The price of gold has been rising this year. What does it mean for the gold market?

Yesterday, gold prices hit $1,190, the highest level since November 2016. Actually, the price of the shiny metal has increased almost 4 percent this year, so far. What were the reasons behind the reversal? Well, I will probably not surprise anyone pointing out the real interest rates and the U.S. dollar. Let’s look at the two charts below.

Chart 1: The price of gold (blue line, left axis, London P.M. Fix) and real interest rates (red line, right axis, yield at 10-year Treasury Inflation-Indexed Security, in %).

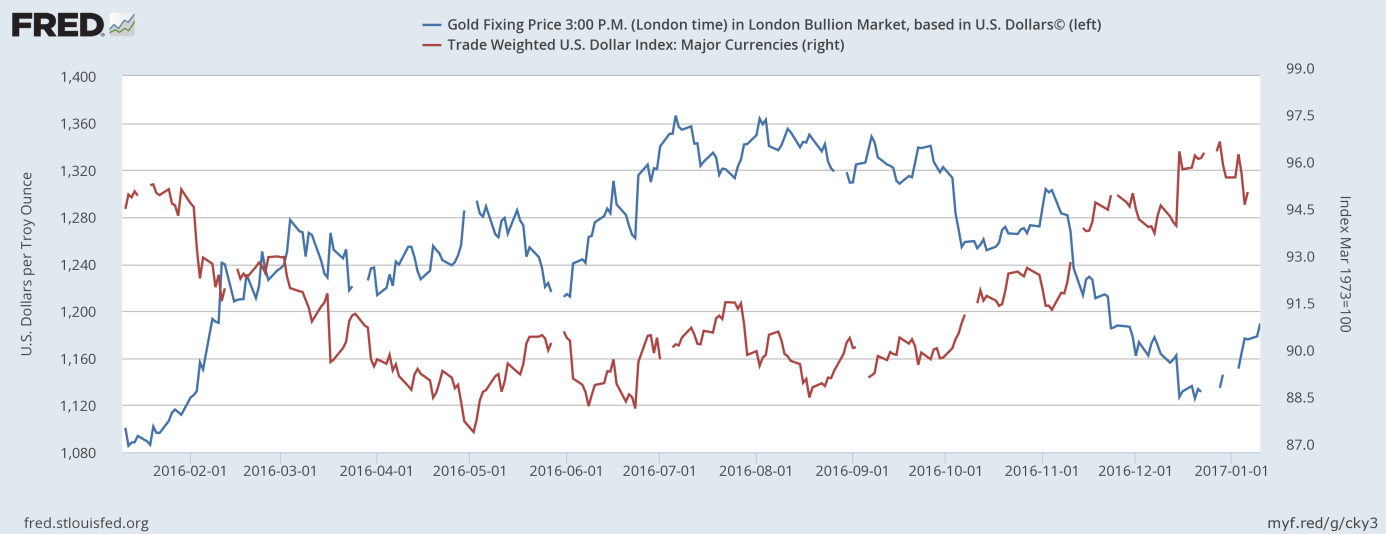

Chart 2: The price of gold (blue line, left axis, London P.M. Fix) and the U.S. dollar (red line, right axis, Trade Weighted Index against Major Currencies).

As one can see, U.S. inflation-indexed bond yields and the U.S. dollar were significantly down from the December’s highs. The decline corresponded with the rise in gold prices. Does it imply that the yellow metal has bottomed out and the bullish rally has just begun? Well, definitely gold has some room to move a little higher, especially if Trump fails to meet the investors’ elevated expectations. Today is his first press conference since the U.S. presidential elections, so it may be a hot day for the markets, especially that investors are vexed, as no President elect before has waited so long with the press conference after winning the elections. However, as we wrote in the today’s Gold & Silver Trading Alert, “gold’s upside potential appears very limited and the downside potential seems very big (for the following weeks and months)”, especially if the President-elect reassures investors that he is going to boost economic growth somehow.

Anyway, the medium-term outlook remains rather bearish, as the U.S. dollar has kept the status of the least ugly currency: there are many risks which may materialize this year, but most of them seem to be concentrated in Europe (Brexit, Italian banking system, elections in Germany and France, Russian threats). However, the presidential election showed that market sentiment may shift really quickly. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview