U.S. personal spending rose 0.2 percent in June. What does it mean for the U.S. economy and the gold market?

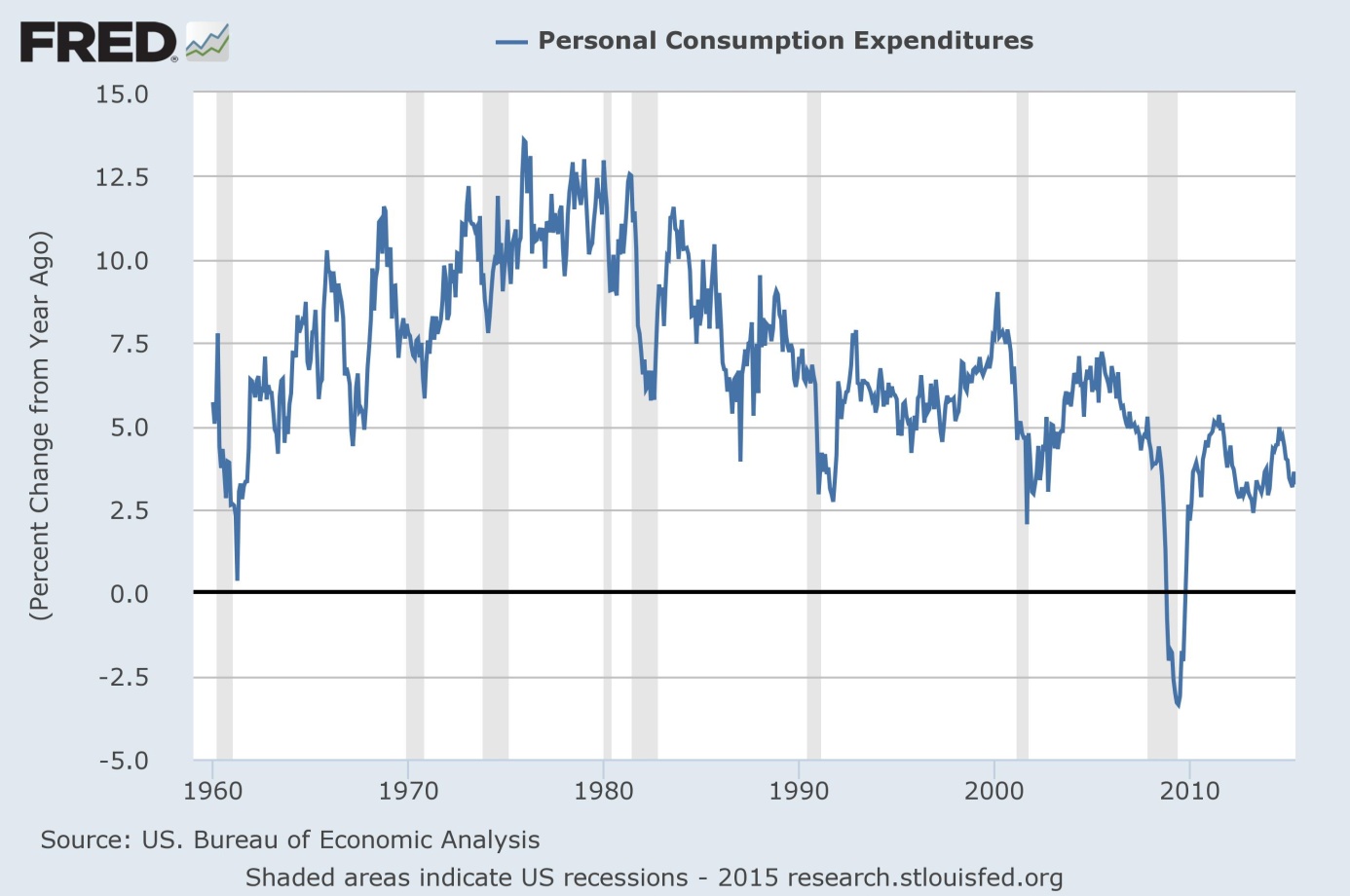

Although personal income rose 0.4 percent in June for the third month in a row (and slightly more than expected), consumer spending took a cooler turn. Personal consumption expenditures rose only 0.2 percent – in line with expectations, but lower than in May (a 0.7 percent rise revised from 0.9 percent). It was the weakest gain in four months. Why did U.S. consumer spending slow in June? Theoretically, it may be a natural development after a quite strong May. However, the drop was driven by expenditures on durable goods (including cars and trucks), which declined 1.3 percent. It confirms that consumer spending depends heavily on the car sales boom fueled by cheap auto loans. Indeed, the chart below shows that personal consumption expenditures have been in a downward trend since August 2014 (if not for years), because people are spending less to repay their debts (the saving rate increased in June from 4.6 to 4.8 percent).

Chart 1: Personal Consumption Expenditures from 1959 to 2015.

Source: research.stlouisfed.org

The cooler consumer spending in June may postpone the Fed’s decision on an interest rate hike. Inflation also showed little movement. The PCE price index increased 0.2 percent in June and only 0.3 percent on an annual basis. The core PCE index, which excludes food and energy, rose 0.1 percent in June and 1.3 percent over the past 12 months.

Adding the weak manufacturing data – the Institute for Supply Management’s manufacturing index fell to 52.7 percent in July from 53.5 percent in June – we obtain a rather disappointing set of data, which raises some doubts about the economy. The combination of anemic consumer spending, benign inflation pressure and sluggish manufacturing makes the interest rate hike this year less likely, however, a lot of depends on the labor market. Additionally, investors and the Fed officials may interpret weak consumer spending as temporary as motor vehicles sales were stronger than expected in July.

The key takeaway is that consumer spending slowed in June, driven by durable goods. Inflation remains benign while manufacturing is still sluggish. However, markets are not too worried about this data, due to a rebound in auto sales in July and optimism regarding the labor market. It seems that Friday’s payroll market will be decisive for the Fed’s decision on an interest rate hike and for the gold market. A number better than the expected 212,000 gains could push gold downward to the next support level, while disappointing data could give gold bulls the needed respite.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on the fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview