Based on the October 3rd, 2013 Premium Update. Visit our archives for more gold articles.

On Wednesday, silver gained almost 2.7% and reached $22 as a weak dollar boosted commodities priced in the greenback. The US currency was under selling pressure as a U.S. government shutdown entered a second day with no end in sight. The white metal was supported by weak U.S. economic data, which raised hopes the Federal Reserve would stick to its commodity-friendly stimulus for longer.

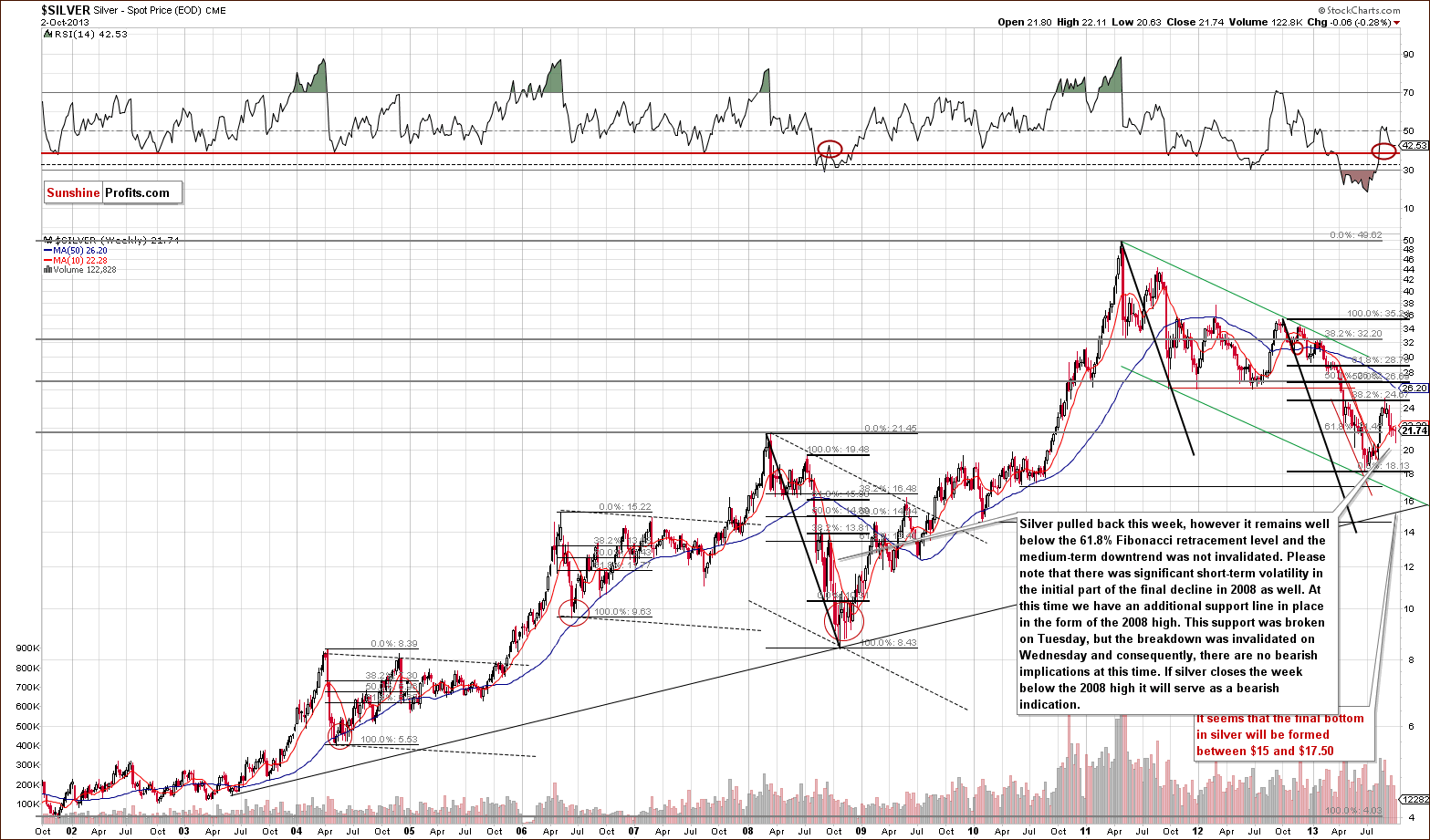

Despite this temporary increase, silver has since given up the gains and is trading below $22 once again. We didn’t expect silver to show significant strength – as we emphasized in our previous essay on the gold price on October 2013, the medium-term trend for the precious metals market remains down.

Will silver decline further? Or maybe the white metal will rebound in the near future? Before we try to answer these questions, let’s take a look at the charts and find out what the current outlook for silver is. Today, we will start with the analysis of silver from the long-term perspective, then move to a short-term chart, and then once again back to the big picture (charts courtesy by http://stockcharts.com).

Although a lot happened this week, really not much changed, as silver remains above the 2008 high. It will be important to check where silver closes this week. At this time, it is unclear whether we saw a true move below this important support level (and Wednesday’s rally was a correction) or it was just a temporary price slide. If so, we probably shouldn’t view Tuesday’s decline below this level as significant.

Please note that the 2008 high corresponds to the 61.8% Fibonacci retracement level based on the entire bull market, which makes this level particularly important.

Now, let’s move to the short-term chart to see the recent price moves more clearly.

On the above chart, we see that silver moved close to the short-term rising support line (based on the June and the August lows) and bounced after reaching it. However, it has now moved quite close to its 20-day moving average, which has been seen stopping rallies multiple times in previous months.

Taking this fact into account, it seems that it will likely stop this short-term upward move once again. If not, we could see a more powerful upswing even to the August highs. Again, as is the case with the gold market, that’s just a possibility, not something that is probable at this time since there has been no breakout just yet.

Before we summarize, we would like to discuss an important long-term factor, which is likely to affect the precious metal market in the coming months.

As you see on the above chart, there have been two major bottoms and two major tops in the current major long-term cycle. As you can see on the weekly chart, the next cyclical turning point will be seen in late November or early December this year. This may be where the next major bottom in silver materializes.

Since the entire precious metal sector tends to move together during major price swings, the above has bearish implications for gold and mining stocks in the medium term.

Please note that we saw extreme volatility right before the long-term cyclical turning point in all previous cases. Therefore, it’s quite likely that silver will be volatile soon.

Summing up, the outlook for the white metal remains bearish for the medium term, though the short term is rather unclear. Taking long-term cyclical turning points into account, we – the precious metals investors – should be particularly prepared to enter new trading positions and/or adjust the long-term investment ones in the next several weeks and months.

How high can gold and mining stocks go on a short-term basis without invalidating the medium-term trend? Knowing this means being prepared for a possible change in the short-term trend and being positioned to profit from the breakout. Today's Premium Update includes details. You can subscribe using this link.

Thank you.

Przemyslaw Radomski, CFA

Back