Stock Trading Alert originally sent to subscribers on June 20, 2016, 6:57 AM.

Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,120, and profit target at 2,000, S&P 500 index).

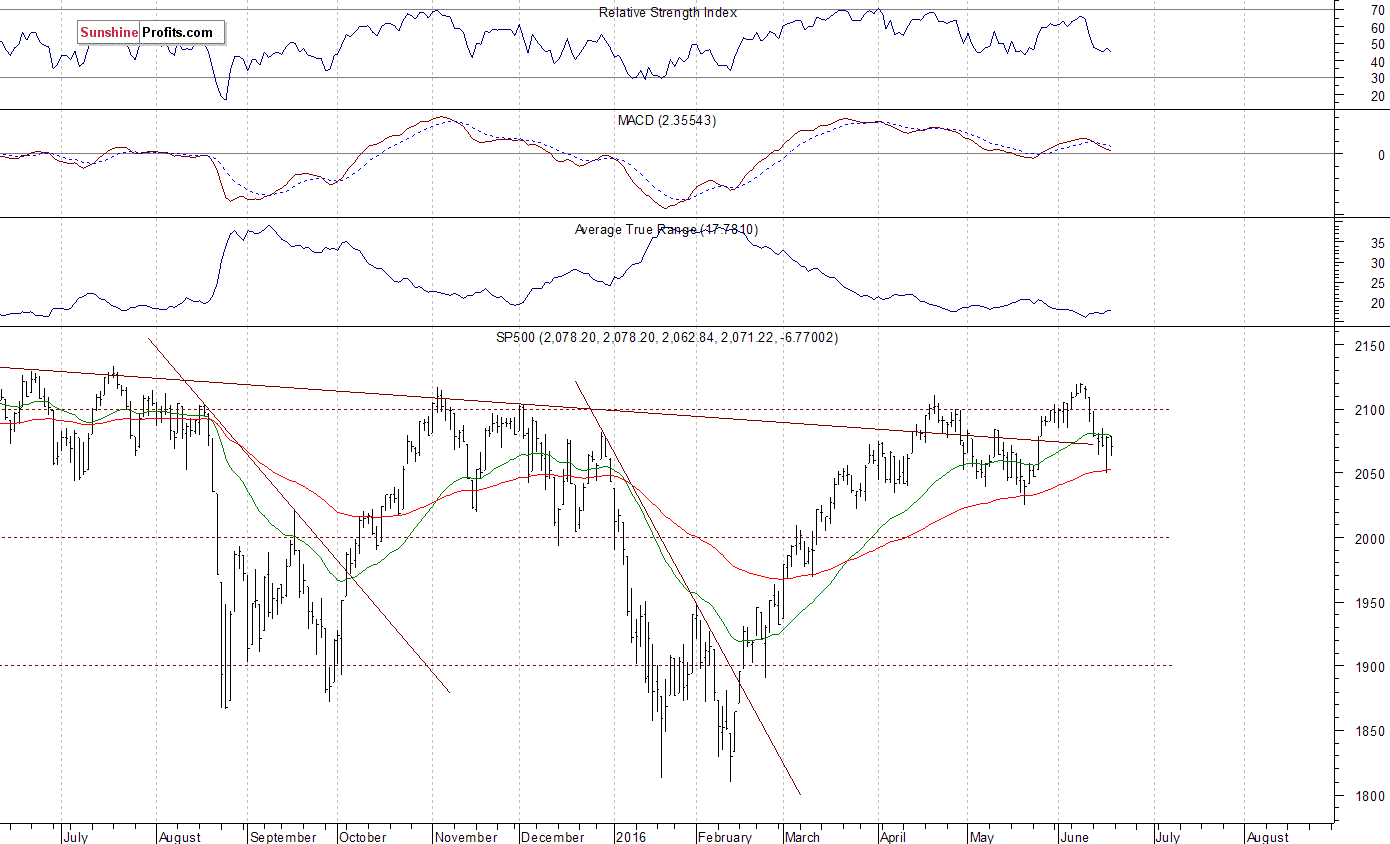

Our intraday outlook is bearish, and our short-term outlook is bearish. Our medium-term outlook remains bearish, as the S&P 500 index extends its lower highs, lower lows sequence:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): bearish

Long-term outlook (next year): neutral

The U.S. stock market indexes lost 0.3-1.1% on Friday, extending their short-term consolidation, as investors reacted to economic data releases. The S&P 500 index continues to trade above support level of 2,050, marked by previous fluctuations. The next important level of support is at around 2,020-2,030. On the other hand, resistance level is at 2,085-2,100, marked by some recent local lows, and the next resistance level is at 2,110-2,120, marked by the early June high, among others. Last year's highs along the level of 2,100 continue to act as medium-term resistance level. Will the market break above these medium-term highs and continue its seven-year long bull market? Or will it reverse its over three-month long uptrend off medium-term support level at around 1,800?

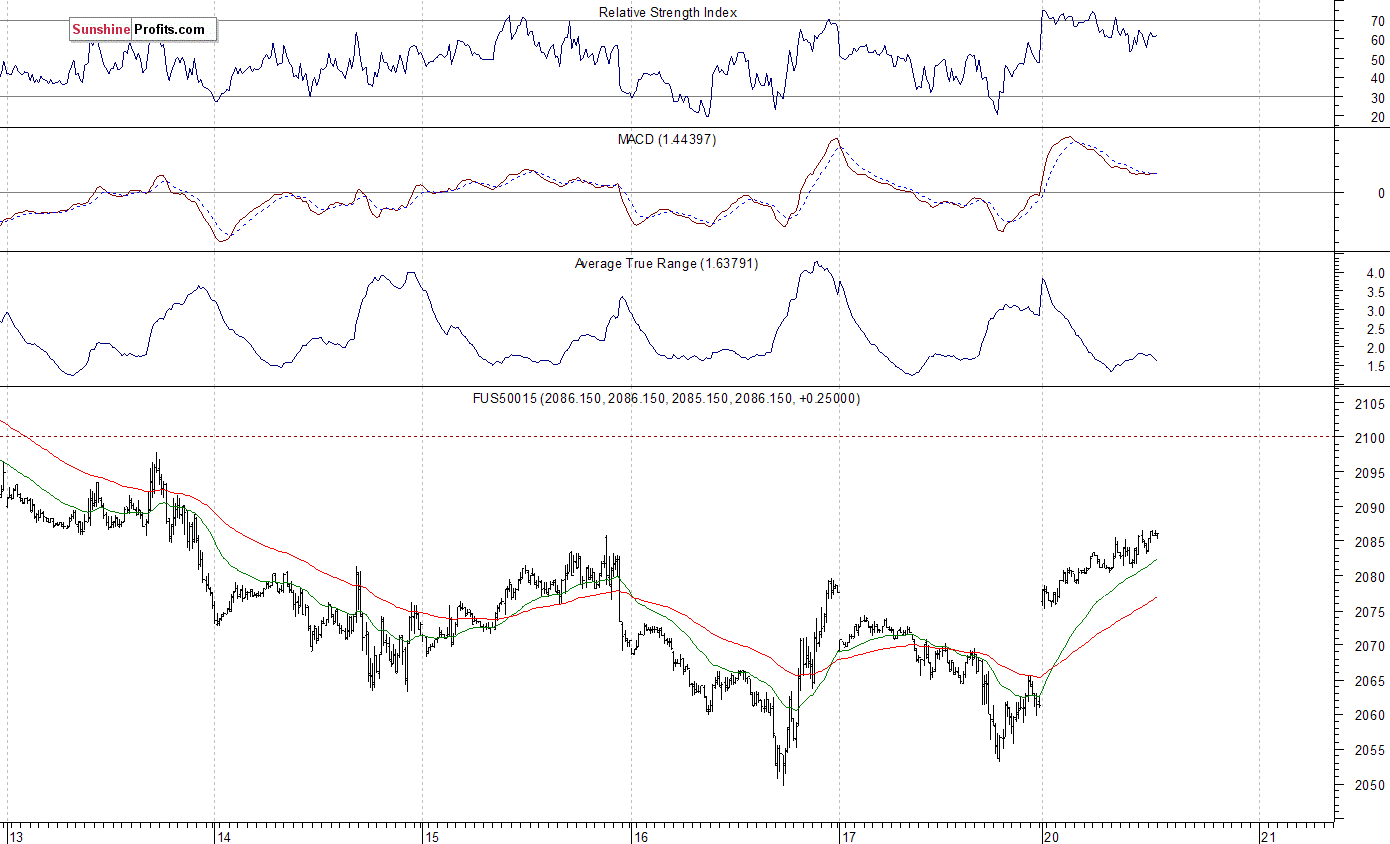

Expectations before the opening of today's trading session are very positive, with index futures currently up 1.2-1.4%. The main European stock market indexes have gained 3.1-3.5% so far. The S&P 500 futures contract trades within an intraday uptrend, retracing its last week's decline, as investors' sentiment improves. The nearest important level of resistance is at around 2,085. On the other hand, support level is at 2,070, marked by the daily gap up, among others. For now, it looks like an upward move within short-term consolidation, as we can see on the 15-minute chart:

The technology Nasdaq 100 futures contract follows a similar path, as it retraces its Friday's move down. The nearest important level of resistance is at around 2,430-2,450, marked by some previous local highs. On the other hand, support level remains at 4,350-4,440, as the 15-minute chart shows:

Concluding, the S&P 500 index extended its short-term fluctuations on Friday, as investors hesitated following recent move down. The broad stock market is expected to open much higher this morning, as investors' sentiment improves. However, we continue to maintain our speculative short position (opened on June 1 at 2,093.94 - S&P 500 index). Our stop-loss level remains at 2,120, and profit target is at 2,000 (S&P 500 index). You can trade S&P 500 index using futures contracts (S&P 500 futures contract - SP, E-mini S&P 500 futures contract - ES) or an ETF like the SPDR S&P 500 ETF - SPY. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts