Stock Trading Alert originally sent to subscribers on January 30, 2014, 6:55 AM.

Our intraday outlook is neutral, and our short-term outlook remains neutral:

Intraday (next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

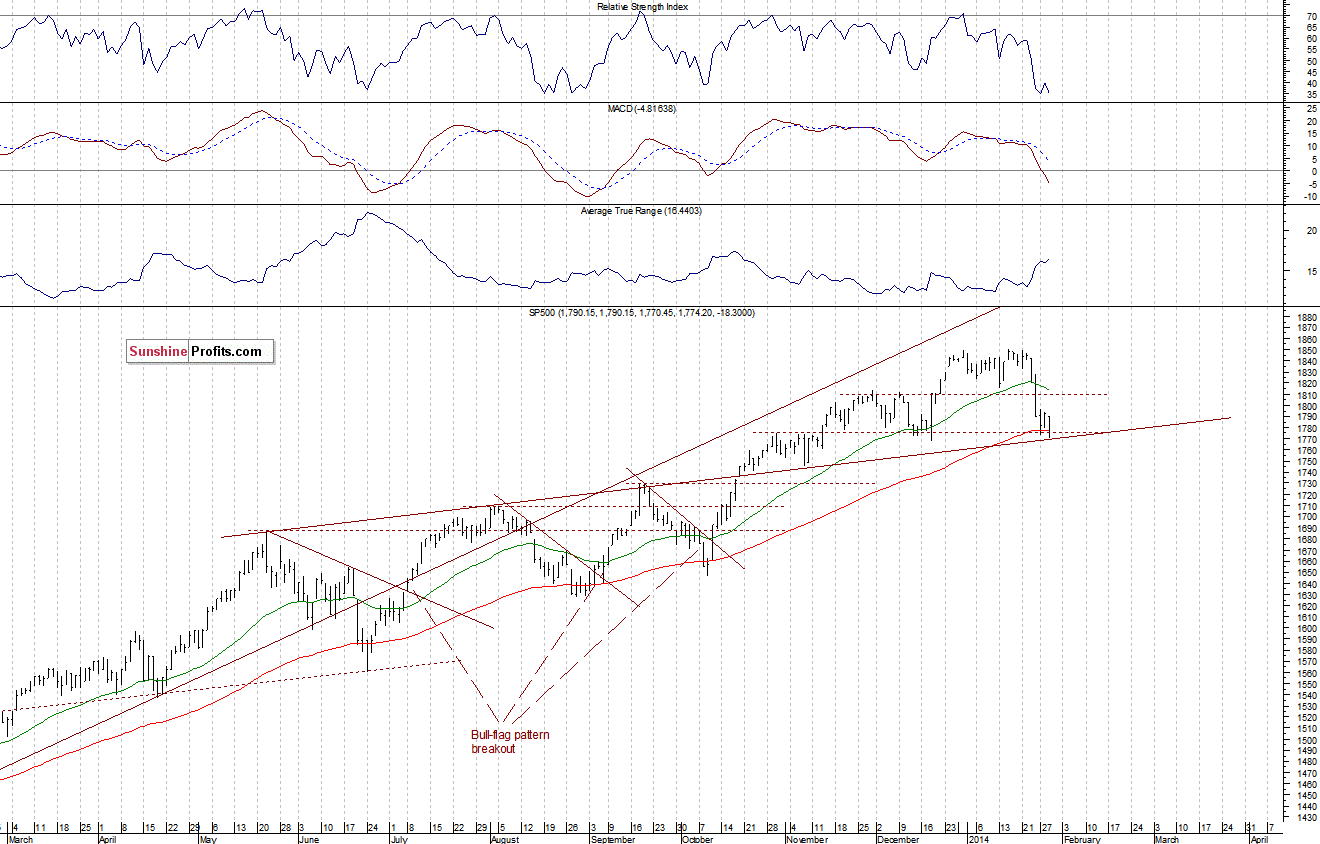

The main U.S. stock market indexes lost between 1.0% and 1.2% as investors reacted to the FOMC’s decision concerning further tapering of its asset-purchasing program. The S&P 500 index extended recent decline, testing the support at around 1,775, marked by some of the previous local highs and lows. The market is close to last-year’s upward trend line. Will it break below the line? The nearest important resistance remains at 1,800-1,810, marked by recent local highs, as we can see on the daily chart:

Expectations before the opening of today’s session are positive, with index futures currently up 0.2-0.3%. The European stock market indexes have lost 0.2-0.3% so far. Investors continue to worry about the emerging markets crisis, pushing down EUR vs. USD. There will be some economic data released today: Initial Claims, GDP-Advance number at 8:30 a.m., Pending Home Sales at 10:00 a.m. The S&P 500 futures contract (CFD) trades near the low of its recent downtrend, testing a potential level of support at around 1,770. On the other hand, the resistance remains at 1,800:

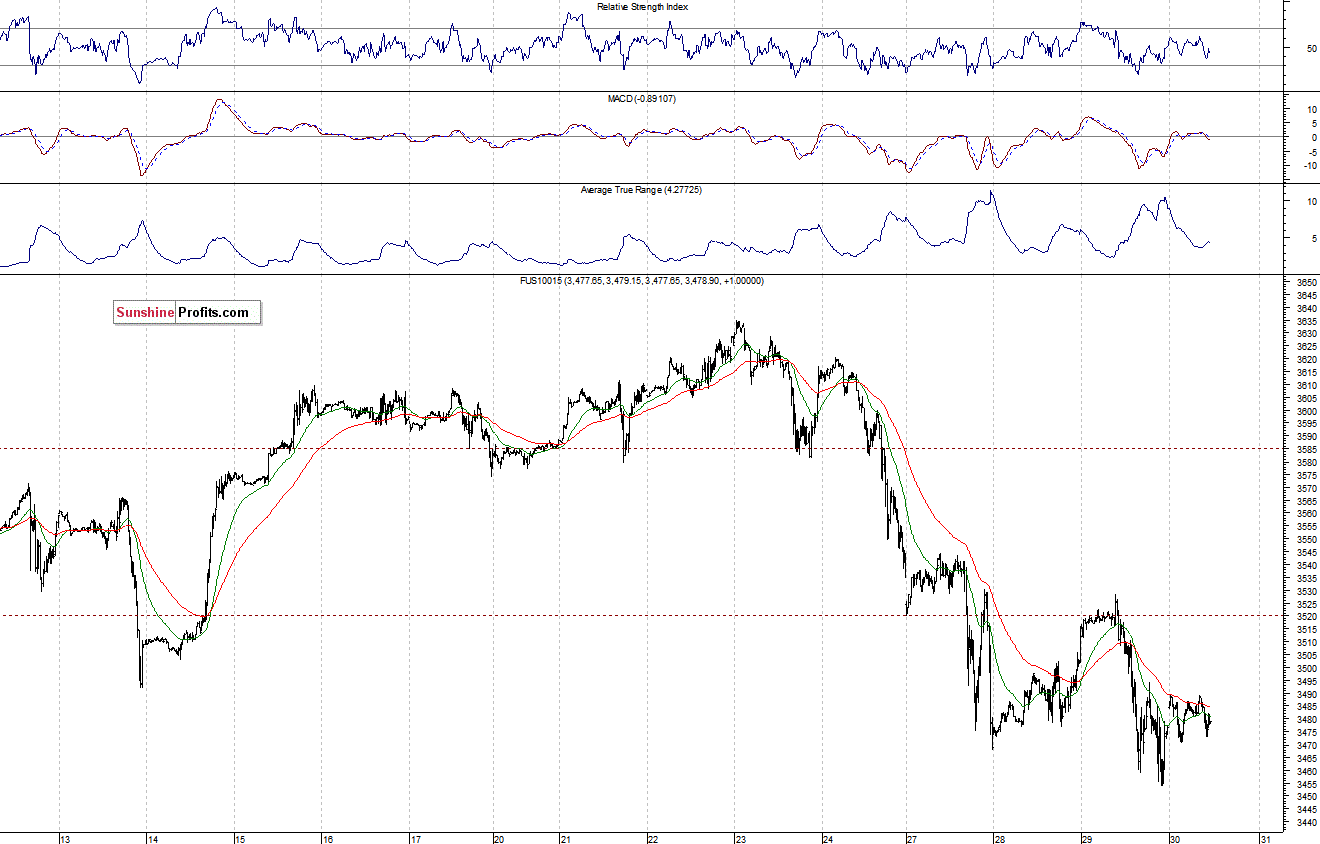

The Nasdaq 100 futures contract (CFD) is in a similar consolidation, close to its recent low. The support seems to be at around 3,450-3,470, and the resistance is at around 3,520. For now, it looks like a flat correction within a downtrend, as the 15-minute chart shows:

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts