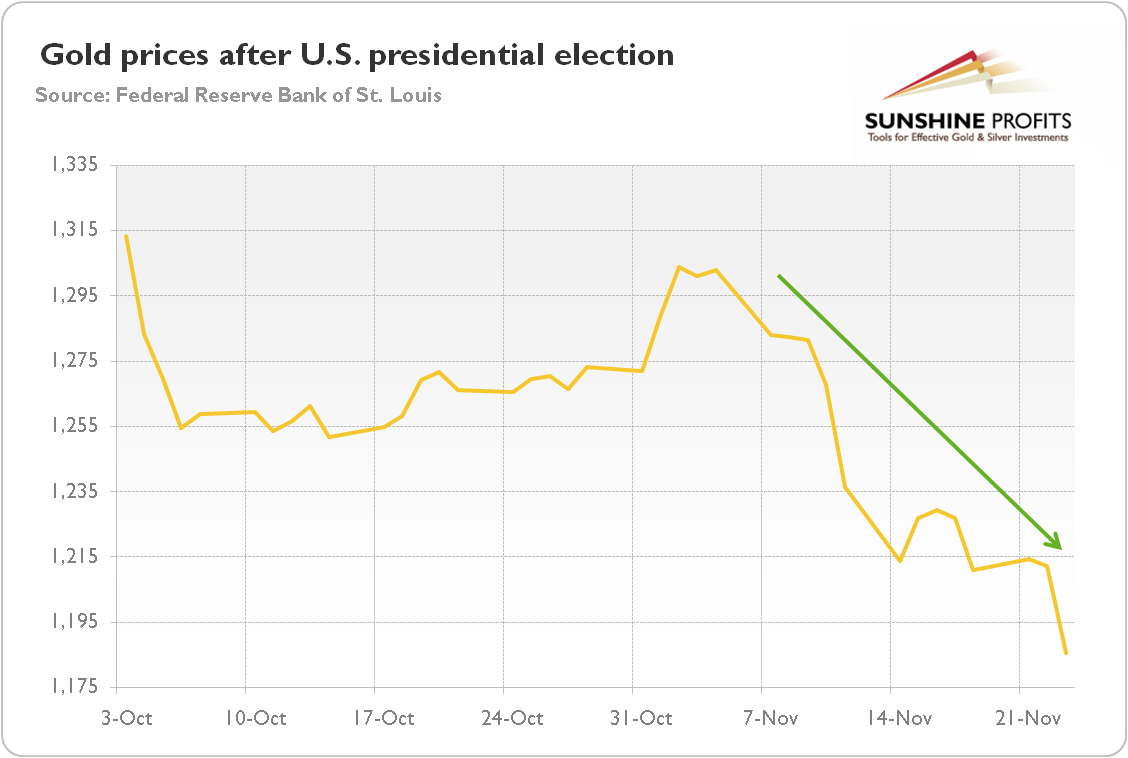

As everyone knows by now, Donald Trump will be the next president of the United States. Investors did not have to watch the news, as the price of gold clearly signaled who won the election. The price of gold skyrocketed more than $65 in just four hours during election night as Trump was heading firmly for the victory. However, contrary to predictions that gold would surge beyond $1,400 or even $1,500, it actually started to decline just after the election, as one can see in the chart below.

Chart 1: The price of gold (London P.M. Fix) from October 3, 2016 to November 23, 2016.

What has happened? To some extent, there was a typical knee-jerk reaction in a response to a previous overshooting. As the outcome of the elections became known, uncertainty decreased and traders decided to take profits (while our subscribers’ profits have been increasing during the decline). However, gold prices went into free fall. The turning point was Trump’s victory speech. He struck a surprisingly conciliatory and mature tone, which calmed the markets. His call for unity encouraged hopes that he would moderate his more extreme positions and that Trump the President would indeed differ from Trump the candidate. Hence, the worst fears eased and the safe-haven demand for gold decreased and gold returned to its previous trend determined to a large extent by the technical situation.

Moreover, Trump promised an increase in infrastructure spending:

“We are going to fix our inner cities and rebuild our highways, bridges, tunnels, airports, schools, hospitals. We’re going to rebuild our infrastructure, which will become, by the way, second to none. And we will put millions of our people to work as we rebuild it.”

Investors really focused on this thread and concluded that Trump’s presidency would lead to faster economic growth, at least in the short-term. Therefore, the demand for risky assets boosted, while the price of gold went south.

But what kind of news should we expect next for the gold market? Will Trump’s presidency provide bullish or bearish surprises? Well, a lot depends on Trump’s upcoming actions. Let’s analyze his agenda for the first 100 days and try to determine what would be the first moves of the next president. Based on Trump’s contract with the voters, he would like to focus on three issues: cleaning up Washington, protecting American workers, and restoring security and rule of law.

To drain the Washington swamp, Trump proposed a few measures, including a constitutional amendment to impose term limits on all members of Congress, limits on lobbying activity and a hiring freeze on all federal employment. Most of the proposals are relatively easy to implement (with the obvious exception of a constitutional amendment), but they should not affect the gold market in a significant way as they are aimed at reinstalling institutional order, not macroeconomics.

To protect American workers, Trump promised to renegotiate (or withdraw from) NAFTA, withdraw from the TPP, label China a currency manipulator, roll back the restrictions on the energy sector, and reduce the climate change programs. These proposals are much more important for the global economy and the gold market. On the one hand, Trump’s lifting environmental regulations and restrictions on the energy sector could mean more economic activity and higher corporate profits, which would be positive for the U.S. stock market, but negative for the yellow metal. On the other hand, imposing a set of protectionist policies and possible trade wars would be negative for the U.S. economy and would increase uncertainty and, thus, support the price of gold. However, it would not be easy to implement all these proposals. For example, Trump can obviously unilaterally withdraw U.S. from NAFTA, but key commitments have already become part of U.S. law. Thus, to change them, Trump would have to cooperate with Congress, which is rather unlikely. Moreover, elevated tariffs would also imply higher inflation (due to more expensive imported goods) which may lead to gold’s greater appeal as an inflation hedge, unless real interest rates also rise.

And to restore security and the constitutional rule of law, Trump wants to remove criminal illegal immigrants from the country and suspend immigration from terror-prone regions. Well, if really limited to criminals, it sounds reasonable, but deportation of all illegal immigrants would imply a reduced size of the labor force (and perhaps some riots), which would be negative for the U.S. economy and, thus, positive for the gold market. However, a massive deportation of illegal immigrants could ease downward pressure on wages in low-paid jobs. The higher wage inflation would strengthen the case for the Fed interest rate hikes and hence would be bad for the yellow metal.

Moreover, Trump also committed to work with Congress to introduce several broader legislative measures, such as tax code reform (including support for infrastructure investments through tax incentives), promoting school choice, and building the wall at the southern US border. The most important issues for the Congress would also be: tax reform – which may spur growth, but also widen the fiscal deficit – and healthcare reform (in contrast to the wall which Congress is very unlikely to fund).

To sum up, if Trumps treats his pledge seriously (he later reiterated some of his promises in the video about the first day of his presidency), he will focus on trade, immigration and corruption in Washington, as well as tax reform and repealing and replacing Obamacare. It may be good for gold, as investors focus now on the promise to boost infrastructure spending, although it was not explicitly stated as a priority during the first 100 days. And the set of protectionist measures may increase uncertainty and hamper business, which should lead to a weaker U.S. dollar and stronger gold. Surely, the current “Trump rally” is likely to continue for some time – which is bad news for the gold market – as markets focus now on the upsides of the new president, particularly the potentially positive impact of his policies on GDP growth. However, honeymoons do not last forever. When investors realize that President Trump really wants to fulfill some of his most worrying promises, markets will shake again, which would spur some safe-haven demand for gold. Therefore, the first 100 days will be crucial as it will show whether Trump softens his stance. In particular, he maintained his intent to renegotiate (or withdraw from) NAFTA which may rattle markets and be positive for the yellow metal.

If you enjoyed the above analysis and would you like to know more about the potential impact of Trump’s presidency on the gold market, we invite you to read the December Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview