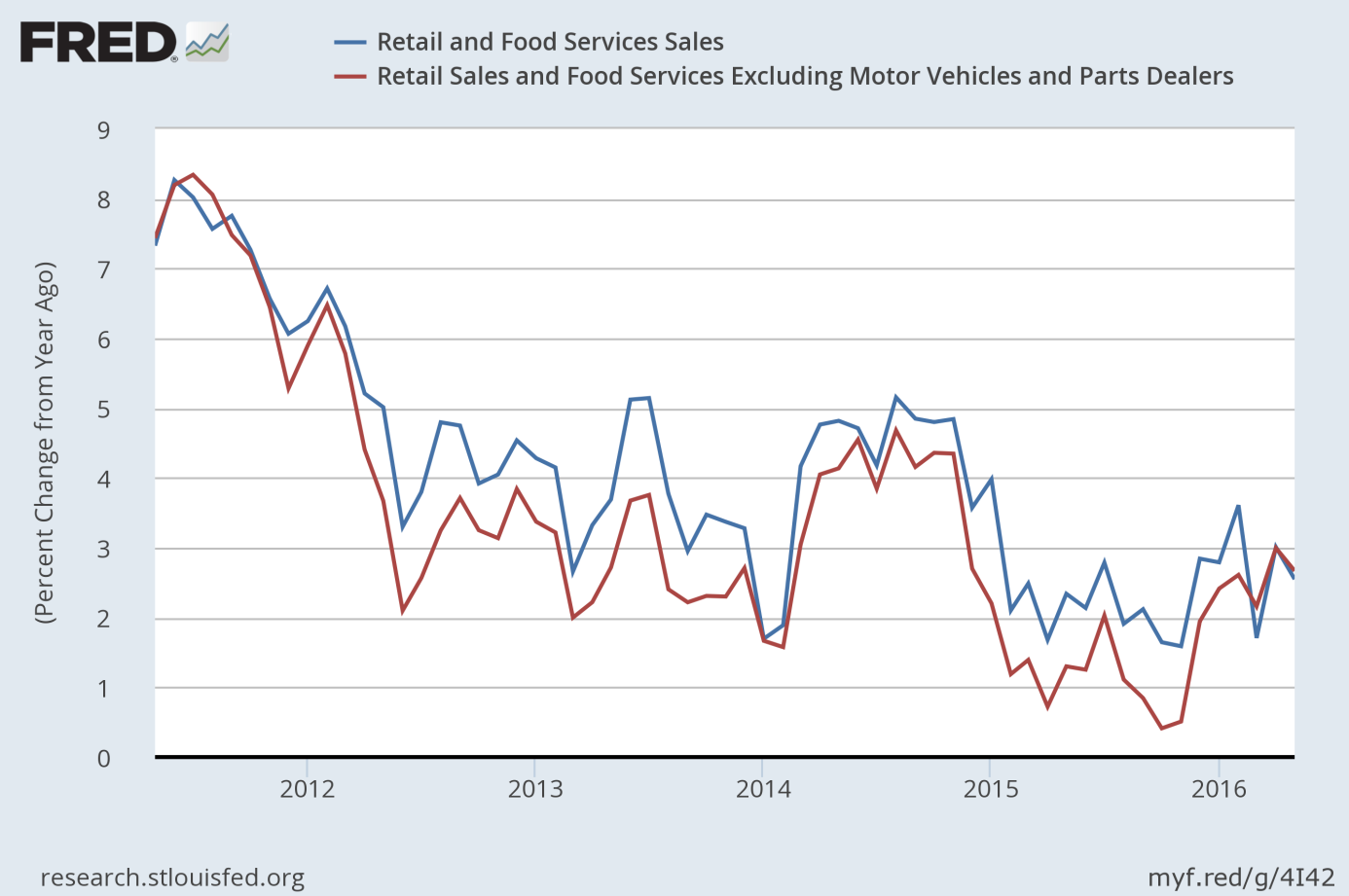

Retail sales increased 0.5 percent last month, according to the U.S. Department of Commerce. It was a smaller gain than the 1.3 percent in April, but it was a solid move, bigger than expected. The sales gains were quite widespread, however, retail sales excluding automotive segment rose a bit slower at 0.4 percent, but in line with expectations. On an annual basis, retail sales increased 2.5 percent, while retail sales excluding motor vehicles jumped 2.7 percent. As one can see in the chart below, the annual pace of growth of retail sales slowed down from April, but it was a second straight relatively strong increase.

Chart 1: Retail and food services sales (blue line) and retail and food services excluding motor vehicles and parts dealers (red line) as percent change from year ago, from 2011 to May 2016.

Therefore, the report may upgrade the U.S. economic outlook for the second quarter. Indeed, the GDPNow model forecast for real GDP growth in the second quarter of 2016 increased from 2.5 percent to 2.8 percent after the release of the retail sales report. Does it mean a hawkish FOMC statement tomorrow? Well, not necessarily. The probability of a June hike is just 1.9 percent, according to the CME Group FedWatch. Thus, the June hike is off the table for tomorrow.

The question is rather what kind of tone the U.S. central bank will adopt. On the one hand, the Fed should point out the strong consumer spending and improved outlook for the U.S. economy. On the other hand, the FOMC could mention the disappointing May payrolls and risks from Brexit and terrorism. Generally speaking, the Fed would like to wait for more data to be sure that the slowdown in job gains was temporary before hiking. However, the U.S. central bank may try to sound hawkish to convince investors that it really wants to raise interest rates. The probability of a July hike is just 20.6 percent, which seems to be uncomfortable for the Fed, as it limits its ability to move next month.

The key takeaway is that retail sales were relatively strong for the second straight month. It could give the Fed another argument that the U.S. economy will accelerate in the second quarter of 2016. The FOMC could also try to raise market odds of a July hike, to secure its flexibility. The hawkish statement should be negative for the gold market, however, the shiny metal is now supported by fears of Brexit. Moreover, the statement will be accompanied by Yellen’s press conference and new economic projections – and it cannot be excluded that the FOMC members now see just one hike this year instead of two.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview