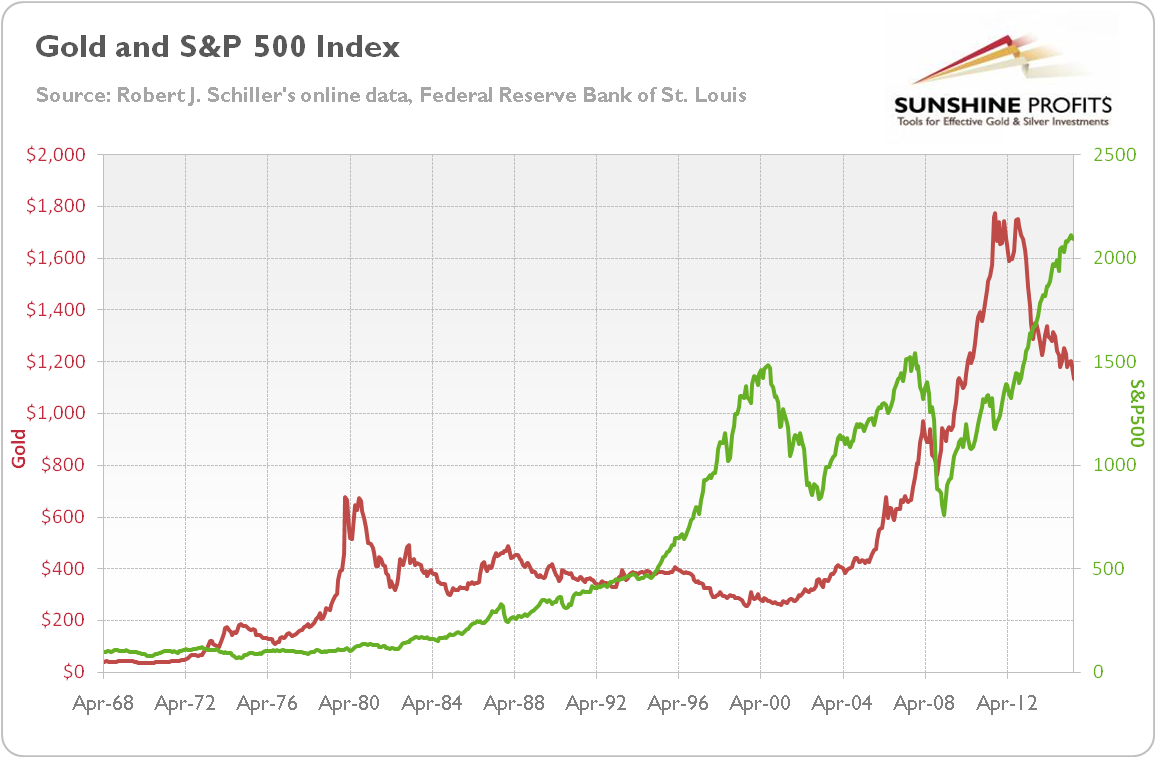

The relationship between stock valuations and the gold price is another widely discussed correlation. The standard view is that these two markets are negatively linked: when the stocks go up, the yellow metal dives, and vice versa. There is empirical evidence that confirms this common opinion, at least partially. The chart below shows the gold price and S&P 500 Index. As you can see, from 1987 to 2000 there was negative correlation between these two markets. Then, the dot-com bubble started bursting in 2000, while the bull market in gold began not earlier than in 2001. The stocks and gold have also been moving in opposite directions since 2011; however the 2000s can be regarded generally as a period of co-movement. Therefore, this chart clearly indicates that the gold-stock relationship changed over time, depending on external conditions, especially the macroeconomic factors.

Chart 1: Gold price (red line, left scale) and S&P 500 Index (green line, right scale) from 1968 to 2015

Why do we often see a negative correlation between the stocks and the shiny metal? Well, this is connected with risk aversion. When traders go into defensive mode, they may prefer gold to relatively risky stocks. The saying goes that gold is a safe-haven, so it is naturally negatively correlated (or at least uncorrelated) to stocks during serious financial turmoil, like in 2008.

The second reason is that the opportunity costs and the resulting investment flows change over time. The risk appetite is the one factor affecting the relative attractiveness of stocks in comparison to gold, but not the only one. Others include the pace of economic growth, the real interest rates, the U.S. dollar exchange rate, the momentum in both markets and so on. Typically, when the economy experiences a slowdown with falling stock market returns, investors may shift their funds from stocks and invest them in the gold market until the economy rebounds. This scenario is likely to happen when the real interest rates are low, which is often the case during periods of a weak economy (due to low demand of cautious consumers and businesses, the monetary loosening implemented by the central banks to revive the growth, or the high inflation). The best example may be the 1970s, when the economy was in stagnation, and the stock market remained flat. The expansionary monetary policy caused high inflation and weak U.S. dollar. All of these factors combined with low real interest rates (largely due to high inflation) made gold much more attractive than stocks. Conversely, the next two decades were a period of stabilized economy and controlled inflation. The Volcker’s interest rate hikes and reduced inflation led to higher real interest rates, which made gold less appealing. Additionally, the subsequent belief in economic prospects under the Clinton’s New Economy (resulting partially from genuine wealth creation fueled by technological progress, deregulation and globalization) combined with Greenspan’s monetary easing fueling the NYSE stock market bubble followed by the NASDAQ bubble.

But why were the shiny metal and equities rising generally in tandem in the 2000s? Well, the financial deregulation implemented in the 1980s changed the nature of inflation. Since then, the new money enters asset markets – including the stock exchange – not the consumer good markets. Thus, the monetary pumping has been seen as causing an asset price rise, not the consumer price inflation. This is why stock prices have been generally rising since the 1970s and have been moving in tandem with gold in the 2000s. This phenomenon was at its highest level of visibility after the Lehman Brothers’ bankruptcy. Since then, the stock market has been essentially on liquidity drip-feed provided generously by the Fed. The truth is that the boom in equities could not last long without the constant inflows of new money and credit.

It should be clear now that, as in the case of oil and gold, there is no casual link between stocks and gold prices. Instead, they are determined by external macroeconomic factors. The only causal relationship between stocks and gold lies in flows of funds from equities to gold market in times of stock crashes. However, these shifts result from changes in investors’ confidence in the fiat dollar-denominated financial system.

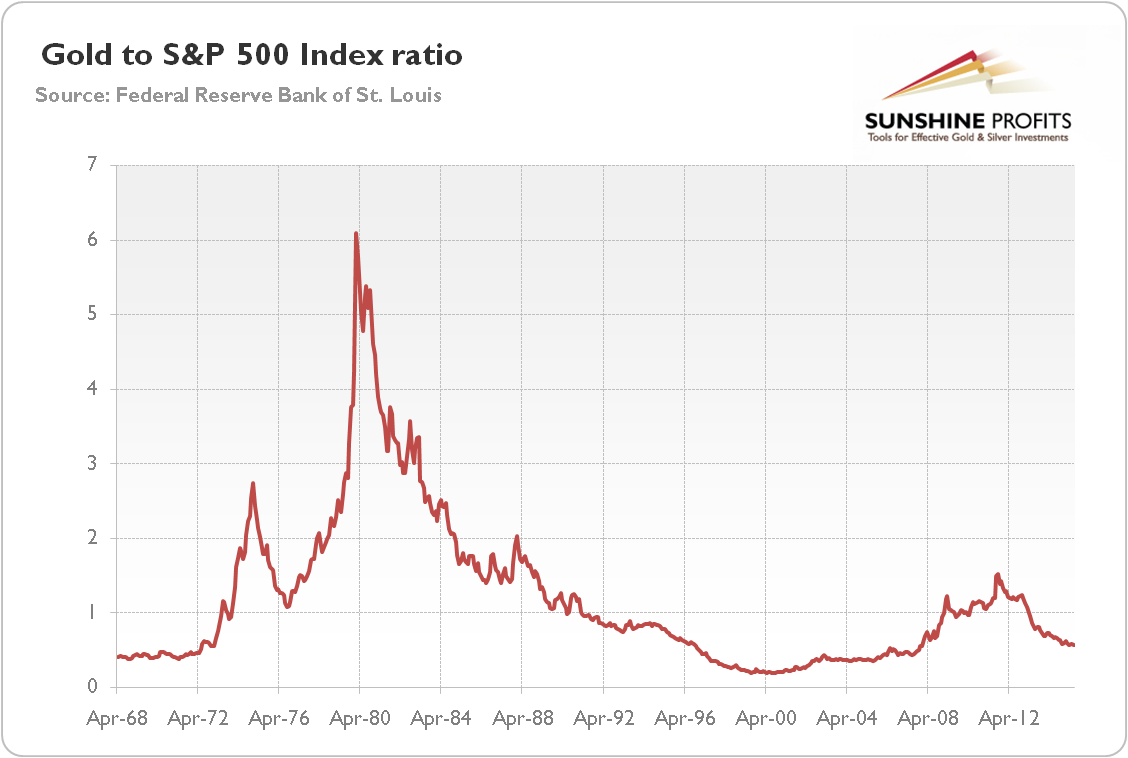

The ratio of gold to the S&P 500 is a good indicator of such confidence, since it isolates these two markets from the effects of monetary expansion. As the chart below shows, the ratio was rising in the 1970s, when the confidence in the U.S. dollar was low, reaching its peak in January 1980. Then, the ratio was declining due to renewed trust in the greenback until August 2000. It rose again until 2011, when the unprecedented central banks’ actions after the outbreak of the Great Recession restored the faith in the global economy prospects and led to the end of the bull market in gold.

Chart 2: Gold to S&P 500 ratio (gold price divided by S&P 500 Index) from 1968 to 2015

The take-home message is that the stock market does not drive the gold market, although it may sometimes seem to do so. Although the stocks and the shiny metal frequently move in opposite directions, there is no stable gold-stock relationship over time. The often observed negative correlation between stocks and the shiny metal results from changes in confidence in the fiat dollar-denominated system, which prompts investors to switch funds from stock market into gold and vice versa. It is just another confirmation that “correlation does not imply causation”, as the observed divergence between performance of stocks and gold results from different responses to changes in the underlying confidence in the monetary system based on the U.S. dollar.

If you enjoyed the above analysis and would you like to know more about the most important factors influencing the price of gold, we invite you to read the September Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview