Stock Trading Alert originally sent to subscribers on March 24, 2016, 6:55 AM.

Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is neutral, and our short-term outlook is neutral. Our medium-term outlook remains bearish, as the S&P 500 index extends its lower highs, lower lows sequence:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): bearish

Long-term outlook (next year): neutral

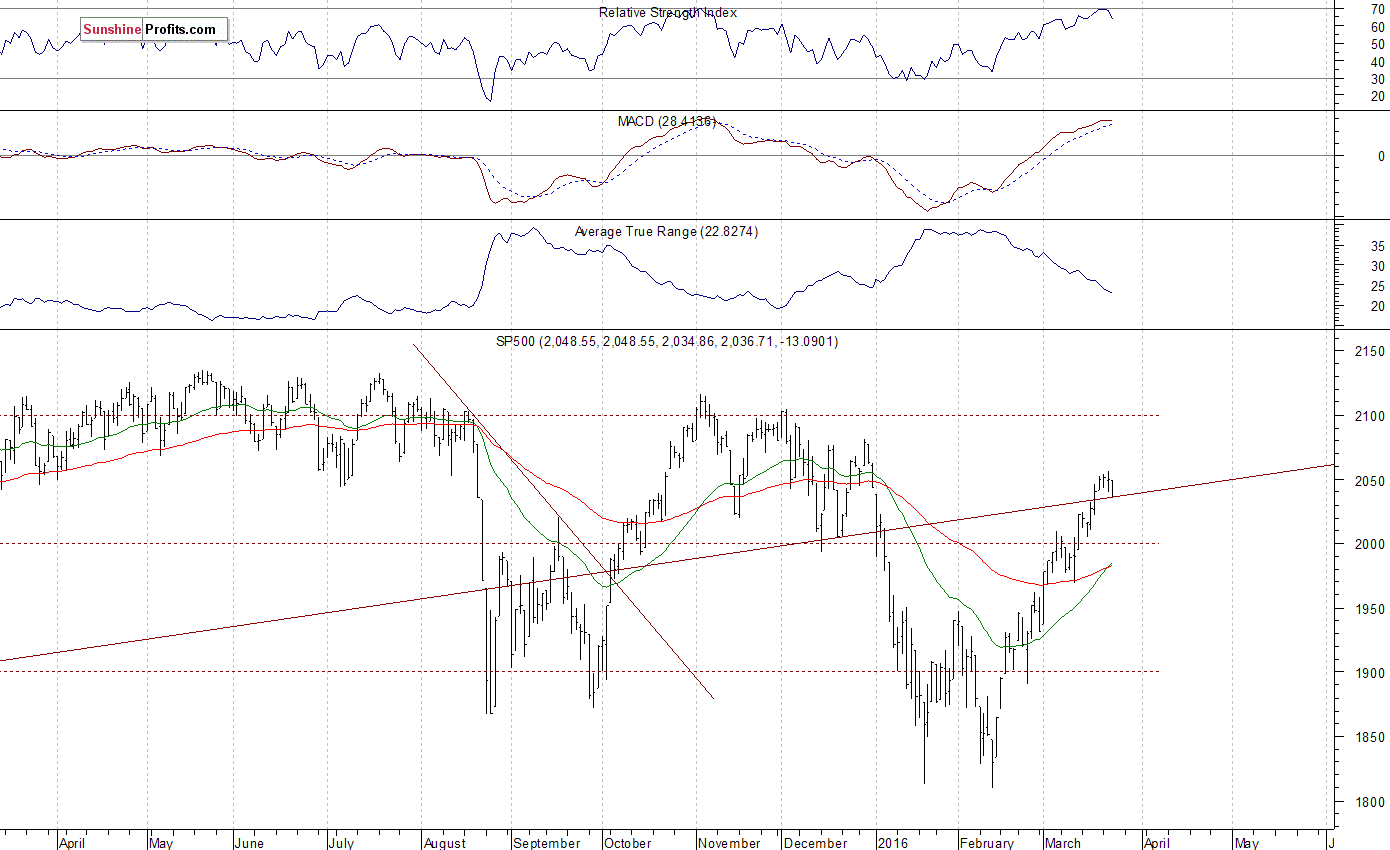

The main U.S. stock market indexes lost 0.5-0.8% on Wednesday, retracing some of their recent move up, as investors took short-term profits off the table. The S&P 500 index extends its fluctuations along the level of 2,050. The next important level of resistance is at around 2,080, marked by the late December local high of 2,081.56. On the other hand, support level remains at 2,000, and the next support level is at 1,960-1,980, marked by previous level of resistance. There have been no confirmed negative signals so far. However, we can see some technical overbought conditions, along with short-term uncertainty. The index continues to trade within a slightly descending medium-term trading channel, as the daily chart shows:

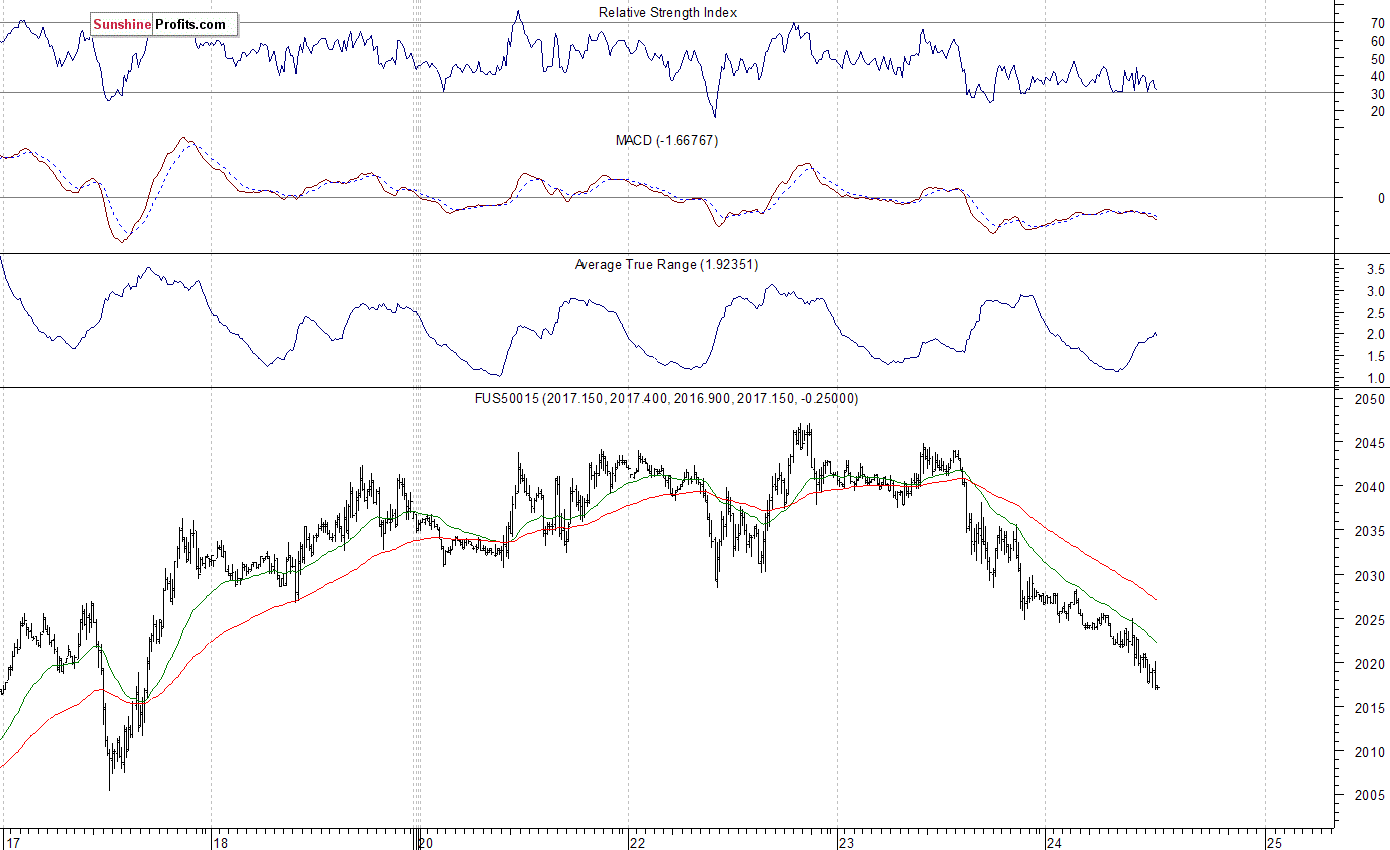

Expectations before the opening of today's trading session are negative, with index futures currently down 0.5-0.6%. The European stock market indexes have lost 1.4-1.8% so far. Investors will now wait for some economic data announcements: Initial Claims, Durable Orders at 8:30 a.m. The S&P 500 futures contract trades within an intraday downtrend, as it retraces its recent advance. The nearest important level of resistance remains at around 2,030-2,050. On the other hand, potential support level is at 2,000-2,020, marked by some previous local highs. For now, it looks like a downward correction following short-term uptrend:

The technology Nasdaq 100 futures contract follows a similar pattern, as it currently trades below the level of 4,400. The nearest important level of support is at around 4,320-4,350, marked by previous consolidation, among others. On the other hand, resistance level is at 4,400, marked by previous level of support, as we can see on the 15-minute chart:

Concluding, the broad stock market retraced some of its recent advance yesterday, as investors took short-term profits off the table. Is this an uptrend reversal or just quick downward correction before another leg up? There is some uncertainty ahead of long holiday weekend. Our speculative short position has been closed on Friday, at the stop-loss level of 2,050 (S&P 500 index). It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow. Currently, we prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

There will be no Stock Trading Alert on Monday, March 28. We apologize for inconvenience.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts