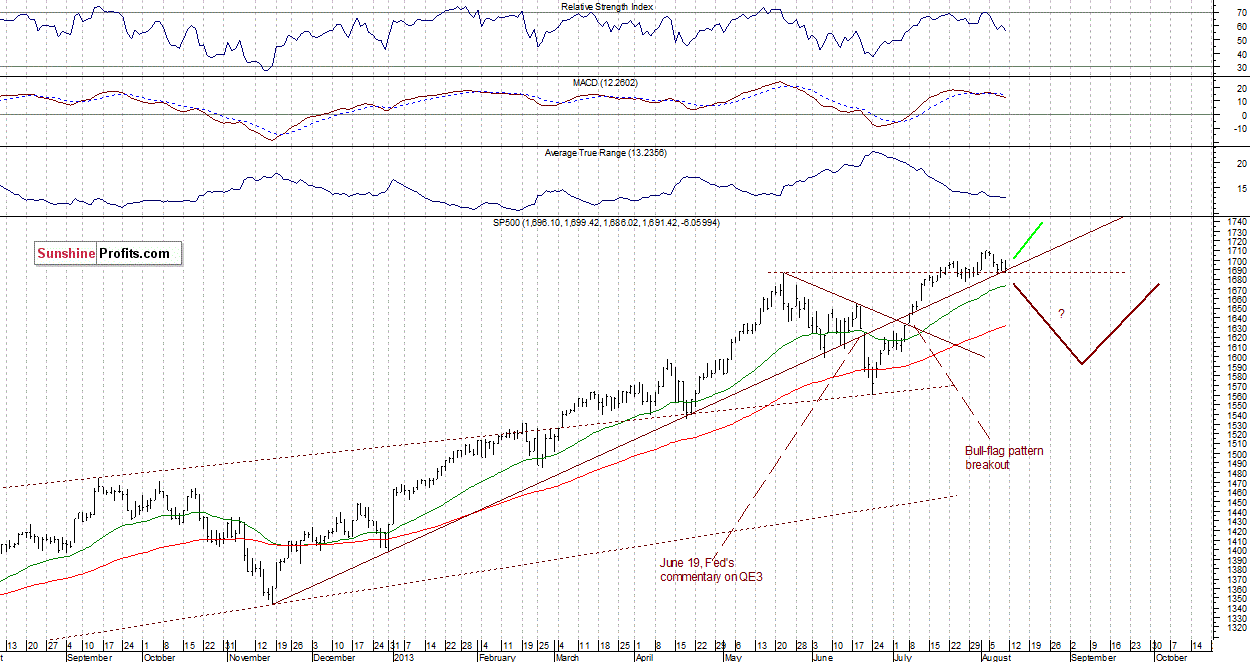

The U.S. stock market indexes lost 0.4-0.5% on Friday, ending last week on a bearish tone as investors feared that the Federal Reserve may soon end its easing monetary policy after the economy showed signs of recovery. The S&P500 index extends its month-long consolidation, just below the August 2 all-time high of 1,709.67. The nearest resistance level is at 1,700-1,710 and the support level is at 1,675-1,690, marked by the late July consolidation. There is still no clear market direction, as we can see on the daily chart:

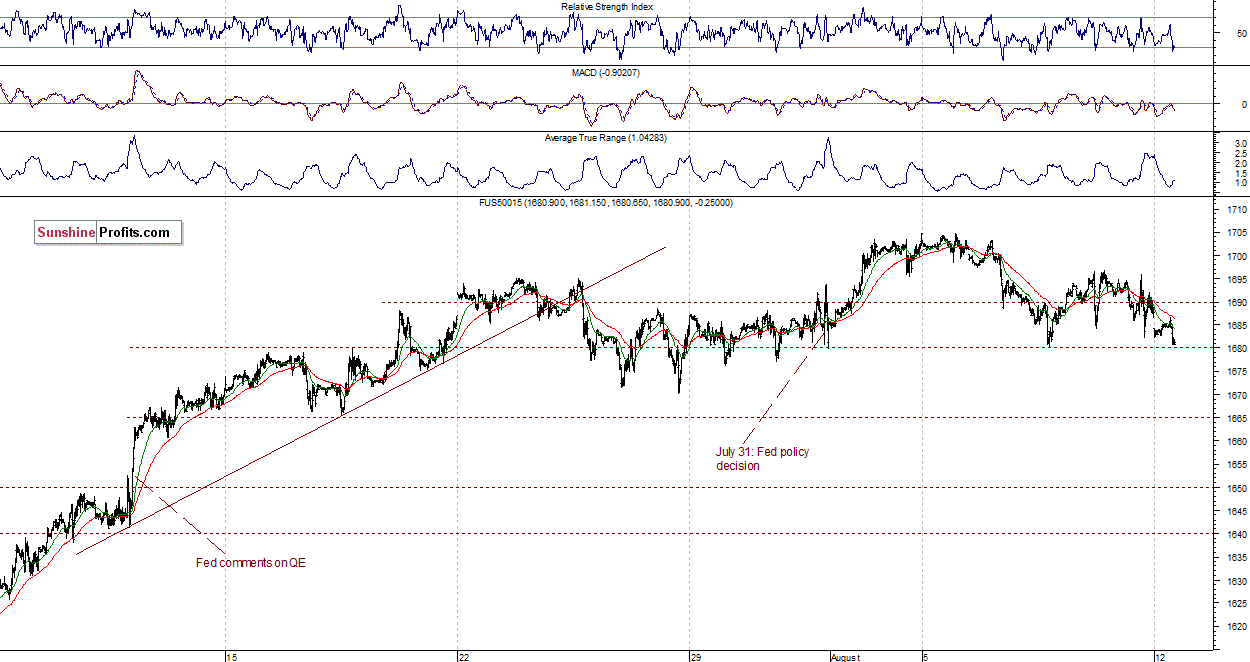

Expectations before the opening of today’s session are slightly negative as the main European stock market indexes have lost 0.1-0.2%. Investors will wait for further economic data announcements to provide some guidance this week: Retail Sales on Tuesday, PPI on Wednesday, CPI, Initial Claims, Empire Manufacturing, Industrial Production and Philadelphia Fed Index on Thursday, housing data and Michigan Sentiment on Friday, amongst others. The S&P500 futures contract (CFD) fluctuates near the lower limit of the recent consolidation. The resistance level remains at 1,700-1,705, marked by the early July topping consolidation, as the 15-minute chart shows:

Thank You,

Paul Rejczak

Back